No Covid re-run: Social, market researchers on consumer mood say 70% tightening belts; young men stressed, 'third-life crisis' at 30 – but 24% free-spending so category discounts not required

Jasmine Beech, Neer Korn and Michele Levine: Consumers are cutting back and stressed about cost of living. Brands need to honestly communicate hikes to them, seek pockets of growth and face headwinds proactively.

Social market researchers think the deepening cost of living crisis will play out very differently to Covid. But there are parallels with previous bust cycles. The “lipstick effect” comes into play, and certain categories – homeware, necessities, some everyday luxury branded goods – should hold up. But home renovations could end up consisting of nicer taps than a whole bathroom suite. While 70 per cent of Australians report making some cutbacks, a quarter of the population will keep spending – and brands shouldn’t think about discounting to that cohort. For the broader population, retailers must communicate price hikes honestly or lose community trust earned during Covid, fast. Roy Morgan’s Michele Levine, SCA’s Jasmine Beech, and veteran qualitative consumer researcher Neer Korn unpack what’s coming down the track – as far as anyone can tell.

What you need to know:

- Social and consumer researchers say 70 per cent of Australians have already started belt-tightening measures.

- Cost of living crisis quickly rising to top of concerns.

- Young people most stressed, particularly young men, but pensioners and squeezed middle also under strain.

- Yet consumer spending, per backwards-looking ABS data, still holding up as Australians dip into Covid savings.

- Forecasting beyond short-term impossible for marketers but lessons from previous prolonged downturns suggest certain categories will hold up due to “lipstick effect”.

- A quarter of population will keep spending – and prepared to pay top prices – regardless. Roy Morgan CEO Michele Levine calls them NEOs and suggests marketers and retailers target them aggressively.

- Honest communication required from brands and retailers over incoming price hikes or trust gains made through Covid will be lost.

Consumer confidence at the moment is sitting at 82.4 [where 100 is the point of neutrality]. So we’re well below that point – it’s down eight points since the election and it’s now lower than in the [2008] global financial crisis.

Signals of a full-blown consumer spending crunch keep coming. Even the global ad platforms are feeling the pinch. Manufacturers are feeling the effects of rising commodity and wage costs – and passing them on. KitKat maker Nestle is the latest to hike prices, McDonald's and Coca-Cola are taking the same route, and the price of a pint in a pub is about to hit $15. Locally inflation is heading north fast with the full effects of a global energy crisis yet to land. Rates are rising, house prices, the bedrock of both Australia's debt and wealth, have fallen for three months in a row, driving the young, the old and families in the squeezed middle to cut back, switch retailers and brands – borne out by the latest social research data.

Even those tapped into market sentiment can see about two feet in front of their noses. Forecasting how consumers will react in the coming months is all but impossible for marketers trying to map a path through the turbulence.

“In a normal period of time, Australians have one or two issues to worry about. It feels now that the world has spun out of control, so it’s incredibly hard to predict where people are because they have got so many huge conflicting worries and trends,” says Neer Korn, Director of qualitative consumer research firm The Korn Group. He rattles off Ukraine, the global economy, rising inflation, crippled supply chains, China, Donald Trump.

“Plus, we still have a sense of PTSD from Covid,” says Korn. ”There seems to be an overwhelming amount of things to worry about.” Which makes predicting consumer reactions and spending a mug’s game. Korn says he feels like a weatherman.

“The weatherman says I can tell you three days, after that I’m just guessing. It’s a bit like that,” says Korn. “A month, two months [out], it’s impossible to tell at the moment.”

Roy Morgan CEO Michele Levine agrees. Though Australia and Australians have traditionally been resilient to macro economic trends, the auguries make grim reading.

“Consumer confidence at the moment is sitting at 82.4,” she says, where 100 is the point of neutrality. “So we’re well below that point – it’s down eight points since the election and it’s now lower than in the global financial crisis.”

