Can media mix modelling unlock a new budget? Here's why it's worth trying, and three lines to pitch to the CFO

Approached the right way, it might just be possible to get the CEO and CFO to agree marketing – and brand budgets – as a capital expense. It's a gamble, says Atomic 212º Chief Data Officer & Partner, James Dixon. But ahead of FY2025, one that might just pay off. Which is where media mix modelling, or MMM, comes in. Plus, he's penned a three-line pitch.

Media mix modelling (MMM) has plenty of benefits, but one of its more under-utilised outputs is referred to as ‘baseline’ sales. These are the underlying sales that media has no direct impact on, and typically represent +50 per cent of the attribution. If positioned correctly, that may just mean more money in your marketing budget.

How? Easy. It starts with defining what’s driving that baseline, and you could say the answer is brand itself. What’s exciting, is that means baseline sales can be used as a proxy for the value of your brand. That is to say, if media was removed from the model, the business would continue to make sales against this baseline for several years (approximately 20 years according to an Ehrenberg-Bass study in the alcohol category).

Sales over 20 years with no marketing? That can be worth quite a bit, and it might help you access more budget if communicated correctly.

What does that mean? If the brand baseline is positioned correctly, a CMO can provide their CEO and CFO with a statistically accurate view on both the long (i.e the baseline) and short (i.e the media) return on marketing investments.

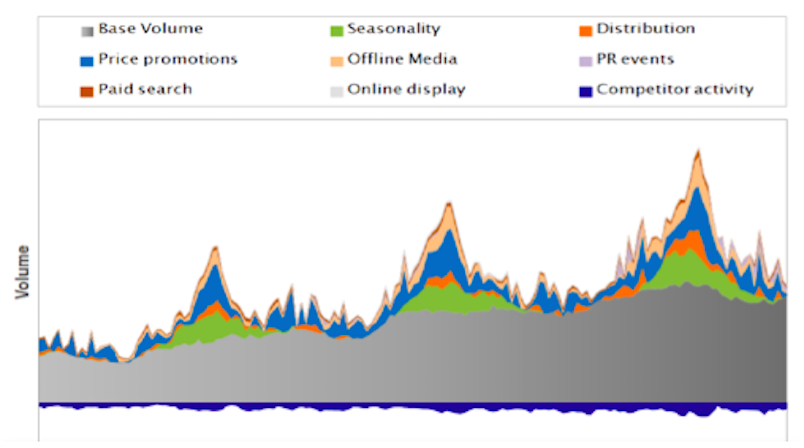

By way of an illustration, the diagram below is a typical output from a marketing mix model. The grey area represents the baseline and we can see a typical uplift trend year on year. The baseline is the consequence of the total marketing effort excluding the short-term sales effect of media (which is attributed in the other colours).

Positioning the Baseline as a capital asset

Marketing budgets typically come from the operational side of the business because accountants see this spend as in-year opex as opposed to multi-year capex. In simple terms: the marketing budget resets year on year because it isn’t seen to generate exponential revenue over long periods of time the same way an asset would.

Unfortunately, the CFO’s accounting standard framework supports this view, as explained in my previous article because the brand value cannot be “distinguished from the cost of developing the business as a whole”.

Given we can now show, per the above illustration, that the baseline will deliver revenue for many years, the annual budget classification is erroneous. My hope is that armed with the above MMM and its baseline value, the CMO has a good position for a pitch such as this:

“Hi [CFO], I have been thinking about my FY25 budget and want to start up some thoughts about treating our brand budget as a capital type expense. I appreciate that accounting standards don't agree, but I have used MMM to show a statistical value of our brand and its long term ROI. With this, might we consider some capital budget flowing my way?’

The response is likely to be puzzled, but it is within the remit of the CFO to migrate the capex budget to opex if the case is strong and compelling.

The compelling case is hinged on the presumption and narrative that marketing, in its full 4P sense, creates a brand, and the brand creates revenues beyond the immediate financial period. It is highly arguable that that the brand is an accounting asset that can be discussed with the CFO with accounting terminologies such as:

- Asset value

- Asset lifetime/depreciation

- Maintenance and advancements

The CFO will defer to accounting standards, however with MMM we have a mathematical model that demonstrates a baseline of sales that will yield over many years. We are not asking to contravene the accounting standard, but are asking that the brand asset has access to capex in recognition of its long term ROI. Capex budgets can migrate to opex at the discretion of the CFO.

Talking about MMM and baseline sales with reference to accounting terminology will help your CFO appreciate that the annual marketing budget is more akin to other balance sheet items such as factories, real estate, machinery and stock. All of which are familiar as revenue-generating over many years and thereby allocated a capital budget.

Sure it’s a radically different approach, and the initial response may be one of confusion, but using MMM metrics to your advantage can go a long way toward positioning the marketing function of your business very differently with the key executive who drives growth and investment within the organisation. That’s worth taking a chance on.