The immediate future of Out of Home: Why cold, hard purchase data trumps programmatic hype

There’s a lot of hype around programmatic trading of Out of Home inventory. It will come, eventually, but our view is that industry needs to take a deep breath, says Bel Harper, Group Director - Product Strategy at oOh!media. In the meantime, brands should be targeting audiences based on actual buyer behaviour if they want to achieve stronger ROI – and thinking beyond supermarket screens.

The past few years have seen rapid development in the Out of Home industry. Established players have grown, new entrants and products have come into the market, data has become more prevalent and complex, and measurement methods continue to evolve in disparate ways.

This is, in some ways, making the industry harder to navigate, at a time when investment in it is of increasing value.

Out of Home looks set to regain audience and revenue growth trajectory from 7% to 10% of the total media pie over the next three years, and media spend is expected to continue its pre-Covid trend of de-emphasising TV, press, cinema and other traditional audiences as they decline and fragment.

Against this backdrop, it’s a good time to simplify things and look at four key areas where most of the action is happening, uncovering how the future is taking shape. The first of these is programmatic, followed by data, then audiences, and finally we end up back where we started with a discussion of what simplicity looks like from our perspective.

Programmatic challenges

There is plenty of talk about programmatic Out of Home being tipped to explode and magically revolutionise the way the media channel is bought. The excitement is definitely there, but how far away is the industry from being able to deliver audience reach at scale, bought from the comfort of the trading desk?

Our view is that everyone needs to take a deep breath, because while programmatic is no doubt moving forward, it’s not as advanced as people assume. Right now, programmatic makes up less than one per cent of transactions, and most operators offering it are sub scale. It is therefore very much a minority practice and will probably be so for some time yet.

While automation is the future, we should note that Out of Home is a very different model to online. We have a finite physical inventory, for example, and significant material investment in that inventory. Real estate and access to premium audiences come with a commensurate price tag, which has implications for the business models constructed to support programmatic.

These models will probably be developed somewhat cautiously. The Out of Home industry cannot rush in or afford the same mistakes as those made in the online realm, and so it will be no surprise to see the big operators take their time to refine their offerings. Watch this space and be patient.

Data discoveries

If programmatic is going to take longer than people think, the opposite is true of data. Investment levels and analytical advances are occurring at a rapid pace and creating many opportunities for companies nimble enough to exploit them.

At oOh!, our approach was to go in hard and early. We made very deliberate choices about our data partners, investing and resourcing this function to get to the leading position we find ourselves in today.

For our oOh! DataScience offering we chose Quantium as our primary data partner, but there are also other inputs. We apply this third-party data down to a product level, mapped against more than 500 audience segments. This approach vastly changes the targeting of a campaign to real product and buyer behaviour, and specific Out of Home audiences. It’s far more effective than simply targeting demographics.

Mapping each of these segments to every one of our 35,000 locations means we can provide an audience solution either agnostic to format and location, or within more refined parameters, reaching category buyers in two weeks with unprecedented audience volume and percentage of buyers.

It’s also clear that when tasked with reaching audiences at scale, intelligent data such as this is far superior and delivers greater ROI than simplistic understandings of buyer behaviour based on historical norms. Today’s use of data needs to be deep and dynamic, with fully optimised schedules that target a brand’s audiences with pinpoint accuracy across large networks, based on actual purchase behaviour, not claimed behaviour.

Reaching audiences

Once data is used to really understand where Out of Home audiences are, it’s a case of building effective campaigns that reach them at key moments throughout the day, wherever they are. This takes confidence, especially at times such as these when the impact of Covid has stretched every marketing dollar and put media buyers under increasing pressure to spend wisely.

Thinking back to the last downturn, during the GFC, brands often booked ads close to the cash register, with no one wanting to be seen as wasteful by splashing out on huge billboards. Fast forward to 2020 and brands again have flocked to the register, but this time because supermarkets were one of the few places where people could be reached due to the pandemic.

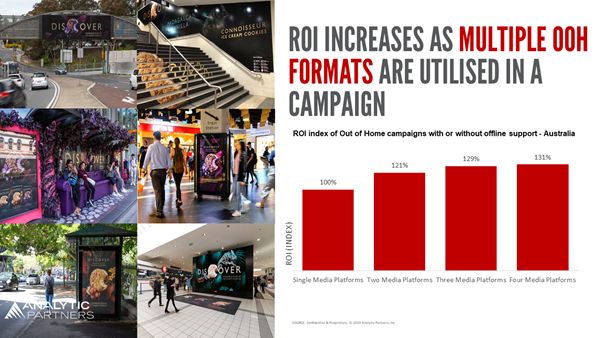

Since early March, we have noticed an increasing number of briefs demanding proximity - 50m, 20m, 10m to a supermarket register. But the reality is category buyers are back at the shops, in the streets and parks, driving to the beach or going to work – especially as restrictions ease. Audiences are in fact everywhere, yet many briefs demand 100 per cent shop window-type panels, despite ROI being almost double when you plan across multiple out of home formats where audiences are, not by single format and specific location as traditionally done.

Buying ‘panels’ or any number of them in supermarket locations delivers very different outcomes than buying according to audience volume, or even by supermarket/product turnover. Not all panels are equal in value, and so buying according to where the category buyers are is the way to drive ROI most efficiently.

Powerful simplicity

With data growing exponentially and audience targeting and measurement attaining ever more granularity, the industry has work to do to simplify buying Out of Home.

From our own perspective, after three decades of both organic and acquisition-fuelled growth, we are working on streamlining the buying process and how clients navigate a wide range of options. We have, for example, over 100 products, 10 environments, tens of thousands of classic panels and almost as many digitals.

Delivering an unrivalled reach of category buyers means that our future focus is very much on a powerful form of simplicity, bringing our rich data and audience-led knowledge quickly to the fore so it is understandable and compelling, even at the most detailed levels.

We know, for example, where the guys are who watch cricket and over-index in craft beer purchasing, and we know how to reach the mums who switch nappy brands. These are buyers based on real purchases, not claimed ones, and are mapped to every one of our locations.

Buying real audiences at scale is the future, but it will be a process – first through the established methods of buying by product or category, and next through automation for efficiency. Only then will we be in any real position to move towards the promised land of programmatic.

Right now we are putting in place the processes and ways of doing business that will make it easier to go on this journey with us, in well-planned steps. This prudent and practical approach will ensure that everyone from our employees to our agencies can overcome challenges together, and make the most of the many opportunities the industry is now presenting to all its participants.