Twister: Media establishment spooked by ex-Nine publishing boss Chris Janz’ VC-backed venture; Edelman Trust report warns society turning sour on ‘divisive’ media, journalists - and the rich - at an alarming pace

Public and business trust towards media is eroding dangerously fast post-Covid - Chris Janz wants to bite the big players, possibly with a model similar to San Francisco's subscription-led tech publisher, The Information.

The rumblings out of Nine have senior execs a little spooked by the arrival of a new VC-backed media venture, Scire, hatched by Chris Janz, the former publishing boss at Fairfax and later Nine. Janz lost out to Mike Sneesby two years ago in the fire dance to replace Hugh Marks as Nine’s CEO - and there’s likelihood that some of what was proposed to Nine’s board in his tilt for the CEO gig is playing out at Scire. The official launch is slated for later this year. It comes as a 23-year longitutinal public sentiment study warns societal distrust is turning feral on the institution of media – for journalists, the tone is harsher. Janz appears to be tapping that undercurrent, even among the business community.

Subscriber and talent raids

The Australian Financial Review’s top brass are said to be particularly attuned to the ambitions of Chris Janz’ subscription-based publishing start-up - and as a circling raider of their best editorial talent.

We’ll cover shortly what I can best deduce from the blips of backroom conversations that Janz is having about Scire. But first a few numbers that might quell the competitive concerns at Nine and beyond. Scire looks like it is building a subscription-led model which, at the top end of its mid-term targets, might have 50-100,000 subscribers. It won’t do display advertising – those ad units of various shapes and sizes ubiquitious on websites. And Janz is said to be bearish on the bulls – that’s most of the market - forecasting automated advertising trading exchanges will conquer a $700bn global ad industry, including Australia, well within the decade. Scire appears to be spurning the publishing economics of ads via programmatic trading, which rewards scale; instead scoping commercial partnership programs.

Although the business model suggests decent operating margins, 50-100,000 subscribers in year two or three is not a sufficiently scaled uprising to threaten Nine or its media establishment peers.

Trust spiralling

But something else is. Or should be. Certainly Janz is rolling it up into his business case with the $5m blessing of partners at VC firm Shearwater Capital.

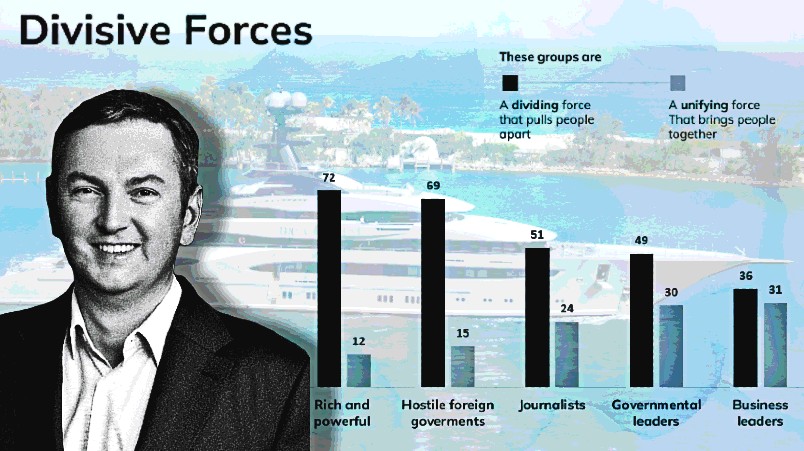

The problem Scire is likely solving for looks partly – and I mean partly - like this: Public trust towards media and journalism is approaching treacherous waters – Edelman’s 2023 Trust Barometer of 32,000 citizens globally – circa 1,100 in Australia* – puts media, journalism and the Fourth Estate behind only the “rich and powerful” and “hostile foreign governments” as the most divisive forces which “exploit and intensify our differences”. Sorry, but that is serious shit. Read it again.

It's a strange and fast fracture of the audience boom for media through Covid where it was precisely the “trust” status of established media services and brands – or mastheads – which saw audiences flock back to the establishment.

I’ll defer to more learned research experts on the technicalities of Edelman’s methodology and framing of survey questions (see the footnote) but the communications firm is not alone in painting a rather bleak picture of trust and credibility for media and journalism as we know it. The brooding public sentiment captured in various consumer polls and research programs is consistent: media’s credibility, impact and influence – certainly for journalism’s central mission as a force for civic-truth and impartiality - is eroding rapidly. Journalism and media’s public standing has never been high but we’re now getting into territory that, if the data was on any other sector or profession other than media, journalists would be pack hunting the dire implications.

Consider this:

- The University of Canberra’s 2022 Digital News Report found just 41 per cent of Australians trust news – the project is aligned globally with the Reuters Institute for the Study of Journalism and Oxford University.

- The same study found 68 per cent of respondents “actively avoid news”, up 11 percentage points since 2017 – Gen Y, women, and “city dwellers” are the biggest “news avoiders” on 79 per cent, 70 per cent and 69 per cent respectively.

- The Guardian and YouGov released survey findings last year in which 82 per cent of Australians say media ownership influences the content that is published.

- Key points in the 2023 Edelman Trust Barometer (conducted in late 2022) are:

- Media is seen as fueling the cycle of societal distrust (48 per cent), ahead of government (45 per cent) and business (33 per cent). But it’s part of a broader sweep towards polarisation – just 24 per cent say if a person strongly disagreed with them or their point of view they would help if that person was in need; 21 per cent would be willing to live in the same neighborhood and 19 per cent say they would have the person as a co-worker.

