SBS Upfronts: ‘Homogenous’ media means diversity dollars to flow to SBS in 2023, SBS OnDemand a Netflix, Disney+, Prime rival – not Seven, Nine, 10

SBS has positioned its OnDemand platform as a competitor to Netflix and Disney+, rather than Seven, Nine, 10 and the ABC's broadcast video on-demand platforms.

SBS’s broadcast competition is “homogenous” and the hybrid public broadcaster knows it – pitching itself as a hub for diversity and incremental audiences who, per OzTam numbers, don’t watch the other networks’ main channels. At its Upfront in Sydney, SBS positioned its SBS OnDemand BVOD platform as a Netflix, Disney+ and Amazon Prime competitor – not 9Now, 7plus or 10Play, and predicted there’ll be two VOD markets, one premium and the other not. Media buyers said SBS’s strengths in diversity are likely to see it grab a disproportionate share of advertiser budgets.

What you need to know:

- SBS held its 2023 Upfront in Sydney yesterday, unveiling a large content slate, a new digital TV buying platform, an Adobe customer data platform, and a rebrand of its brand partnerships team and radio division.

- It set out to demonstrate it had unique audiences, differentiated content, an easier buying process and a better user experience.

- SBS says its share of commercial TV viewers has risen above 10 per cent in 2022.

- SBS OnDemand is a premium environment that will compete with Netflix, Prime and Disney+, SBS’s Andrew Mudgway says, not Seven, Nine and 10.

- Media buyers said it was a strong presentation from a content, commercial and audience perspective, though noted the positioning against Netflix might not land.

As brands increasingly move into this space SBS will in our opinion take a disproportionate share of spend.

SBS says its on-demand streaming platform is more premium than the other commercial networks and should be viewed alongside Netflix, Disney+ and Amazon Prime, as it makes a play for increasing diversity spend from advertisers against “homogenous” competition.

At its upfront in Sydney’s Barangaroo yesterday, the hybrid public broadcaster unveiled a new digital ad buying platform – SBS Connect, a new Adobe customer data platform, a rebrand of its brand partnerships team and radio division – to be SBS CulturalConnect and SBS Audio respectively, and a 300 per cent increase in revenue for First Nations media through NITV.

This year, the network’s share of the commercial TV audience has grown and the “world has shifted to us” in directing more media spend to more diverse audiences. SBS is the first choice when shifting spend to culturally and linguistically diverse (CALD) audiences, media buyers said.

“In 2022, our share of commercial television viewers has grown from 9.8 to 10.4 per cent. Why does this matter? Well, in a homogenous media landscape, SBS is unique placed as a distinctive hybrid public broadcaster and is more relevant than ever,” Andrew Mudgway, National Sales Manager, told the crowd.

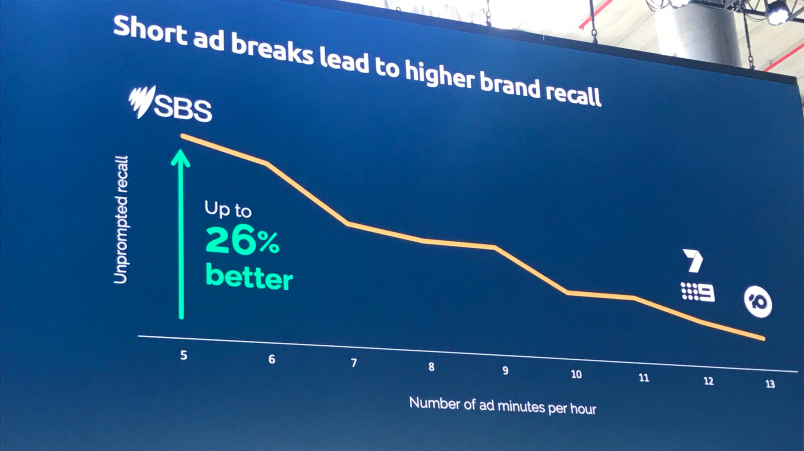

“You may think our competitive set is these brands,” he said, showing a slide with Seven, Nine, 10 and the ABC’s logos. “However, today I want to challenge that perception.” A slide with Netflix, Amazon Prime and Disney+ appeared. “Whether OnDemand or on linear television, SBS also offers a premium environment for advertisers. We run fewer ads than the other networks, which we know offers advertisers a unique, high value audience that you won't find elsewhere.”

