Rise of the AVODs: Netflix ad roll-out 'turns a corner' after 'rough start', Binge ad tier sees 'negligible' churn rate ahead of open market launch; non-ad streamers urged to fast track ads in AVOD arms race

The new streaming ad kids, Netflix and Binge, are on the rise but TV networks are now plotting their Upfronts strategies for later this year - expect a strong counter.

Stung by a spluttering launch of its ad tier service late last year, Netflix is starting to get its act together for advertisers. The global streamer has been steadily growing Australian impressions each month, providing media buyers and brands with greater assurance that it can deliver on its launch partner promises. Globally, Netflix says about a quarter of all new subscribers are signing up to its ad tier service. But it still has some catchup ahead in the Australian market to keep pace with Foxtel Media’s Binge on scale. Binge opted to convert all of its entry-level subscribers onto an ad-funded plan versus Netflix which is building an ad tier audience from scratch. With Disney+ predicted to launch an ad-tier in the next year, Amazon Prime revealing its own advertising ambitions and Paramount+ already dabbling with sponsorship – the AVOD duke out is heating up.

What you need to know:

- After a sluggish start, Netflix's advertising offering has 'turned a corner', per media buyers.

- Media agencies say it is growing ad impressions by 10-15 per cent each month.

- Netflix has slowly started ramping up marketing of its ad tier service across OOH, retail screens, digital and social – it's also now providing better audience insights, both welcomed developments.

- Foxtel Media's Binge is sustaining a pre-launch advertising audience forecast of circa 400,000.

- In July it will open advertising to the wider market but keep a tight control over ad loads and frequency.

- Linear TV money continues to shift into BVOD and AVOD platforms.

- Other global AVODs could enter Australia – Disney+ is mooted this year, Paramount+ could also expand its ad offering.

- Domestic SVODs could face a "tipping point" if they delay plans to sell advertising.

You find in these environments you're getting a highly engaged audience, and that is going to have more impact and cut through because there's actually less advertising.

Team turnaround

After what many industry observers described as a “rough” to “disastrous” launch, plagued by audience and ad inventory shortfalls and a lack of support for advertisers, Netflix has started to scale its advertising offering, produce consistent growth in ad inventory levels, deliver better audience insights and a marketing push that promotes its ad-funded subscription tier.

The Netflix turnaround comes as Foxtel Media’s Binge, which launched around the same time but with less controversy, prepares to open its advertising books to the wider market in July after launching with 21 advertising partners.

Netflix keeps audience figures close to its chest but revealed at its Upfronts event last month it had five million global active monthly users on its advertising-tier plan – which is one of several subs tiers it now offers. It said around a quarter of new subscribers opt to watch ads, and the audience skews younger with 70 per cent under 50 and a median age of 34.

In Australia, Netflix, like most global platforms, gets away with opaque disclosure on local market audience size and commentary on local operations but media buyers told Mi3 they get a steer based on the number of impressions it is able to serve each month, and this has been growing month-on-month by about 10-15 per cent.

Omnicom Media Group chief investment officer Kristiaan Kroon, who called out Netflix for failing to deliver on audience projections and questioned its commitment to an ad business in Australia at the Future of TV event, has somewhat changed his tune in the past few months.

“Netflix is delivering growth of impressions every single month,” Kroon said. “While the scale is still below what was originally anticipated, because they started at a low base, there is steady growth and we are now seeing a marketing campaign. They are also providing audience insights that help us better understand who we can reach. We hope to see this acceleration of audience continue into July and August.”

Melissa Hey, who recently succeeded Seb Rennie as GroupM’s investment chief, backed that view.

“After a rough start, they’ve definitely turned it around," she told Mi3. "We are seeing more impressions available in market and they are getting a lot better at controlling that. Before it was a bit of an unknown for the amount of impressions you were going to get. It's a positive for advertisers to have that additional audience.”

Netflix slower to scale

Hey said advertisers were in a “test and learn phase” with the platform to understand the Netflix audience and how activity on the platform fits into a broader AV strategy. While she suggested it is heading in the right direction, Hey predicts it will be a slow process for Netflix to scale.

When it launched, Netflix didn’t convert current subscribers onto its ad-tier offering, unlike rival Binge, and has had to build an audience from the ground up.

It has done this with modest marketing support, although it's starting to ramp up.

