Prime time: Amazon’s Australian advertising revenue tops $153m, subscribers soar 40% ahead of streaming ads launch; ecom marketplace eats eBay share as analysts predict massive 2024, pressure cooker for local rivals

Advertising, ecommerce sales and fulfilment plus subscription revenues are all powering north at Amazon in Australia – and its ad takings, up 51 per cent in 2023, should get a major boost in the second half of this year as it links streaming ads on Prime to its retail media business. I.e. vertically integrated brand and demand with sales and delivery. The company's claim to advertisers that it will hit 5 million subscribers may be a stretch but is doable, even if some analysts suggest its 40 per cent subscriber growth rate has maxed out. Either way, consultants suggest there is existential pressure for local incumbents as the juggernaut starts to hit top gear. After playing the long game, they reckon Amazon is finally approaching primacy, with pure-players likely to be "knocked off" as a result.

What you need to know:

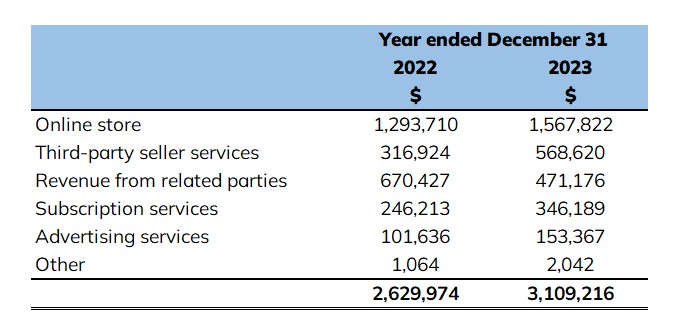

- Amazon's Australian revenues hit $3.109bn this year

- While its online store is the biggest contributor to net revenue at $1.567bn, third party seller services, mostly commissions and fulfilment charges, is the fastest growing.

- Amazon's local marketplace is now Australia's biggest, overtaking eBay for the first time, suggest ecom consultants Pattern, growing while its main rival shrinks and placing potentially existential pressure on smaller pure plays.

- The first day of Prime Day, launched in 2023 is believed to be the single largest sales day ever on Amazon.com.au.

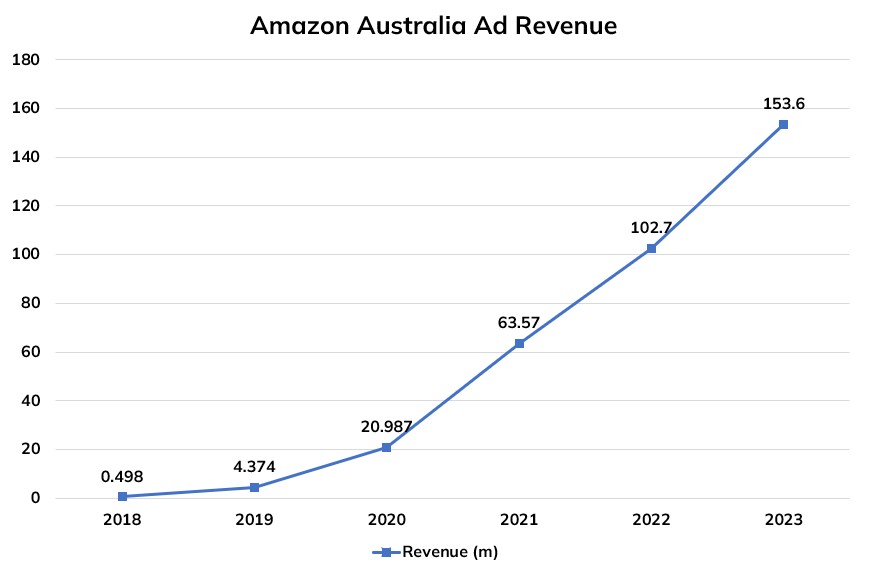

- Meanwhile ad revenues climbed 51 per cent to $153m. Expect the total ad take to grow substantially this year and next as the firm links its retail media business to streaming ads on Prime from the second half of 2024.

