Off a cliff: Broadcast ratings - ABC, SBS, Foxtel included - dive 20% in two months as lockdowns end

The TV networks are talking a good game as their cash cow, linear television broadcasting, faced an exodus of viewers in the past eight weeks and a return to long-term declines as NSW and Victorian lockdowns eased.

There’s no denying that the 2021 TV ratings performance… has been less than impressive.

What you need to know:

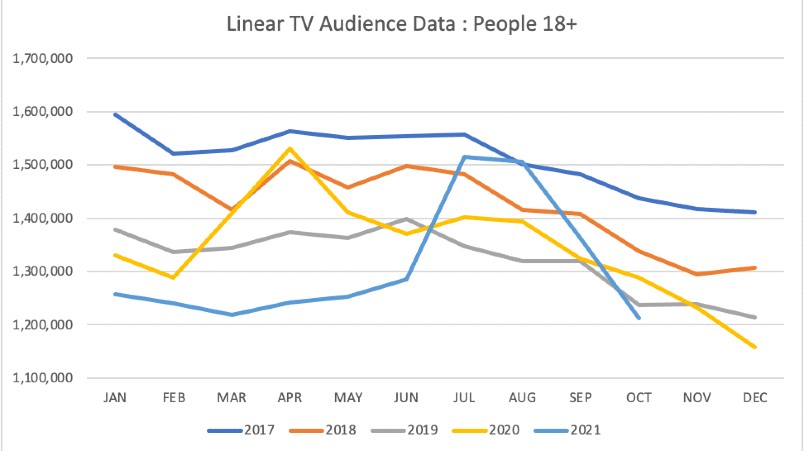

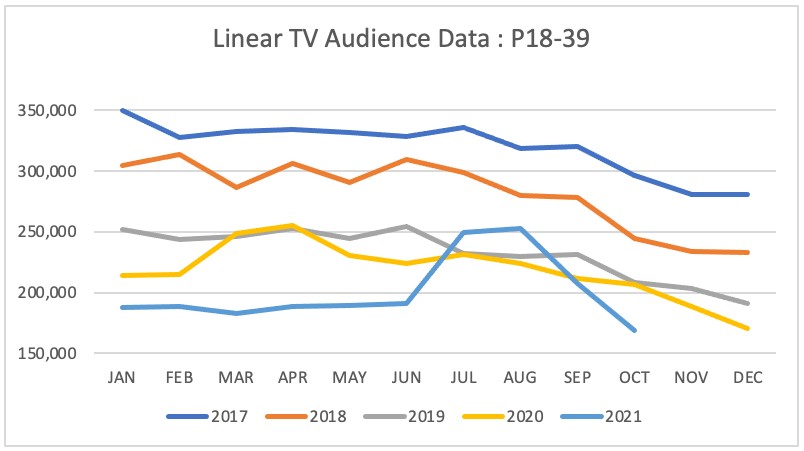

- Early in September, overnight linear TV ratings started tanking when lockdowns eased - under 40 viewer numbers, for instance, sunk to their lowest in four years.

- Since 2017 there’s been just four months when linear TV audiences have been higher than any preceding period.

- Seven’s Chief Revenue Officer Kurt Burnette says any analysis of linear TV viewing in isolation “is flawed”.

- Nine’s Chief Sales Officer, Michael Stephenson, said “total TV”, ie linear, live streaming and BVOD combined, “reaches the same number of people that linear TV in isolation did 10 years ago”. No data was provided to substantiate.

- ThinkTV CEO Kim Portrate said looking at linear ratings in isolation, without streaming and BVOD numbers, was like “considering Facebook on PC versus Facebook on a mobile phone. It’s all Facebook”.

- Carat’s Chief Investment Officer Craig Cooper said “extra bonus” and “make good activity” was accounting for TV audience falls.

- Linear TV audience graphs based on OzTAM data: January 2017 – October 2021, All Metro TV Including SBS, ABC and STV, all day parts

Lockdowns unleash linear TV

In July this year TV network execs were quietly skipping. TV audiences had surged back to levels not seen for three years as harsh lockdowns in NSW and Victoria returned.

The adrenalin lasted eight weeks for the broadcasters.

Early in September, overnight TV ratings started tanking when lockdowns eased - viewer numbers sunk to their lowest in four years for those aged under 40 and other key demographics weren't far behind.

Privately, some TV industry executives say the number one driver of TV audiences today is unemployment – more people not working equates to better ratings, particularly for daytime viewing.

With the jobs market now white hot, TV ratings are on ice, returning to their long term pattern of year-on-year declines.

Since 2017 there’s been just four months when TV audiences have been higher than any preceding period; two of them when the world went into lockdown in March and April 2020 and again in July and August this year when NSW and Victoria did the same. It coincided with the Tokyo Olympics going into full broadcast swing and TV viewing surging.

Television is much more than linear viewing... and any analysis of TV audiences that does not take that into account is flawed.

Not pretty

That was the good bit. The rest isn’t pretty.

Under 40s have declined 31.7 per cent in the past four years across all the networks - public and commercial. So far this year they’ve declined 11 per cent while the money demographic, 25-54 year-olds - sought after by advertisers, is back 10 per cent this year and 22 per cent since 2017.