SBS audiences don't watch much on the main commercial network channels, SBS says.

10% linear, 27% BVOD spend

SBS reaches more than 13 million Australians a month, per VOZ data, and has more than 11 million registered users of SBS OnDemand. Running no more than five minutes of ads per hour, its pitch to advertisers is to match spend to market share – by putting 10 per cent of linear spend and 27 per cent of BVOD spend with SBS, marketers can see 36 per cent linear TV and 20 per cent BVOD savings in a “butterfly effect”.

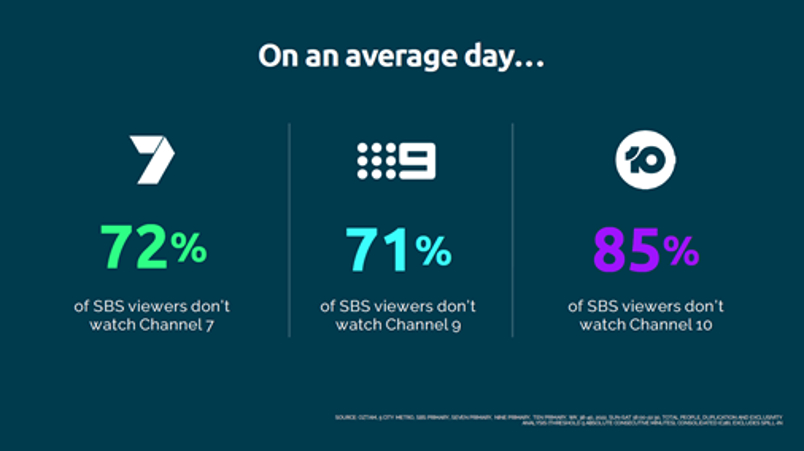

Against a backdrop of linear decline, SBS says audience is very different from the other commercial networks. It shared analysis of OzTam data showing 72 per cent of SBS viewers don’t watch Channel 7, 71 per cent don’t watch Channel 9, and 85 per cent don’t watch Channel 10.

The relationship between ad break length and brand recall. Pic: @TVTonight

NITV audiences rose over the past year, growing 21 per cent in prime time, alongside a 27 per cent increase in indigenous content viewing on SBS OnDemand and high double digit rises in website, Facebook and Instagram traffic.

On some metrics, SBS OnDemand’s viewership has declined over the past year, with monthly active users dropping slightly from between 1.8m and 2.1m to 1.7m. Its share on BVOD has fallen from 27 to 26 per cent of the market, though that fluctuates between 26 per cent and 30 per cent depending on the programming available – The Handmaid’s Tale, for example. With the FIFA World Cup later this month, which is sold out for advertisers, the network will invest heavily in launching its 2023 content slate off the “single largest sporting event in the world”.

The SBS CulturalConnect division delivers inclusion training to some 700,000 people around Australia and is backed by the Media Federation of Australia. It is mandatory in some agencies, like Mediabrands’ Initiative.

Meanwhile SBS Audio, formerly SBS Radio, produces 262 hours of original audio content a week in more than 60 languages. Combined, it has more than 6m streams each month.

SBS OnDemand key

After a record year in FY22 that powered a $30m boost on anticipated income to $157.1m for the network, SBS’s Director of Media Sales, Adam Sadler, reckons it’ll be up again in FY23 – and SBS OnDemand will power that second consecutive record revenue.

