Three quarters of media buyers have used programmatic DOOH: IAB Australia

There has been an “explosive” recovery for OOH after the dramatic pandemic downturn - there was a 125 per cent increase on net media revenue for the Q2 2021 compared to 2020, the OMA says.

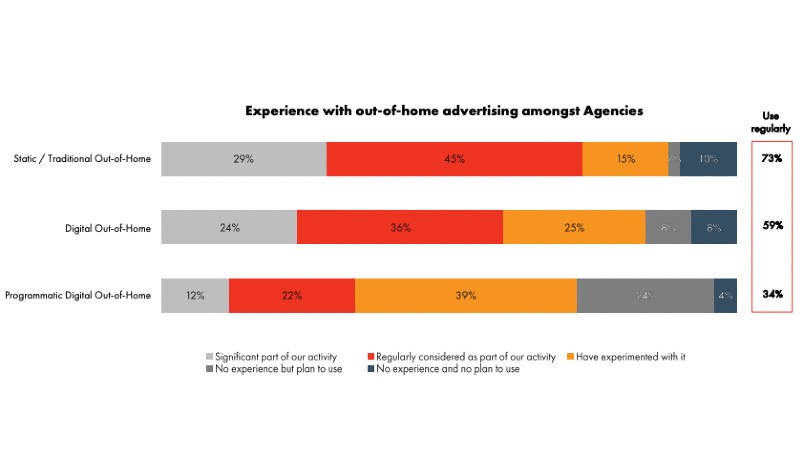

The signs are positive for take-up of programmatic digital out of home. Spend in the OOH sector is returning, the Outdoor Media Association says, and three quarters of media buyers and advertisers have traded OOH programmatically. In 2020, almost a quarter tried it for the first time.

What you need to know:

- Almost a quarter of agencies traded digital out of home programmatically in 2020 for the first time.

- Three quarters of media buyers and advertisers have used programmatic digital out of home.

- IAB Australia's inaugural Attitudes to Programmatic DOOH report surveyed 183 media buyers and advertisers in May.

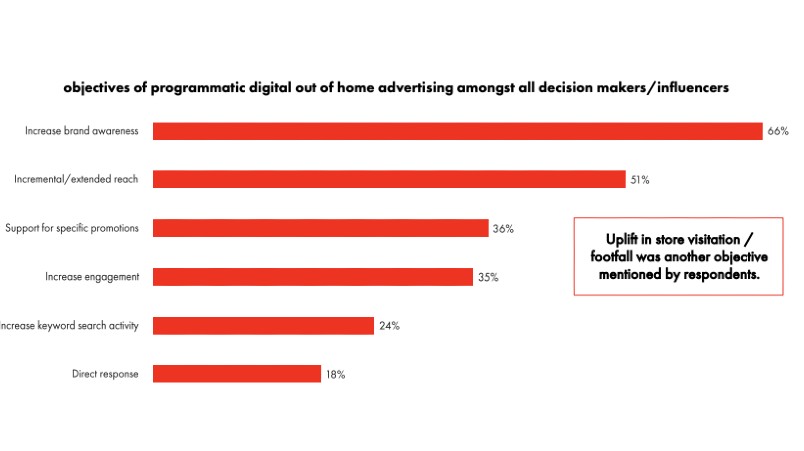

- Increasing brand awareness was the main objective of pDOOH advertising.

Almost a quarter of agencies in Australia traded programmatic Digital Out of Home inventory (pDOOH) for the first time in 2020, the IAB says, while another 10 per cent increased their programmatic investment.

In IAB Australia’s first Attitudes to Programmatic DOOH report, which surveyed 183 Australian media buyers and advertisers in May, respondents said flexible buying options, enhanced reach and data and targeting were the driving factors why agencies considered pDOOH.

Of the 183 people surveyed, 139 had used pDOOH advertising. The key objectives of using pDOOH were:

- Increase brand awareness (66%)

- Incremental/extended reach (51%)

- Support for specific promotions (36%)

- Increase engagement (35%)

- Increase keyword search activity (24%)

- Direct response (18%)

Ben Allman, Chair of the IAB Australia’s DOOH Working Group and APAC Sales Director at Broadsign said: “There has been plenty of chatter regarding the willingness of brands and agencies to embrace the programmatic buying of DOOH and the findings of the report confirm this.

“The report enables us to pinpoint exactly where industry effort is required to maximise investment in the space.”

The report, the first from the organisation’s DOOH Working Group, found 47 per cent of decision-makers stopped or lowered pDOOH activities in 2020. Half (49 per cent) of pDOOH influencers always or frequently buy inventory independently from other media, and those surveyed rated their understanding of digital Out of Home at 6.8 out of 10 (10 being expert).

The survey also predicted the sector will see greater creative experimentation in the 2021/22 financial year.

“I have every confidence that the programmatic DOOH market will boom through 2021 and 2022,” IAB Australia CEO Gai Le Roy said, “embracing the benefits of programmatic while also retaining the long-standing agency approach to developing fit for purpose OOH creative for different environments and placements.”

There has been a OOH boom

Earlier this week, the OOH industry said there had been an “explosive” recovery after the dramatic pandemic downturn, announcing an increase of 125 per cent on net media revenue for the second quarter of 2021 compared to 2020.

The Outdoor Media Association said the industry had recorded $203.3 million in Q2 2021, up from $90.3m in 2020. Digital OOH revenue accounted for 61 per cent of total net media revenue so far this year, an increase from 57.9 in 2020.

“Out of Home advertising felt the full brunt of the pandemic at the height of lockdowns in Q2 2020, which explains the explosive increase of 125 per cent year-on-year,” Charmaine Moldrich, OMA CEO, said in a statement.

“A better indication of our recovery is that we are only down by 17 per cent on pre-pandemic revenue from Q2 2019. Each month this year has been better than the previous month.”

Year-to-date revenue has increased 22 per cent and is sitting at $374.6m, up from 307m on 2020 revenue.

According to Standard Media Index (SMI) figures, advertising spend is on track to report growth in the 2020/21 financial year, with OOH bookings up 198 per cent in May and “mind boggling” numbers in recent months.