OOH's second brush with lockdown: survival of the smartest

As a nation we were recently navigating COVID-19 reasonably well, with both business and consumer confidence on the rise. Then boom... a second wave hit Victoria and some of the optimism disappeared. It’s unfortunate, but perhaps not all that surprising that new clusters emerged. So what does this mean for Out of Home advertising?

The first thing to note is that we’re not going back to the drawing board here, as we have learned enough about consumers from the first wave to understand what’s next.

Key points:

- As restrictions started to lift before the latest outbreak in Victoria, business confidence grew significantly, reports the AFR. We saw strong improvements in the retail space, demonstrating that companies had the confidence to rebound as profitability, forward orders and employment intentions rose.

- While consumer confidence in the economy grew sharp and fast, we still have a way to go to get back to where we were pre-Covid.

- We now have access to a wealth of data to help us understand Australians’ attitudes and behavioural changes in the wake of COVID, providing a foundation for predicting how future restrictions and lockdowns will impact our cities.

If you were a leader of our country, what would you have chosen to do in a global pandemic? Especially with no rulebook and a limited understanding of the virus sweeping across the globe, would you contain or eliminate?

Our leaders chose containment, but the truth is that the future and learnings from places like New Zealand can only judge what the right strategy was.

The reality is that further outbreaks will occur until a vaccine or cure is discovered, no matter where you are. Melbournians seemed to have the strictest lockdown rules of all regions in the wake of COVID, yet they are the ones currently managing a second wave.

We are now in a period of juggling what’s important – our health, our economy, our businesses, our finances, our jobs and, especially, our loved ones.

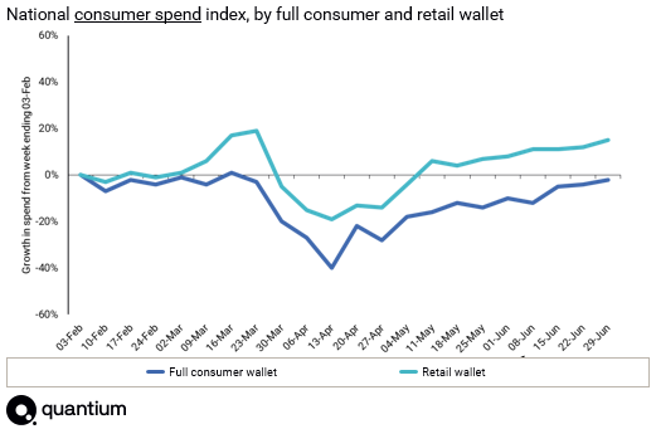

Regarding the economy, the latest NAB business survey reported a record rebound in business confidence. Trading, profitability, forward orders and employment intentions all surged. Through Quantium we saw that Australians were also spending again, with total consumer wallet returning to pre COVID-19 times and retail spend actually higher in some areas.

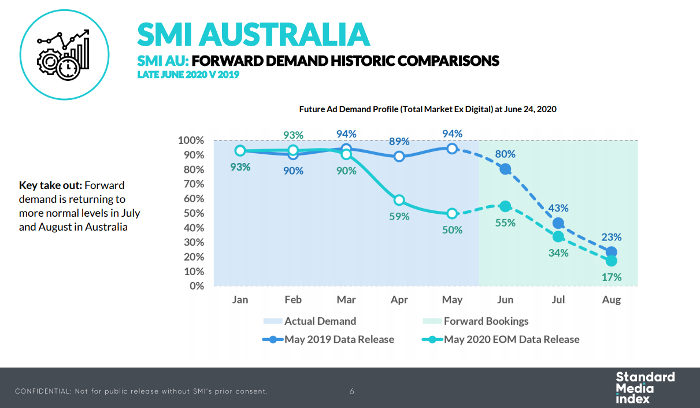

Advertisers were gaining confidence, with campaigns being planned and bought from Q3 onwards, and forward pacing showing promising signs. At the end of June, SMI reported that forward demand was returning to normal levels in July and August.

Everything was looking positive, but then pandemic reality struck again and greater Melbourne entered into a six-week lockdown.

This rapidly changing and uncertain environment strongly suggests that from here on, the survival and recovery phase will not be won by brands who are merely fit, but rather by those who are smart as well.

Historical data shows that previous recessions caused by epidemics have had V-shaped recoveries.

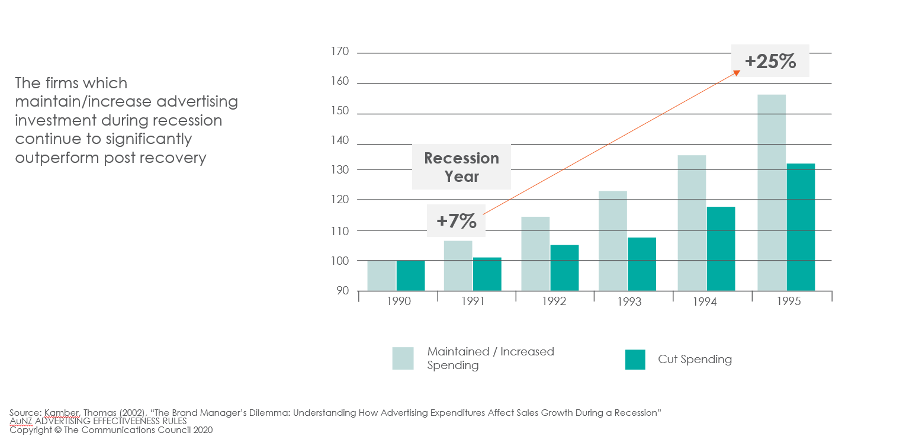

The key for our nation to get through this recession is to keep Australians spending, and marketers have a role to play in that. The knee jerk response most businesses make is to slash brand budgets and put what’s left into performance, but evidence shows that this is the opposite of best practice.