- Amazon last year told media buyers and brands it would launch streaming ads to a subscriber base of 5 million. 2023 subscription revenues climbed 40 per cent. 5 million is a stretch, some suggest, but doable even if growth rates have topped out.

- Subscriber numbers at the end of 2023 stood somewhere between 3.5m and 4.3m based on an analysis of the filing.

In terms of overall subscriptions, it's a lot to ask them to grow at the same rate ... [Either way] these are impressive numbers. It really highlights how it's been a slow burn for Amazon. It didn't really succeed in Australia initially. But in the last couple of years, it's really ramped up.

Top gear

Australians may be tightening their belts but Amazon's juggernaut is still going through the gears, notching 18 per cent revenue growth in 2023 to $3.1bn per latest ASIC filings.

The online store hit $1.57bn for the year, up 22 per cent from $1.29bn while third party seller services (basically commissions, fulfilment and delivery charges paid by merchants) are fuelling its growth engines, up 79 per cent to $569m. Mi3 understands those commissions typically scale from about 7 to 15 per cent depending on the category with an average of about 8 to 9 per cent.

Subscription revenues were up by $100m to $346m, an increase of 40 per cent.

Amazon's Australian advertising business is also powering, up 51 per cent to $153 million. That advertising figure, built on a retail media base, will likely increase substantially in the second half of 2024 as streaming video ads launch on Prime.

In November last year, Mi3 reported that Amazon Prime had been briefing media buyers and brands on a mid-2024 ad tier launch to 5 million local members. It was touting three-month launch packages of $150,000-$250,000, per those briefed on the plans. As in the US and UK, Amazon is confident of hitting those numbers by rolling all subscribers onto an ad tier by default, and then charging more for those that don't want ads.

As well as aggressive pricing for its ad bundles, given the rates charged by Netflix for much lower reach when it launched in Australia ($6m-plus for 12-month packages with fewer than 100,000 initially on the ad tier), Amazon Prime is also expected to cap ads at four minutes per hour. Analysts think that combination leaves significant upside for its streaming ad revenues.

Globally, Amazon's advertising business is on the cusp of cracking a $50 billion advertising annual run rate, a benchmark it should achieve by mid-2024. As with its global results, Amazon Australia this year is more open about ad revenue business, breaking out its performance individually for the first time. Previously in Australia, they were buried under 'other.'

An Amazon Australia spokesperson told Mi3: "Our entire approach to advertising is based on creating customer experiences that are highly useful and relevant. Done right, advertising can be very useful for customers – for example, helping them discover products and brands within Amazon’s vast selection they may not otherwise know about. Advertising only works if we make it great for Amazon customers, and when we create great customer experiences we deliver better outcomes for our advertisers."

Either way, the Prime play means Amazon can also link its largely performance-focused retail media ads business to brand building or upper funnel ads.

Other retail media players such as Woolworths-owned Cartology are taking a similar approach with Coles 360 heading in that direction – though for BVOD and CTV they have to partner with third parties, broadcasters for the former with Nine keen locally, and the likes of YouTube for the latter. Amazon has vertical integration on its side, though it hasn't yet bought any billboards businesses.

Amazon Australia's ad growth tracks the digital sector's famous hockey stick trajectory

Pressure building

Last year Amazon opened a new purpose-built fulfilment centre in Perth to help improve delivery speeds to more areas of Australia, and announced a new broadcast deal for Prime Video to be the home of ICC Cricket in Australia, adding to the value of a Prime membership, the spokesperson said. The platform has been bidding for sports rights more aggressively around the world.

The company claims that since 2011, Amazon has invested more than A$15 billion across all of its businesses in Australia. It's growth trajectory suggest that is now starting to pay off: The first day of Prime Day in 2023 was believed to be the single largest sales day ever on Amazon.com.au and the year marked the first time the site overtook eBay in terms of traffic, and company insiders believe, revenue.

