‘It’s a goddamn lockbox’: History repeats as $20bn wasted in global online ads, Australian brands indifferent on scrutiny versus other media channels

From left to right: Atomic 212's James Dixon; Virgin's Ben Will; Tumbleturn Media's Jen Davidson; OMG's Philip Pollock; Penfolds-Treasury Wines' Ben Oliver and Trinity P3's Darren Woolley

US advertisers released another mind-bending report a few weeks ago on the scale of wastage in the digital ad market - $20bn. But most Australian marketers remain blissfully – or negligently – unaware. Scrutiny and understanding of programmatically-traded advertising is all but absent within most brands. Their media agencies are rarely challenged on digital ad schedules yet they will pursue line-item auditing of other media with rigour. Virgin’s Head of Paid Media Ben Will is one of the few to call it: “The ad industry is putting a lot of trust into data without really challenging it.” Ben Oliver, digital media lead at Treasury Wine Estates in-house agency Splash, is another. "When you're trying to get an insight into what's going on – and I won't name names – but there are some programmatic partners who just won’t give you any." Oliver is turning to outspoken US ad fraud analyst Dr Augustine Fou for answers he can't get here.

What you need to know:

- The majority of CMOs (80 per cent, claims one source) "don't give a shit" or are "blind" to wasteful, murky programmatic supply chains.

- Industry experts warn that invalid traffic, bots, ad fraud running rampant on open exchanges that Australian advertisers use. "It's 100% the same as in the US", where an ANA [Association of National Advertisers, US] report noted 20 per cent of digital display ads are wastage.

-

The ANA findings may also be undercooked; Mi3 has learned the ANA initially wanted 67 advertisers as part of the study but this pool quickly evaporated to 21 after brands had been advised by their legal teams not to take part, with some citing data and privacy concerns. The Trade Desk is another that declined to take part.

-

The complacency is driven by several factors: an obsession with cost over value; an over-reliance on tech and agency partners; lack of interest or resources to challenge.

- "Well-lit neighbourhoods" exist, but the majority of ad impressions on exchanges not being tracked from end-to-end

- Google Display Network called out for "poor quality inventory" and ignoring inclusion 'white' lists.

- There are four practical steps marketers can take to avoid wastage: focus on value, not low CPMs; buy from PMPs (private marketplaces) and preferred deals; challenge agency partners; learn about the digital media ecosystem.

- Industry bodies are working on buyer-to-seller tracking and transaction IDs.

When I think about the transparency piece, a lot of the time when you are working with programmatic partners externally, it's a goddamn lockbox.

Australian CMOs are not investing enough time or asking hard enough questions about their programmatic media spends, which can lead to poor campaign outcomes and wastage.

