Toyota’s ‘humility’ challenge and big fix: An Australian brand makeover expands across 17 Asian markets to tackle next gen perceptions that rivals are snappier, louder, more innovative on mobility’s future

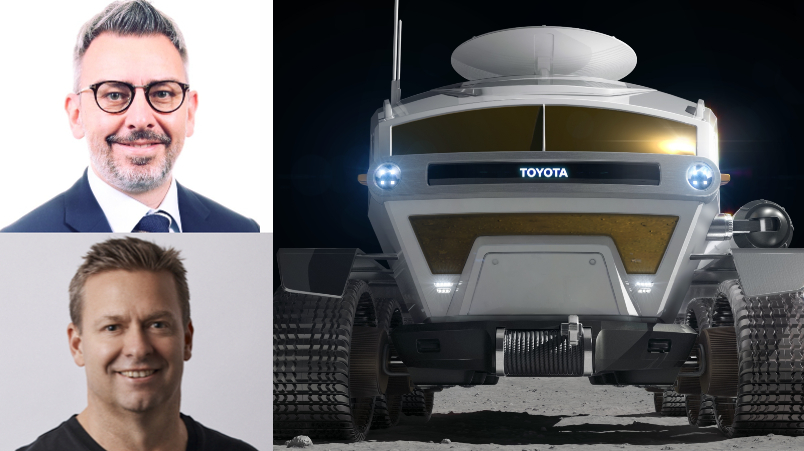

Toyota's Jérôme Louis (above left) and Houston Group's Stuart O'Brien (below left) with Toyota's Lunar Cruiser vehicle.

Australia is Toyota country and the brand holds similar clout and market dominance across 17 key markets in Asia. But there were looming clouds on the horizon that some Toyota APAC execs could see would become an imminent challenge for the region’s leading carmaker. Toyota’s “humility” around spruiking its innovation and future of mobility vision and tech, risked being too conservative and out-voiced by more aggressive, louder rivals attempting to own these new greenfield areas. Toyota knew its next generation of customers was being lured away. Here’s how Toyota’s APAC VP of Sales and Marketing, Jérôme Louis, and an Australian firm, Houston, mapped and delivered a four-year program to unify, for the first time, 17 highly-autonomous countries, all with their own market positionings, brand strategies, taglines and imagery. After four years in the making, a sweeping overhaul is now being operationalised. It’s an instructive case study in how Toyota's new line. “Move your world”, will shape everything across APAC.

What you need to know:

- Toyota is designing a hydrogen-fuelled moon car with the Japanese space agency JAXA but its younger, future customers think it lacks edge - and tech nous - versus newcomers like Tesla.

- A more assertive and streamlined Toyota is emerging in Australia after a multi-year staged overhaul of its market positioning, brand and imagery. Australia has kept it's decades-old 'Oh What a Feeling' tagline but 17 key Asia Pacific markets ares set to consolidate and unify more than a dozen taglines, advertising strategies and consumer product and brand positions. A fractured Toyota brand in Asia is about to look and feel more similar.

- Across the Asia-Pacific, Toyota's consumer research consistently indicates the company and brand is strong but lacking a modern, snappier and innovative edge.

- Jerome Louis, Toyota’s APAC VP of Sales and Marketing, says Toyota has been an engineering and product trailblazer but brasher, louder rivals are capturing the attention of future younger customers. Toyota has to become less conservative.

- The enterprise-wide overhaul to becoming a 'mobility solutions' company has significant short and long range market impacts - and growth upside. Toyota's engineering and innovation nous is well ahead of public perceptions. It has been working on a four year plan to change them.

- Unifying 17 key, fiercely local and independent markets has been central to a new, co-designed masterplan.

- Per Singapore-based Jerome Louis: “Once you start talking about transformation, electrification, new mobility, it's actually new territory for most of [the company]. And that's where you realise that the challenges and the processes they have to go through is very common.”

- Houston CEO Stuart O’Brien says getting agreement from 17 markets started without a fixed plan - but after the collective realised how similar the challenges were they each faced, a unified strategy became easier to develop.

- O'Brien says Toyota's shift from car manufacturer to mobility company “gives us permission to then offer different types of services, different types of products, different types of experiences to customers."

- Now to see if like Australia, the rewiring of Toyota across Asia works.

We didn't have to change ‘Oh, What a Feeling’. We changed everything around it and what it stood for and what it felt like.

Moving in Australia

Every year, Toyota sells about twice the number of cars as any other company in Australia.

With a roughly 20 per cent marketshare, one could add all of Mazda and Hyundai’s 2018 sales together – the market’s second and third biggest car manufacturers – and still have enough room for MINI, Porsche and Skoda before reaching Toyota’s 217,061 vehicle sales.

Yet, a few years ago, there were concerns about the marque in Australia. It didn't have the cred that came for those that grew up three decades ago with Celicas and Supras. Toyota here embarked on a sweeping overhaul of its customer and market strategy, and brand and imagery that it counts as an unfinished success story.

