Google smashing Amazon in smart speaker race, but Razorfish boss predicts ecomm giant will rein-in rival; SCA says marketers missing major growth across millions of homes, heavy streamers

"Commerce has to be the next accelerant" of smart speaker take-up and use, Razorfish CEO Jason Tonelli says. Above: A Google Nest Mini and an Amazon Echo Dot device.

As Amazon delayed, Google pounced, bucking the global trend and capturing well over half of the Australian smart speaker market. But latest data suggests Amazon is starting to eat into Google's share. Razorfish boss Jason Tonelli thinks it will ultimately win the "arms race to own the home". Marketers have a major growth opportunity in front of them, across broader commerce and per latest streaming numbers. Few have yet fully tapped the potential.

What you need to know:

- While Amazon is the global smart speaker juggernaut, Google is dominating the Australian smart speaker market, which comprises 28 per cent of streaming hours, according to SCA.

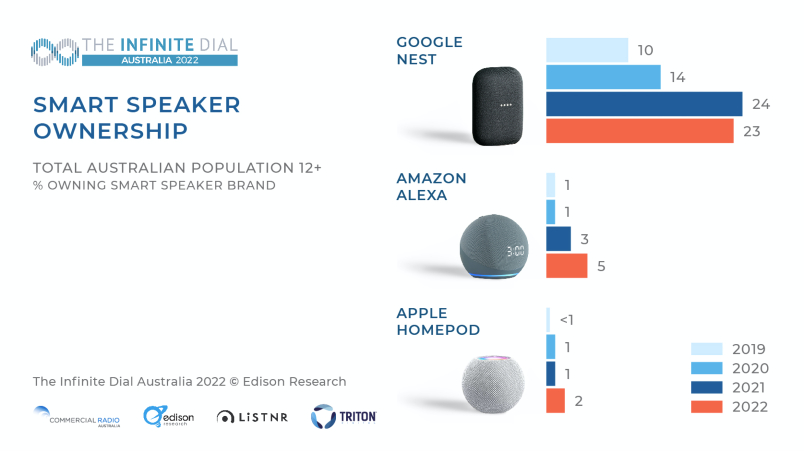

- New data shows 23 per cent of Australians over 12 years old have a Google smart speaker, crushing Amazon, at five per cent. But Amazon last year started to close the gap.

- Razorfish’s Jason Tonelli says despite being the smaller player locally, Amazon has the ecomm advantage – and will grow rapidly as a result. Amid an "arms race" to own the home, he's backing the marketplace juggernaut to win.

- Either way, marketers are missing the opportunity, per the publisher, with few committing spend – though Amex is a notable exception.

- SCA’s Chris Johnson says two thirds of the network’s audience has a smart speaker and the average session is 2 hrs, 44 mins – people are buying smart speakers to replace radios.

Google v Amazon

For now, Google is dominating the Australian smart speaker market, with smart speakers now a major force in the audio market – they account for 28 per cent of Southern Cross Austereo’s streaming hours. Brands are starting to experiment with the tech, but not proportionately to those kind of numbers.

Google’s dominance locally is at odds with the estimated USD$6.6bn (A$9.55bn) global market, where Amazon has the largest market share in most western markets. In the US, for example, Amazon’s Alexa voice assistant and its Echo product have 70 per cent of the market, while Google holds 25 per cent.

New data being published today via the Infinite Dial 2022 report shows just how far the local smart speaker market has grown: Three in 10 Australians over the age of 12 have a smart speaker, with 23 per cent using a Google device, five per cent owning an Amazon device and two per cent with Apple.

But the big tech battle may be starting to turn.

A snapshot of the data to be released in the Infinite Dial 2022 survey today, showing smart speaker take-up and market share.

Google’s share dropped by one percentage point, which experts say may mark the start of an Amazon resurgence.

“It’d be fair to say [Google] flooded the market. They certainly did,” Foad Fadaghi, Managing Director and Principal Analyst at consumer research firm Telsyte, said.

This is a “battle of the big tech organisations”, Fadaghi says – Google, Amazon and Apple.

“Google was very early to the Australian market, made sure its products were available widely through promotional and retail channels including Bunnings and other places where you might not expect to get smart speakers,” he said.

“They were very aggressive in their initial targeting of the Australian market, and as a result maintained a large share.”

