Linear TV is neither dead nor dying: But it needs to evolve faster than VOZ

Audiences have already converged. Now the TV, digital and media planning industries are racing to catch up. But some routes are quicker than others. Choose wisely, says Amobee’s ANZ Head of Sales, Andrew Dixon.

There’s a long-held narrative that linear TV is dying. But as we move away from a post-truth world, it’s good to get back to facts.

TV has certainly seen digital eat into its lunch over the last decade as marketers pursued more measurable results. This year, Covid certainly crimped TV dollars – despite audience gains during lockdowns and in their aftermath.

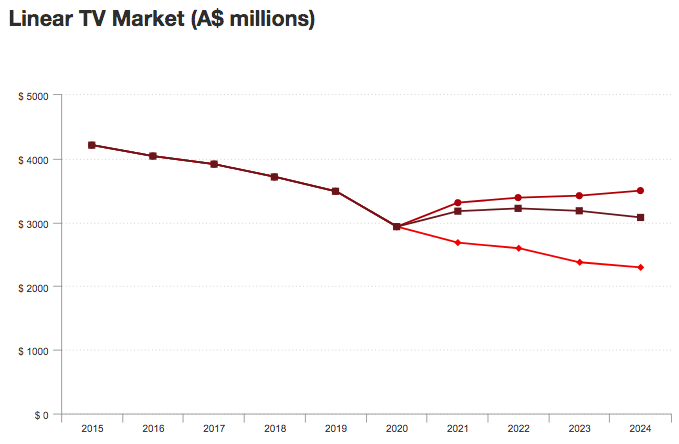

But PwC’s latest forecasts suggest TV ad revenue will recover and then hold steady until mid-decade. Come 2024, per the consultancy, linear TV will still be a $3bn+ market in Australia.

Source: PwC’s Australian Entertainment & Media Outlook 2020 - 2024

But… BVOD

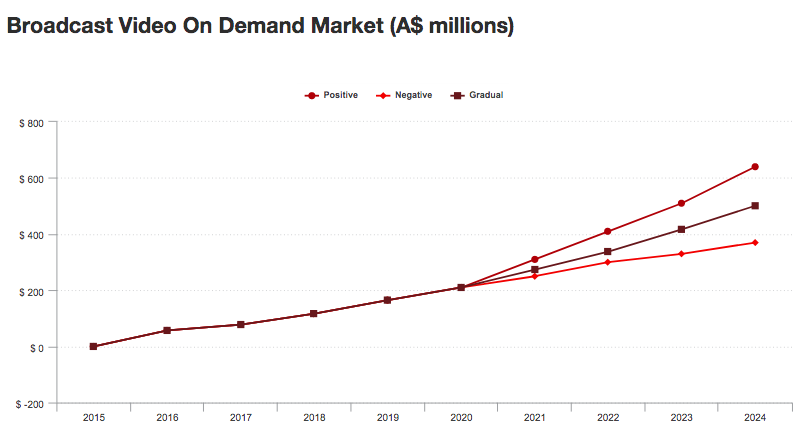

BVOD is undoubtedly booming and yes, advertisers should be genuinely excited about the opportunities it presents to do things differently. But, even if its current rocket-fuelled trajectory steepens, the BVOD ad market in Australia will at best amount to little more than a fifth of linear TV by 2024, according to PwC’s numbers, some $640m.

Source: PwC’s Australian Entertainment & Media Outlook 2020 - 2024

But… SVOD

Subscription-based services are certainly piling into Australia and everywhere else. But they are not much use to traditional advertisers – though integration and product placement opportunities will likely increase, and brands will ultimately still find ways to reach these paying audiences, just not in ad breaks.

Advertisers need TV – but smarter

The numbers show that reports of the death of linear TV are greatly exaggerated – even with all the change and fragmentation underway. Brand advertisers need TV, linear for baseload, and BVOD or over the top (OTT) for additional reach, addressability and attribution.

Media buyers know this.

According to Media i’s latest survey of media agencies (Media i publishes Mi3), TV has shown the most significant improvements in channel perception across all media types over the last six months. Agencies are also far more bullish on TV’s immediate revenue growth prospects than in the two prior years, according to the twice-yearly poll of thousands of media agency staff.

But it is also an established fact that TV trading, measurement and attribution must evolve, so that linear’s predictable scale and reach can be combined with digital’s advanced targeting, attribution and frequency control.

The industry has been working to address these issues for years. Although some of the key pieces are starting to fall into place, the pace of change may mean the solutions - data tools like VOZ - are out of date by the time they arrive.

Meanwhile, opinion is divided on how linear and digital TV should be bought (senior buyers, brands and network execs weigh in on that issue here). That is, should linear or digital trading methods and metrics prevail?

Shift happening

Fundamental changes to the digital ecosystem – the death of third party cookies – bring that challenge sharply into focus, given the impact it will have on digital advertising, trading and measurement. The TV networks are heading this off by pushing hard into first party data, asking viewers to sign in to see content.

But there are some significant chasms between traditional TV planning and measurement and the new digital landscape - which is why the technology choices we make today really matter.

We believe an identity solution that can stitch multiple data points across online and offline sources – from TV, digital and social – will prove to deliver best value.

We also think traditional TV teams will continue to drive this space, given the knowledge they hold and the value they oversee.

Either way, the ability to plan, execute and measure on a platform that combines both online and offline data sets – and unifies those two worlds – provides a major competitive advantage for brands and their teams.

That is a fact.

TV is evolving. Be part of the future.

Amobee provides advertising solutions for the converging world, unlocking end-to-end campaign and portfolio management across TV, digital and social. We are trusted to do this by brands including Nestle, Woolworths, McDonalds, Volkswagen and many more. We can help you evolve too. Find out more at amobee.com