Cartology plots next growth surge with OOH, BVOD push as trade-marketing-agencies align, but boss Mike Tyquin warns on market ‘crush’ and $450m TV leakage forecasts

"Do you really know what's going on with customers?” – Cartology chief Mike Tyquin on retail media's critical factor.

Woolworths' ad business Cartology is approaching five years old, amassing north of 300 staff and, at least per Morgan Stanley estimates, $550m of Australia’s rapidly rising retail media market. But boss Mike Tyquin questions the numbers being thrown around by investment analysts, especially the hundreds of millions predicted to leak from TV. He needs the network majors onside to power the next leg of off-network growth beyond Youtube and while no deals are yet done, he likes the cut of Nine’s jib. Meanwhile, Tyquin warns the rush to capitalise on media’s fastest growing category could backfire without three critical foundations in place. But he suggests that brand marketers, their trade sales counterparts and media agencies are now aligning in earnest to move the investment needle.

What you need to know:

- Cartology is backing BVOD and out of home to power next leg of growth outside Woolworths Group’s owned assets. Partnerships with media owners are likely to be announced soon for BVOD.

- Those deals should offset some of the forecast revenue “leakage” from Australia’s big publishers to retail media, says boss Mike Tyquin. He thinks potential upside has been overlooked by analyst forecasts.

- Tyquin thinks retail out of home has been a blunt reach tool.

- With Shopper Media bedded in and after taking Vicinity’s business from oOh Media, he’s backing better data, targeting and segmentation to move the needle for a broader set of advertisers – and for Cartology’s next growth leg.

- Meanwhile, he says while hype and a rush of retail media arrivistes is welcome at a category level, under-delivery could prove damaging.

- But “directionally” he can’t argue with massive growth forecasts – and a sure sign is that traditionally siloed trade and marketing teams are starting to align and entrust agencies with both budget pots. Goodman Fielder, he suggests, will soon have company.

There's a crush of people that want to be involved. At a category level, I’m all for people promoting the virtues of retail media. But if you want to do the job you think you can do for brands, retail media is about three things: retail context ... first party customer access ... and really deeply invested client partnerships ... even beyond advertising.

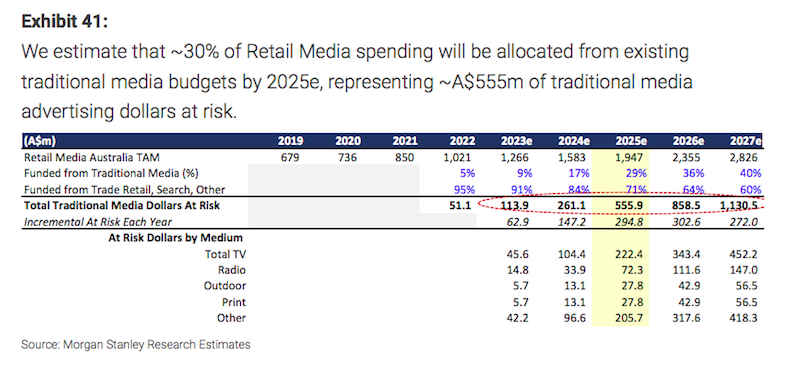

Cartology turns five in July. Over that time, interest in retail media has boomed. Morgan Stanley, which estimates Cartology’s revenues at circa $550m, is the latest to predict how fast the local market will accelerate. The investment bank forecasts a $2.83bn retail media ad market by 2027, eating $1.1bn to $1.5bn of traditional publisher revenues by that point, with the biggest chunk – $104m in 2024 and $452m by 2027 under its base case – coming out of TV.

Meanwhile the market is starting to heave with retail media networks and new retailers entering at pace, with Kogan and David Jones among the latest movers.

Tyquin thinks some of the big retailers can carve out a slice. But he warned those jumping onto the gravy train may be yet be derailed – if not by incoming privacy law changes but because they don’t have the fundamentals in place. Namely, shops, shoppers and permission to tap their data, relationships with brands that go beyond advertising – and the ability to tell those brands what’s going on with a) their customers and b) their ad dollars.

“There's a lot of activity and a crush of people that want to be involved. At a category level, I’m all for people promoting the virtues of retail media. But if you want to do the job you think you can do for brands, retail media is about three things,” he told Mi3.

“First, you've got to have a retail context. Otherwise the customer position and how you connect brands with that becomes quite… interesting.

“Second, you must have first party customer access; you must have a customer franchise. Because if you don't have the customer franchise, you'll never have permission to work for and with those customers to derive the data, and to do the things that you want to do for the benefit of your clients,” he added. “And when I mean customers, I mean the people that walk in the door of the store or go online.

“Third you must have those endemic client partnerships, really deeply invested partnerships where there's a real alignment around the importance commercially of that relationship, even beyond advertising,” said Tyquin.

“But what we're seeing is a lot of [players] popping up in retail ad placements, in retail contexts or environments, that lack a couple of [those] things. The ability to for example, to explain to a brand what's going on? Why their brand is being impacted by cost of living? Do you really know what's going on with customers?”

Without those fundamentals, per Tyson, there is a risk that brands are left disappointed, crimping retail media’s growth curve. “You can't do it without truly understanding customers.”

Morgan Stanley forecasts on revenue leakage from Australia's traditional publishers to retail media players.

