Warning signal: Fosters, Milo, IGA, QBE, RACV, Commbank watch brand strength slide; ‘cost of business to rise for Qantas’ amid brand fallout – biggest declines ranked

Brand Finance MD Mark Crowe: Qantas turbulence will hike cost to do business, diminish market influence; warning lights flashing for others.

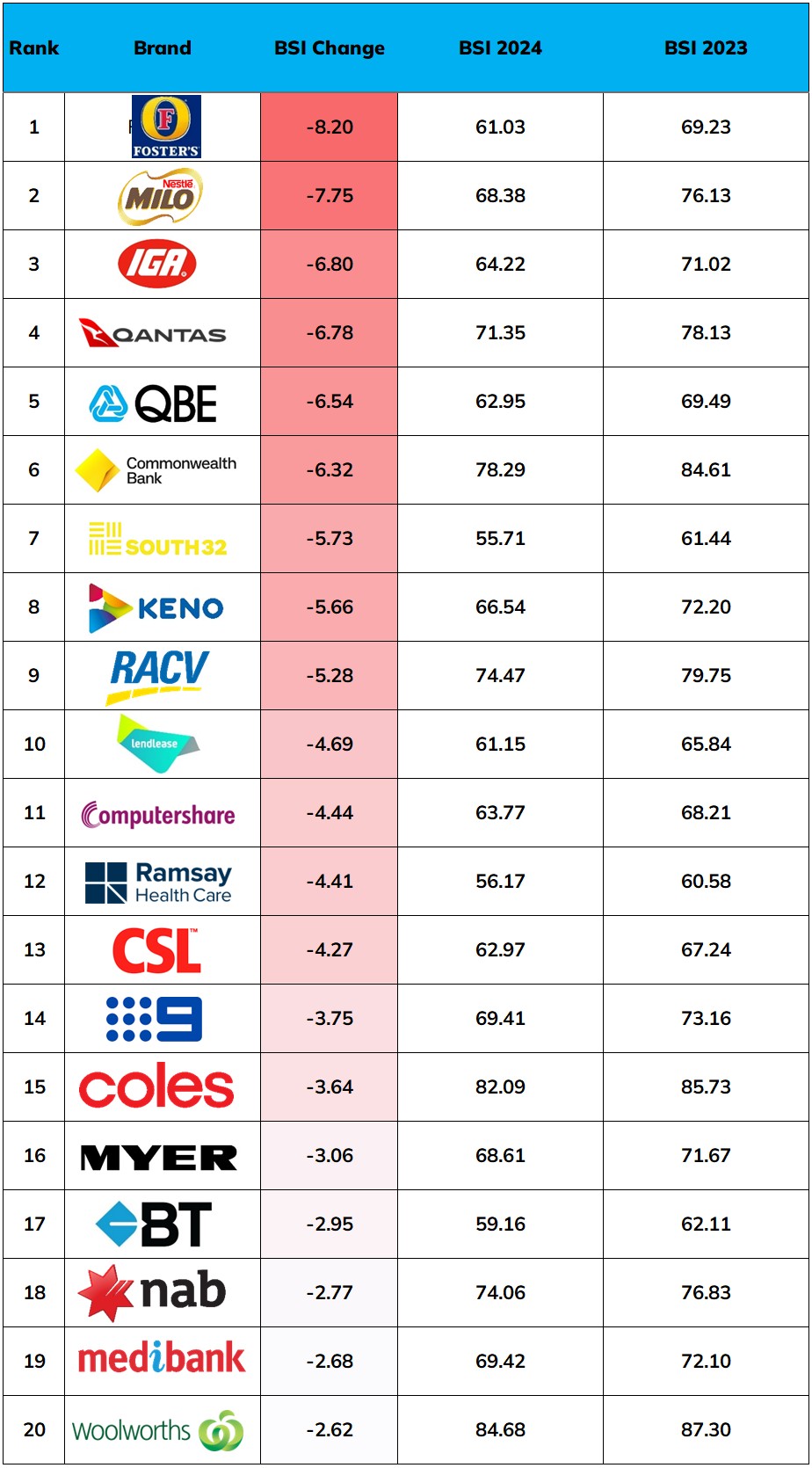

Fosters, Milo, IGA, QBE, RACV and Commbank face potential financial impacts due to falls in key brand health metrics including customer service, familiarity, recommendation, consideration, reputation and trust. These are some of the developments challenging blue chip brand managers over the past year, according to analysis for Mi3 from the 2024 Brand Finance Australia 100, which values and ranks the top 100 Australian brands on value and their reputational strength. Qantas faces further “significant” turbulence due to ongoing brand strength declines, according to Brand Finance MD Mark Crowe. He thinks the airline now faces increasing business costs as a result of sustained brand damage. Whether it can ever fully recover its brand peak is “probably in doubt”, per Crowe, though a category tailwind could deliver a bounce. Other airlines locally and globally are powering in the equity markets and that could help Qantas if it can stem bad news. Brand Finance's methodology posits any declines in its brand strength index scores are a proxy for future brand value, and the ability of strong brands to both insulate from market challenges and create financial network effects. This year, 20 firms scoring the biggest brand strength declines in the firm's Brand Strength Index (BSI) are early signals for more attention on brand management for company leadership and boards, Crowe says. Nine, Coles, NAB, Myer and Woolworths, per Brand Finance’s calculations, may also have cause for concern. On the flip side, Westpac and ANZ’s brand strength gains are outperforming the banking category, IAG and Suncorp scored huge insurance brand value gains, while in retail JB Hi-Fi and Carsales are pumping.

What you need to know:

- Declines in brand strength should sound a warning for some of Australia’s biggest FMCGs, banks, insurers and retailers – because brand strength acts as a proxy for where brand valuations are headed, with lower values hitting pricing power, influence, customer acquisition and loyalty, recognition, consideration and recommendation, ultimately impacting revenue.