Netflix’s current marketing efforts promote the price of its advertising-tier plan, its cheapest on offer. The platform told Mi3 that all future marketing campaigns will continue to promote programming and the price of its ad-tier with “starting from” messaging (see image below). The current push is running nationally across DOOH, transit, retail, digital and social.

The global streamer is also rolling out Nielsen Digital Ad Ratings in the US in the December quarter, which offers deduplicated audience measurement and engagement metrics and program sponsorship opportunities, although it is unclear when these developments will arrive in Australia.

It follows criticism by buyers like Kroon that Netflix was not taking its Australian launch seriously, especially for the premium price it has taken to market.

Although Netflix does not publish CPM figures, Mi3 understands Netflix CPMs range between $55 to $65, well above the market range for BVOD ads of between $35 to high $50s.

Although he wouldn’t comment on CPMs specifically, Kroon reckons SVOD pricing could become more dynamic in the future.

“As you build scale you could well see SVOD pricing for standard ad units drop, but at the same time they will try to bring more premium ad units to market,” he said.

Hey said the premium being charged for AVOD ads is “not yet there” in terms of value, “but I’m hoping to get that soon’

Binge remains the fastest selling advertising product that we've ever taken to market, we probably could have sold twice the number of packages than what we did at launch.

Binge viewing holds with ads

Netflix may be starting to find its AVOD stride but media buyers warn it has some way to go to catch up to the swagger of Foxtel’s ad-funded Binge.

When Binge launched an ad tier in March, it placed all of its circa 400,000 subscribers straight onto the ad-funded plan, providing it with audience scale. This strategy has given it a sizeable head start over its global rival.

Foxtel Media chief executive Mark Frain told Mi3 that Binge had sustained an audience of around 400,000 and its ad-funded tier has had “negligible” churn.

“The difference between us and Netflix was we wanted to make sure we had a fast start. Because we had a scalable base of around 400,000 customers, we could immediately do the maths on how many ad impressions that would deliver, how many advertising partners we could launch with [21] and be comfortable delivering,” Frain said.

“There has been minimal churn and only a handful have spun up to the ad-free tier. The audience has remained very consistent, if not grown a little. Binge remains the fastest selling advertising product that we've ever taken to market, we probably could have sold twice the number of packages than what we did at launch.”

Lower adloads, less formats

Like Netflix, Binge has been careful to limit ad loads to no more than four minutes per hour and it carefully controls frequency capping. In July the platform will open up to the wider market as the three-month launch partner exclusivity period comes to a close.

Frain said there is a fine line between rolling out Binge too quickly and over-selling inventory.

“From an advertiser perspective, there's now an undeniable fact that lower ad loads deliver higher attention, engagement and impact,” Frain said. “My expectation is that we will gradually build, probably adding another 20 per cent to 30 per cent more brands each quarter as we roll into the new financial year. There will be controls in place so we don’t get tempted to increase the ad load just to take the additional revenue.”

Frain says Binge will also avoid “all the tips and tricks” that some platforms are testing when it comes to new ad formats.

For example in the US, NBCUniversal’s streamer Peacock launched shoppable ad formats, as well as a Frame Ad and In-Scene advertising, while British broadcaster Channel 4 is experimenting with interactive ad formats on its All 4 streaming platform.

Frain’s ambition to keep Binge ad formats simple does not extend to the use of data and targeting. Foxtel’s sports streaming platform Kayo is soon rolling out segmentation in the form of ‘Kayo Characters’ that allow advertisers to target consumers across different segments and consumer categories. It is reasonable to expect this technology will soon make its way onto Binge, although a firm date has not been set.

For GroupM’s top media buyer, getting the balance right about reduced ad loads and providing a non-intrusive viewer experience will be vital to ensure audiences stick with ad-funded plans.

“Because you have paying consumers, they have to get that balance right and they can’t do too much to put off consumers. I think [Netflix and Binge] are both doing a good job managing that,” Hey said.

“You find in these environments you're getting a highly engaged audience, and that is going to have more impact and cut through because there's actually less advertising. Usually premium quality and fewer ads, for example cinema, you find that you get a better recall and brand awareness.”

These are disruptors to linear TV broadcasters and their BVODs, which have never faced this type of top-tier threat that offers premium content combined with lower ad loads.

The AVODs are coming… will the money follow?

If the US is an indication of how this TV market could play out, Netflix and Binge are just the vanguard of an AVOD [Advertising Video On Demand] invasion.

