Paramount+ kicks off ad tier sales but eschews Amazon, Binge approach for no customers at launch, bundles TV, BVOD, ‘lower ad load than rivals’ streaming package – and leaves wriggle room outside of OzTam

Bullish on the bundle: Paramount international ad sales boss Lee Sears and ANZ sales chief Rod Prosser.

Paramount+ is officially in market with an ad-funded streaming play but is keeping numbers tight. Initially audiences will be low, because it's eschewing the Amazon Prime-Binge approach and building from scratch instead of rolling over streamers unless they pay more for no ads. It's also selling streaming ads as a bundle across the broader businesses, though sales chief Rod Prosser said standalone programmatic buys will follow "this year". Ad loads will be lower than rivals, per global global ad sales boss, Lee Sears, and he claimed that what its rivals are lacking – sales tech and infrastructure – will provide competitive advantage alongside content ownership and local variants of global integration opportunities. On measurement, Prosser's not wedded to OzTam alone.

What you need to know:

- Paramount+ weeks out from launching ad tier, has briefed three of five major buying groups.

- Rates and audiences tight – but will be selling low numbers as not automatically rolling subscribers onto ad tier.

- Aims to sell as bundle across TV, BVOD and FAST for now, programmatic streaming buys later.

- “Committed to OzTam” on measurement, per Rod Prosser, but “we're not putting all our eggs in one basket”.

- International ad sales chief Lee Sears claims service will have lower ad loads than rivals – and better sales tech and infrastructure.

- Plus, owning all of its own content brings major brand integration opportunities – and Sears aims to help global deals land locally in Australia.

We're not putting all our eggs in one basket with OzTam. If there's another provider that can do it … we can marry it up with what we’re doing with OzTam.

Zero base budgeting

Paramount’s direct-to-consumer business – Paramount+ and FAST unit Pluto – was one of the few bright spots in its latest financials. Now it’s in market locally touting the ad-funded streaming play set to launch “late June or early July” per ANZ sales chief Rod Prosser – but it’s still early and starts off a low base.

Of the five main ad buying groups, Paramount has so far spoken to three about audiences and rates, said Prosser, though he expects to be able to provide firmer numbers within the next fortnight.

While other streamers – notably Amazon Prime and Foxtel-owned Binge – have rolled base level subscribers onto an ad tier automatically unless they pay more in a bid for immediate scale, Paramount, like Netflix, is eschewing that approach, effectively kicking off with a nil base for a basic with ads service at $6.99 sitting below its current standard ad-free package (and on par with Netflix).

It’s instead aiming to squeeze the balloon, moving money throughout its TV, SVOD, BVOD and FAST channels via a “one Paramount” approach”, said Prosser.

That approach is working in the US, according to global ad sales boss, Lee Sears, praising the ad tier’s impacts on the “entire [Paramount] ecosystem”.

“It's really created a halo effect around our business and the ability to convergently go to market and sell all of our inventory as one,” he told trade press, echoing local boss Beverley McGarvey and fellow global exec Marco Nobili on the merits of bundling versus silos.

Australia will be the second international market to rollout the ad tier, after Canada, now two weeks into its own launch. The move comes close to three years after Paramount went live with an ad-supported streaming tier in the US in June 2021, making the entertainment conglomerate one of the first SVOD (streaming video on demand) players to revert to the old-new ad model.

Prosser underlined the integrated play is key to its approach.

“There’s three entry points if you like, and most of them will be packaged in a way where it's a one Paramount approach,” says Prosser.

“Whilst we build for scale, we will have a package that will sit across both 10Play and Paramount+ - so we’ll ensure that each campaign delivers first and foremost."

There’ll be another package that combines linear, BVOD and SVOD, that will go out with a blended CPM (cost per thousand).

To begin with, the ad tier will only be available as a bundled buy, though Prosser said the plan is to open it up to programmatic buying “at some point through the course of the year”, i.e. when there are sufficient numbers. Given the soft start, inventory will inevitably be far more limited than 10 or 10Play – and will come at premium.

Starting from scratch

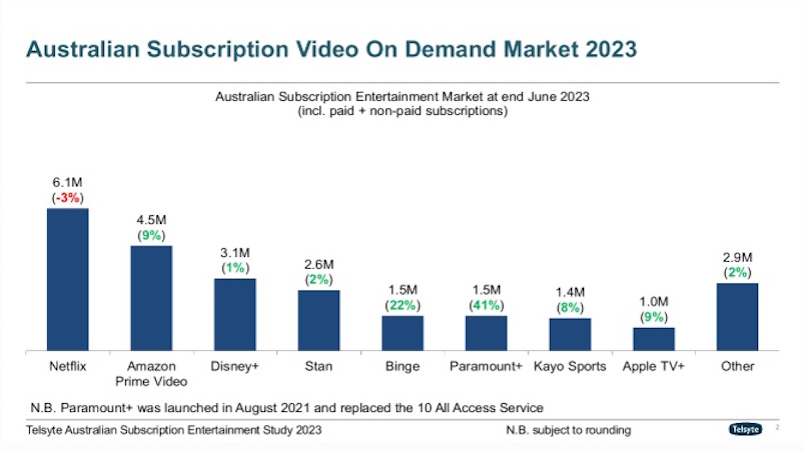

While Paramount is keeping numbers tight, globally Paramount+ subscriber numbers stood at 67.5m at the end of 2023. Locally analysts Telsyte – which has consistently proven credible – estimated its paying subscribers at 1.5m as of June 2023 and marked it as the “fastest growing” of the streamers. Since then, Prosser indicated that figure has lifted significantly.

