Tech

Featured this week

Keep Reading

Tech Library

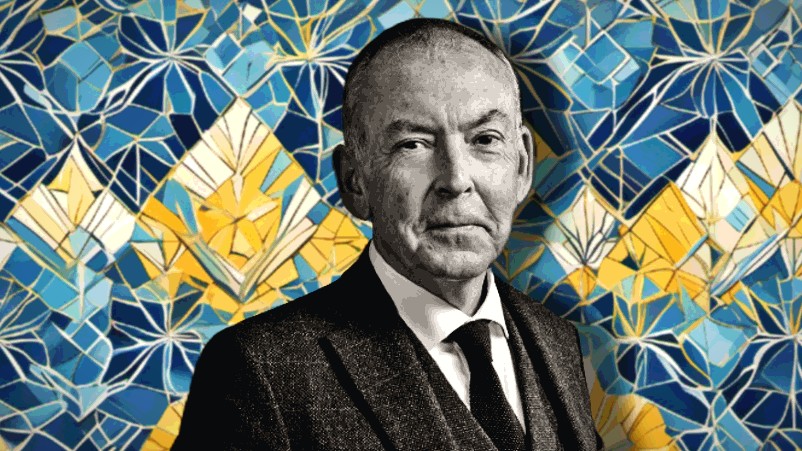

Five years ago media ecologist Jack Myers made a prediction in the second ever edition of Mi3: By 2025 media would be largely automated, almost totally AI-informed and just a quarter of sales would remain with people and ideas. It happened faster than even he thought. Now Myers predicts that within 12-18 months, most media planning will be entirely machine-led – and by 2030, “80 per cent or more of all media planning and buying will be done without human intervention”, with major implications for jobs. Meanwhile, AI is already being turned in on itself to spotlight where the money is being wasted amid a “programmatic backlash”. The “machines are actually checking on machines,” says Myers. He forecasts an incoming wave of consolidation across major media companies and a “collapse of the programmatic marketplace”. For agencies, “the re-emergence of consolidated agencies”, i.e. creative and media back together, “is the big story of 2025-26” with generative AI forcing the toothpaste back into the tube. “So I believe in 2024-25, we're going to see massive consolidation, massive contraction, and then in 2025, 26, 27 a rebirth of the advertising business.” But 2025, he warns, will be tough. Plus Myers – who likewise called out retail media’s impact early – sees a “can of worms” for the sector as analysts uncover instances of arbitrage of non-retail inventory within some retail media networks. He also has reservations on the surge by media owners into data clean rooms – Disney alone is operating 100-plus – “Who is cleaning the data? Who is validating that it is clean?”