Here's how Google fleeced billions from advertisers and publishers through three secret programs, claim 17 US states

Google’s exchange processes about 11 billion online ad spaces each day. US states say it has rigged the market, charging advertisers more, paying publishers less and pocketing the difference.

Google created programs to make advertisers pay more for ads while paying publishers less by deliberately adjusting ad prices over a decade, a major US lawsuit alleges. Here's how US states claim the monopoly fleeced brands and publishers around the world.

What you need to know:

- Google invented programs that deliberately reduced how much publishers earned for their inventory and increased how much advertisers paid, in a violation of competition law, a major US court case alleges.

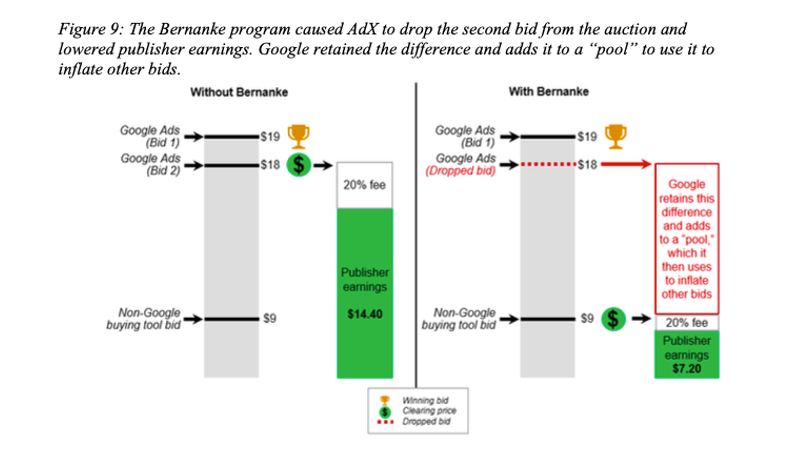

- A program called Bernanke secretly made many of its second-price auctions, where the highest bidder pays the second-highest amount, into third-price auctions, where the advertiser would pay the second highest amount, but the publisher received the third highest bid – with Google taking the difference, per the newly unsealed filing.

- Dynamic Revenue Share increased and decreased Google’s usual 20 per cent cut depending on the winning bid.

- Reserve Price Optimisation manipulated publishers’ floor prices based on what advertisers had previously bid for ads.

- These combined programs netted Google in excess of $700m a year, the court case alleges. And these are just a few of the ways the tech giant is accused of gaming the ad tech system it largely owns.

Secret programs

Google ran secret programs that misled advertisers and publishers about how much digital ads cost, rigged auctions, and quashed competition by preferencing its own tools, according to new, unsealed documents signed by attorneys general from 17 US states.

The allegations from a major US antitrust court case adds more detail about how Google fleeced billions from publishers and advertisers in ways even its own employees believed could amount to trading with “insider information”.

Mi3 covered the explosive allegations last October, but a new, longer statement of claim details how three specific programs operated:

- One called “Bernanke”,

- Another called “Dynamic Revenue Share”, and

- “Reserve Price Optimisation”.

Google states the lawsuit is "full of inaccuracies and lacks legal merit", telling the Wall Street Journal it planned to file a motion to dismiss it this week. "Our advertising technologies help websites and apps fund their content, and enable small businesses to reach customers around the world. There is vigorous competition in online advertising," per a Google spokesman.

Bernanke

Between 2010 and 2019, Google told advertisers and publishers its exchange, AdX, operated what’s known as a “second-price” auction. But that allegedly changed through a secret price manipulation program called Bernanke that increased Google’s revenue by hundreds of millions of dollars.

In a standard auction, the highest bidder wins and pays their highest bid. This is called a “first-price” auction. For example, the Sydney Morning Herald is selling an ad impression and Ford bids $19, Toyota bids $18 and Mazda bids $9, Ford wins and pays $19 for the impression.

Then there are “second-price” auctions, where the advertiser who bids the highest wins – but pays the amount bid by the second-placed bidder. This is how eBay auctions work. Using the same analogy, the Herald wants to sell an impression, Ford bids $19, Toyota bids $18 and Mazda bids $9 – Ford wins but pays $18.

This is how Google said its auctions worked.

If Ford won, it would pay $18, Google would take a 20 per cent fee of $3.60, and the Herald would earn $14.40.

Instead, the case alleges, through a secret program called Bernanke created in 2013, Google made its exchange “third-price” auctions. So using the same analogy, Ford bids $19, Toyota bids $18 and Mazda bids $9. Ford wins and pays $18. The price for the impression, however, is $9, and the Herald gets just $7.20 when Google takes its 20 per cent fee. Google pockets the difference between the third-price bid and the winner, according to the filing, with the states' example illustrated below.

