Independents smell wins as global agency networks distracted

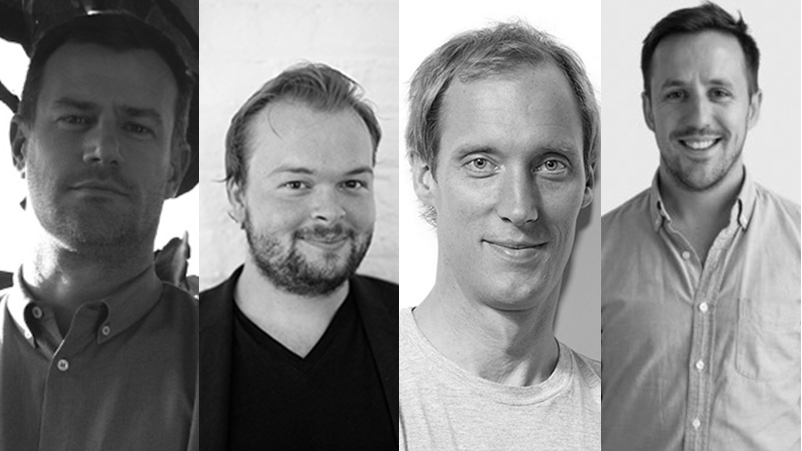

Founders at Mutiny, The Hallway, The Royals and Sparro outline the new opportunities competing against "distracted" global agency networks and consulting firms across predictive data, specialist creative, full-service media and creative and specialist digital performance. Big brands, they argue, are liking the story.

"Our biggest competitors, the multinationals, are the most distracted they’ve ever been. Their eyes are off the prize. This is the era of opportunity for independents.”

Jules Hall: Media begets data begets growth

Creative is “critical” in connecting with customers, says The Hallway founder and CEO, Jules Hall. But so is media - and the firm has just become a full service agency for one crucial aspect.

“Why did we start getting into the media buying game? Not because we’re particularly interested in buying media, the driver was access to data,” says Hall.

“Getting that data upfront to inform strategy and ideas, having real time visibility of how people are responding to the creative, optimising it and linking that back through so we’ve got the evidence to demonstrate the efficacy of what we’re creating,” he adds.

“We’re here for one reason. We exist to grow our client’s business. That data footprint is critical all the way through that process.”

Some suggest that the market for indy agencies is getting tougher – at least for start-ups as barriers to entry grow taller and the route to exit narrower as holding groups look to consolidate instead of acquire.

However, larger corporates appear more comfortable with handing work to independents, albeit more often project work rather than the chunky retainers of old. While an entry point to the top table, that creates challenges in terms of investment and resource, requiring indies to upscale and downsize in line with the project cycle.

“That is the reality we need to adapt to – the breadth of services agencies need to offer is only going to increase, but you need to have adequate depth across that breadth,” says Hall.

“I think probably one of the biggest barriers to entry for new start-ups is getting to that critical scale quick enough. Once you’ve got to a level of scale, it gets a lot easier. But it’s getting there when you have latency and underutilised or unused resources that it becomes a financial drag on the business.”

However, Hall challenges the notion that the indy sector is “struggling” and cites The Hallway’s contracts with ANZ and Google as evidence that its data-through-media strategy is bearing fruit.

“Look at the people we have around this table, four very different businesses. We are all demonstrating as big businesses choose the independent option over multinational networks that it’s a pretty healthy market,” says Hall.

He suggests it is the holding groups that have greater challenges.

“Our biggest competitors, the multinationals, are the most distracted they’ve ever been. Their eyes are off the prize. The culture in our businesses is rocking. It’s a tractor beam for talent and clients are seeing the same,” says Hall. “This is the era of opportunity for independents.”

Henry Innis: Corporates want riskier thinking

Mutiny is a ‘predictive growth consultancy’ focused on boosting bottom line revenue, according to co-founder Henry Innis. He believes the rise of cloud computing levels the playing field between nimble indies and the big four consultants, which Mutiny sees as its competitive set.

“Cloud technology allows you to crunch statistics more effectively and at greater scale,” says Innis. Where previously consultants or agencies needed “seventy MBAs” to plough through reams of data, “now you need a couple of data engineers and some computing power, which has changed the dynamics of analysing business problems quantitatively at scale”.

Innis believes there is a gap to exploit between the traditional consultants and the nimble new breed, born out of an increasing willingness among corporates to take a measure of risk. They are realising, he suggests, that business as usual is no longer an option.

