Carsales resurrects its Safari audience via its CDP; builds a $55m ad business – but silos made hard work of the tech rollout

Carsales' CDP is not just another piece of marketing tech says Stephen Kyefulumya, its GM media product and technology. Instead, it's the bedrock of a data ecosystem that has buttressed the growing business against the decline of third party cookies and the rising tide of privacy regulation. Despite a sometimes challenging implementation complicated by the need to build engagement across commercial, marketing, product, and technology disciplines, the business experienced rapid speed to value — and resurrected its cookie-deprived Safari audience along the way.

What you need to know

- Carsales' advertising play — Carsales mediahouse — looks on track to generate approximately $60m in revenue this financial year.

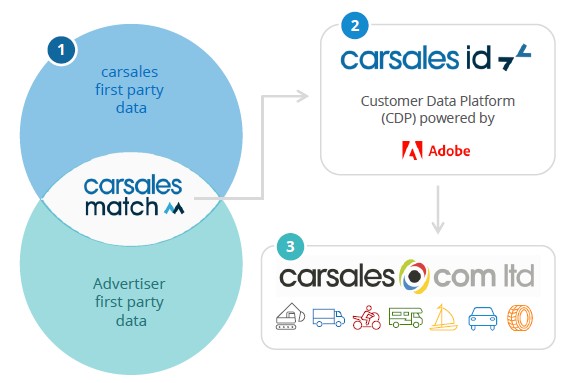

- At the heart of the model is a data ecosystem built around Adobe's Real Time CDP as well as the Adfixus identity solution that mitigates against the decline of third party cookies and the rise of more aggressive privacy regulations.

- The business is already banking wins, having effectively resurrected its Safari audience which went dark in recent years due to Apple's third party cookie deprecation policies.

- The project achieved a quick speed to value, in about six months according to the executive in charge, and that was despite the complexity of managing stake holders across multiple disciplines including commercial, marketing, product and technology.

We knew we needed a people-based media approach. We knew we needed an immediate performance element in our strategy and that's all about how you deliver the best cost per acquisition for advertisers. And we knew that we also wanted to create a media solutions offering that was a lot more integrated to get to those higher value proposals.

Carsales move to put first party data at the heart of its advertising business and its investment in a customer data platform (CDP) and an identity solution is already paying dividends, allowing the company to resurrect its Safari audience.

So says Stephen Kyefulumya, GM media product and technology, Carsales mediahouse.

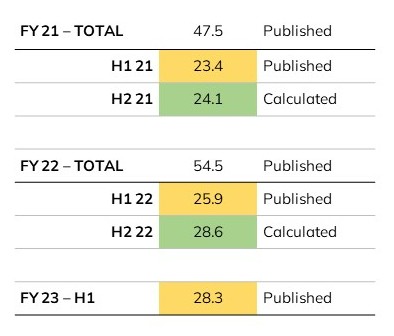

The company’s advertising business is showing steady progress, with nine per cent growth in the first half of FY2023 compare to the corresponding half last year. The division now looks on track to deliver annual revenues of $60 million this year, representing close to 15 per cent of the Australian digital pioneer’s local revenues. That builds on the FY 21 and 22 figures of $47.5mn and $54.5 million respectively.

The Carsales mediahouse strategy is built on three elements:

- Carsales match; a people-based marketing solution built on a CDP.

- Ignition; a platform economy play via a new self-service offering called Ignition.

- and Fuse; a full-funnel execution solution to client briefs via a team of specialists.

Best data wins

The economic environment has created something of an opaque horizon for the auto sector. February saw 86,878 new car registrations according to the Federal Chamber of Automotive Industries, up 1.8 per cent on February 2022. For the first two months of 2023 new vehicle sales are up 6.5 per cent. March data won’t be published until late next week, but it’s a safe bet that Q1 2023 is up on the first three months of 2022.

However, the impact of rate rises is unlikely to be fully felt until mid-year because wait times in Australia – and around the world – have been exacerbated by global supply chains still recovering from Covid. Six months lead times are common for most brands, and for some models manufacturers are quoting nine months plus.

