Data sheds light on return to CBDs

Australia’s changing patterns of movement, culture and commerce as we adapt to post-Covid life throw up interesting challenges for advertisers trying to reach desired audiences. Here’s what the data tells us so far.

It is without a doubt that we are in an enviable position here in Australia. With the benefit of having contained Covid-19 thus far and the vaccine rollout underway, as a nation we continue to navigate our way out of the pandemic with likely ebbs and flows to come. And even with the potential of brighter times ahead, signalled by reopening of borders and establishment of travel bubbles, the scars of the year that has passed and the reality of snap lockdowns and ongoing effects of the virus, means the ground is still shifting and will continue to do so.

So as consumer behaviour continues to adjust, the need for robust and reliable data capturing consumer behaviour is at an all-time high.

When we look at some of the more dramatic changes in behaviour over the past year, the effects of Covid on daily life was no more evident than on that of professionals and our working life. We saw dramatic changes in our work lives and routines through 2020 and as life creeps back to normal and the return to the office picks up, there are still a number of unknowns alongside some bold predictions.

Recent claims that working from home is the future of the workplace may not be wholly accurate. In fact, mobility trends for workplaces demonstrate that CBD and office workers are returning across the country. It’s still early days and hence begs the question – despite the pandemic, will the lure of central business districts, established hundreds of years ago as places where people would gather for retail and commercial purposes, endure as professionals yearn for the connection and opportunity that they present?

Data signals yes as we see a distinct upward trend in recovery

Data shows that Australians are back on the move and are confidently back out and about. Roadside audiences have been performing strongly across Australia reaching 99% of year on year levels in April, with the oOh! Road network delivering 264 million contacts per week1. CBD audiences interestingly are now on the same upward trajectory, with oOh!’s Office and Cafe networks each delivering over 27 million contacts weekly, signalling a positive outlook. In line with this return is the continued growth and recovery of consumer confidence up 1.9pts to 112.3. This has now slightly surpassed the 2021 weekly average of 110.6, but more importantly is a substantial 47pts higher than the record low recorded the same week, 12 months ago10.

A further factor supporting the return of audiences to business hubs is the gradual recovery of business travel, with Qantas recently stating that corporate travel and business travel has reached about 65% of pre-Covid levels with ongoing growth each month2.

CBD peak times shifting post-Covid

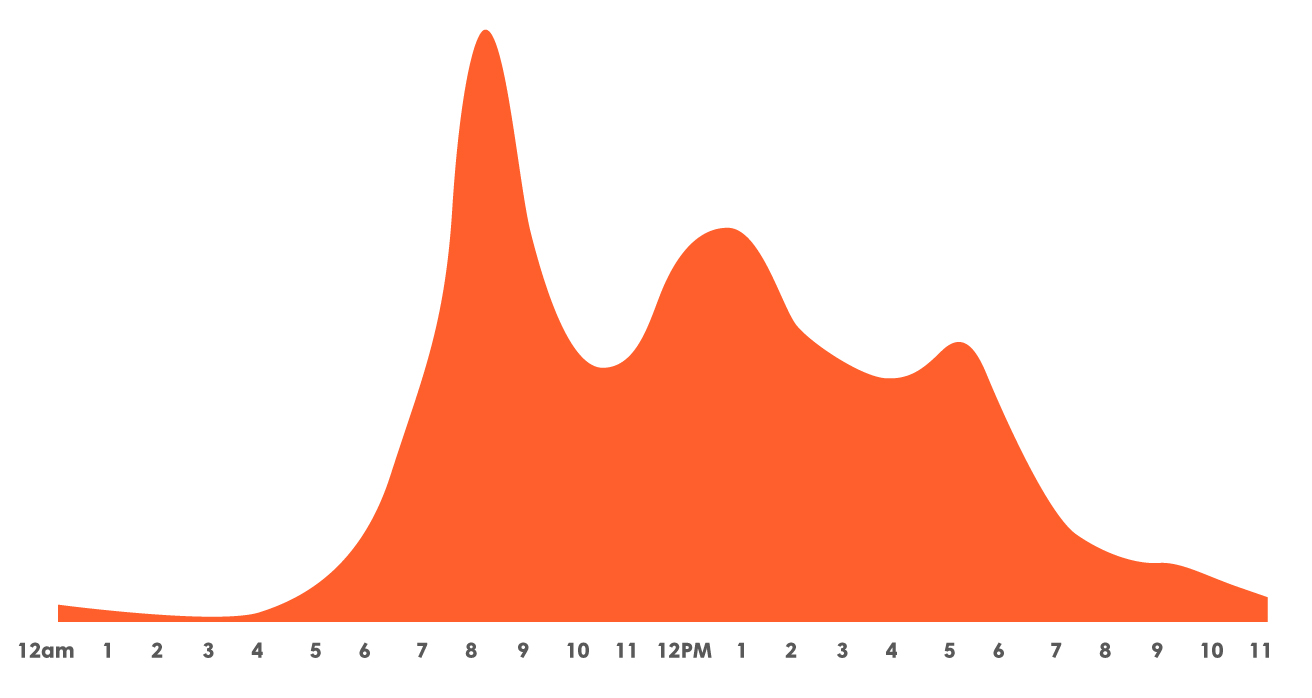

While confidence in the return to business hubs is on the rise, one trend we are seeing emerge is the pivot of peak hour travel. The traditional morning and evening peak in traffic into and out of business districts is changing. While maintaining a definite lift at the beginning and end of the day, travel patterns are flattening and spreading across the entire work day as workers take advantage of flexible working conditions to avoid periods of heavy traffic and congestion on roads and public transport. This means more people on our roads and transport networks across various moments throughout the day, and a redefinition and broadening of the traditional peak ‘hour.’