- 51 per cent say journalists are a divisive force who “exploit and intensify our differences” – they’re behind only the “rich and powerful” which top the undercurrents of public resentment at 72 per cent and “hostile foreign governments” on 69 per cent - that’s not company many journalists should want to keep.

- Just 36 per cent say they trust journalists – lower than CEOs (39 per cent) and government leaders (41 per cent). Scientists and “my co-workers” sit at the opposite end of the scale with trust scores of 70 per cent and 73 per cent respectively.

- Gen Z is least trusting of media (30 per cent), Millennials most trusting although hardly flattering (41 per cent), Gen X (38 per cent) and Boomers (38 per cent).

Polarising tribes

In the Edelman findings the only prima facie upside is that social media is in an even more of a parlous state of trust than media conglomerates as society – consumers, customers and communities – hurtle towards their tribes of worldview myopia.

This all leads back to the challenge ahead for media and journalists – and the premise of Scire’s model. Janz is privately saying in market the broad underlying public sentiment towards main media is mirrored at the top end of the business, technology and political classes. The thrust is essentially that an economically viable chunk of the top end is as dissatisfied and sceptical as the punters towards the media establishment. It’s perhaps why the AFR is taking a bit of notice. “Australian business is changing: there’s the rise of entrepreneurialism, the start-up sector, and tech being infused in people’s day to day lives,” he told The Australian in his only public interview on Scire. “Secondly the conversations that are happening in the boardroom aren’t being covered in the traditional press in the same way that’s happening overseas. There’s a gap there from a readership point of view, and there’s a gap in the number of voices being heard.”

San Francisco media model

Janz’ comments on Australian coverage not matching what’s being done overseas is a nod to publishers like the San Francisco-based subscription-based tech site, The Information, which is firmly on Scire’s radar. Another which seems to occupy similar territory is the UK’s “slow media” start-up, Tortoise Media, which like Scire, avoids general news reporting to get further under the hood on context. Tortoise has built a subscription base of circa 100,000 going slow behind the daily news and a program for specialist communities beyond published content.

Before launching Mi3 in 2019, I spent some time at The Information’s San Francisco “Media Boot Camp” in which the publisher – founded by a former Wall St Journal tech and media reporter Jessica Lessin - transparently outlined her business model, learnings around building a subscriber base from 2013 (news alert, even most subscribers don’t consumer content as frequently as we assume). Like Janz intends to, Levine sidestepped publishing’s traditional advertising reliance entirely. The Information’s early mission was trailblazing stuff, coupling a new business model with its editorial mission to go beyond the light flashpoints of tech news. Its tech stack was built in-house, including a subscriptions platform although that was a decade ago. By the time I attended the media bootcamp, Lessin & Co were pointing smaller-scale publishers like Mi3 to specialist subscription platforms like Piano. For disclosure, Mi3 has a project with Piano and is currently moving our circa 10,000 marketing, media, tech and consulting “members” to an always logged-in state. We have a member financial “support” option, which needs more work, but we don’t have a subscription play,–but even moving to a “registration wall” as we are, is a skills and resource-stretching program for a tiny trade publisher - but we’re making progress.

More broadly though, and perhaps a counterpoint to this media trust saga, is that news media subscriptions globally are not tanking. Piano's APAC boss Tim Rowell says Piano's aggregate data across 600 publishing companies and 3,000 websites worldwide - including The Economist, Dow Jones, Nine and Stuff NZ - publishers are still in subs growth around the world "but not at the rates we saw during the pandemic - double digit growth then was common," he said. "Churn and combating churn is a priority for all publishers now - both passive and active churn - but smart publishers use techniques, both tech and tactical, to combat churn."

The allure

Whether Janz pulls Scire off will be telling – he’s done this stuff before as the founding CEO of Allure Media in 2005, backed by former Microsoft doyen Daniel Petre and eBay boss Allison Deans. Fairfax acquired Allure’s parent Netus, in 2013 as an alternative to its mainstream mastheads. Allure licensed international titles like Business Insider, Gizmodo, PopSugar and Lifehacker, using a combination of international and local content to lower costs and explore digital publishing strategies the Fairfax mothership might adopt. It was profitable and built some big audiences – Business Insider at one point claimed more than a million monthly Australian users – but it didn’t quite become the runaway train many had hoped for and was folded into Nine’s Pedestrian Group after it acquired the Fairfax business. In 2015 Janz was appointed Australian CEO of The Huffington Post, now HuffPost, another “new world” publisher that was at the time taking the US by storm. In Australia it was a joint venture with Fairfax but that too faded to black.

The tight ownership structure of Australia’s biggest media assets in a small number of media conglomerates is what many dream of busting open but struggle to land. Janz has seen enough of the insides of these big ships to be convinced he can bite the elephants. What he has going for him is an underbelly of public disdain and trust erosion towards media but success will lie in breaking the say-do conundrum – what people say in research versus how they act is often as contradictory and perplexing as media itself.

*Note: This is Edelman’s survey explainer: “The 2023 Edelman Trust Barometer online survey sampled more than 32,000 respondents, which includes 1,150 general population respondents across 28 markets. The margin of error among the global sample at the 95 percent confidence level is +/- 0.6 percentage points. For the Australia sample, it is +/- 2.9 percentage points. The survey was produced by the Edelman Trust Institute and consisted of 30-minute online interviews conducted between November 1 and November 28, 2022. It is the firm’s 23rd annual trust and credibility survey.”