Selling data, in a fluctuating world of data privacy and consent

Like oil markets, data prices are governed by supply and demand economics. The incoming changes from big platforms will soon start to be felt. This presents both opportunity and a threat to businesses that have previously untapped data.

At the end of the last decade, The Economist declared that oil was no longer the world’s most valuable resource and that "data is the new oil".

Today, Amazon, Apple, Facebook, Netflix, Google, et al have valuations and revenues that dwarf the GDP of many countries.

The value of data

Studies have shown that an estimated A$300 per year is what the average person is worth if you look at each person's data as a commodity.

That will give you some insight into why, in this new world of privacy legislation the big platforms are so focused on retaining and protecting as much data about their millions of users is as 'legal as possible' while trying to avoid fines and antitrust suits.

Supply and Demand

Like OPEC prices, when there is a shortage of oil, prices go up globally. The same is true of data. With access to data dramatically disappearing via the demise of third party tracking, Apple's ATT etc., the urgency to locate pertinent data and insights is only compounding demand which, in turn, is increasing the value of data across all types and sizes.

The probability, therefore, that companies will take previously untapped data that they own to market grows with it. Regardless of what type of data they have access to. One man's trash...

Technical and legal barriers to selling data

Data monetisation seems like a breeze at first.

Businesses will think about gathering data across their business, finding someone who wants to purchase that data, and simply pushing that data across to the client at any time it is required.

This is a convoluted, intricate and lengthy process, however.

To create an asset-class of the data owned by your business, there are core principles that you need to follow, to ensure a profitable and risk-free outcome. The long-term end-reward is worth the effort and planning that you put in.

Create a data catalogue, researched and managed by a core team

If you cannot locate nor understand a) which datasets you have across your business nor b) the potential buyers for each data set, you will not be able to move forward.

To catalogue the data owned by your business, you need to also:

- Audit the different systems in which your data is currently housed

- Understand the extraction methods of those existing systems

- Ensure you have ticked all of the regulatory boxes around how this data can be used within/without your business.

- Hypothesize on the monetary value that can be derived from each data set and why.

- Determine how customers/clients of your data will use it. EG, feed machine learning models vs measurement vs targeted marketing.

Keep in mind, that there are longer-term/slow burn opportunities ahead when you are creating these catalogues and this is no longer something that only your sys-ops team should be in charge of.

Systems Operations and IT leads used to be the people to liaise and explain to the sales leaders, compliance teams, engineering, measurement folks, etc., in differing ways. That took time and was often not as clear as the C-Level would like.

And for most businesses, Information Operations are still in charge regardless of how things have changed.

They are a valuable part of your team, but would admit that they are neither trained nor hired to interrogate and undermine any benefits that they may find within the various catalogues of data within the systems that they manage.

They are certainly not the people who can forecast forward and strategically identify multi-million dollar product opportunities and how to plan and build around that.

The reality is that within the 12 months, you would get many insights into what to do better next year but no actual revenue from your data.

If you were to form working groups from a cross-section of your organisation which utilise data, including product managers, marketing leaders, compliance teams, and data scientists; you can run workshops to imagine the potential revenue, but also potential savings from managing your data more effectively. For example, the general estimated cost when a large business leaks data/has a breach is A$1.8m. That's a large enough incentive to find some operations budget to start to take stock and catalogue your data across all systems.

Where to sell your data?

There are two core routes that you can take to monetising your data – data brokerages, and data marketplaces.

Data brokerages are the firms that you would recognise, such as Equifax, Experian, TransUnion, Acxiom LLC, CoreLogic , PeekYou and Datalogix. But, you can also find many more if you do an online search.

Data marketplaces (public and private). These are where your data is available for people who are searching for it. The data equivalent to a Catch.com.au - a place where people search and purchase datasets.

The better known of these are the Snowflake Data Exchange and the AWS Data Exchange. They have already have set up the piping and infrastructure for businesses to sell data to partners that have integrated with their platforms.

However, there are some crucial aspects to consider before you commit to this methodology:

- Do they have the ability to control which pricing is available for certain buyers?

- Is there a way to ensure only companies that you want to sell to, can view and access your data, or is it 'all or nothing?'

- What is the percentage of each sale transaction that you would get for the data?

The ACCC and others are watching. Be very conscious of this

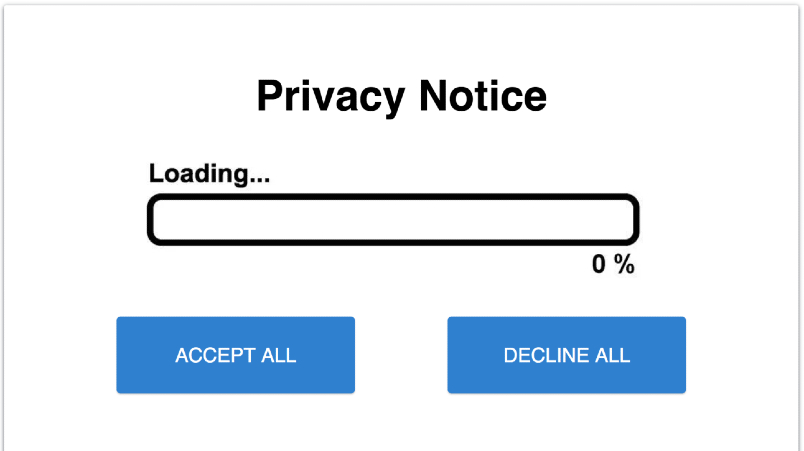

While preparing for making revenue from your data, it's clear that we are now in an economy where people have ever-growing (and much needed) layers of awareness and protections on how your business is collecting, storing, and using information about them.

If you are working with data internationally, you would be aware of the growing patchwork of regulations such as GDPR, CCPA etc across Europe and the USA. This is incremental to previously existing offline data resale and privacy regulations.

Locally, in Australia you can see a trail of articles and case-rulings over the past year, all marching towards Rod Simms and ACCC putting in place regulations that could closely mirror those of the GDPR, which you are most likely (hopefully) preparing for already.

So far as making money from data? This is very good news, because it will push businesses to become more focused on how they collect, store and use the data they have across their business.

By working with a "privacy by design" approach to collecting and organising data across systems, a business can also be very certain about the granular permissions and controls attached to the revenue-generating data that you have identified as being an asset class.