The two biggest learnings from Peter Field’s and Rob Brittain’s ‘Winning and Losing in a Recession’ were:

- Do not go dark – going dark is expensive to recover from and is proven to carry many risks during recession, resulting in more lost market share and slower profit recovery.

- See recession as an opportunity for growth – overall ad spend is declining, giving you an opportunity to increase your share of voice.

And the best way to do this according to Les Binet and Peter Field’s ‘Marketing Effectiveness in the Digital Era’ is via broad reach brand campaigns, which are “still the best way to drive market share, which in turn is a key driver for profit”.

Out of Home media fits into this ‘broad reach’ approach seamlessly and is the best way to increase your share of voice. It does the heavy lifting for your market mix and makes other channels like digital and TV work better.

The fact of the matter is that there are going to be more outbreaks and more lockdowns, but this shouldn’t turn you away from advertising. This is a time where consumers are looking to brands, and we now have the data and proof of what lockdowns do to Australians, their attitudes and their movement behaviour.

We’re no longer applying a ‘make it up as you go’ technique either. Phase 1 has given us the data we need to know about every region in Australia when it goes into lockdown, and we have the capabilities to apply those learnings by state, market or area as we potentially move in and out of lockdowns or restrictions.

At oOh!, we are tracking over 4,000 locations around Australia using telco data from millions of devices to provide the most representative and robust measure of Out of Home audience trends. We have the size and scale of locations to split this data by different networks and different areas for a robust indication of consumer behaviour and changes in trip making.

The data tells us that the total number of trips made in metro areas are now back just -11%yoy, a 44% increase since Mid April. With an understanding of audience behaviour, we can see that work based trips have been replaced with more localised travel with suburban based audiences returning to 76% of pre-Covid levels.1 The average trip length that we are seeing across Australia are 3 minutes shorter YOY with work trips down -53% vs same time last year and non work based trips down just -6% yoy. This gives us a greater understanding of how audiences are traveling more so about their local communities, on shorter trips for non-work related purposes. (Source 1)

We are also seeing encouraging signs across our national network. After audience volumes dropped by half in mid-April, we are now up to 80% of 2019 audience levels.

I’d argue that even with pockets of Australia in lockdown, Out of Home media is still the most efficient broadcast media channel for Australian brands to gain share of voice from their competitors.

This is what the movement data tells us about the best way to implement your Out of Home campaign through this pandemic:

- Be open to buying all markets and national audiences – the more 1+ reach you drive, the better your result. The audience you might lose in lockdown areas can be gained and targeted elsewhere. In regional areas for example where one third of the population reside, audiences are above 2019 levels, signalling a return to and relish of the outdoors after months in lockdown.

- CBD traffic is still amongst the most affected as people move about their local suburbs more, so upweighting in metro suburban areas and regional areas is the way to go to balance your reach.

- If an area goes into lockdown, don’t panic! The COVID reality is that we’re going to see areas locked down and a rollercoaster of infections. But don’t turn your brand off. Instead, leverage the data available to switch an impacted area’s Out of Home strategy to target people’s daily trips to buy essential goods. For Melbourne this means suburban roadside assets like Street Furniture and Billboards, plus Retail within supermarket precincts.

Similar learnings can be applied by the shopping behaviour we see in transactional trends. If an area goes into lockdown, expect a jump in spend on non-discretionary goods to the detriment of discretionary ones.

This was evident in the week we saw consumers in Melbourne go back to their hoarding habits before their second lockdown.

In fact, our COVID-19 Pulse Report found that across Australia almost half of Gen Xers said they will continue to store more household cleaning and hygiene items at home, while two in five intend to store more non-perishable food items in their pantry. And as we look to the future, Baby Boomers in particular remain positive about their future spending power, as the vast majority (81%) believe their ability to purchase products and services in the future will be unimpacted.2

Our government chose a strategy of containment, so we can reasonably expect a wave of outbreaks and subsequent lockdowns throughout this pandemic. Every day we become more accepting that this is how it’s going to be, so confidence will build up again as Australians adapt to these ‘new normal’ conditions and unite to support our country.

Source: 1 Dspark, Trip volumes, Metro Australia, Total Trips, Work Trips and Non Work Trips, week ending Feb 3rd, April 13th and June 29th 2019 vs. 2020. Trip defined as a trip from one SA2 to another SA2 with a dwell of at least 15mins