$10bn year for Facebook and Google: Digital ad spend smashes pre-Covid levels; $3.2bn in September quarter, up 42%

IAB Australia CEO Gai Le Roy: Timetable was always tight, but "no red flags".

Australia’s digital advertising sector is booming, IAB Australia says, reaching $3.232 billion for the September quarter. Which presents a Christmas present for Facebook and Google, which trouser more than 80 per cent of all digital ad dollars, suggesting a $10bn year for the duopoly.

What you need to know:

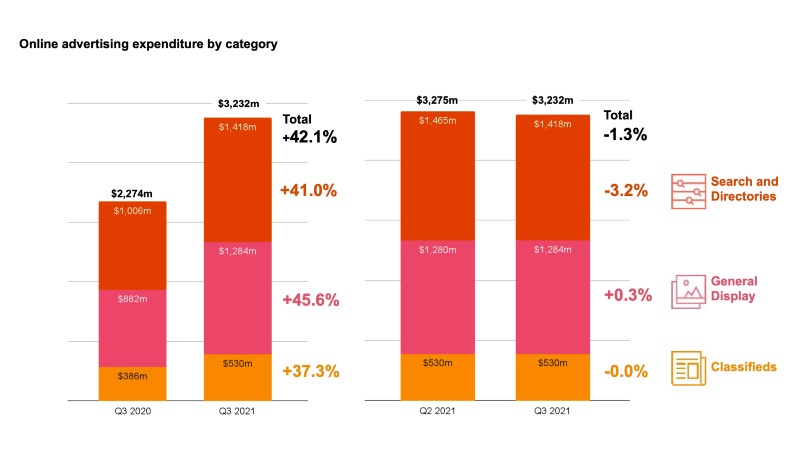

- IAB Australia has released its latest Online Advertising Expenditure Report, finding the total digital advertising market grew 42 per cent year-on-year to more than $3.2bn.

- Slight contraction from last quarter, but a 36 per cent increase on the same quarter from 2019.

- Retail was the highest-spending category on display ads, followed by finance.

- Figures suggest a bumper year for Facebook and Google.

Australia’s digital advertising market has continued its upward surge, reaching more than $3.2 billion for the months of July, August and September alone – up 42 per cent year-on-year, according to new IAB figures.

The figures, compiled by PwC in IAB Australia’s Online Advertising Expenditure Report, show retail is the biggest spending category and video is still growing rapidly.

“The September quarter had a mix of highs and lows with Olympics activity encouraging investment but the travel market pulling back again with local lockdowns," said IAB Australia CEO, Gai Le Roy.

"Overall though investment in digital advertising market continued to impress, with the September quarter increasing 42 per cent on the Covid impacted September 2020, but also increasing 36 per cent compared to the 2019 September quarter.”

With results of $3.2bn in this quarter, and the $3.28bn, $2.89bn and $2.95bn in previous quarters, the past year has seen digital advertising investment of more than $12.3 billion. That suggests a circa $10bn year for Facebook and Google, which take more than 80 per cent of all digital ad dollars in Australia, according to the ACCC.

Search and directories grew 41 per cent, general display grew by 45.6 per cent and classifieds grew 37.3 per cent. The total market declined by 1.3 per cent on the past quarter.

Retail held 14.4 per cent of the display advertising market, followed by finance, with 10.6 per cent and automotive with 9.9 per cent.

Video advertising expenditure rose by 10.8 per cent on last quarter, to a record $784.1 million.

Programmatic trading of publishers’ content inventory increased in the September quarter, peaking at 45 per cent of total expenditure, versus 40 per cent bought through agency insertion orders and 15 per cent direct.

Legacy media dips

While Australia's digital duopoly continue to increase takings, Australia's domestic publishers suffered a dip in takings for October, according to SMI data, though largely due to timing issues.

SMI, which compiles media agency spend, reported a 8.4 per cent drop in TV revenue year on year and an 8.7 per cent dip for newspapers – but pointed out that both AFL and NRL grand finals were held in October last year due to Covid.

See the full SMI story here.