Now it's the turn of the broader Asia region where the company four years ago sensed, like Australia, something was brewing. Consumer perceptions and brand tracking in Asia Pacific signalled a strong, solid company with solid product, but one that lacked spark and excitement. The concern that Toyota was losing the younger set to more modern, snappier rivals positioning around electrification and mobility prompted an ambitious and long-range brand overhaul across 17 historically highly autonomous markets. Each had their own positioning, taglines, communications and product roadmaps.

Four years on, the early hope to re-energise and unify the Toyota brand across the region, transforming it into a ‘mobility company’, is about to land. A new strategy and product pipeline centred around "mobility", not just car ownership, is a central idea. With it comes a new unified tagline, an overhauled visual identity, pan-regional brand assets and a future-skewing tone of voice. The co-architects of the grand plan say a “more modern, more contemporary Toyota” will be evident - eventually.

But like the Australian overhaul, Toyota's natural restraint will remain. Rowdy claims around the new direction is not an agenda item.

“It's not a fireworks campaign," says Stuart O’Brien, CEO of Sydney-based brand and design firm Houston, which co-led the local remit and now the regional reshaping with Jerome Louis. "We've talked a lot about not bumping a big fireworks campaign; about having enough market proof points, having enough momentum, that people felt change – not just saw it in an ad," says O'Brien. "So that's why it may feel like it takes some time, but it's going to give us some longevity.”

That was the Australian lesson, says O'Brien and the expectation too for the regional redesign. “We didn't have to change ‘Oh, What a Feeling’. We changed everything around it and what it stood for and what it felt like,” he says.

Tagline change might be a different story in many Asian markets, however. The new unified line, Move Your World, aims to encapsulate everything Toyota is trying to do and deliver. While each of the 17 Asian countries will chose when and if they will embrace the mantra, Toyota's regional execs expect it will have strong take-up.

From car manufacturer to mobility company

The shift from car manufacturer to mobility company was a global mandate says Jerome Louis, Toyota’s Singapore-based Vice President overseeing the APAC region’s sales and marketing.

“We wanted to lead the future mobility society and enrich lives with the safest and most responsible way of moving people,” he says. “We could see that the competition was getting more intense with more competitors investing in Asia… [the change] was both about strengthening our brand to remain leader in the region and at the same time reaching our vision of mobility company.”

Mobility is a concept that Australian consumers have probably only considered in the past two years, O’Brien says. For him, the notion of mobility began as “getting in something and going somewhere”. But it has come to mean a lot more – like the movement of goods to people.

“[Australians], we see ourselves moving,” he says.

“Now, when we're getting a lot of home delivery, now we're seeing groceries, now we're seeing services that started with the food ordering services on the back of Covid – you've seen so many of those platforms. Across Asia, that mobility, to me, has been happening for a long time… when you're in Asia and working out of Asia, mobility, that is a bigger ideal.”

Once you start talking about transformation, electrification, new mobility, it's actually new territory for most of [the markets]. And that's where you realise that the challenges and the processes they have to go through is very common.

For a car company, mobility is a shift in how to understand a product’s use and a customer’s use of a product. “More and more consumers are looking maybe not so much to own a car, but maybe more to use and have multiple solutions and flexible solutions for different stages of their life,” Louis says. “The idea is that from just mostly manufacturing a car and selling a final product, we try to build total solutions that will be flexible to the different needs of different customers.”

There are initiatives around car sharing, public transport, commuting, as well as sharing the cost of moving from one point to another.

“Toyota was a manufacturing business and was very much a product-centric organisation,” O’Brien says.

“Because you work on a car a decade out, all the initial thinking, all the innovation, all the smarts, went into going and making a Yaris. It ended up being a Yaris targeting the X audience and doing this and the functionality or the benefit of the car to the segment,” he says. “So much of what Toyota had done … was very humble, very quiet. Now, a millennial, or this kind of new world, wants to discuss purpose, wants to talk about why we do things.”

The approach

Unlike many other companies, Toyota’s regions and markets have historically had a fair bit of freedom. There have been some core assets, but the brand has built relationships in each country in a way that would have made it difficult to re-engineer with a top-down approach.

“We have this word of 'best in town' internally, which means that it's about finding really the most appropriate solution for each local community,” Louis says. “We are a pretty decentralised organisation when it comes to building strategy.”

Relationships, expertise and insights are often more than 50 years’ old. No external agency could come in and dictate how things should be done.

“Typically when you would talk about markets and strategies, the first thing the markets would highlight is how different they are – which of course, they do have differences,” Louis says. “When you step back and you listen to the other markets and they share about their challenges, it's so interesting to see the reactions … to see how much in common these challenges were.” Louis says he hoped the process would result in a unified identity for the brand across the 17 Asia Pacific markets but wasn’t confident it would happen.