According to the 2024 Marketplace Consumer Trends Report from ecom consultancy Pattern, "Amazon outperforms all other marketplaces on average monthly site visits, including eBay by a significant 48 per cent in the past three months." Its report suggests Amazon is taking traffic and custom from eBay – and predicts a huge ramp up of business in 2024, suggesting its turnover will reach $5.5bn. While that figure seems high, others, such as Accenture Song's Managing Director and ANZ Commerce Lead Peter Davias, have made broadly similar predictions – with rival marketplaces set to feel major pressure.

"I feel that their business will likely double in size over the next couple of years, which is going to then start to really have an impact [on] retailers, probably knocking off the pure players, but then going into particular categories and really starting to carve [them] out," Davias recently told Mi3. "I think we're going to see a lot of change happening across the sector over the next couple of years there."

Pattern Managing Director Merline McGregor, told Mi3, "Amazon's commitment to long-term growth is a winning factor in the marketplace stakes ... This is paying dividends on the customer loyalty front." The component parts to its long game are now all in place, she suggested.

"This includes logistics, product information, and final mile delivery as well as advertising to the target consumer on the platform. The end-to-end experience for the customer sets the standard for marketplaces today."

Amazon Australia's calendar 2023 net sales, figures in thousands.

Prime time

Amazon's subscription services bundled under Amazon Prime grew 40 per cent. If that run rate continues across the first half of 2024, the firm could hit the 5 million subscribers it has told advertisers to expect at the launch of its streaming ads business. How many pay more to avoid ads remains to be seen, though US projections indicate Amazon expects around three quarters of subscribers to stay put on the ad tier. Meanwhile, some think subscriber growth rates may now fall.

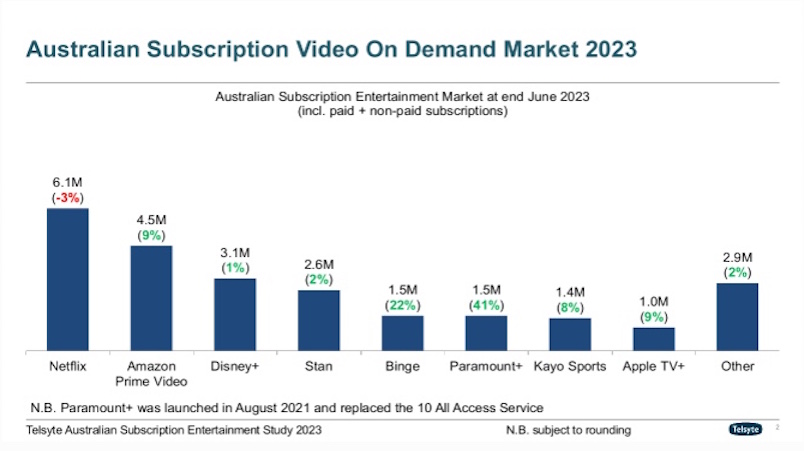

Research firm Telsyte last year suggested Prime has already cracked 4.5m subscribers locally (see chart below). Amazon's latest financials suggest its subscriber base is somewhere between 3.5 and 4.3 million depending on the split between monthly and annual subscribers.

"Amazon has a lot of data and a multimillion member customer base in Australia now as these numbers prove. It represents a viable advertising opportunity if you think about the audience size and the audience's interactions with Amazon. It is quite powerful for advertisers if they can target based on requirements," said Telsyte MD Foad Fadaghi.

"The combined value of both deliveries and streaming as well as music and other services in the bundle is increasingly attractive to Australians. It's also been one of the lower costs subscriptions – where others have been increasing their prices, Amazon has remained steady," he said, backing Amazon to become "an important cornerstone of the streaming market" via its multi-pronged approach.

But Fadaghi thinks Prime's growth rate may have topped out.

"In terms of overall subscriptions, it's a lot to ask them to grow at the same rate given that we've just come out of Covid, and given saturation is increasing in the Australian market. So they probably won't grow at that rate next year."

Either way, he said, "these are impressive numbers. It really highlights how it's been a slow burn for Amazon. It didn't really succeed in Australia initially. But in the last couple of years, it's really ramped up."

It's certainly pushing the envelope: According to its ASIC filing, Amazon's Australian sales and marketing spend last year climbed 15 per cent to $337m.