“There’s no denying that the 2021 TV ratings performance, particularly in the second half, has been less than impressive,” said Carat Chief Investment Officer, Craig Cooper. “Linear TV ratings have been in decline for years. 2020 was a unique year given lockdowns… ratings from 3-4 years ago are unlikely to return to the linear platforms as consumer behaviour has shifted to a more on-demand style of video content consumption.”

Cooper said next year would see another five to 10 per cent fall in broadcast audiences if “a series of large events” are counted separately: The Winter Olympics in February, Commonwealth Games in July and the World Cup in November.

Foxtel Media boss Mark Frain said of the rating crash in October that “yes we are seeing it re-calibrate as expected” but argued the year-on-year decline in October “appears bigger” because the finals of the NRL and AFL finished later last year, in October, which inflated the 12 months old number versus 2021.

Nine’s Chief Sales Officer, Michael Stephenson, “doesn’t agree at all” that the end of lockdowns meant TV wasn’t able to deliver “mass audiences across every screen”, a message the TV sector was in solidarity on this week to Mi3.

Total TV today reaches the same number of people that linear TV in isolation did 10 years ago.

Linear ratings in isolation “flawed”

“Television has changed and no-one should be looking at linear TV or overnight ratings in isolation,” Stephenson said, arguing the future of TV was “total TV”, a combination of live linear, live streaming and on demand viewing across multiple screens and devices. “Total TV today reaches the same number of people that linear TV in isolation did 10 years ago,” he said, without providing numbers. Live streaming on 9Now is up 48 per cent year-on-year “and that growth isn’t going to stop.”

Seven’s Chief Revenue Officer Kurt Burnette echoed the message: “Television is much more than linear viewing... and any analysis of TV audiences that does not take that into account is flawed. The importance and relevance of total TV data explains why Seven has led and will continue to lead the push for the industry to move away overnight ratings and focus on the real TV viewing number.” Seven CEO James Warburton has been vocal on killing overnight ratings reporting, although that is technically unlikely – the network-owned ratings body, OzTAM, is contracted to its paying clients, mostly media agencies, to provide overnights.

ThinkTV CEO Kim Portrate also took the same line: “I would challenge why you would slice one type of view out from another when considering the total TV market,” she told Mi3. “It’s a bit like considering Facebook on PC versus Facebook on a mobile phone. It’s all Facebook. We would not artificially split out linear from BVOD (Broadcast Video On Demand) because we see it as total TV.”

Aside from the daily releases on linear ratings from each of the networks, linear TV, not streaming or BVOD, remains the source of most of the cash for networks. Ongoing erosion of linear audiences threatens TV’s golden goose.

It’s a bit like considering Facebook on PC versus Facebook on a mobile phone. It’s all Facebook.

TV’s dive offset with BVOD’s rise

Portrate and the TV networks didn’t dispute linear TV’s ratings crunch, or long-term declines. But they pointed to OzTAM numbers showing their digital streaming assets are close to making up for linear’s declines – particularly among younger demos.

“If you actually go to adults 18-plus, the numbers are almost lineball when you add back in BVOD,” Portrate said.

“You've made the point it’s different by demographics. The viewing behaviour is different. What we know is that the BVOD audience is a younger audience. Let's call it under 40. And so what they do is they add back into the total audience. So it’s largely line ball on an average week.”

Portrate verballed total viewing numbers as proof but would not send the figures, citing OzTAM ownership.

Those figures, obtained by Mi3 elsewhere, show BVOD is clawing back most, not all, of the declines in linear viewers. TV and BVOD viewing across five metro cities for 25-54 year-olds is down 3.4 per cent this year compared to last – linear on its own is off 9.6 per cent. Over the same period for 18-39 year-olds, linear viewing is down 10.8 per cent but the decline reduces to 2.4 per cent when BVOD viewing is added.

“In any portfolio management strategy where audiences are moving from one screen to another screen, what we're seeing is that it's not an exact switch, but it's getting close, particularly in younger audiences,” Portrate said.

Fluidity the future

Carat’s Cooper said the “fluidity between these linear and digital video platforms” was the future and “hopefully the broadcasters have invested enough in this area to help offset linear declines. But time will tell.”

PHD Australia’s National Head of Trading, Joanna Barnes, is buying the argument.

“In some instances, linear programming, live stream and catch up do deliver incremental audiences of 25% plus, depending on the genre,” she said. “Hence the importance of taking a holistic view of where the audiences are coming from and their viewing habits with the data we have available. A video strategy that encompasses linear and BVOD in the right environments for brands is what ultimately matters.”

BVOD’s boost to overall audiences for shows like Seven’s SAS Australia is 38 per cent; Big Brother is 30 per cent and The Voice was 24 per cent. Foxtel’s streaming increases, said Frain, were up circa 20 per cent for the 18-39 and 25-54 year-old demos.

Overall, commercial TV BVOD viewing so far this year is up 38 per cent.”

Makegoods and bonuses

In the meantime, networks will be carefully reviewing their linear audience guarantees to advertisers – the TV ad market is firing but lower audiences spell trouble for monetising them.

“At the end of the day, if we underdeliver on linear agreed performance metrics then we must work with the broadcaster to ensure that the gap is made good,” said Carat’s Cooper.

“So whilst from a linear TV point of view, ratings are trending down, we ensure that all approved KPI’s are eventually delivered."