“It was incredibly important that we retained a neutral position in this,” O’Brien says of Houston’s involvement. “We weren't walking with a digital agenda, we weren't walking with a comms agenda, we weren't walking with a product agenda. We worked really hard for it to not be a marketing agenda.” No agencies in individual market could feel threatened, and neither could their marketing or sales teams. It came back to a Japanese term ‘gemba’, which loosely means ‘the actual place’. It means going to the place the information actually is. There was a lot of listening and understanding before any actions were taken, O’Brien says.

“We talked a lot about nothing changing in five years, everything changing in 20… And that may have still been 17 [separate] journeys. Our role wasn't to determine what path, but it was actually to help them articulate that – and moving ‘brand’ out of marketing was critical.”

The listening start meant there was a perception little or nothing was happening, Louis says.

“We really chose to spend a lot of time in the assessment, which also led to maybe the perception of a slow start. But I think this is really important because this is where you build your foundations,” he says.

“When you start seeing the faces of various market representatives so surprised to see the commonalities. That was really a point where we're like, 'okay, we have something, we have something to work on together'.”

"Even [the automotive industry's] key players – no matter how strong their legacy – need to think of ways to stay ahead," Houston Group says in its case study.

Pushback and consensus

Every country, state, company, department and team has their own self-preservation instincts – and it was the same within the regional teams of Toyota. “Even most West Australians I know think they're different to anyone. We've got the same kind of cultural divide East Coast, West Coast,” O’Brien says.

“They're often perceptions rather than the realities.”

A key driver of brand consolidation and progress was convincing everyone they were all on the same side but that uniqueness was good. And the internal and external industry data was crucial to that.

“We would have quite in-depth presentations where we'd show the voting, we would share a lot. We would put onto dashboards all markets, we would highlight similarities and we also made sure we identified the differences. So it wasn't like, ‘oh, you're all the same’. Honestly, it was a balancing act between not trying to lead them down a path, but letting the facts tell the story,” O’Brien says.

Per Louis: “Once you start talking about transformation, electrification, new mobility, it's actually new territory for most of them. And that's where you realise that the challenges and the processes they have to go through is very common.”

Implementation

The change to a more modern, more contemporary Toyota isn’t something that happens overnight. It will be rolled out market by market.

“We want to find the best timing for each market based on their activities, their milestones,” Louis says. “Some markets have started already from January, others will only start in 2023.”

And as alluded above, it’s more than just a marketing team’s domain. It was back in 2019 that Toyota’s President, Akio Toyoda, wrote about the shift to a mobility company.

“There's no big switch as well when you transform a brand,” O’Brien says.

“It's a series of 1,000 things and opportunities. So just picking up on what did we do: We worked in close with HR. We worked in closely with the dealers on transformation of service. We worked in closely with the design and development back in the factory. I'm most proud of a lot of the work that we've done that mightn't even hit the market for eight years, in a product form. There's probably 15 hours of educational video and induction videos. There's probably in excess of 300 pages of guidelines. It says 100 templates, lots of practical tools that the markets can pick up and use whether they put the tagline on or not.

“So I think this is a really important thing, not making this about the tagline.”

It will “feel like the brand’s transformed in front of your eyes over a period of 12, 18 months to three years”, O’Brien adds.

Move Your World was one of five or six taglines tested in Toyota’s markets, but this one stood out. It has an individual and collective meaning, which resonates with the company’s Asian customers. But there’s a consideration of values and society, too. “We think this tagline captures that pretty well,” Louis says.

The phrase was “the point of the needle on the point of the needle” that has been powerful once discovered. And now the seed of the new brand architecture has been planted across the region, he adds.

“There are already other projects that are starting in terms of campaign making and efficiency… it's like, it seeds in many other areas that you can already see bringing benefits,” he says.

“I think we can really say between this year and next year we will see definitely very visible expression of the new brand architecture and tone of voice in all the markets across the region.”

The end result

In a few years, Toyota wants to be able to offer more than vehicles. It is working on a Space vehicle with the Japanese space agency, JAXA.

“By the time we get [to the end], Toyota has permission to be that company and the brand has moved into that (mobility) space. And that gives us permission to then offer different types of services, different types of products, different types of experiences to customers. That's what the heart of this transformation is about,” O’Brien says. “While maintaining selling a million cars a year at the same time.”

Key Performance Indicators will be measured over time – how the brand is perceived internally and externally, as well as how energetic, contemporary it is.

The four-year process has done a lot for Toyota, but it’s also put the notion of ‘brand’ on more desks, so it now forms part of the strategy discussions.

And if 2021 in Australia is anything to go by, comparing to 2018, the company is starting the brand shift from a commanding position – there are a lot more players entering the market. If one company controlled all sales for Honda, Suzuki, Audi, Skoda, Volvo Car, Jeep, Renault, Land Rover, Porsche, Mini, SsangYong, Peugot, Chevrolet, Fiat, Jaguar, Genesis, Alfa Romeo, Maserati and Bentley – and added all of those to Toyota’s biggest rival, Mazda – it would not equal the 223,642 vehicles Toyota sold last year.