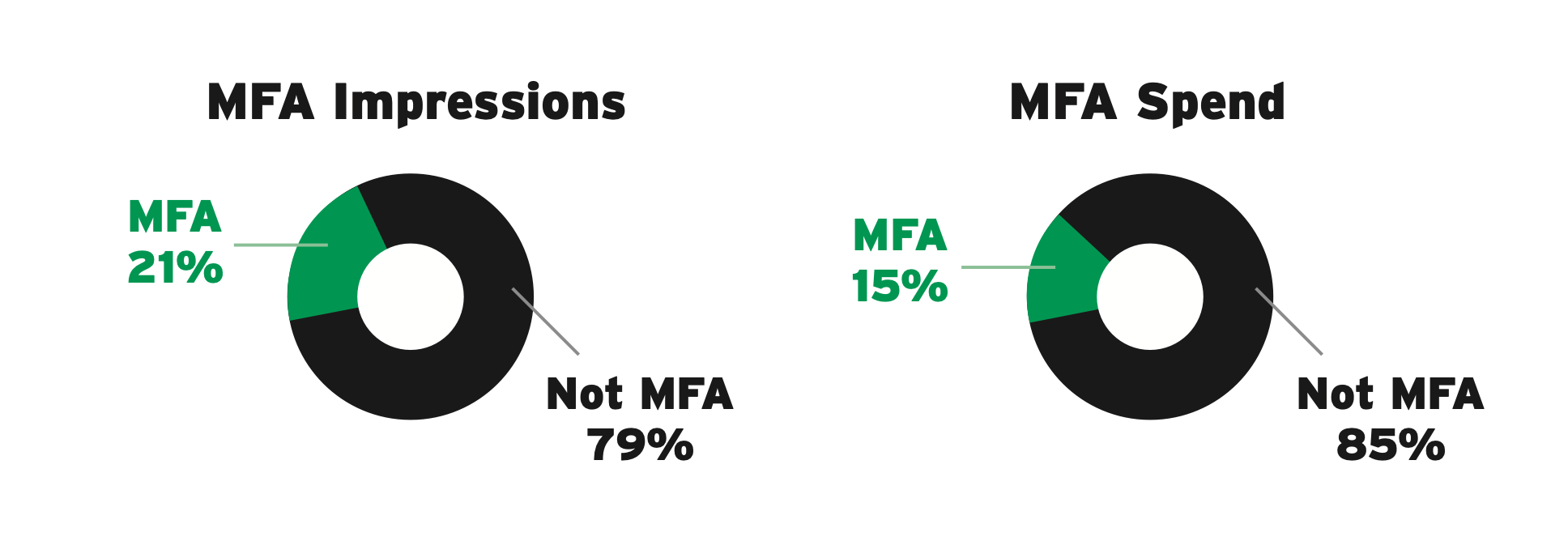

That is the consensus from industry experts reacting to an ANA report that found more than $20bn worth of advertising (22 per cent) served in programmatic exchanges is wasted on cheap clickbait sites that offer little transparency, introduce brand risk and are more likely to be subject to fraud.

The issue in Australia, argue some experts, is less likely to be as acute in Australia as it is in the US, where a larger volume of brands use open ad exchanges that are more likely to serve ads in the “long tail” of digital display where dodgy "Made for Advertising" websites are prolific; for example the average campaign, the study found, ran across 44,000 sites.

Although the murky world of programmatic advertising has been doing the rounds as an issue for more than a decade, the report is significant because it places a figure on the scale of the problem – one that is alarmingly large – based on log-level analysis across 21 advertisers and 35 billion impressions, accounting for $123 million in spending.

The findings may also be undercooked; Mi3 has learned the ANA initially wanted 67 advertisers as part of the study but this pool quickly evaporated to 21 after brands had been advised by their legal teams not to take part, with some citing data and privacy concerns. The Trade Desk is another that declined to take part.

Industry experts such as Dr Augustine Fou and Bob Hoffman have long warned about fraudulent programmatic display advertising, gamed by nefarious forces.

Mi3 approached marketers, media agency experts and industry leaders to find out what is at the heart of the problem, its scale and what can be done to fix it.

See not, waste not

The programmatic display supply chain, in particular when trading on opaque open exchanges, provides a safe harbour for fraud and bad actors, who establish click farms using Made for Advertising websites, run bots and have a larger volume of cheap inventory that is poorly placed and rarely seen by humans. Estimates place the cost of ad fraud at between $80bn to $120bn industry each year.

The issue of wastage and ad fraud has been kicked around for about a decade in reports from the World Federation of advertising (2016), the ANA (2016 and 2023), and ISBA (2020 and 2023), but its prevalence continues to thrive for several reasons.

One is transparency of the tech, especially on open exchanges.

“When I think about the transparency piece, a lot of the time when you are working with programmatic partners externally, it's a goddamn lockbox,” said Ben Oliver, digital media lead at Splash, the in-house agency for Penfold’s parent company Treasury Wine Estates. “When you're trying to get an insight into what's going on – and I won't name names – but there are some programmatic partners who just won’t give you any.”