As Covid struck in April 2020, travel into Sydney’s CBD dipped to just 17% of 2019 levels. However, our latest data from April 2021 shows audience levels have nearly tripled since the beginning of 2021 (3).

The sprint to recovery for commuter hubs

While visitation to CBDs increases, non-CBD commuter hubs demonstrated not only a resilience during Covid-19, but have also sprinted to recovery, with workers returning at a rapid pace across our capital cities

Looking at major commuter hubs in Sydney, audiences were maintained throughout the pandemic as workers returned to the office sooner due to the comfort of lower population density and the ability, in many cases, to access outer business hubs via personal modes of transport. In the Pyrmont business hub for example, average weekly visitation saw far less declines than Sydney CBD and has been tracking above 2019 levels since the beginning of the year4.

Although heavily affected throughout 2020, Melbourne tells a similar story. While Melbourne CBD audiences were impeded and are experiencing a consistent return 4.1, just three kilometres away in South Melbourne, audience levels have jumped more than 50% since the beginning of the year 4.2 to near 80% of historic levels 4.3, leading the way in indications of a broader return to work into the future as confidence grows.

Attitudes towards return to offices

With all of the talk and focus on the ‘return to the office’, it’s important to remember that white-collar professionals make up just 43% of the Australian workforce. There’s a huge chunk of Australians who, when faced with Covid-19, could not do their jobs from home. In 2020, staff in construction, operations, retail, healthcare sectors and more, continued to make the daily commute and work on site when conditions allowed. So while office workers retreated to their homes for work and took to local streets for daily trips out and about, there remained a significant amount of the workforce that carried on.

Office-based workers may have enjoyed the convenience of reduced commute times and ease of working from the dining room table (or study for those who were lucky). But there are many less overt benefits of being in the workplace to consider. PWC’s latest survey finds that 66% of people would prefer to connect with others at a physical workplace6. This is reflective of the trends we’re seeing as office and café audiences reach the highest contact levels since December 2020, delivering over 110 million contacts nationwide in March alone11. Once people were given the chance to return to the office, they have dipped their toe in and are gradually returning more frequently.

Anecdotally, across our own offices we’re seeing an increase in returning employees, who are soaking up the culture, connection and team morale that can’t be achieved from dining room tables.

On a wider scale, as of mid-November 2020 close to half of workers were found to be not working remotely at all7. Meanwhile, 85% of people who are working remotely do not want to do so every day, signalling that flexi working and the physical role of the workplace are here to stay8. In addition to the attraction of the workplace for the benefits of collaboration, connection and opportunity, we’re seeing a return in spend that signals confidence in heading back to cafes, out to work lunches or after work drinks and even a spot of retail therapy.

Snap lockdowns are here to stay; Navigation is crucial

Confidence in audiences and an understanding of behaviour is crucial for our medium, and it’s reassuring to note that while snap lockdowns continue, people bounce back just as fast – the Sydney Northern Beaches and Victorian lockdowns in late 2020 and early this year both saw a strong and near immediate return of audiences as they jumped over 15% week on week9.

It’s clear evidence that some kind of normality is returning, despite Covid rumbling on. Extensive data reveals a return to city life and office work, which is good news for our economy as a whole and marketers seeking to reach new and existing customers, wherever they are. Having a finger on the pulse via reliable and robust data sources is crucial in interpreting our changing behaviour and the impact this has on where we reach Australians through advertising.

While the future is never certain, and the jury remains out on exactly what work life will look like into the future, early indications are we may just see CBDs and business hubs adapt, survive and thrive for years to come, just as they have for centuries past.

Our cities define us, offering culture, connection, opportunity and energy that can’t be gained from a home office or zoom meeting.

In the meantime, we’re keeping a close eye on the numbers – and will always keep you in the picture.

Sources

- oOh! Smart Reach, DSpark, aggregated weekly total volumes Road locations nationally, period week ending 12th April

- https://www.businesstravelnews.com/Transportation/Air/Qantas-Reports-Recovery-of-Majority-of-Domestic-Business-Travel

- oOh! Smart Reach, DSpark, Movement data for Sydney CBD, Road locations period 12th April 2021

- oOh! Smart Reach, DSpark , Office locations , Aggregated weekly total volumes

- 2021 volumes as a % of 2019, period last 4 weeks of 2021 (15-Mar-21 – 12-Apr-21) against same weeks of 2019

- 2021 % growth since first week period Jan (12-April-21 / 04-Jan-21)

- 2021 % volumes 12- April-21

- Quantium, Banking transactional data (electronic spend only), weekly Transaction volume vs same week 2019

- PwC, ‘Changing Places: How hybrid working is reinventing the Australian CBD’ report (2) PwC, ‘Thinking Beyond: How the pandemic is rewiring a new world of work’ report

- Pitcher Partners & Bastion Insights employee survey, New Normal Special Report: Hybrid working 2021, n=970 (14/9), n=1,006 (13/10), n=988 Australian employees (17/11)

- BCG survey, Personalisation for your people: How Covid-19 is reshaping the race for talent, n=1,002 Australians, 2020

- oOh! Smart Reach, DSpark , Roadside and Retail locations , Aggregated weekly total volumes, 3,200+ oOh! Road locations and 500+ Retail locations, period week ending 22nd of February

- ANZ – Roy Morgan Consumer Confidence March 30th 2021

- oOh! Smart Reach, DSpark, Movement data for Office and Café locations 01-March 21 to 29th March 2021