PwC forecast smashed: Digital advertising hit $13bn, surpassing predictions for 2025

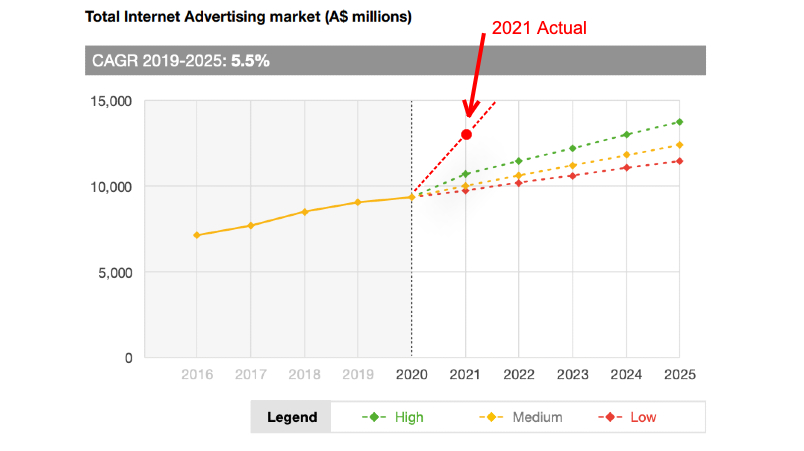

The predictions made by PwC in August last year versus the actual figures - also prepared by PwC - for 2021.

Digital advertising was worth less than $10 billion in 2020 – now it’s about $13bn, according to IAB Australia. The more than 30 per cent growth blows some estimates, including the PricewaterhouseCoopers (PwC) 2021 – 2025 Outlook, out of the water. Just last year, PwC predicted the internet advertising industry would reach $12.4bn in 2025.

What you need to know:

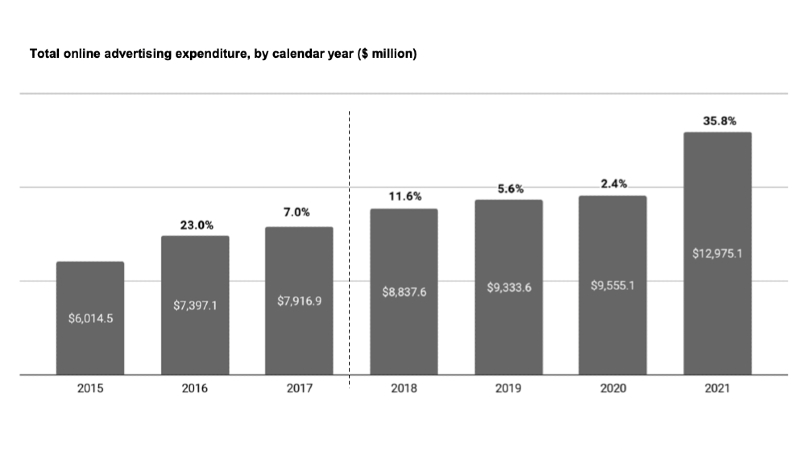

- IAB Australia says the digital advertising market reached about $13 billion in 2021, up 35.8 per cent compared to 2020.

- This is well ahead of PwC’s Entertainment & Media Outlook Report, which, in August last year, forecast that internet advertising would reach $12.4bn by 2025. It now appears it was already out of date for 2021. PwC also prepares the IAB Australia quarterly report.

- Standard Media Index says January spent was up 15.4 per cent on last year and 5.1 per cent on preCovid 2019 numbers.

Australia’s ad market has roared out of the gates in 2022, up more than five per cent on 2019 figures in January with new figures showing the digital ad industry has already eclipsed PwC’s outlook for 2025 – three years early.

Digital advertising hit $13 billion in 2021, the IAB’s latest expenditure report shows, growing 35.8 per cent compared to 2020. IAB Australia’s breakdown was:

- General display was up 38.2 per cent, to $5.1bn.

- Search and directories were $5.7bn, up 31.7 per cent.

- Classifieds was $2.2bn, up 41.5 per cent.

IAB Australia’s quarterly Online Advertising Expenditure Report is prepared by PwC. Interestingly, PwC also prepares its own annual ‘Entertainment & Media Outlook Report’. Last year it forecast for 2021-2025, predicting Internet Advertising would reach $12.4 billion in 2025.

“The internet advertising industry recorded growth of 3.3 per cent in 2020,” PwC wrote in their outlook, “reaching A$9.3 billion, with the industry expected to grow at 5.5 per cent over the forecast period to $12.4 billion by 2025.”

While there may be some differences between how PwC measures “Internet Advertising” in its own forecast and “online advertising” for the IAB, it now appears its predictions were already out of date for 2021 – let alone 2025.

Although some of the money over the past year may have come from redirected funds from Cinema and Out of Home, which experienced substantial audience falls with Covid restrictions, those account for only a fraction of the hundreds of millions of dollars that the market has grown by in 2021.

IAB Australia’s report says Retail, Finance, Entertainment, Health & Beauty, Travel, and Gambling were the categories that increased their share of spend the most in 2021. Automotive, FMCG, Technology and Media all decreased their share.

Meanwhile, Standard Media Index, which looks at aggregated agency billing figures, says combined ad spend in January was up 15.4 per cent compared to last year, hitting $556 million for the month.

“The value of Australia’s advertising market in January is not only well above pre-Covid levels but also 4.5 per cent above the last record level of January ad spend set in 2018, which underscores the strength of the ad demand we’re currently experiencing,’’ SMI AU/NZ Managing Director Jane Ractliffe said.

Digital media rose 18.7 per cent year-on-year, while TV was up 18.9 per cent – buoyed by the Australian Open. Out of Home rose 18.6 year on year after a tough couple of years.

The Government category was the largest in the market in January, increasing media investment 51 per cent year-on-year.