Another reason, added Ben Will, the Manager of Group Paid Media at Virgin Australia, is how programmatic ad campaigns are measured.

“I think it's due to a lack of sophistication in being able to measure the true value of programmatic. Programmatic ad platforms offer a lot of performance data, but it's not often linked to business outcomes,” he said. “The ad industry is putting a lot of trust into data without really challenging it.”

The lack of challenge against programmatic was mentioned by several execs interviewed, who suggest that senior marketers are stretched and have bigger fish to fry in their day jobs than run the rule over programmatic spend, which is often handled by media agency partners.

Last week, Arnott’s CMO Jenni Dill said she spent around 5 per cent of her job on media, former Coles, Tourism Australia CMO Lisa Ronson said she spent upwards of 10 per cent. Even Sarah Sorrenson, who until recently was Unilever’s Director, Digital Marketing, Media & Commerce lead - i.e. the head of media - only spent circa 60 per cent of time on media.

If I made 20 phone calls to CMOs at the top end town, none of them would be aware of the ANA report – 80 per cent don’t give a shit. We still have marketers here that fundamentally rely on agencies to do their job. They are so stretched, they don’t have the resources or time for this.

Arbitrage still common

Jen Davidson, managing partner at consultancy Tumbleturn Media, said clients often accept a programmatic line on media plans without any due diligence. Arbitrage, she suggests, is still common.

“Digital doesn’t get the same degree of scrutiny by clients as other channels. Unfortunately that just seems to be a fact. Agencies aren’t challenged to give details or break out costs,” she said. “We speak to media publishers regularly and there is definitely a gap between the price of inventory sold by publishers and the buy costs on plans."

Atomic 212 co-founder and chief digital officer James Dixon said marketers knowledge about programmatic is “a mixed bag; some are highly aware of it and the risks involved, some are not. We let our clients know that it's a murky business, we can't guarantee brand safety despite best practices. But if they need to go there we have a look at what its ROI is.

“It's become a bit of a game of whack a mole, where you'll find this stuff pervasive through most programmatic display campaigns, even though we use inclusion list and brand safety technology.”

A well-connected senior industry figure, who spoke to Mi3 on the condition of anonymity, reckons programmatic wastage and ad fraud would not be on the radar of most CMOs and questioned how many are even aware of the ANA report.

“If I made 20 phone calls to CMOs at the top end town, none of them would be aware of the ANA report – 80 per cent don’t give a shit. We still have marketers here that fundamentally rely on agencies to do their job. They are so stretched, they don’t have the resources or time for this.”

Another agency leader said marketers are indifferent about programmatic and that typically it only accounts for five per cent of media investment, adding “they get more interested in whether TV ads get viewed or not…programmatic is more of a hygiene channel now that can deliver decent ROI, especially with retargeting.”

If you've been spending millions of dollars on programmatic, how do you turn around to your CFO that your effective cost per thousand was $1, now it's got to be $10? Is that inflation or is it because when you were buying low more than half of it was not actually seen by a living person.

"Obsession with cost”

Aside from the lack of time and resources, TrinityP3 Founder and global CEO Darren Woolley said a major drive of wastage and ad fraud is an “obsession of cost in rather than value out”, pointing out it is beyond the means of most marketers to physically analyse 44,000 websites ads appear on, per the ANA probe, so there is an over-reliance on technology and far too many vendors and intermediaries have the fingers in the pie.

“The trouble with relying on technology is that it's like the lunatic marking their own homework,” he said.