Google analysed the effect of Bernanke, and found it cut publisher revenues by upwards of 40 per cent. As one Google employee observed, according to the court documents: “Bernanke is powerful”.

“Publishers had no idea Google was dropping second-highest bids and impacting their revenues in this way,” the documents state.

Under Bernanke, Google put this difference into a separate “pool” that it then used to inflate the bids of advertisers bidding through Google Ads to win impressions they would have lost to advertisers using rival buying tools.

The filing states there were three versions of Bernanke. The second was known as “Global Bernanke”, launched in 2015, which put the accumulated money from across publishers’ auctions into a global pool to win auctions that would otherwise have been lost to other exchanges.

The third iteration, known as Bell, targeted publishers that didn’t give AdX preferential access to their ad inventory. Those publishers’ auctions would be dropped from second-price to third-price, decreasing AdX revenue by up to 40 per cent, per the claims.

Dynamic Revenue Share

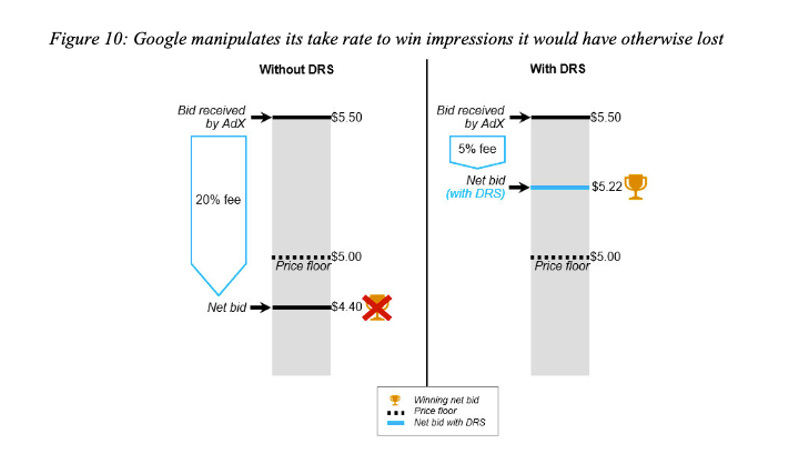

In 2014, Google’s Quantitative Trade team, known as gTrade, launched a program called Dynamic Revenue Share (DRS) that “deceived publishers and advertisers”, according to the states's claims. DRS changed how much Google took as a fee after looking at bids from rival exchanges to win as many as possible.

So, for example, if the Herald set a floor price of $10, and Ford bid the highest at $12, Google would likely lose to a rival exchange with a lower fee – Google’s 20 per cent cut meant it would only pay $9.60, pushing Google's bid under the Herald's floor.

“DRS manipulated Google’s exchange fee after soliciting bids in the auction and after peeking at rival exchanges’ bids to win impressions it would have otherwise lost,” court documents state.

But the program also increased AdX’s fees above 20 per cent on impressions when one buyer bid significantly above the publisher’s floor price.

“One known issue with the current DRS is that it makes the auction untruthful as we determine the AdX revshare after seeing buyers’ bids and use winner’s bid to price itself (first-pricing)…” one internal Google note stated.

A diagram from the court documents explaining how Google's DRS program worked.

DRS increased Google revenue by $250m a year, the case alleges.

Reserve Price Optimisation

In 2015, Google’s gTrade group created a program called Reserve Price Optimisation (RPO). RPO allegedly increased publishers’ floor prices without telling them, making advertisers pay more for impressions, and pocketed the difference.

So if the Herald is selling an impression with a floor price of $10 and Ford bids $15, Toyota bids $12 and Mazda bids $11. Under a normal second-price auction, Ford wins and pays $12.

But RPO learned what advertisers had bid in the past, and set Ford, Toyota and Mazda a floor of $14.90, $11.90 and $10.90 respectively – a “unique and custom floor based on what each buyer had bid in the past”. So instead of paying $12, Ford would pay $14.90 – the artificial, inflated floor price. In an internal email, one Google employee said: “Is RPO not just basically pushing our second price auction – that is supposed to be fair – toward a first priced auction?” RPO allegedly netted Google an extra $250 million in additional, recurring revenue.

“Exacerbates harm”

The US lawsuit alleges Google used these three programs “in conjunction with each other”. As an example, RPO would increase the price paid by an advertiser by raising the price floor, while DRS would ensure the advertiser’s bid cleared the floor. This “exacerbates harm to competition in the exchange market”.

It was a non-transparent arrangement that preferenced Google’s system. As one senior Google allegedly put it, “[b]y charging non-transparently on both sides, we give ourselves some flexibility to react and counteract market changes.

"If we face tons of pricing pressure on the buy-side, we can fall back on the sell-side, and vice-versa.”