Kroon told Mi3 that BVODs will be keeping a close eye on how Binge in particular and Netflix scale, and that AVODs will soon become an established part of the media ecosystem – as they already are in the US.

Kroon reckons that other domestic SVODs, such as Paramount+ (which has an ad tier service in the US and offers sponsorship of its A-League coverage in Australia) and Stan (which says it won’t run ads), will need to work out if they want to join the AVOD gold rush before Netflix and Binge become too dominant.

“We have two players in the market that are moving from a long launch phase into being more mature. Netflix is starting from ground zero and building with Xandr, and they've done a good job in that space,” he said.

“Binge has the benefit of the infrastructure that Foxtel Media has from a sales perspective, and they’ve converted their bottom-tier subscription with instant scale. These are disruptors to linear TV broadcasters and their BVODs, which have never faced this type of top-tier threat that offers premium content combined with lower ad loads.”

Stan hybrid ads?

If Nine and Stan hold out on an ad tier, Nine could opt for a hybrid product using its database of 17 million logged-in users to target Stan subscribers when they are on other Nine assets that carry ads. Given that many of its Stan subscribers will also log-in to watch its BVOD services, the firm may argue that it doesn't need to launch a streaming ad-tier.

Other global streamers eyeing local ad dollars include Disney+, which has already hatched plans to sell ads and could be the next cab off the rank. This week, the Wall Street Journal revealed that Amazon Prime Video will run an ad-tier, Max (formerly HBO Max) and Discovery+ are other production powerhouses that could crack Australia.