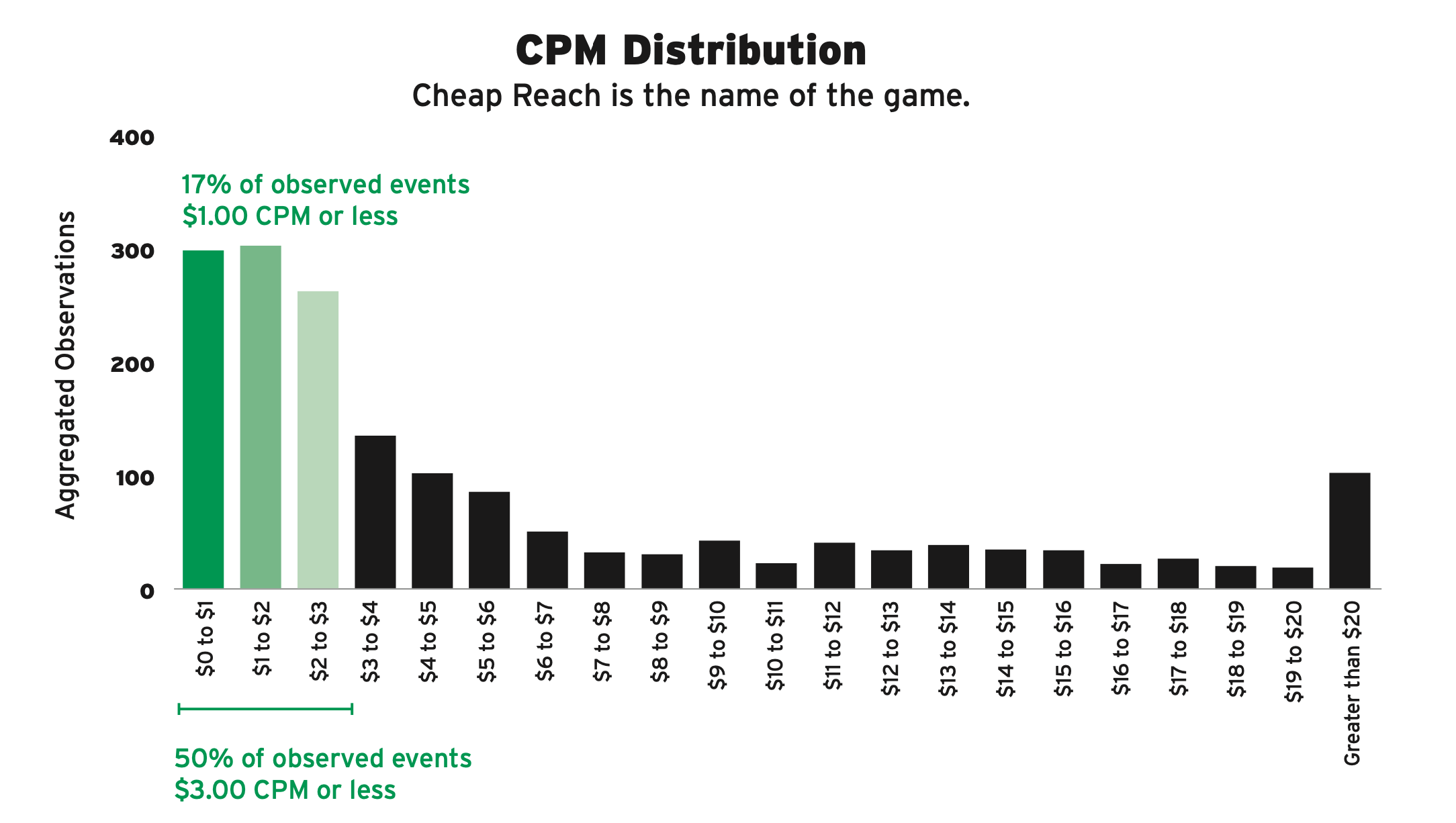

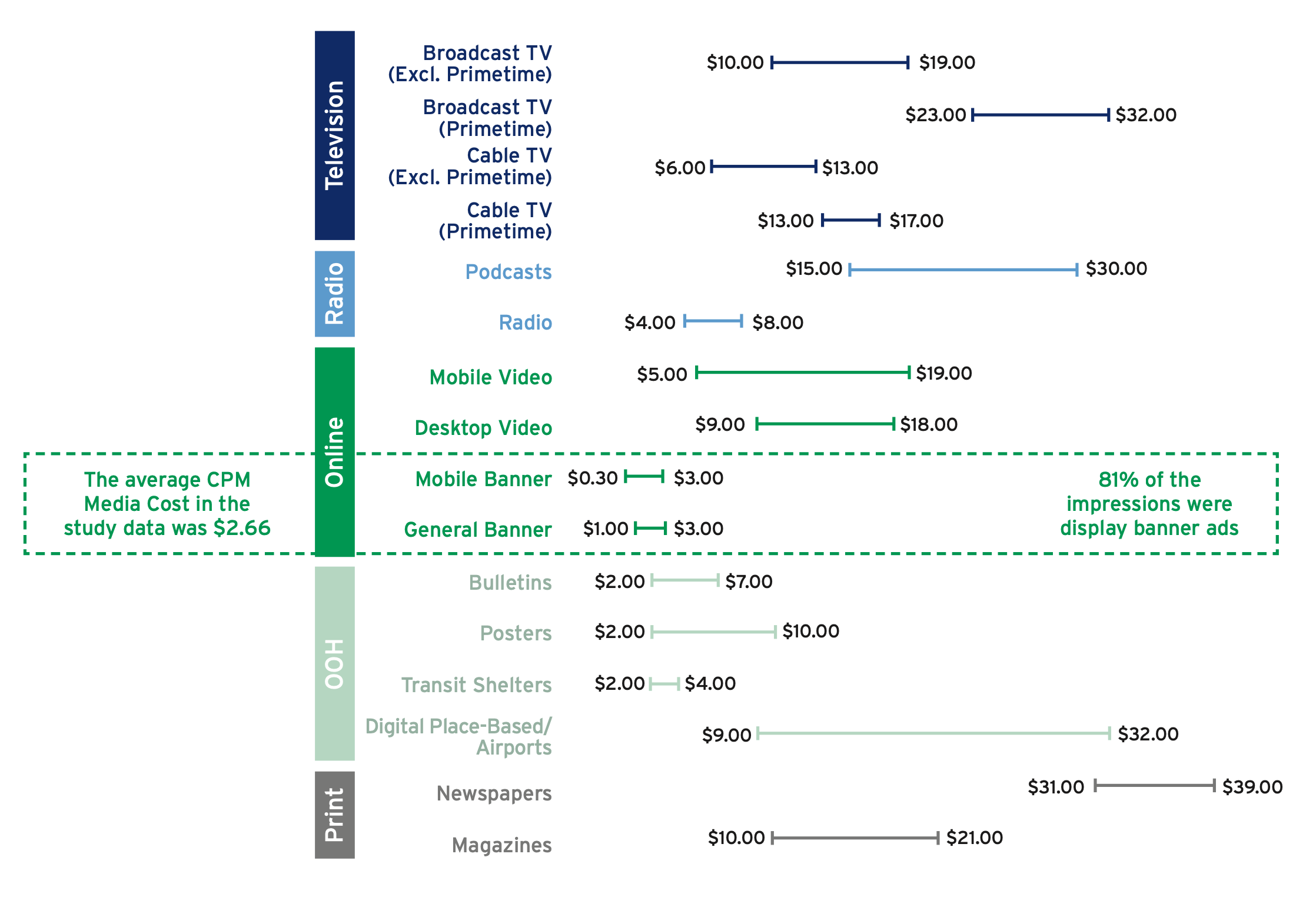

The other problem is the obsession with cost on CPMs means that to change tack could lead to rather awkward conversations between a CMO and procurement or CFOs. This was backed up by the ANA study (see charts below).

