Lowest point in 30 years: Nine's Drive to insert itself into car sales with major e-commerce push as auto brands pump dollars into digital

Drive CEO Alex Parsons: "In the new car space, the historic model has never really been disrupted. This is the space where we think there is a material opportunity."

Volvo's marketing boss Julie Hutchinson last year said she had shifted money out of "bottom end of the funnel" media channels like Carsales, CarAdvice and Carsguide to invest more in brand building efforts but the CEO of Nine's auto sites Alex Parsons says a new Covid switch is on from car marketers which are back investing heavily in digital. He's flagged a merger of CarAdvice into Drive next year, focusing squarely on new cars and a bid to insert the revamped Drive platform into the transactional aspects of e-commerce - Parsons argues a "material opportunity" for disruption is on. Market leader carsales.com.au will be watching closely.

“What we’ve seen, with our key [auto] partners, has been greater investment in not only digital transformation around e-commerce but also how they invest their ad spend.”

What you need to know:

- After crashing to a 30-year low in April, new car sales are gradually picking up pace although still down 20% on last year

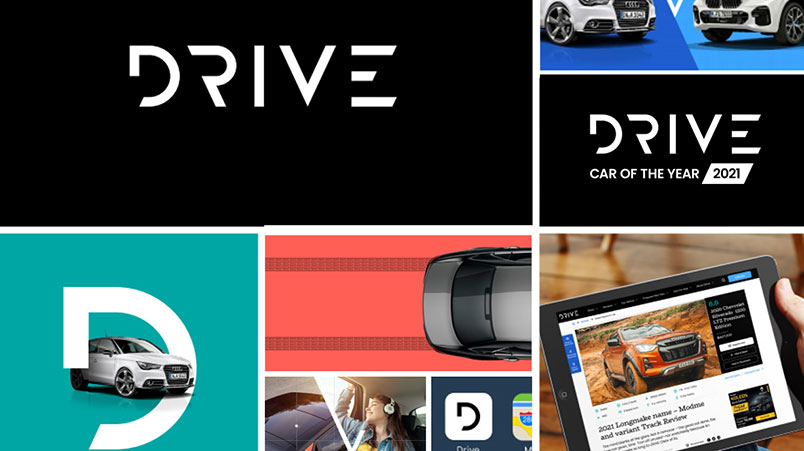

- Drive and CarAdvice are being merged into the Drive brand next year

- The new platform aims to drive e-commerce and will concentrate on new car sales as manufacturers increase their digital focus and spend, though will still host used car classifieds

- “In the new cars space, the historic model has never really been disrupted. We think there is a material opportunity,” says CEO Alex Parsons.

- “We want to get into that transactional space.”

Shifting gear

After crashing to a near 30-year low in April, car sales are gradually picking up pace. But Nine thinks Covid has fundamentally changed market dynamics. It’s placing e-commerce front and centre of its merger of CarAdvice and Drive and plans to better harness Nine's collective assets to underpin growth.

From next year, Drive will become the solo brand. CEO Alex Parsons believes the market is ripe for disruption given the acceleration of e-commerce since March.

Yet the business model remains simple at heart: “We want to help manufacturers sell more cars and we want to help consumers get into the right car,” says Parsons.

“Commentary, comparison and commerce” are the central tenets of the platform. The hope is that the first of those two aspects drive the third.

“We are arming car buyers with information, understanding and intelligence like never before. What we want to try to capitalise upon is the next step in that process, the commerce aspect of it,” says Parsons. “We want to get into that transactional space.”

While the new platform will still host used car classified, a smart move given cheap second hand deals are booming post-Covid, Drive appears to be ceding right of way within that market.

“Clearly one of our competitors has done a great job in used cars – and we take our hats off to the work they have done in that space,” he says.

“But in the new car space, the historic model has never really been disrupted. This is the space where we think there is a material opportunity."

Digital acceleration

Parsons thinks behavioural change on both demand and supply sides will accelerate Drive’s e-commerce push.

“Lockdown brought a lot of automotive services to a standstill, every aspect of the consumer purchase journey,” he says.

“What we’ve seen, with our key partners, has been greater investment in not only digital transformation around e-commerce but also how they invest their ad spend.”

Drive is eyeing a greater percentage of that $2.4bn that carmakers pour into marketing each year.

On the flip side, many buyers are now making up their minds online, rather than being swayed by physical salesmanship at the dealership. “The method of purchase has completely evolved, and it doesn’t look to be returning to its previous state any time soon. That means more e-commerce for auto and subsequently more demand for content,” Parsons says.

“Brands are also looking for more leads, given that too has slowed, and we see a lot of potential to fill that gap, especially as our engagement levels show an extensive level of online research [over the last six months].

“So the auto market will need to invest more in online platforms such as Drive to maintain its position in the path to purchase,” he adds. “And I can tell you, the manufacturers and the dealers want more business out of us than they had in the past.”

Brand, performance and recovery

While enabling e-commerce and building transactional models and products will be core to the merged Drive platform, Parsons says it is by no means turning its back on traditional advertising approaches.

The relatively small number of players that make up the automotive category means it can take a bespoke approach, blending traditional brand advertising with performance, delivering more test drives or qualified leads to dealerships, and e-commerce.

While new car sales remained back 21.8% year on year in September on the back of 28.8% YoY declines for August, Parsons believes market recovery will continue as people spend less on big ticket items such as overseas holidays.

Meanwhile, car sales were also hit by supply chain disruption, which he thinks may provide an uplift as OEMs work though Covid constraints. As a result, pent up demand that suppliers can now serve may yet drive growth.

“If you look at it on a comparable financial basis, there is going to be an ongoing decline in major international travel, even a slowed return to domestic travel,” Parsons says.

“That’s a large sum of money that can be funnelled elsewhere, especially now previous supply and demand issues have been solved.”

Regardless of immediate market fortunes, Parsons is confident that the fundamentals remain strong: People want cars and they spend most of their time researching them online – which means manufacturers need to be there more strongly than ever.

Ultimately, he says, “there's not a single manufacturer out there who doesn't want to reach more consumers and experience more leads”.