- Fosters, Milo, IGA, QBE, RACV and Commbank were among those ranked by Brand Finance as notching the biggest brand strength declines over the last 12 months.

- Qantas slid further. Brand Finance MD Mark Crowe warned last year that decline across key brand and customer metrics risked a inviting a financial hit. This year the warnings are louder.

- Crowe said Qantas’ cost of business will increase while its ability to influence employees, regulators and government will wane. But he thinks it can turn the corner next year – provided there’s no more bad news and the carrier invests strongly.

- But there are some big winners in the latest rankings. Insurance is the standout sector, with IAG and Suncorp both massively increasing their brand value – and getting pricing power gains and customer resilience as a result, despite higher premiums, according to Crowe.

- Across the big banks Commbank and NAB saw brand values decline with ANZ, Westpac and Macquarie on the up.

- In retail JB Hi-Fi and Carsales made strong double-digit brand value gains. Liquorland and IGA went backwards hard.

- Across the piste, the market – investors – are increasingly nervous about reputational risk heading into 2024, which Crowe aligns directly to brand investment and strength.

[Suncorp and IAG] have an ability to still able to maintain a price or volume premium, even when there's pressure in the marketplace. Premiums have increased. But those brands are certainly demonstrating an ability where they are able to still attract favourable perceptions from their customers – and they're still able to command that price premium, which is very much brand driven.

Falls in brand strength should cause concern for brands including Fosters, Milo, IGA, QBE, RACV and Commbank, according to latest Brand Finance analysis.

Brand strength scores indicate where brand valuations are headed, according to Brand Finance MD Mark Crowe, with declines therefore signalling weaker future growth prospects. Which means even modest falls at the likes of Nine, Coles, NAB, Myer and even Woolworths could create potential knock-on effects across pricing power, customer acquisition, loyalty, recognition, consideration and recommendation.