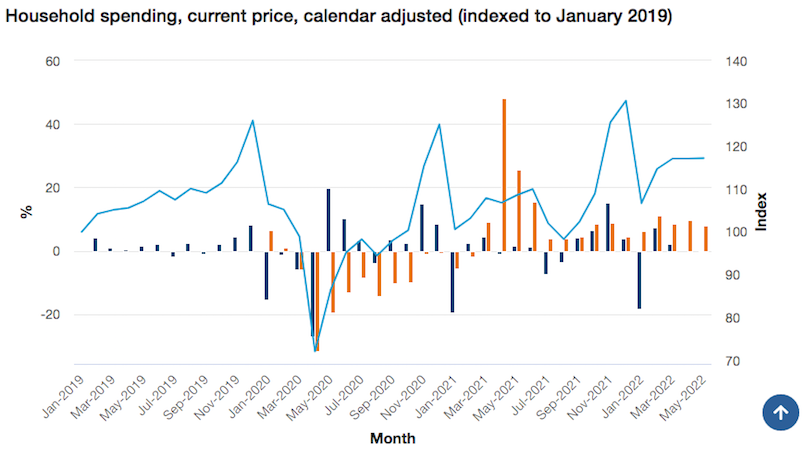

Despite the portents of doom, evaporating confidence has not translated into a wholesale spending crunch – at least per latest Australian Bureau of Statistics data, which shows household monthly spending held up from March to May. Other than annual Christmas spikes, spending remains above pre-Covid levels. Latest ABS retail trade data for June shows slight growth month-on-month – and 12 per cent gains over June 2021.

“I keep predicting that spending is going to start tapering off, but we are not seeing that,” says Levine, “so we have this counterintuitive spending.” She puts that down to millions of Australians banking government funding through Covid – with many now starting to spend savings.

“It’s dangerous to talk about averages, but your average Australian is typically feeling a bit more solid because of their savings,” adds Levine. “Savings really skyrocketed during the pandemic. They’re coming down a bit now as we spend, but they are still way higher than they were before Covid.”

Source: Australian Bureau of Statistics

We are seeing people look at money saving measures – 70 per cent of the people that we surveyed had undertaken money saving measures in the past four weeks, which is incredible.

Cost of living headwinds hit 70 per cent

But a savings cushion is by no means universal. Swathes of the population are already starting to tighten purse strings, per Southern Cross Austereo's Client Insights and Effectiveness Director Jasmine Beech, who oversees a twice yearly consumer mood survey. Beech says its latest findings – from May – suggest Australia’s collective psyche is feeling the weight of the world.

“One of the underlying worries coming through is cost of living,” says Beech. “Previously when we asked an open-ended question around ‘what is your biggest worry right now?’ it was always money, health, family. But for the first time we are seeing articulation of the cost of living coming through as the number two concern. And that was from May, before all of this had really started to happen, so we are seeing consumers really start to feel concerned about what is to come.”

Concern about the Australian economy “is actually higher now than it was during Covid”, adds Beech. “What we're seeing now is the cost of living is having a direct impact on the hip pocket, which is then impacting mood. We are seeing people look at money saving measures – 70 per cent of the people that we surveyed had undertaken money saving measures in the past four weeks, which is incredible.”

Anxiety attacks: 18-29 year olds take brunt

Over the nine years SCA has surveyed consumer sentiment, happiness has been trending down and anxiety rising. Beech says young adults are bearing the brunt.

“Our 18 year olds today were nine years old when we first started surveying. So we’re seeing this whole generation come through with our tracking … Obviously so much has happened in nine years, and particularly the last two that impacts our mood. But the anxiousness is very much driven by those 18-29 year olds. We are seeing [anxiety level] increases a lot stronger within that age group.”

Neer Korn thinks collective angst is a readjustment to reality by a cohort that has been perceived as rejecting the work-life norms accepted by predecessors.

“For 25 years, we've had consistent growth, low inflation, low unemployment. People were cocky. That's why the 18-29 year olds could just be in a job for a year, say ‘I don't like you anymore’ and go to the next one,” he suggests. “That has been their life up until now, then suddenly it is not any more.”

The result, he says, is a deep-seated weariness and amplification of uncertainty already taking root in pre-pandemic Australia.

“In 2019, 1.2 million mental health plans were issued in Australia. So before Covid, we’re not happy, we're stressed. John Howard used to say that his aim is to make the people relaxed and comfortable because that's what the nation needs. I don't know if he got there, but we are far, far away from being relaxed and comfortable,” says Korn.

“Which is why it is hard to find patterns in all of this. Because there is no mass movement, there’s just bits and pieces of people saying ‘what do we do in our circumstance?’ That sense of uncertainty is the biggest thing that’s happening right now…. And the weariness is unbelievable.”

Young males are absolutely skyrocketing on dimensions of anxiety, stress, depression. Women have high levels of depression as well. But the men are where we are seeing the massive increase.

