Telstra CMO's $250m warning: Commit to our carbon targets or get flicked; agency bosses question big brand commitment to clean and pricey versus cheap and dirty

“[We’re] looking at our supply chains as well and how we actually get our suppliers to commit to the same targets we have. And then if they can't commit, then choose a different supplier," Telstra CMO Jeremy Nicholas said.

Telstra CMO Jeremy Nicholas has reiterated that the telco aims to cut out publishers, agencies and tech providers that do not align with its decarbonisation and social mandates. In advertising and promotion alone that puts $250m annual revenues at risk for suppliers. The warning comes as GroupM prepares to launch carbon calculators across digital channels, and independent agencies mobilise on sustainability. But other agency bosses suggest whether blue chips walk the talk or remain fixated on cheapest media remains to be seen.

What you need to know:

- Telstra CMO Jeremy Nicholas says part of the company's ambitions to meet decarbonisation goals means decarbonising its supply chain, which includes media owners and agencies.

- Those that don’t align with Telstra's mandates will eventually be pushed off the plan.

- Nicholas joins a brand and agency percussion section starting to beat in unison. GroupM CEO Aimee Buchanan and Essence’s Pat Crowley last week told Mi3 a carbon calculator is in the works that will run the rule over programmatically traded supply paths.

- Yet the bulk of the market remains unmoved. Nunn Media’s Chris Walton says he’s starting to see questions from brands, but no investment decisions are yet made on the basis of decarbonisation,

- Meanwhile, other holdcos bosses think the big brands making the most noise will still buy on the basis of lowest price, not lowest embedded emissions.

If they can't commit, then choose a different supplier.

Decarbonisation Is Why

Media agencies and owners will need to commit to similar carbon goals as Telstra or risk being sidelined, the company's top marketer Jeremy Nicholas says.

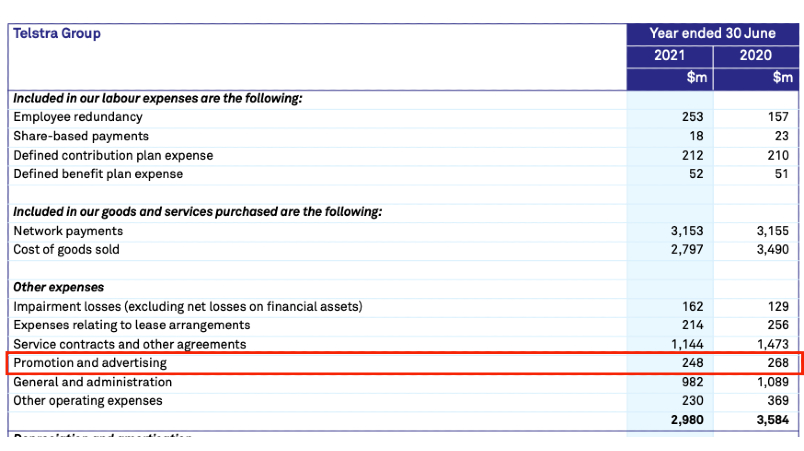

The telco is one of the country’s largest advertisers, with an OMD-held master media account estimated to be worth more than $100 million. It spent $248 million on “promotion and advertising”, according to its 2021 annual report.

Speaking on a sustainability-themed panel at an event hosted by Nine, Nicholas was asked how Telstra communicates with its customers about its decarbonisation plans. Telstra is already carbon neutral - and has been since 2020, plans to cut emissions by at least 50 per cent by 2030, and will use 100 per cent renewable energy by 2025. It is one of Australia’s top 15 energy users, Greenpeace has found.

“The worst thing you can do is go out and advertise when it's actually not true, or you're actually fudging it,” Nicholas said.

“[We’re] looking at our supply chains as well and how we actually get our suppliers to commit to the same targets we have. And then if they can't commit, then choose a different supplier.

“That's where we're at on that stage now, and that's where there'll be opportunities for companies like [Nine] and others to actually participate in that.”

Nicholas said some companies won’t be able to commit, but there’ll be opportunities for those that can enact change.

“Which is a great question for the advertising industry, which is the media supply chain, and where the media supply chain is going to participate in that as well,” he said. “And there are some opportunities there.”

It’s not the first time Nicholas has linked future spend with supplier carbon action – he warned it was coming in July last year.

Nicholas made the comments at Nine’s State of the Nation event. Nine has made a pitch for brands to go bigger on sustainability, launching a series of editorial sections and podcasts across its publishing division dedicated to covering the challenges of decarbonisation.

Meanwhile, Nine itself has no current decarbonisation timeline or published strategy, and its 2021 Annual Report’s “environment” section, which covered its emissions obligations energy reporting, extended to a little over 200 words. In comparison, execs at the UK broadcaster ITV are given bonuses for successfully meeting climate targets and has set a goal of 2025 to cut ties with suppliers who don’t meet certain criteria.

Nine yesterday released research that found, through a survey of more than 5,000 Australians, that 38 per cent couldn’t name a single brand or company that is pursuing sustainable practice. It backs up a previous survey from OMD that found that figure to be 50 per cent.

There are probably only 300 or so advertisers in Australia that spend more than $3m a year on media. There might be another 100,000 [small advertisers] that just want to raise awareness of their brands and convert demand ... [ESG media mandates] will be driven by the top end of town.

Top end of town mobilising

Of the holding companies, GroupM is trying to take first mover advantage on decarbonisation. Meanwhile indies including Melbourne-based Optimising, Benedictus Media and Alchemy One have secured B-Corp certification, which means their social and environmental performance, legal commitment and transparency have been measured and assessed independently – and means they are probably the only agencies genuinely walking the talk.

Nevertheless, GroupM CEO Aimee Buchanan will outline a plan next week to staff to develop a carbon calculator that will benchmark where a media plan – and digital media channels – sit in terms of carbon footprint, while Essence CEO Pat Crowley last week told Mi3 he sees carbon credits becoming “a fundamental part of every single business in this country moving forward”. Their comments echo global GroupM CEO Christian Juhl’s plans to drive decarbonisation, which are making waves through the media supply chain: Juhl's interview was one of the most highly read stories on Mi3 last year.

Indies not buying it.... yet

While GroupM may be going hard and early, Chris Walton, MD at Nunn Media, one of Australia’s largest independent media agencies, said supply chain mandates and sustainability are not yet swaying budget allocation.

Walton said some of its clients are starting to demand proof of commitments to ESG criteria, alongside DE&I and modern slavery policies, but thinks supply chain purges remain some years off.

“There are probably only 300 or so advertisers in Australia that spend more than $3m a year on media,” said Walton. “There might be another 100,000 [small advertisers] that just want to raise awareness of their brands and convert demand. So the Telstras, the NSW and Federal Governments, the Toyotas, dare I say the Harvey Normans, are the ones that have to drive meaningful change,” said Walton.

“It is definitely coming [ESG metrics in media panning and buying] but it will be driven at enterprise level.”

A holding company boss agreed:

“We are working on ESG and other pillars [to plan and buy against],” he said. “But whether the brand owners are prepared to pay more to live up to the corporate mission statements in lights above their reception – or will as usual just opt for the cheapest rates – remains to be seen.”