Split vision: Specsavers backs brand as challenger rival Bailey Nelson sees 400% growth in online conversions with VR play

Specsavers' Shaun Briggs: “The remake rate of eyewear is really high; the error rate around lens and style is a lot to manage, so e-comm goes up in lockdown, but it's a very small part of our business.” Plus, Mi3's Freya Morris tests Bailey Nelson's VR.

Market leader Specsavers and challenger brand Bailey Nelson are diverging wildly for their post-Covid growth plans. Bailey Nelson has gone big on e-commerce, delving into virtual reality to keep sales alive, seeing conversions increase 400 per cent. Specsavers, following an integration deal with Nine and Married at First Sight, is chasing more locally developed and targeted creative. And both brands are gearing up for a big fourth quarter and a Christmas boom. The racing goggles are on.

What you need to know:

- The launch of Bailey Nelson’s Virtual Try On experience boosted online sales conversions 400 per cent.

- E-commerce driving 50 per cent of Bailey Nelson's in-store visits, acting as a media channel in itself.

- Market leader and rival Specsavers is instead focusing its efforts on brand activations.

- Specsavers' marketing boss hinted at more integration through TV and local campaigns following 10-week MAFS campaign earlier this year, but with a different approach.

- Bailey Nelson pulling back from OOH brand push to focus on digital for remainder of year.

We’re going to be sticking to digital channels. Last year we had a more typical brand push but the uncertainty this year with trade and caps on public transport have made it difficult.

The full Nelson

In a literal battle for more eyeballs, two leading eyewear brands in Australia are pursuing vastly differing approaches to marketing in a category that has been deeply impacted by lockdowns. Can both grow and gain share? By early next year the market will find out.

Global giant Specsavers and Australian challenger Bailey Nelson kicked off this year with big brand efforts, focused primarily above-the-line channels such as TV and outdoor, respectively.

But in the wake of another round of lockdowns and in a sector where sales are driven mostly off the back on in-store eye tests and yearly check-ups, both companies have opted for different approaches to a "vital" fourth quarter and Christmas.

Bailey Nelson has gone large on e-commerce, pushing deeper into VR capabilities to improve online conversions, as above-the-line efforts stalled in the face of Covid.

This month Bailey Nelson reported online sales conversions grew by over 400 per cent in 2021 following the launch of its 'Virtual Try On' function.

The brand partnered with 3D augmented reality (AR) platform, Plattar, building a 'virtual visualisation product' from scratch, enabling customers to try on 60 products through its e-commerce platform.

Head of Marketing James Kerridge told Mi3 that while plans to launch the feature had been underway for some time, lockdowns expedited the e-commerce game plan tenfold.

“Our aim was to create a differentiated experience that would keep sales going while matching the in-store experience as closely as possible,” said Kerridge.

The online play was primarily driven by Bailey Nelson’s performance-orientated media strategy with a 60:40 ratio over brand although it has also been exploring above-the-line opportunities.

Traditionally skewing toward text messaging, email marketing and organic search, Kerridge branched out into outdoor earlier this year as the main channel to boost brand awareness. Bailey Nelson could be seen across multiple bus wraps in major cities, designed to target locations and suburbs with current or new stores.

Kerridge said the push raised awareness but he ultimately pulled the strategy given Covid decimated commuter numbers. While lockdowns are expected to lift next month, he thinks the brand push has done it's job for now – and will focus on conversion between here and 2022.

“We’re going to be sticking to digital channels," he said. "Last year we had a more typical brand push but the uncertainty this year with trade and caps on public transport have made it difficult.”

“We will be pulling out-of-home for the next few months and diverting that into capitalising on people spending more time on their phones or in digital channels.”

E-commerce, he said, has become a major plank of Bailey Nelson's overarching clicks and bricks strategy. “The website should act as a catalogue for our range. More than 50 per cent of our in-store traffic begins on the website with people booking an eye test.”

Kerridge said the next step is to incorporate VR directly into its in-store experience and use the technology to sell products that may not necessarily be available in stock.

“The website is a critical step in the customer journey. Any investments in the website are not specifically about driving e-commerce," said Kerridge, but boosting omnichannel commerce. "I love driving dollars through the online channel. When you've got traffic, 50 per cent of the leads coming into store start from the website, it makes the return on investment on that touchpoint a lot higher.”

Hence, the more it invests in e-commerce, the more Bailey Nelson anticipates it will drive in-store purchases.