“If you've been spending millions of dollars on programmatic, how do you turn around to your CFO that your effective cost per thousand was $1, now it's got to be $10? Is that inflation or is it because when you were buying low more than half of it was not actually seen by a living person. Isn't it easier just to continue to turn a blind eye, particularly when your agency will tell you that they're doing everything possible to make sure that risk is minimised.”

Australia's problem

There are various estimates about the scale of the issue globally, but so far it is difficult to gauge the extent of wastage (or invalid traffic) and ad fraud in Australia – but its likely to be substantial.

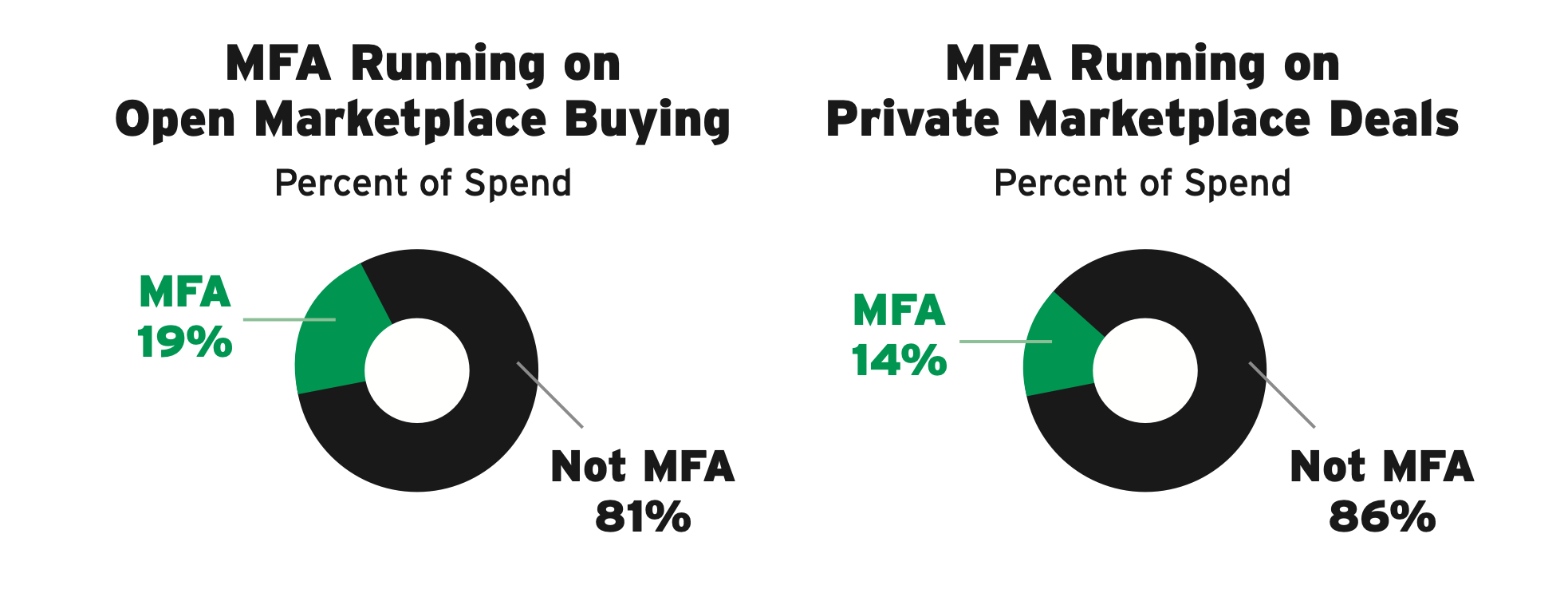

In FY 2022, Australian advertisers spent $5.4bn on general display advertising, of which 70 per cent was traded programmatically, according to figures from the IAB and PwC. It's hard to quantify how much of that figure is through open exchanges versus PMPs to create an equivalent to the ANA's 22 per cent wastage figure. But hundreds of millions is a safe bet (and per the ANA's report, PMPs were not all squeaky clean).

