Rod Prosser: 10 tipped as #2 network in next four weeks but agency deals stymie audience response

Network 10 is staging an all-screen resurgence as the network leads audience growth across all platforms – before and during COVID. But there are “shackles” among “less agile” agency groups because of earlier revenue share deals they struck, says Network 10 and ViacomCBS Chief Sales Officer Rod Prosser.

ViacomCBS and Network 10 Chief Sales Officer Rod Prosser tips 10’s surging audience growth this year will see it jump network and channel audience rankings in the coming month to second spot in under 50s, 16 to 39s, 18 to 49s and the advertiser-critical band of 25 to 54s. 10’s audience growth pre and during COVID is pacing well ahead of commercial broadcast rivals, particularly Network Seven.

“If I was a betting man I would suspect within the next month, with MasterChef doing the numbers it’s doing and the halo effect we’ve got across all of our schedule, that 10 might just be the number two network in 25-54s and all the key demographics,” says Prosser. “I wouldn’t put a date on it but I’d say in the next month. Week 16 is a great example and I’ve never seen this on television – we had a 10+ percentage point year-on-year audience share growth across under 50s and all key demos. We smashed it. The audience growth story has been going since the start of the year really.”

Network 10’s Head of Programming, Daniel Monaghan, and Endemol Shine’s veteran MasterChef executive producer Marty Benson, predicted in a Mi3 Podcast in February that Masterchef audiences would rise 5-10% for the overhauled 2020 series with an all-new judging line-up. MasterChef is currently up 53% year-on-year. Prosser says the 2020 launch of MasterChef has been the best since 2011 and although some commentators have linked the success to COVID lockdowns, Prosser says it’s only partly right.

“Everyone says ‘you’re in a COVID environment’,” he says of market commentary on MasterChef’s success. “Whilst TV was slightly up, it wasn’t as much as what you’d expect when you see the numbers like that of MasterChef. People were going to turn it on whether we were in a COVID environment or not.”

Prosser says it’s the same story for strong audience and timeslot growth this year across Gogglebox, The Project, Australian Survivor, Ambulance Australia, 10 News First and I’m A Celebrity…Get Me Out Of Here.

Agile agency groups responding faster to TV shifts

Commercial TV viewing, year-to-date, is back about 1% overall but Prosser says Network 10’s portfolio was up 19% overall, while 10 primary channel viewing was up 18%. In contrast, Seven was back 10% and Nine was down 2% for linear TV viewing.

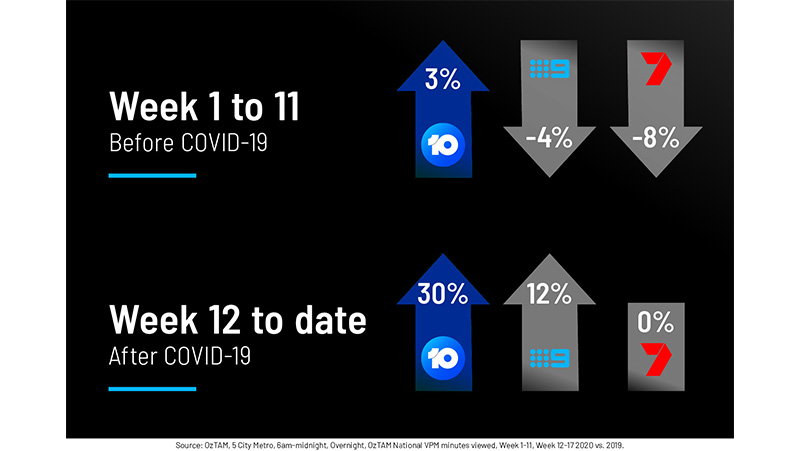

The figures shift markedly during COVID. So far, overnight commercial TV viewing is up 11% year-on-year, led by 10’s portfolio, increasing 30%, more than double the growth of Nine and Seven combined. Nine’s linear viewing is up 12% and Seven’s is flat year-on-year.

In Broadcast Video On Demand (BVOD), viewing is growing significantly year-on-year during COVID, up 56%. Live streaming minutes viewed are up 89%, with 10 Play’s live streaming growth ahead of the market at 229%.

Prosser adds: “During these uncertain times, total TV is standing out in the media mix with increased audiences supported the effectiveness, reach and trust of the medium.”

Still, Prosser says parts of the market are responding slowly to the audience shifts. “We’re having those conversations with agencies and advertisers now. I can see it in our share numbers who the agencies that are quite agile and can move where the audiences are,” says Prosser.

“You can see others who are just shackled by these deals that they’ve done in the past – it doesn’t allow them to shift their media dollars where they should be. If I was a marketer, I’d be asking my agency if 10 wasn’t on the schedule at present, why not? Clearly, very clearly, we’ve had a huge resurgence now in our numbers, which I’d argue, would make us one of the most efficient mediums and certainly TV networks that advertisers can get involved in at this point in time.”

A global perspective

Prosser remains upbeat about the market from September and, as the only Australian TV network with international owners, he says the global perspective has been insightful. “It’s quite comforting to be able to reach out and talk to peers across the globe,” he says. “Australia looks to be better at managing this crisis at this point. Our views here in Australia are a lot more optimistic. The view on what happens to revenue and the market in the next couple of months is pretty universal though.

“The advertising market here has been really resilient, it’s been great to see. We have earned every dollar coming through the door.”

Merging Network 10 and ViacomCBS huge for the market

For ViacomCBS and 10, May 1 brings with it the final stage in merging the sales units in Australia – Prosser says sales teams at Viacom and Network 10 will officially become one. “This is huge for us,” he says. “We’ve obviously got a fairly new sales team but a really good one, I think, that’s been getting accolades all over town in the last couple of months. We won a couple of Sales Team of the Year Awards from UM in Sydney and Brisbane and the team picked up Sales Team of the Year for Mediacom, which is outstanding. And from May 1, we go to market as one group and with MTV, Nickelodeon and Nick Jr. now part of the family, we’re really strengthening our under 50s focus.”