Brand value vs. brand strength

Brand Finance analyses brand and financial metrics to rank brands. Crowe drilled down on its 2024 data set for Mi3 to show the 20 biggest losers both across brand value and brand strength, the core metrics calculated to create its indexes. Both tables are set out below.

Brand value ('BV' in the first table below) is a calculation of the economic benefits a brand brings to a business.

Brand strength ('BSI' in the second table below) is a measure of three areas: The quality of investment in the brand, the equity the brand holds, and financial performance.

Category splits: Banking flux

There was movement in the finance sector, Commbank and NAB declined in brand value, while ANZ, Westpac and Macquarie made double digit gains.

Factors cited for Commbank’s declining brand strength score versus 2023 included recommendation, customer service and reputation. For NAB recommendation and reputation were also cited along with a “considerable drop” in loyalty, though this was offset by “strong” familiarity and consideration scores.

Insurance powering

Insurance – powering with four of the top six biggest climbers by brand value – is the “most interesting category result,” said Crowe.

Of the major players, NRMA led the line with a brand value almost doubling (91 per cent) to just shy of $2bn. Suncorp climbed 53 per cent to $2.8bn. Overall, the insurance category’s brand value this year increased by 40 per cent in aggregate, driven by NRMA, Suncorp, RACV and IAG-owned CGU (which more than doubled brand value to $737m, the biggest climber across all categories).

Suncorp and IAG’s brand value gains “are very much driven” by their growth in brand strength, said Crowe, leading directly to revenue and margin resilience.

“It means those businesses have an ability to still able to maintain a price or volume premium, even when there's pressure in the marketplace. Obviously, insurance premiums have increased. But those brands are certainly demonstrating an ability where they are able to still attract favourable perceptions from their customers – and they're still able to command that price premium, which is very much brand driven.”

While IAG continues to benefit from a long-standing commitment to brand-building (NRMA won the 2021 Grand Effie partly on the back of citing a $300m brand value increase that was four years in the making), Crowe suggested Suncorp, which in 2023’s ranking scored a 5 per cent brand value decline, is now notching the benefits of sustained brand building, winning big at Cannes in 2022 before scooping gold and silver Effies. “You are seeing that marketing investment and effectiveness come through in this year’s results. Both the Suncorp and AAMI brands have had significant growth.”

Retail pressure

Pressure on consumer spending dragged down valuations across large pockets retail. Of 18 retail brands in the top 100, eight gained in value, with Carsales (+56 per cent) and JB Hi-Fi (+23 per cent) posting biggest percentage gains. Ten retailers saw their brand values slide, with Liquorland (-36 per cent) and IGA (-21 per cent) the biggest losers. Retail’s top end, Coles (-10 per cent) and Woolworths (-5 per cent), was not immune.

Yet overall, 2024 index shows the top 100 brands have made significant gains over the medium term. In 2022, they had a collective brand value of $161bn. In 2024, that stands at $199bn, an increase of 23 per cent.

Qantas turbulence

There are some notable brand equity losers. Bega, ranked 6th strongest brand in 2022 saw its brand value collapse 72 per cent from $1.65bn in 2023 to $460m.

Meanwhile, Qantas was ranked 1st in 2019 and 7th strongest brand in 2022. While in 2024 it climbed one ranking place in terms of brand value to 17th, Brand Finance calculates its brand value actually declined 7.4 per cent, or by $224m. Its brand strength fell similarly, taking it from 17th in 2023 to 41st place. Crowe last year predicted an incoming financial hit for the carrier based on its falling brand strength score – and suggests further business impacts given an 11 per cent brand strength fall over two years.

“That’s very significant … certainly when you're looking at the attributes where they've been impacted, it's all very much around reputation, value for money, trust, consideration.”

You will see that a weakening start to impact Qantas, not only on a revenue front, but also on a cost front – because the cost for Qantas in doing business will increase. They're going to have to invest a lot more in brand, in customer service and customer experience. But also Qantas’ brand was incredibly influential in terms of the attractiveness to employees, the assurance the brand bought to suppliers, to regulators, to government.

