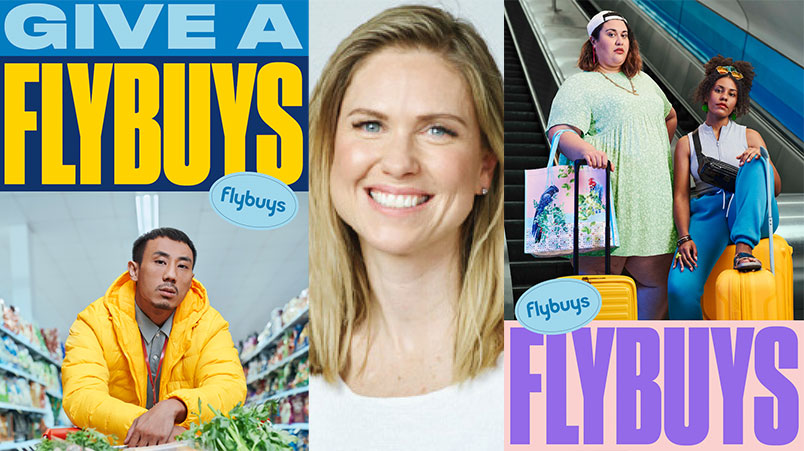

We're seen as boring, transactional: Flybuys customer chief switches owned channels for brand building in bid to soar once more

Flybuys Chief Customer Officer Rosemary Martin says an 18-month customer research study found it is perceived as boring and transactional. Not great news, given Covid has crimped acquisition and redemption for the Coles-Wesfarmers JV and coming off the back of a sector-wide ACCC investigation. Now it's going large on brand in a bid to shake off a dowdy image and attract a younger customer set.

What you need to know:

- Flybuys investing big in audience segmentation, brand building and awareness after focus groups revealed the brand was seen as "boring and transactional".

- New campaign and positioning attempts to reverse that perception.

- Flybuys will also spend more money on media than traditional owned channel approach in a bid to acquire new customers.

- Chief Customer Officer says OOH one such channel.

- Also looking beyond ecommerce and to do better personalisation.

Points to prove

Flybuys, Coles and Wesfarmers loyalty joint venture, is investing big in audience segmentation, awareness and younger demographics. It had to, after an 18-month study suggested it has become staid.

Chief Customer Officer Rosemary Martin told Mi3 Flybuys’ challenge is "not trust but relevance" after some 20 focus groups revealed the brand was seen as "boring and transactional". Hardly ideal, she says.

"Our regular consumer pulse checks continue to show great brand awareness, satisfaction and net promoter scores but what we could see in our own data was a ceiling to engagement with Flybuys. It's not about awareness of what Flybuys is but how to utilise it," she said.

"So we saw an opportunity to grow our highly active user base and generate further interest in actually redeeming points and shopping across more partners in our coalition."

Martin thinks there was previously a stigma around discount shopping and using programs to save, with the stereotype of being a "tight ass" often going hand-in-hand with how loyalty brands were perceived. But she thinks Covid has changed people’s outlook.

"Looking at the last 18-months of spending through our program we saw a clear increase in the amount of people shopping more price consciously," Martin says.

"There was also an attitudinal shift – people no longer saw bargain hunting as a “tight ass” behaviour and instead were proud of finding financial hacks or discounts. So we had to create something that highlighted that change."

The result is ‘I Give a Flybuys’, which is also shortened to I GAF.

The campaign, intended to become a long-term proposition for the brand, utilises the recent research to find clear customer segments and characterise them for an over two-minute ‘hero’ ad.

These segments include the everyday saver, a fuel price-savvy tradie, the Mosman 'Yummy Mummy', travel focused points spenders and a stay-at-home dad.

"We've now found some clear and distinct groups that use the program and delved deeper into the how and why they use the Flybuys program. However, there was a common thread of it still being a 'transactional' proposition, leaving the overall perception as a bit boring," acknowledged Martin.

"So we went big with the creative and now have an established platform that will continue to roll out over the coming months, with further activity planned throughout the year to ensure it's recalled as a long-term brand position."

We’ve seen the customer journey evolve past ecommerce - and as a brand that factors into multiple different purchase paths with various retail verticals. We need to be looking at broadening where we appear.