That means many of the new registrations now being reported are for cars ordered mid to late last year, and for buyers who ordered cars when interest rates were lower. Whether there’s a tightening over the next months remains to be seen. If there is, Carsales mediahouse revenues could act as a hedge against any decline in Carsales traditional revenues. It's also a good example of how the best data wins and why companies are investing in data infrastructure to make better decisions – or in the case of Carsales mediahouse, to also help clients to do so.

When Kyefulumya joined Carsales in late 2020 from Nine, where he was group director, Commercial Products, Data and Business Solutions, many brands were still grappling with the implications of the decline of third party cookies and the rising primacy of first party data. And for publishers, a robust data architecture was essential infrastructure to deliver the best outcomes for advertisers.

“We knew we needed a people based media approach. We knew we needed an immediate performance element in our strategy and that's all about how you deliver the best cost per acquisition for advertisers. And we knew that we also wanted to create a media solutions offering that was a lot more integrated to get to those higher value proposals. Layered on top of that, we also knew that we wanted to create a better interaction a better transaction process with our customers.”

But there was an immediate problem – those crumbling cookies.

“At the time," he says, “there were three macro changes going on."

On the one hand there was Google’s stated policy (still not yet actually implemented) to get out of the third party cookie game, he said.

And then there was Apple which had already moved aggressively on two fronts.

“So you've got Apple, what they’ve done with the IDFA [the iOS identifier for advertisers] is one element. [And] here’s what they have done with Safari and ITP (Intelligent Tracking Prevention)."

“They've already deprecated the third-party cookie. So the industry is operating on circa less than 40 or 50 percent of inventory,” he said.

Early wins

The ability to restore that visibility has proven to be one of the earlier wins for Carsales match. The decision to execute a first party strategy using the combination of a CDP and a first party identification platform helped the business to create what Kyefulumya describes as identity matrix resolution, and helped address the issue.

“I can provide it my first party cookie, along with a bunch of all the other IDs that I have acquired, and it resolves that into a segment for you. If you combine those two things, what we've now seen is that we have resurrected our Safari audience.”

“Close to 70 per cent of our traffic is mobile. Apps and mobile browser is the biggest part of our traffic. And of course, what's the highest use application in Australia, it’s iOS by a country mile, it’s staggering how dominant they are,” he says.

“With this technology we put in place we've seen a three times lift in our audience reach, so it’s substantial (though he qualifies the term reach due to ambiguity over what represents a unique audience member)."

The reality is, its not a siloed execution. It’s not a piece of martech that will sit in the corner. This is a data ecosystem play.

Execution challenges

While the CDP is delivering wins, the implementation what not without its difficulties. In fact Kyefulumya identifies the execution of the CDP as the biggest challenge he has had to overcome during his two and a half years with the business.

“The reality is, its not a siloed execution. It’s not a piece of martech that will sit in the corner. This is a data ecosystem play. That basically means you're bringing in a piece of technology, but you've got to have good stakeholder engagement across commercial, marketing, and product, and of course tech.”

For Kyefulumya, a key learning he would pass on to others embarking down the CDP path is to have a really solid understanding of the data architecture when the project begins and a clear vision of where you want to get to.

“The gap between that is of course your requirements. Be clear about that before you go into an engagement because I think that we'll make the process much easier.”

“And this execution was complex.” However he says the organisational and governance structures Carsales put in place enabled the business to realise value quickly.

“In a complex implementation it took between four to six months before we were realising some value.”

Indeed it was this issue that governed the selection of which CDP to buy.

Like NAB’s decision to go with the Tealium CDP which we reported earlier this year, Carsales choice of Adobe’s Real Time CDP was driven in part by speed to value considerations.

“We went through a very detailed RFP process… We didn’t have a CDP in the business. We didn’t have that piece of in-between orchestration technology. We had a DMP, we had Google Ads Manager, we had some marketing technologies in place for marketing automation, and from a product perspective we had some internally built systems to execute the product.”

He told Mi3: “Understanding the CDP and the role it needed to play was something we thought through. Then we went through a detailed process to find the right one.”