Young men most stressed, depressed

Roy Morgan has been tracking mental health for two decades. The data confirms it’s younger Australians, “particularly young males, that are absolutely skyrocketing on dimensions of anxiety, stress, depression,” says Michele Levine. “Women have high levels of depression as well. But the men are where we are seeing the massive increase.”

The increase could partially be attributable to people and businesses having mental health process and language in place, “whereas previously it was not discussed,” Levine suggests. She thinks societal change already underway has fuelled deteriorating mental health among men.

“There is no question that the women’s movement has turned the men’s world upside down,” says Levine. “There’s a lot of strange and different pressures on people. Covid is not a continuation of that – that’s another thing. But Neer’s point about post-Covid PTSD is probably true and the way we handle that is going to be incredibly important. Because if everyone in Australia goes on a mental health programme, we’ll all just be sitting around talking about things. When to some extent, we just need to get back into life, back into work.”

The new economic order: NEOs keep spending

While the young, the impoverished old and the squeezed middle fret about how to make current and future ends meet against a backdrop of rising prices, Levine says marketers can take some comfort from a free-spending cohort that Roy Morgan calls NEOs. Per its persona data, they make up 24 per cent of the Australian population.

“These premium consumers, called NEOs [or new economic order] are always the ones that recover first – from anything that is thrown at them,” says Levine. She argues that is because they have the capability, financially and mentally, to adapt.

“The NEOs recovered first after the global financial crisis. They are already recovering first now – their consumer confidence is 20 per cent higher than the rest of the community. They'll be looking at things like interest rates and saying, ‘okay, if interest rates go up, the opportunities that creates will be here’. They are active participants in life. They're active with their money, they're active with their decision-making.”

NEOs stand in stark contrast to Australia’s financial bottom rungs. Neer Korn cites a recent pensioner focus group, “where they are telling me how much they are worried about their boiler breaking down. Or another says ‘all I do for myself is every Friday I get the pension, I go to McCafe and I have a cappuccino and a raisin bread’,” says Korn.

“So a quarter of the population [making up the NEO cohort] sounds about right. They are confident, they are earning reasonably well in good jobs; they are safe. They don’t have these huge worries. Money is absolutely the most stressful thing one can handle," he adds.

“Those people who know the system in society, they do really well. The worry is for those who aren’t doing so well and do not have that agency.”

NEOs will fall in love with high value beautiful products and services and pay nine times the base price. But if you look at it and think ‘people are feeling poor, and gee, the pensioners can only afford raisin bread, let's just give it a 20 per cent premium…’ Well, they'll pay the 20 per cent premium, but they were ready to pay nine times that.

Hunt NEOs, don’t discount

Levine implies marketers hunting NEOs have to be singular in their pursuit – and charge them full price.

“We look at people’s customer databases, whether it’s a Meyer or any organisation, and what you find is that the NEOs will spend more. They buy more product and they spend more frequently. They buy cars every year, not every seven like the average. So you have to identify those people in the market and target them,” says Levine.

“One of the big challenges is identifying the willingness to pay that exists … because NEOs will fall in love with high value beautiful products and services and pay nine times the base price. But if you look at it and think ‘people are feeling poor, and gee, the pensioners can only afford raisin bread, let's just give it a 20 per cent premium…’ Well, they'll pay the 20 per cent premium, but they were really ready to pay nine times that.”

Levine says that holds true even in a global downturn.

“That is one of the critical things – I know lots of really rich people who are not NEOs, and they are petrified. They have so much money that they're never going to run out of money, but they're so worried about things. It is not just about having money, it is about the agency and the expectation that they will be able to do good things – and they just want to get out and do it.”

Marketers aiming to tap that group need to better understand their wants, says Levine.

“Examples include having a product delivered in an hour. They will pay for that. But if you only operate within a week, that is all that’s on offer, they won’t… There is huge hidden potential that organisations are missing out on by not understanding their customers and their potential customers.”

Where boomers had a gap year, young people have created a gap decade to explore, travel, build a CV with experiences to regale future generations with stories. Now they say, hold on, I think owning a home is not going to happen. That is why we’ve had a third-life crisis at 30. So I think they are going to be a bit more conservative and worry about their careers and money.

The ‘third-life’ crisis

SCA’s Jasmine Beech was a teenager when the GFC hit. Now 30-ish she thinks experiencing Covid has given her generation greater “emotional resilience” to deal with the current cost of living crisis. She thinks millennials are more financially savvy and more willing to trade today’s needs for security tomorrow.