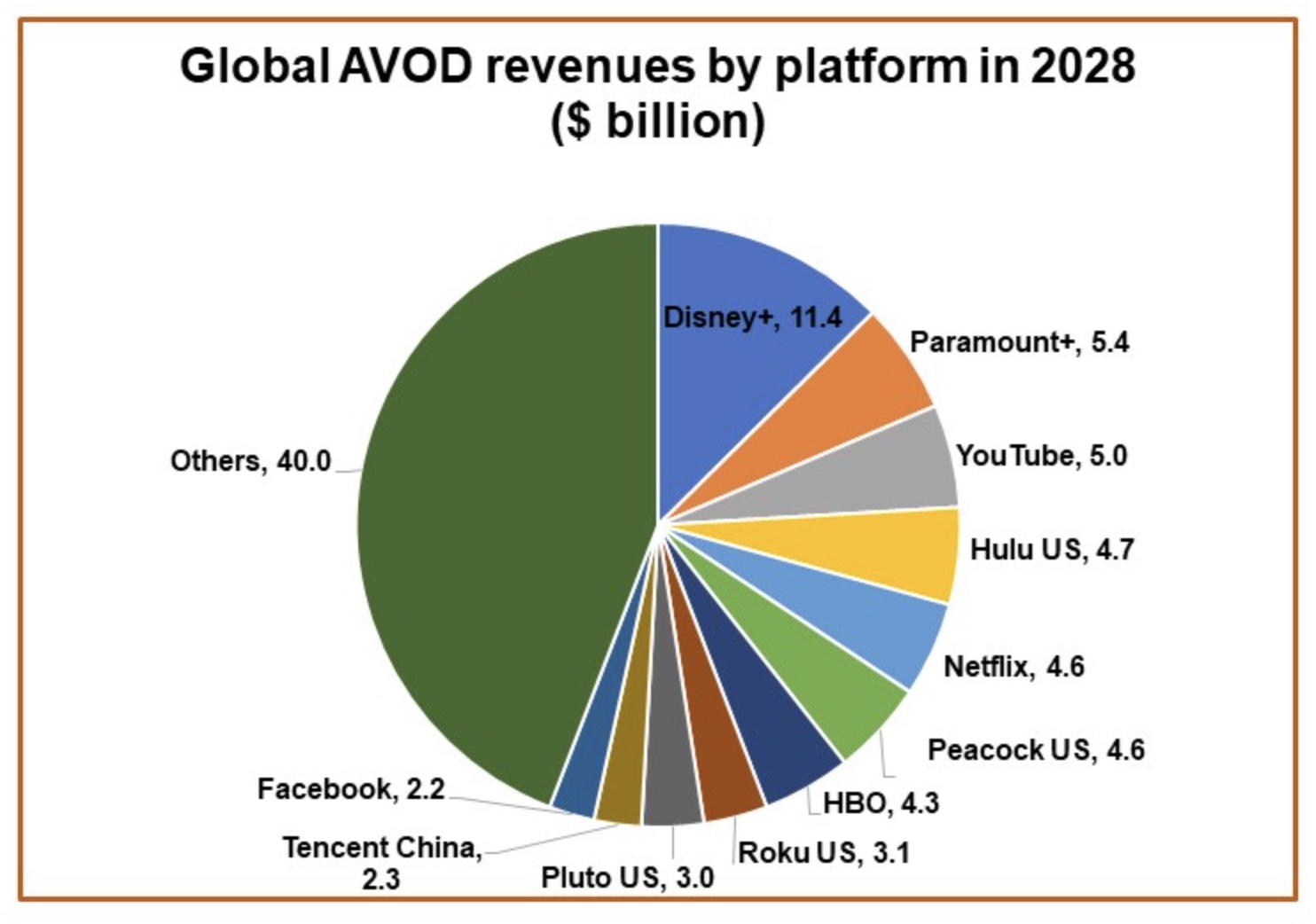

Globally, it is predicted AVOD revenues will grow by $50 billion to $91 billion in 2028, per a report by Digital TV Research (see chart below). Viewers are certainly switching over to AVOD services. In the US – widely considered the most mature AVOD market – households streaming AVODs grew by 29 per cent, more than SVODs (up 21 per cent), according to Comscore research. The figures indicate viewers are open to cheaper ad-funded options, especially in the current economic crunch.

More streamers coming?

Local buyers who spoke to Mi3 are not aware of other global streamers looking to imminently enter the market and Group M’s Hey is not convinced all of the studios will head Down Under.

“If you look at overseas streamers, they are already playing a lot of their content through the two players here, Stan and Binge, and also to the networks,” she said. “HBO talked about finding the right balance and whether it was worthwhile launching here with the cost of the setup versus selling the content to established players here.

“You would think most of them would be putting [a market the size of Australia] at the lower end [of their priority list] if they haven’t already come.”

Frain isn’t concerned about more streamers arriving and a further fragmentation of audiences.

“These businesses have proven globally that a balance of subscription revenue and advertising revenue can work together. So I think there's an ongoing opportunity in that area, because it's such a rich audience that comes with rich data,” he said. “I only see more growth.”

The upshot for legacy TV broadcasters is revenue will continue to migrate, albeit slowly from linear TV to BVODs and AVODs.

Kroon said: “We are predicting a 10 per cent full year decline in linear TV ad spend, and BVOD and SVODs could scoop up the lost money with a bit of YouTube at the end,” he said, reiterating his early year prediction that around $300 million worth of advertising will shift from linear TV to various digital video channels. Though he qualified that statement in April by underlining that BVOD "will do very well" in recouping the lion's share of that leakage.

A single currency “unlikely”

One area that streamers will need to grapple with is measurement. In the US, AVODs mark the success of ad campaigns using their own “currencies”. Finding a consistent approach could be “some time away”, argued Frain, especially because global streamers won’t apply software development kits (SDK) in their code to calculate video player measurement (VPM). SDKs are what OzTAM uses for its VPMs.

Foxtel Media, as previously flagged by Frain, is also veering towards digital measurement by converting TV viewing data from its million set top boxes into digital impressions. This approach mirrors the one Sky has taken in the UK and enables agencies to take a similar trading approach to digital video and terrestrial TV.

But a fragmented approach to measuring AVOD ratings seems inevitable for now, even if it’s not what the market is looking for.

OMD’s chief investment officer Marelle Salib has urged the industry to unite BVOD and SVOD measurement to provide a single currency that can accelerate the take up of streamer advertising, but that, for now, seems a more distant prospect.

GroupM’s Hey says a more realistic first step would be for third-party verification of audiences that allow vendors to audit walled garden figures from global streamers.

Finding a unified approach in the fractured and fiercely competitive TV and digital video industry has long proven tricky with different agendas often paying lip service to areas such as measurement – though new measurement providers, the likes of Samba, Adgile and Beatgrid, are all stepping into the fray.

That challenge compounds as the new kids on the block fight harder for a chunk of the TV and video advertising pie. After wildly contrasting launches to bring their AVODs to market, Netflix and Binge are starting to gain traction.

TV networks have already started planning for their upfronts presentations later this year where a strong counter to the new SVOD ad challengers, potentially via a mooted combined BVOD reach play, will be high on the agenda.