Part of the local launch strategy locally is price, with the ad tier coming in significantly lower than some major rivals.

Priced at $6.99 a month – the same as Netflix’s ad tier – the Paramount+ ad-supported offering is one of the cheapest in market.

It comes in under Binge’s ten-dollar ad-supported tier, and well below the $13.99 and $12 entry points into the standard Disney and Stan subscriptions. Amazon’s consolidated ecommerce and SVOD service comes it at $9.99 in Australia, with its own Australian ad-tier pencilled for a mid-year launch. (In other markets Prime charges more for no ads, £2.99 in the UK, equivalent to circa $6.)

While the newest tier on Paramount+ reduces the barrier to entry for audiences, it doesn’t offer as much as a saving on the flagship tier as its competitors. The cost for a ‘standard’ Paramount+ subscription will set you back $10.99 as of this month, versus the $16.99 users pay for Netflix’s standard tier. Likewise, the gap between the ad-supported and standard tier on Binge sits at eight dollars.

Sears says there’s a sophisticated rationale behind the pricing strategy, that not only “attracts new users” but avoids churn by giving users the option to drop down to the lower fee when they’re “feeling the strain”.

“We feel really good about that,” says Sears. “What we've seen in other markets supports the price points that we've got.”

US playbook

Like his global peer Marco Nobili, Sears is bullish on the Australian ad tier given claimed individual success in the US market and that “halo effect” across the borader business.

He’s confident that advertiser demand is strong – claiming weekly approaches by major advertisers since the international launch of Paramount+ with ads.

“I think the appetite and the desire for it, because it is truly the most premium content that's out there – it’s unparalleled.”

He’s also confident Paramount has the sales infrastructure to make it work – something that has dogged streamers entering the ad business for the first time.

He talked up the “unified ad-server” that offers up all of Paramount’s video content globally, “in one instance” – and thinks that infrastructure and sales muscle will set the service apart in the local market versus its pure-play rivals. Alongside content audiences and actionable data, ease of transaction, he said, will be key.

But what Sears appears to be most excited about is the capability to integrate brands within the content itself – given Paramount owns its entire catalogue.

“That gives us the ability to integrate brands into that content and put products into some of the most premium, high calibre dramas and even movies, because we have that wider ecosystem and we have the FAST channels, AVOD, and BVOD.”

He pointed to a recent Teenage Mutant Ninja Turtles integration with Pizza Hut by way of example.

“We did an integration with Pizza Hut where the turtles actually ate from a Pizza Hut box that was in the movie. Then, we create experiential marketing - which Pizza Hut obviously bought - around that when it then came on to the SVOD service.”

“So outside of the scale, the unified stack, the consolidation of our business, we are also creating world leading content, which provides an additional layer, an opportunity for client’s brands,” said Sears. “And that’s something we do globally. The Pizza Hut deal was executed in many markets.”

He said he will be working with the local Paramount team to ensure those integrations can be executed locally, “so Rod and the team are well positioned to have conversations that give them that advantage in market”.

Lower ad loads

Drawing on its learnings from the US, Sears said Paramount will be putting user experience at the forefront.

“We're not going to saturate the ad tier with ads, the value exchange is going to be appropriate and it's not going to be perhaps as heavy and ad load as you'll have seen with other services.”

“We're very conscious of the fact we want it to be a good experience, not only for the consumer, but for the advertisers themselves as well,” per Sears. “They don't want to see all of the clutter - they want to make sure that it's a really premium experience and placement.”

However, the ad load will vary between content types. Sears said that “broadly speaking”, the strategy will be that “there's extended pre-rolls before movies”, while “TV series that are slightly longer” will have both mid-roll and pre-roll ads.

“That's going to be time length-dependent and also content-dependent,” he added. “What we want to do is make sure we’re not just putting in an ad where it doesn’t feel correct.”

As for measurement, Prosser reiterated that Paramount is “committed to OzTam”.

With streaming meters already in households, the network funded measurement body has a fundamental grasp of collective and individual streaming numbers – but not yet program-level granularity.

“They will continue working with us on that but really importantly we need to make sure [we are measuring] apples with apples, so that's the next part of the evolution.”

But Prosser left himself wriggle room.

“We're not putting all our eggs in one basket with OzTam. If there's another provider that can do it … we can marry it up with what we’re doing with OzTam.”