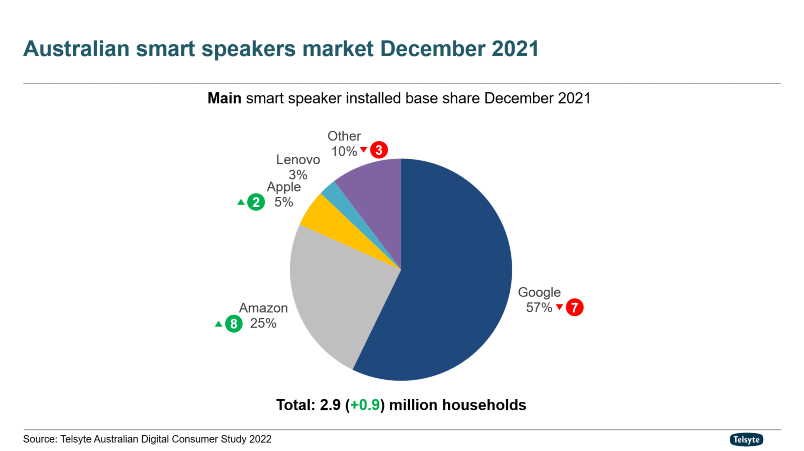

His company’s research puts Google’s local share at 57 per cent in December 2021 – dominant, but a decline of seven percentage points year-on-year. Inversely, Amazon climbed eight percentage points to 25 per cent.

Smart speaker market share year-on-year in December 2020 and 2021, according to Telsyte.

Amazon roaring back

Amazon has an advantage, Jason Tonelli, CEO of Publicis Groupe’s Razorfish, says. Despite its underdog position, its global resources and integration with e-commerce will be a key driver of the next wave of growth.

“If things integrate to ‘Hey, Alexa, can you order me more toothpaste’ when there's an Echo Dot in the bathroom [or] ‘Hey Alexa, can you put this on my shopping list or buy me this pasta’? As that accelerates, that will see the Amazon products start to accelerate with it,” Tonelli said.

“There's an arms race for owning the home… it’s the internet of things – but it's real now. I think the big driver now is that the novelty is gone. The basics are the same. Commerce has to be the next accelerant.”

Smart radio-audio shift

In the UK, smart speakers make up 10 per cent of all radio listening each week. It’s understood the local market is about half of that but is growing rapidly.

"Competition between the smart speaker brands will only benefit the growth of live and on-demand radio listening in Australia," Commercial Radio Australia CEO Ford Ennals said.

“It’s part of radio’s strategy to be everywhere our listeners are... Smart speakers are an exciting addition to that line up and a natural extension of live radio being available in all places."

For radio networks, the emergence of smart speakers is a bit like the start of the internet. If a listener in Sydney asks, ‘Play the footy’ – what do they mean? How does the device know which code, which commentary, which radio feed to line up?

“The analogy is almost like a domain – you buy it and build awareness of it. You still have to educate the audience to activate that,” SCA’s Head of Digital and Innovation, Chris Johnson, said. According to SCA, two thirds of its audience own a smart speaker – and those that stream radio on them listen to, on average, two hours and 44 minutes at a time.

“Within our own streams, listening in terms of online SCA property, smart speakers make up about a third – that’s 118 per cent year-on-year. We’re seeing dramatic growth still in smart speaker usage,” he said.

“They talk about smart speakers as replacement for radios. Get rid of physical radio, buy smart speaker… The trend’s only going one way. We’re not naive to that.”

It's just an opinion, but my opinion is that shopping and commerce is definitely something that will drive smart speakers, because I can start to shop and do those things from those devices.

Smart speakers won’t be everything for radio and audio, Johnson says – FM, DAB, mobile and desktop will still play a role, but it will create opportunities for marketers and agencies. American Express are one brand to experiment with smart speaker targeting, which is usually coming from experimental budgets at the moment. Last year, it ran The Locals’ Guide, an interactive skill in Sydney that let people ask what events were coming up. SCA talent would reply with more than 100 businesses and events in the area.

“For us, the challenge is continuing to integrate, improve the experience for consumers and clients. How do we maximise the opportunities to use that creative to improve ROI, interact or leading to transaction,” Johnson said.

Razorfish's Tonelli says getting a smart speaker campaign right would deliver direct, measurable and practical return on investment – but only when the market grows bigger.

“As that size grows, being able to say, if you're, I don't know, P&G, ‘download this skill for your ultimate brushing tips’ is a really interesting call to action,” he said.

“‘Subscribe now to get this toothpaste delivered to you every four weeks’ – those calls to actions are a lot simpler. A great user experience, great advertiser experience and a really direct ROI… It's just an opinion, but my opinion is that shopping and commerce is definitely something that will drive smart speakers, because I can start to shop and do those things from those devices.”

Apple down but not out

No-one should discount Apple’s place in the race, Fadaghi says. iPhones make up slightly over half of the smartphone market locally, and the trust and comfort with Apple devices might win them back substantial share.

“With a more advanced product, it could activate a lot of Apple users sitting on the fence not comfortable with Google or Amazon product - or current Apple product,” he said.

“It’s quite interesting, it is the fulcrum of competition for speaker dominance, and I think it’s unclear whether it’s going to be winner takes all.

These smart speaker stats are an excerpt from the sixth annual Infinite Dial Australia 2022 study, which looks at the penetration of online digital audio in Australia. The full results will be presented by Edison Research later today, including insights on radio, podcasting and streaming. The research is sponsored by CRA, LiSTNR and Triton Digital. Register for the webinar here.