Of digital spend, walled gardens like Google take 80 per cent of ad revenue, making it difficult for advertisers to track where their spend ends up.

This was the thrust of a point made to Mi3 by Dr Augustine Fou earlier this year when discussing an ISBA and PwC report that showed the “unknown delta” of ad spend had reduced from 15 per cent in 2020 to 3 per cent in 2023.

Fou said the ISBA study could not match 96 per cent of impressions across the whole supply chain.

“As an advertiser and ad buyer, would you be satisfied with knowing only four per cent of what you bought could be successfully traced from end to end through the programmatic supply chain?”

He also warned that the study reflects "well lit neighbourhoods" of programmatic advertising that may not be indicative of the wider landscape.

Another agency boss, speaking on condition of anonymity, believes the problem is far greater than many realise.

“This is one of the world's greatest white collar crimes. I believe there's billions and billions of dollars going into those fake sites. They're probably run by huge Russian or Eastern European or Chinese crime syndicates, because they're operating at scale,” per the exec.

“If we've got a client spending five grand a week on programmatic, it will be across 20,000 sites and you kind of go through the list and recognise Gumtree and Sydney Morning Herald, realestate.com.au. You go down the list and quickly into this grey area of sites you've never heard of. They can look legit, but you start to realise they look the same, the content is being written by AI, using the same stock images and it's claiming to have given a million impressions in a week.”

The difference in CPMs were illustrated in the ANA study below.

‘We buy differently’

Omnicom Media Group’s chief operating officer and activations lead Philip Pollock was more upbeat. He said the way agency holding groups buy digital display ads is different in Australia than the US.

“When we are buying inventory for our client base, generally we focus on premium based inventory. And clients do want to have the ability to inspect and audit a lot of the placement reports of what we are buying,” he said.

Often this is done via a preferred deal or through a private marketplace (PMP) because there are far fewer publishers and media owners in Australia, they often prefer to have relationships with advertisers … and most of the premium inventory is secured on preferred deals and is in short supply.

Pollock said there are some cases where inventory is bought on the open web, such as when a client “wants to find an audience”, and that inventory would be as susceptible to the wastage identified in the ANA report.

“If an advertiser is putting pressure on its agency to reduce the overall CPM and you are unable, internally, to give a reasonable argument of why you should be buying a higher CPM, then you are squeezed into those places that are clickbaity and poor quality sites.”

It's not just open exchange platforms that are the problem, a closed exchange platform that several cite as notorious for lower quality inventory is Google Display Network – one the largest players in the market.

Pollock said he would rarely recommend clients to buy inventory from Google’s Display Network because, “generally speaking, it’s not a very good fit”, but there are other platforms also offering a long-tail of “poor quality inventory”.

Another agency source who uses Google primarily for buying via Google DV360 said they had set a “white list” of 500 websites, but claimed they continued to be served “grey list ads”. “When you put the whitelist on in Google, it still buys grey list”, per the exec.

“Google don't really want to solve this problem, because they probably recognise that a third or even half of their revenue in this area comes from grey sites.”

The ANA study also found a remarkably high proportion of Made for Advertising websites in private marketplaces.

Cleaning up the chain

There are some practical steps the industry can take to reduce the incidence of programmatic wastage and ad fraud:

Value over cost, improve KPIs

One of the key recommendations from the ANA report is a plea for advertisers to focus on value instead of cost or “low hanging fruit”. The temptation to cut costs and over-index on performance over brand. Pollock said there is still a conflict between procurement versus marketing, and how agency KPIs are set is often still centred around a CPM, or cost of advertising, metric. More enlightened briefs, he said, add qualifying metrics such as viewability and take up inclusion lists (though some argue viewability is also a poor proxy). Virgin Australia’s Ben Will would like to see metrics linked to business outcomes and reckons a move towards attention metrics could lift the quality. He added: “Programmatic in a post cookie world will also look differently. It might lead to improved contextual targeting and lesser focus on audience targeting which could be beneficial.”

