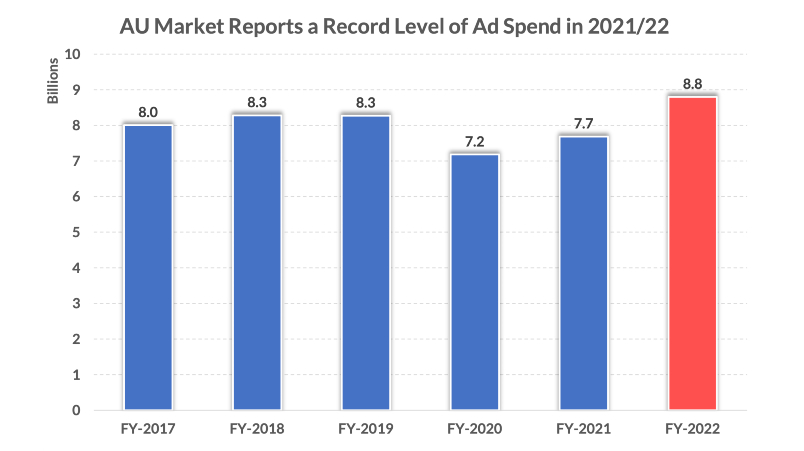

Ad agencies spend $8.8bn in FY21/22, ad spend rose in June despite US, UK, Canada falls: SMI

“Clearly advertisers in our region are more confident in the future than those in the northern hemisphere as they are continuing to invest strongly in their media investment,” SMI's Jane Ractliffe said.

Ad spend crunches felt abroad – in the US, Canada and the UK, for example – haven’t hit Australia, with SMI reporting 0.4 per cent growth in June spend. The 2021/22 financial year was a record, putting Australia’s agencies on track to reach $9 billion in spend in the current year.

What you need to know:

- Ad agencies are on track to spend $9 billion in the current financial year, after surging to $8.8bn in 2021/22, per SMI numbers.

- The $8.8bn figure is a record, eclipsing preCovid levels.

Australia’s media agencies have reported record ad spend in the 2021/22 financial year, eclipsing pre-Covid levels to reach $8.8 billion.

Standard Media Index figures show spend in the month of June lifted 0.4 per cent compared to last year, reaching $775 million. For the June quarter, ad spend rose 7.1 per cent to $2.26bn, while there was growth of 14.5 per cent between last financial year and this financial year, from $7.7bn to $8.8bn.

“The Australian market has moved well beyond the COVID period, with the total financial year ad spend now 6.4 per cent or $528 million larger than in the pre-COVID 2018/19 period,” SMI AU/NZ Managing Director Jane Ractliffe said.

“The data also affirms the ongoing growth of Agency ad spend in Australia, with the market arguably on track to hit $9 billion in size next year, having grown by more than 35 per cent - or by $2.3 billion – in the past ten years (since FY2011/12).”

Ad spend by Australia's major media agencies in the past six financial years.

The Federal election didn’t skew results, either, Ractliffe said. Removing the ‘Government’ category, ad spend was still up 7.4 per cent year-on-year.

SMI’s US data showed its first decline in 22 months, contracting 3 per cent, while Canada’s market fell 4 per cent in June. In the UK, the decline was 13 per cent.

“Clearly advertisers in our region are more confident in the future than those in the northern hemisphere as they are continuing to invest strongly in their media investment,” Ractliffe said.

Travel spend fuelled the rise, surging 31 per cent this financial year, while government add spend overtook Automotive Brand as the second largest category.