“There is a bit more appetite for risk taking. I think if you’re coming from a big four auditing background, you’re risk averse by the nature of your culture. You don’t think, “How can we use numbers to take a calculated risk?”. You think, “How can we use numbers to mitigate risk?” Culturally, we come at using the numbers in a completely different way,” says Innis. “We like to say that we’re a management consultancy with the creative agency’s attitude for risk taking.”

Part of the attraction, Innis suggests, is that corporates understand that they will be challenged.

“Our business is called Mutiny. You don’t pick us if you are looking for yes men.”

While viewing the big consultancies as his competitors, Innis thinks a lack of risk taking is also part of the malaise affecting traditional large communications companies.

“I look at the holding groups and I think a lot of the work coming out of them is quite boring, to be honest,” he suggests.

“There’s certainly still a lot of really good people in holding groups, but from afar, it feels like they have lost their step, become too focused on internal politics and mergers rather than on the two things that matter: Their clients and their work.”

Morris Bryant: $100m says clients want specialists

Digital marketing firm Sparro has become a $100m business since launching in 2013. Partner and co-founder, Morris Bryant, suggests that growth trajectory demonstrates market appetite for specialist digital shops.

Social, search and video, he says, “are so transparent, they should drive value, they should be easy to understand and visualise. I think that is what clients are not getting from the big media agencies. So that is where we see the opportunity and that is what we have built our business upon.”

That, and “getting shit done,” adds Bryant. Asked to unpack that, he suggests it is simply a case of “always driving our channels forward.”

“Just putting the best product out there and testing new things and really going beyond the click, looking at what happens before the click, who we’re speaking to, what is the audience segmentation, what happens after. We’ve made a sale but how can we get more out of that customer, how can we sell to them again?”

Bryant suggests that Sparro’s share of the market, second only to Dentsu and Columbus in search and Google spend, affirms his view that specialist agencies can thrive – and do not have to attempt to be all things to all clients.

He thinks that will lead to “breakout digital briefs” within global contracts traditionally placed with holding groups. “I see that coming. People will want that expertise and specialisation.”

Given the breadth of skills required, as noted by The Hallway’s Jules Hall, “there is no way you can bring someone on and do an incredible job from concept to creative to digital implementation,” suggests Bryant.

He believes specialist digital agencies and media agencies will continue to move more closely together to reduce friction.

“We have two relationships with government clients where we work with a media agency and it is fairly successful,” says Bryant. “You obviously have the clash of cultures and metrics and understanding of things, but I think that is also an opportunity - and a bit of the future.”

"When you meet us, you are not just meeting the pitch team that then goes on to the next pitch, you are meeting the team that is going to run your business - and that is the most senior people in the agency."

Dan Beaumont: Creative is key, we won’t get into media

Creative shop The Royals won’t be going full service any time soon, says managing partner, Dan Beaumont. “Creative still has a huge role.”

“We are a creative agency, but everything we do is digital,” says Beaumont, who believes the debate around short-term results versus long-term brand building has begun to hit home.

“It’s not one or the other, it’s both and that is the biggest conversation we’re having with clients: how do you take creative responsibility for a brand while still driving acquisition, a click, an action of some kind?”

While The Royals will not move into media, it’s happy to work with clients’ media specialists, or will draw on its alliances with indy media shops such as Hyland Media if required, says Beaumont.

Ultimately, he says big clients choose independent specialists because they are precisely that: independents thinkers that have experienced life within multinationals and who now harness their experience and freedom to deliver sharper results.

“All of us running our own agencies, we haven’t been doing it for five minutes. We’ve all worked in big multinationals and realised their faults,” says Beaumont. “It’s probably why we started agencies in the first place because we thought we could do it better.”

Beaumont offers more nuance than Mutiny’s Henry Innis that communications holding groups are guilty of allowing dispassionate grunts churn out “boring” work.

“They are trying to do the same job that we are. But they’re probably fighting a battle internally as much as they are externally, and that’s probably process, hierarchy.”

But he agrees that indies offer better service, “because we genuinely give a shit; it is our business. When you meet us, you are not just meeting the pitch team that then goes on to the next pitch, you are meeting the team that is going to run your business,” says Beaumont, “and that is the most senior people in the agency.”

Beaumont says the one advantage that multinational retain over independents is the ability to cope on a global scale: “It would be bloody hard to convince a global client in New York or London that we could competently manage their business globally.”

But he agrees that the shift away from retainers towards project work provides independents a better chance of securing top tier clients – if they can manage resources in an increasingly fluid environment.

“[Landing big brand projects] gives us an opportunity, but it also means our business has to scale up when required and contract when that project ends,” says Beaumont.

That suggests agility, the ability to attract top talent with a flexible demeanour, and the cashflow to navigate lumpy revenue and payment terms, will become increasingly critical to independents plotting further incursions into holding group territory.