Cost impacts

Crowe said Qantas' brand woes are more apparent when compared to the broader category.

“The airline industry globally is up significantly – United, Emirates, American Airlines and Delta are seeing brand value increases of 15-30 per cent," he said, with Jetstar also gaining ground. "So Qantas is going against the trend. The sector is benefitting from people returning to travel, but Qantas hasn’t enjoyed that, driven primarily by the decline of brand strength,” said Crowe.

“You will see that a weakening start to impact Qantas, not only on a revenue front, but also on a cost front – because the cost for Qantas in doing business will increase,” he added.

“They're going to have to invest a lot more in brand, in customer service and customer experience. But also Qantas’ brand was incredibly influential in terms of the attractiveness to employees, the assurance the brand bought to suppliers, to regulators, to government and indeed the media. So the cost of doing business for Qantas will go up,” said Crowe.

“Similarly the [diminished] ability of Qantas to influence the number of airlines that are allowed to have additional routes coming in and out of Australia will add to cost,” he added.

“So you've got to look at brand in terms of not only its ability to contribute to increase revenues, but its ability to also reduce cost to the business as well through that influence, through the trust and the reputation that a brand engenders where people are prepared to pay more because of the trust they have in that brand.”

Worst over?

Yet Crowe thinks Qantas has the levers to reverse its slide amid a category tailwind.

“The outlook for the airline category is still quite positive. But the challenge for Qantas is improving its brand over time – and the big question mark is to what extent Qantas can return and start again to enjoy the imagery associated with the spirit of Australia. Can it can still leverage its very positive heritage? That's going to be an enormous challenge, and is probably in doubt.”

But he thinks some of its problems are beginning to ease.

‘From a consumer perspective, some of the issues for Qantas are related to airport experience – arrivals, long queues – which airlines can’t be fully responsible for. They are likely to come off and Qantas is fundamentally a strong business. Its outlook is still positive and it will invest not only in brand awareness, but more so in terms of brand activation, encouraging sales,” said Crowe. “So in that type of environment – and assuming there are no more negative stories over the next 12 months – I'd expect to see Qantas’ brand strength improved by 3, 4, 5 points.”

With the investment community, the discussion is often less about brand and more about reputation. But ultimately, it's the same thing ... and during a period like this, when there is a drop in consumer sentiment, reputational risk comes to the fore.

Outlook: reputational risk and reward

For brands the year ahead is “not an easy read,” Crowe admitted. “It’s spotty, depending on category. It’s fair to say the Australian economy is resilient, but there is certainly a lot of pressure on consumer spend.”

Irrespective of category, that pressure “brings effective management to the fore and good marketers will relish these conditions”, he suggested. “It’s when you can put your brand to work, demonstrate how effective it is and how much it can help fortify your business. You can often see that even where a brand value declines, it doesn't decline as much as the enterprise value.”

Does the argument of maintaining marketing budgets to gain excess share and brand strength wash with companies with quarterly targets, twitchy shareholders and severe cost pressure?

“There is more maturity these days in terms of that approach to investment. Previously the first thing to suffer under any cost cutting would be marketing. But there’s a bit more rational approach to that now and a better understanding as to how much you can put a brand to work,” said Crowe. “Strong brands thrive during periods of volatility, because they're providing assurance. They're providing strong perceptions around loyalty and also quality: Consumers are paying more for their products at the moment and in their minds aren't necessarily seeing any improvement in quality.”

Does that argument hold water with investors?

“With the investment community, the discussion is often less about brand and more about reputation. But ultimately, it's the same thing,” said Crowe.

Markets tend to take a medium term view, Crowe suggested, which means investors “are not going to jump at shadows” when brands face isolated short-term issues.

“But, where you're seeing long-term decline in terms of reputation, that's where the market is now very sensitive. Because the market certainly understands that it takes a hell of a lot longer to recover … and during a period like this, when there is a drop in consumer sentiment, reputational risk comes to the fore.”