There are some interesting nuances [to market sizing]. I think this is where what Nine is doing from a partnering perspective becomes an interesting discussion. They've got a very good perspective about retail media, which is a partnering program. They understand their role, they understand they're not retailers.

TV leakage overcooked?

Tyquin’s also not convinced by some of the numbers being bandied around by consultants and investment banks. “Morgan Stanley is directionally okay – and most of these reports are similar. But there's some things in the background that need to be understood as context for framing these numbers,” said Tyquin.

Firstly, what is being classified as retail media? Some retailers will dump everything into that bucket, including catalogues. (Cartology doesn’t include Woolworths’ catalogue revenues.) Secondly, said Tyquin, the predictions of major revenue leakage for traditional publishers – with Morgan Stanley suggesting TV networks, particularly Seven, are most exposed – don’t necessarily include upside.

“People need to think about partnerships [when running the numbers],” said Tyquin. He hinted deals with major publishers can be expected in short order, particularly around BVOD, which Tyquin indicated would be a major focus for 2024 as Cartology aims to scale so-called off network revenues. I.e. making money from advertisers by enabling them to target advertisers with its data across platforms Woolworths Group doesn’t own. It’s already active off network with Youtube.

Tyquin wouldn’t put a number to its off network growth expectations beyond “it's a really material part of what we want to do”. Neither would he name incoming publisher partners, but did talk up Nine’s approach to “sofa to store” retail media partnerships via its RTLX unit announced at last year’s Upfront. Either way, to hit those "material" off network revenue targets, Cartology needs the big publishers to partner up and take a slice rather than go on the defensive.

“There are some interesting nuances [to market sizing]. I think this is where what Nine is doing from a partnering perspective becomes an interesting discussion. They've got a very good perspective about retail media, which is a partnering program. They understand their role, they understand they're not retailers. I think [Nine sales chief Michael Stephenson] has explained it very, very well. But they're very active and interested to work with retailers and retail media businesses to co-create other propositions.”

In fairness, Morgan Stanley does state its leakage estimates could be overweight if traditional media owners partner with retail media players. Its report also flags incoming data privacy laws as potentially crimping growth. While the government’s indication it will not give consumers an unqualified right to opt out of targeting removes a potential cliff edge, compliance around consent management poses hurdles.

Regardless, Tyquin claimed Cartology is “completely fit for purpose with the big changes that are coming from a privacy and regulation perspective in 2024” in terms of using customer data to power its ads business. “We've got a very privacy-compliant model, which we're very comfortable with at the moment, it's probably not as … adventurous as you'd see in other markets like the US.”

When we bought Shopper we felt that retail out of home, studying it from the outside, had lost some of its retail appropriateness, specificity and context … it had become quite a flat reach play ... and that was confirmed when we bought the business.

Out of home data push

After spending $150m on Shopper Media in 2022, Cartology last December struck an exclusivity deal with shopping centre operator Vicinity that takes its total retail out of home reach north of 5,000 screens. Tyquin said the first deal made the business case for the second – and sees major opportunity to scale both its on-network Shopper business and off-network Vicinity screens partnership through sharper targeting and segmentation.

“When we bought Shopper we felt that retail out of home, studying it from the outside, had lost some of its retail appropriateness, specificity and context … it had become quite a flat reach play,” said Tyquin. He thought it could go deeper and more granular.

“What we felt was going on – and it was confirmed when we bought the businesses – was we were seeing [retail] briefing that was part of [broader] out of home plays, and that can absolutely be appropriate. But for some clients, particularly endemic FMCG clients, we couldn't really square the idea that there wasn't more of a retail-specific opportunity,” he said.

Like what?

“Which centres, which audiences, which context; big centres, small centres, supermarket-anchored centres versus super regional centres; why and where were certain brands showing up in retail environments… So when we bought Shopper we felt there was an opportunity to do some work around how do we enable the data that we've got about customers to be more useful for brands.”

In short by better mapping the customer data and footfall to the buy. What Cartology calls ‘next level targeting’ launched 12 months later into the Shopper business and will be rolled into the Vicinity approach as of next month. “So we will unlock those much bigger audiences for a broader group of advertisers. It's a really big step for our off network business,” said Tyquin.

“We can tell brands which centres and which screens over- or under-index on their target audiences. So whereas the customer practice has probably been to sell more at a centre level, and make broad assumptions that certain audiences and centres behave in a certain way, we can now actually plan those campaigns much more specifically around the audiences that really are in those centres,” he added.

Having Big W in the fold gives visibility beyond supermarket shoppers, said Tyquin, “and in a broader non-endemic client sense [i.e. advertisers that don’t traditionally sell in the group’s stores] we can build a lot of segments.”

Somewhat ironically, Cartology took the Vicinity business from oOh Media, which Morgan Stanley suggests is the "least exposed to retail media leakage" of the traditional majors.

Trade-brand-agency movement

The bulk of retail media revenues to date has come from existing trade budgets, with brands historically operating trade sales and marketing units separately and agencies getting nowhere close to the trade teams. But that is starting to change with the likes of Goodman Fielder last year combining its trade sales and marketing budgets and handing them to Initiative to manage.

Tyquin suggests that alignment is the shape of things to come.

“It’s a really big trend … We are seeing a really big groundswell, some very rich conversations there. It’s starting to accelerate and broaden out across a very big client cohort as we look at it.”

Which means more growth, whichever way you cut it.