“Yes, I still want the house and the car, but I also want to make sure future Jasmine is all set up as well.”

Neer Korn thinks that mindset shift has been long in the making. He suggests Australia’s millennial cohort is having a ‘third-life’ – as opposed to midlife – crisis. He thinks a swing back to conformity is one of the few areas “that we can actually make a prediction”.

“In the last two decades, where boomers had a gap year, young people have created a gap decade to explore, travel, build a CV with experiences to regale future generations with stories.” But then house prices went crazy, torpedoing the “Australian dream” of home ownership, and forcing a generational rethink, says Korn. Meanwhile, those weathering their first prolonged economic downturn are now re-evaluating.

“Now they say, hold on, I think the home is not going to happen. That is why we’ve had a third-life crisis at 30,” he suggests. “So I think they are going to be a bit more conservative and worry about their careers and money, instead of sitting on the beach in Koh Phi Phi or volunteering in Nigeria.”

Communities, trust now key for retailers, brands

Covid brought consumers much closer to their communities, changing city, suburb and regional dynamics. Michele Levine thinks that trend will continue.

“That doesn't mean that Kmart hasn't got a hope. But Kmart does have to recognise that the local community that it's operating in has different kinds of people and make sure that it's actually relevant to them,” she says.

Levine cites US bookseller Barnes & Noble as a standout.

“Essentially it was doing really badly. Then it decentralised control down to the local managers who could choose what books, what prices – and it has flourished. That's because once an organisation gets engaged with the community it feels like part of the community – and it's a wonderful circular thing where it can do better and it attracts the community. So that is a really important thing to look out for.”

The flip-side to that is trust. Woolworths and Coles “stormed ahead during Covid in terms of people trusting them and not distrusting them, because they stepped up, stayed open, went to deliveries and did what people needed,” says Levine.

“But that trust will be fragile if they don't get it right in this next phase. Will people be comfortable when lettuce goes from $4 to $11 or do they believe that it's a real issue? So that will be incredibly important.”

She says clarity and honesty of communication will be critical as headwinds bite deeper.

“For bigger companies, when something happens that makes people distrust them, it just goes like wildfire. So there'll be a really important communication piece for large, visible companies with a big voice. The simplest way to talk about this is 'truth told simply',” Levine suggests. “Don't be tricky. Don't try and put prices up and make up excuses for it. Come out and let people know.”

The lipstick effect: Categories holding up

Neer Korn thinks Australia’s poorest will keep buying many of the non-essential products that provide small comforts. “The sense is, ‘if I have got to buy the home brand Tim Tams, what is the point of living?’.”

More broadly, he thinks home deliveries will also hold up. “It is convenient but there is more to it. When you get home, there is a package there. We’re looking for little surprises in life; when you can’t enjoy the big things, enjoy the tiny things. And these things are really important, so the emotional purchases are really key.”

In a resource-rich economy, “doom and gloom is not a foregone conclusion”, per Michele Levine. Either way she thinks some categories will see a bounce, as they did in the eighties, the last time Australia faced recession.

“Chocolate consumption and lipstick purchasing went up – which feeds into Neer’s point around little surprises, little luxuries. People need to feel good, so we can expect that kind of behaviour. But what’s really important is that the data is currently showing that the biggest growth in spending is non-food, more discretionary items,” says Levine.

At the top end, the free-spenders will still want quality products and services, such as electric cars and luxury holidays. At the bottom end, those on the lowest incomes “will still have to buy their basic needs”, she adds.

“It’s the stuff in the middle. If you’re selling basic products and trying to convince people to pay a lot more for them, that’s the area you’re really going to struggle in.”

SCA’s Jasmine Beech says the lipstick effect may ultimately cross categories.

“We’ve spent so much money on home renovation over the last two years. What does that look like with the lipstick effect applied? Is it rather than doing a big bathroom renovation, it becomes spending on tapware? Within that there are going to be those who get the really cheap new tapware and those who indulge in the expensive luxury items.”

The trick for marketers is working out where the pockets of growth lie while convincing boards not to turn off the taps altogether. That requires agility, says Neer Korn, with longer-term planning “a bit futile … any huge brand plan will have to change constantly”. But Michele Levine says the worst plan is to wait passively for things to unfold.

“Consumers shape the future. Organisations that want to be part of it need to listen to the future shapers. What do people really want, what are they imagining, what will it look like? Now, in this kind of weird time, is a great time to get out there and do that, rather than sitting and waiting for the storm to pass.”