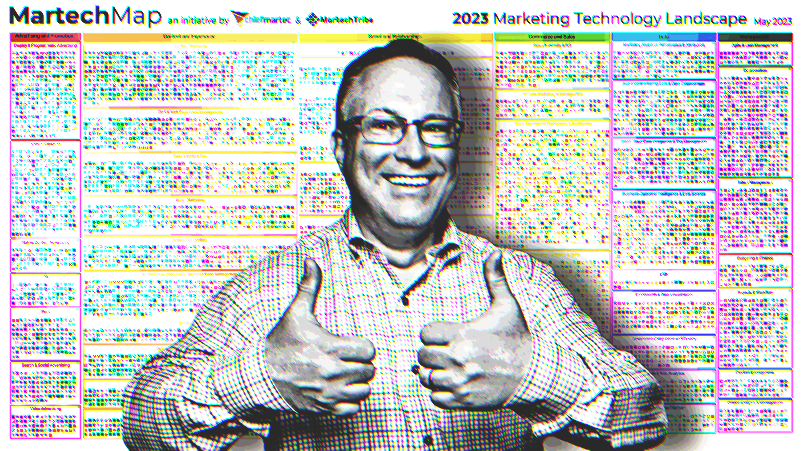

Martech maxis: Latest landscape shows 11,000 martech solutions, 196 Australian firms mapped – but shakeout ahead, warns Scott Brinker

Chiefmartec editor-in-chief Scott Brinker

Twelve years ago there were circa 150 marketing technology solutions. Now there are more than 11,000 – and even a massive retreat by VCs and equity capital markets last year could not stop the martech mushrooming, with nearly 1,800 new solutions emerging last year alone, according to the latest martech landscape, released today. Luckily for marketers and CTOs, the rate of growth is cooling – and there may be a shakeout ahead, says martech supremo Scott Brinker.

What you need to know:

- Number of solutions increases to 11,038, representing 11 per cent net growth.

- 196 Australian firms on the list with Canva and 99Designs the biggest in revenue terms.

- Software composability could see more specialised solutions added to martech's long tail.

- Gen AI inspiring a new wave of start-ups.

It will be interesting to see how tightening capital drives consolidation forces for existing funded martech companies that may likely face tougher times raising their next round, if they haven't yet achieved a path to profitability.

In the 12 years since the scale of the fast growing marketing technology sector was first tracked, the number of solutions available to time-poor CMOs has exploded from a manageable market of about 150 solutions to just over 11,000 today, according to the just released 2023 martech landscape map.

The data also reveals that there are now 102 vendors in the martech world who generate annual revenues in excess of $US10bn (though not all if it from martech). Of these Salesforce and Adobe dominate, and Adobe (as best we could tell) is the only vendor to straddle all six of the main categories tracked, although in an increasingly composable world that may not be the advantage it once was.

According to Scott Brinker, editor-in-chief of chiefmartec, this year's martech landscape represents double digit net growth over 2022. He told Mi3: "We did remove 689 companies from last year's graphic, which represents about seven per cent churn but we added or discovered 1,795 new solutions... leading to a net gain of 1,106 solutions."

A martech for every human...

In his commentary coinciding with the release, Brinker wrote that once again we are seeing the same dualistic story we’ve seen for the past 12 years. "Yes, there is consolidation and churn. Even significant consolidation and churn. But the rate at which new start-ups have launched has consistently outpaced the exit rate of those who leave the arena, whether victorious or dead."

"While competition grows and economic pressure rises – both forces that should lead to greater compression of the landscape – barriers to entry for software products continue to fall and the size of the underpenetrated portion of the market for many of these capabilities remains tantalisingly large," he said.

We may however, finally be reaching a limit. "We can safely say the upper limit on martech solutions is well below the population of the planet. (“You get a martech company! And you get a martech company!”) The rate of growth has already slowed by an order of magnitude, from 100 per cent year-over-year to just a hair over 10 per cent. Equilibrium seems near."

Australia contributes 194 vendors into the mix, with particular strength across content and experience, social and relationships, and data. The two largest local companies on this years martech landscape map are Canva and 99Designs, both of whom have revenues of between $US500m and $1bn, according to chiefmartec. At the other end of the development pipeline, Brinker and his colleague Frans Riemersma identify 36 Australian businesses still looking to record their first million dollar year.

Despite a wide spread tech investment retreat in 2022, martech for now keeps on keeping on, per Brinker, although he acknowledges that could change.

"I suspect the slow down in capital markets could affect the creation of new martech startups, but there's obviously lag there," he told Mi3. "Today's landscape is largely companies created before this year. It will also be interesting to see how tightening capital drives consolidation forces for existing funded martech companies that may likely face tougher times raising their next round, if they haven't yet achieved a path to profitability.

While you could read the original sector map without the benefit of reading glasses, if you find yourself squinting at this map to try and discern the logos, don' worry, that has less to do with how much you have aged and more about how quickly the sector has scaled.

Happily, Brinker provides an interactive map so you can drill into the details. It's immense.