Changing channels

The campaign deviates from FlyBuys' usual marketing strategy, spending money instead of going for owned channels.

"Given this campaign has been more about shifting perception and repositioning the brand we knew an investment in above-the-line channels was going to be key," Martin says.

Martin said the new platform is designed to address two factors in member behaviour: increasing engagement of existing members and broadening the programme’s appeal to new customers (hence going larger on paid channels).

There is a particular focus on the18-29-year-old age bracket.

"We don’t under-index in that space but we have some ongoing acquisition targets and we’re looking for a 20% uplift in younger cohorts," said Martin.

"To address this we've gone for a 60:40 split, digital versus traditional media. We've still spent a lot more than we normally would on those traditional channels but are also conscious we need to invest digitally with more targeted messaging as part of the acquisition side of the campaign."

Programmatic will continue to play a big part in the FlyBuys marketing plan going forward, as it brings in more of the brands rich transactional data, she added.

Ecommerce, OOH

While ecommerce has boomed post-Covid, Martin thinks brands have to look further ahead.

"We’ve seen the customer journey evolve past ecommerce already and as a brand that factors into multiple different purchase paths with various retail verticals. We need to be looking at broadening where we appear on that journey," she said.

"So we have increased the level of investment in channels such as out of home, going beyond just appearing in a shopping centre but also in key city and suburban locations, still close to shopping districts but certainly more prevalent [elsewhere]."

The firm is also working closely to ensure its partners are fully aligned, given widespread business model shifts post-pandemic.

"Many businesses have transformed their digital capabilities, going online or developing new platforms, so it also became vital to ensure our product and service could smoothly integrate with their changes," Martin says.

"Fortunately FlyBuys has been a digitally-led business for many years now, so we had little changes to make internally, which I think made it a lot smoother for us when working with external partners."

Turbulent times

The clue’s in the name, but it’s safe to say the last 12 months haven’t been the best for FlyBuys, given travel is its main redemption point. Meanwhile, its temporary card, placed in Coles supermarket checkouts to attract in new members which are then converted to full card holders, was a no-no for people in a contactless Covid world. People just doing less in-store shopping also hit acquisition.

In response, Flybuys has launched a digital temporary card solution, with people able to scan a QR code, bringing up a digital card on their device.

"We did see a drop-off in acquisition as a result of those initial concerns around physical shopping. The last thing people wanted to do was pick-up or use anything in-store that was directly related to their purchase," said Martin.

"It was slow to begin with but is starting to normalise, particularly as shoppers are now becoming more comfortable with being in-store for longer periods of time, as opposed to the 'in and out' mentality we saw at the beginning of the pandemic."

Meanwhile, Covid's impacts on the travel industry require closer relationships with key redemption partners.

"It's a massive part of how our customers spend points, and always has been. So as we saw the fallout, we took the time to invest into enhancing the travel category for customers for when it returned.

"We have since increased our partnership Virgin’s Velocity program, improving the points conversion rate between the two brands. We also offer the ability to automatically transfer points into the Velocity program for those who remain avid travellers as well."

Customers expect us to use their data to give them a better experience. If we aren’t doing that, it almost causes more friction, as they question the reasons for collecting it in the first place.

After the ACCC

FlyBuys has also spent the last year managing the fallout of the ACCC's inquiry into loyalty programs.

The investigation sought to address consumer concerns around privacy, data and payment terms.

In its final report, the ACCC outlined the following recommendations for the loyalty program industry:

- Improve how loyalty schemes communicate with customers

- Prohibition against unfair contract terms and certain unfair trading practices

- End the practice of automatically linking members’ payment cards to their loyalty scheme profile

- Improve the data practices of loyalty schemes

According to Martin, the majority of the ACCC’s findingswere already being addressed by the brand.

"The report didn’t highlight any glaring needs to change our practices," she suggested.

That said, after speaking with customers, “it became clear that one of the concerns was how member data was being treated and used".

The brand witnessed greater expectation from customers around transparency following the final report, she said, yet most of it related to how access to customer data was communicated to members, who found the jargon hard to comprehend.

"Customers think we are doing more with their data than what we actually are and a lot of that is tied to not understanding the terms of use," said Martin.

"They expect us to use the data for a more personalised and better experience for them – so if we aren’t doing that, it almost causes more friction as they question the reasons for collecting it in the first place.”