Avoid open exchange, focus on premium

There are several ways to avoid wastage, but the most obvious one is to invest in premium inventory by trading in private marketplaces or preferred deals. GroupM recently set up a private marketplace of more than 200 news sites that offer higher quality inventory. Atomic 212’s James Dixon reckons: “That's a really nice story for clients. Let's buy proper Australian human validated inventory. You'll pay a premium but you'll notice it's human, you know it's not bought [traffic] and you're supporting our journalism.”

Challenge your agency

Splash’s Oliver said that marketers need to show “the care factor” and ask probing questions about programmatic ad spend. “I want to know that if I'm spending money on display that it's actually being seen by bloody humans. Those discussions didn't always come up with our media agency partners. So a lot of the time we're kicking over rocks that were never kicked over before.”

Education & standards

The AANA, IAB and MFA encourage advertisers and their supply chain to get familiar with Australian Digital Advertising Practices (see the video above), which they say provide a baseline education about the digital media ecosystem and how advertisers, buyers and other parties can transact in a consistent and fair manner. It is one initiative that aims to drive knowledge and accountability across the supply chain.

Financial audits, transaction IDs & what’s next

Although AANA members declined to take part in this report, the peak industry body for large advertisers is working to build on best practices from UK and US counterparts ISBA and the ANA.

ISBA is focused on is encouraging members to use its Financial Audit Toolkit to conduct regular audits of their programmatic supply chain as a routine part of marketing practice. The AANA is exploring how this could work in an Australian context. “The AANA is advocating for an automated solution such as a transaction ID which would provide end-to-end tracing of each ad tech transaction so that all advertisers can track and audit the delivery of the ads they have purchased,” a spokesperson said.

“There are privacy concerns associated with a transaction ID and we are exploring with members ways to provide this in a privacy-safe way.”

A transaction ID was one of the solutions put forward by the ACCC a couple of years back. Some of the major players are not keen. But for Omnicom’s Pollock, transaction IDs that allow marketers to track ads from end to end would be a positive step forward.

He said ISBA's struggles to connect ads bought to where they end up end to end underlines the need for that kind of industry-wide solution.

“The biggest call out for me was how difficult it is for the all the different entities to work together and come up with a singular view of a transaction that can be followed right from the buyer to the publisher and everything in between.

“I can't think of any other industry that would work like that, where you wouldn't have some type of identifier that follows (a product) all the way through from buyer to seller.”

A problem with this approach will be getting global walled gardens – the likes of Google, Meta and others – to play ball. They do not want third party identifiers entering their systems. Plus, some jurisdictions, such the EU, have tight regulation over data and privacy, such as General Data Protection Regulation (GDPR).

Australia may have an advantage to drive change pending the ACCC’s digital platform services enquiry, which is investigating walled gardens and the competition issues that arise from them.

That investigation is due to close in 2025, so immediate change is not likely to happen straight away, and the outcome of Australia's privacy laws will also have a significant bearing on the platform remedies it choses to implement.

Perhaps a quicker solution for advertisers to avoid wastage is by becoming savvy to shady programmatic trading environments and start genuinely viewing media investment as value-driver rather than a saver of cost. Buyer beware was essentially the message from the ACCC's probe of the digital advertising supply chain almost two and a half years ago, if anyone was paying attention.

“The call to action for marketers is to become much more circumspect in the way that they're investing their media money in programmatic,” Woolley said. “If marketers started holding back on these wholesale programmatic spins across the 44,000 websites, it will actually force the industry to come to the party and prove that they're not wasting their money.”

In a challenging economic climate some marketers might argue they can't afford to pay more for media. The response to that is can they afford to keep wasting money and outsourcing due diligence on a significant line item?