Customer lens: The verdict on VR

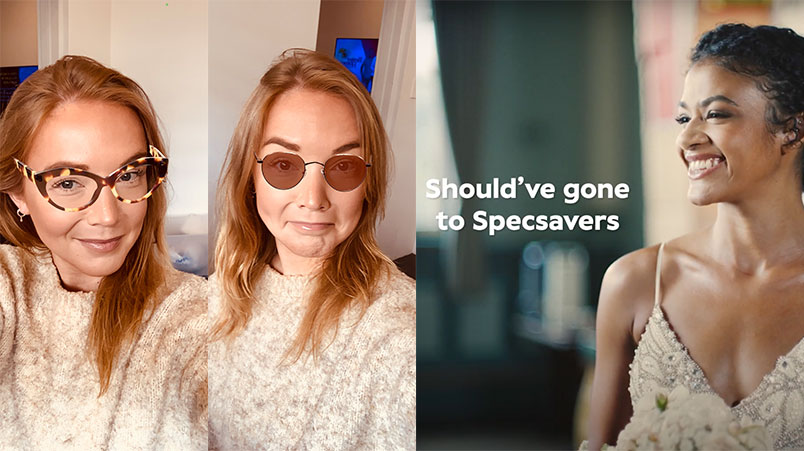

Intrepid Mi3-er Freya Morris (pictured) took a slightly nearsighted review of Bailey Nelson's VR app. Here's what she found:

"Novel, convincing way to try on glasses. Select ‘Virtual Try On’ and the glasses appear on your face, very realistically."

"Detailed so that you get a sense of the look of the design and how it fits your face shape."

"AR adjusts to distance well so you can also look up close – see the detail. Also, glasses adjust to the different angles you hold your face, so a sense of a 360 degree view."

"Feels genuinely accurate, but does seem to work better for some glasses than others."

"Can also flick between your face and the ‘object’ view – a 360 degree view of the glasses themselves."

"Tried on nearly every pair that this was available for and it worked well 99 per cent of the time, so the VR tech seems solid."

Verdict: "It’s probably the only way I’d ever trust myself to buy glasses online without trying them. Actually makes buying glasses fun!"

Honestly, we need to do more locally-led work and we don’t do enough pure brand, in my opinion… but it’s hard. There’s a lot of stakeholders to align in our consumer and trade efforts.

Specsavers: Both eyes on brand

For Specsavers head of marketing planning, Shaun Briggs, e-commerce isn’t where the action is – it’s a nice to have but isn’t making up for the impact from Covid-induced store closures.

He said its e-comm platform performs well for commoditised products such as contact lenses but lags when it comes to its core eyewear portfolio.

“The remake rate of eyewear is really high and the error rate around lens and style is a lot to manage, so e-commerce goes up in lockdown for us, but it is an incredibly small part of our business,” Briggs said.

While the brand keeps an 'always on' performance and digital strategy – roughly a quarter of its marketing activity – Briggs is eyeing further opportunities in above-the-line channels that drive brand awareness.

After a major brand push earlier this year, led by a campaign created in partnership with Nine and its flagship reality program Married at First Sight, Briggs sees further opportunity to focus on local creative.

Specsavers locally was given the nod to create a bespoke, integrated TV ad specifically for MAFS – which led to “entertaining and light-hearted” creative from agency AJF, nodding inevitably to its “Should Have Gone To” tagline when deciding to get married at first sight.

The campaign helped bolster online traffic by 6-7 per cent but after 10 weeks of the same campaign, it started to run its course, said Briggs.

He said the concept was the right move at the time but admitted he would be hesitant to repeat the exact strategy again.

“By the end of the MAFS season, we could see in our metric that people had seen enough – so would I do that again? Probably not – but there’s still a lot of room to find similar opportunities if the budget allows for it,” Briggs said.

“Honestly, we need to do more locally-led work and we don’t do enough pure brand, in my opinion…but it’s hard. There’s a lot of stakeholders to align in our consumer and trade efforts.”

Briggs said brand activations were vital as major markets such as NSW and Victoria aim to exit lockdowns before Christmas.

He said when the brand pulls activity, as it did for three months last year during Victoria’s harshest lockdown, Specsavers sees a “noticeable decline” in core metrics such as top of mind consideration.

“What I saw in Kantar research was a significant drop off in those main areas of consideration that I consider lead indicators for a business,” Briggs said.

“However, when we reinvested into those channels post-lockdown, they all came back again and hockey-sticked back to our normal levels.

“We’re also a brand that benefits from that return to retail rush. So we’ve got to remain geared towards that activity, especially as the rush for Christmas begins.”