Launched in 2011, SBS OnDemand has 15,000 hours of very different content to the other on-demand BVOD platforms. Likewise, user experience “will be the new battleground”, Sadler said, and advertising-funded video on-demand (AVOD) will be a new “premium publishing arena” within that battleground.

“I think you’ll start to see two markets emerge,” he said. “I think Netflix, Binge, Disney, [Amazon] Prime all validate our strategy over the last three years around being clearly differentiated, having a premium user experience, differentiated content, advertising that ranges anywhere between four to five minutes… It will create a premium publishing content arena where the likes of SBS, Disney, Binge and Netflix will be seen as premium publishers in this space. And that will truly differentiate us from some of our perceived competitors.”

SBS's new trading platform, SBS Connect, in name mirrors the broadcasters' ongoing attempt to build a unified trading marketplace, named BVOD Connect, that would wrest back control of BVOD inventory and pricing. While SBS had held back from joining that initiative, SBS execs said using the same was was "purely coincidental".

I heard a quote from a national trading director saying, ‘if you want diversity in your media schedule, you must have SBS’… I think the world's shifted to us ... We're being realised.

Diversity favours SBS

In early 2021, SBS launched Beyond 3%, an initiative to increase ad spend with First Nations media in line with First Nations people’s proportion of the Australian population. Major advertisers – AAMI, ANZ, Nike, Kmart, LinkedIn, Optus, rebel, NAB, Suncorp and medibank, for example – have spent with NITV over the past year, though NITV’s National Sales Manager Anna Dancey said none had hit the three per cent target.

But it highlights that on the diversity front, SBS stands to win commercial share. When GroupM's Mindshare launched its Inclusion Private Marketplace, SBS and The Guardian were the two founding publishers. It is the “number one choice” for CALD audiences, media buyers said.

“I heard a quote from a national trading director saying, ‘if you want diversity in your media schedule, you must have SBS’… I think the world's shifted to us as opposed to us shifting to the agencies,” Sadler said.

“We're being realised, we're being acknowledged. Are we a beneficiary? I guess we are a as a result of that … There is no doubt that the pie is shrinking and if anything, I think [Nine’s Michael Stephenson] Stepho, [Seven’s] Kurt [Burnette] and [Paramount’s] Rod [Prosser] obviously see us as a complimentary network to their networks. We offer a point of difference, we offer incremental reach, we offer different content, we offer different audiences. I think the market's becoming a lot more sophisticated.”

Media buyers agreed – SBS is a necessary trading partner for many advertisers looking to hit increasing diversity goals.

The investment is absolutely following these audiences and following the content. I think that the other broadcasters or networks need to catch up with the money.

Buyers react

“From a diversity point of view, they’re the number one choice when you are looking for those audiences,” Craig Cooper, Carat’s Chief Investment Officer, said. “Most briefs now – the government obviously is heavily investing in that area – but it’s now become a bit more mainstream because of things like the Beyond 3% program.”

While CALD audiences do watch Seven, Nine and 10, Cooper added, SBS is the one place where you can buy those viewers in a way that’s easy to transact and prove.

Initiative CEO Mel Fein said the brands she speaks to say spend is moving fast and SBS has “first mover advantage”.

“The marketers that I talk to, they want to start shifting their spend and they're doing it strategically and carefully to make sure that they still hit the audiences that they need,” she said. “But essentially, the investment is absolutely following these audiences and following the content. I think that the other broadcasters or networks need to catch up with the money. It's starting to follow these audiences.”

OMG Chief Investment Officer Kristiaan Kroon said the broadcaster had built up a market-leading position on DE&I and purpose built over a decade.

“As brands increasingly move into this space SBS will in our opinion take a disproportionate share of spend,” Kroon said.

“Combining performance at scale is a critical enabler which I think they are delivering and will accelerate in 2023.”

Kaimera CEO Nick Behr said 67 per cent of his agency staff were first- or second-generation Australians, which was why SBS made sense. “Forget about the fact it’s diverse and it’s the right thing to do, you’re reaching incremental audiences that you can’t reach elsewhere,” he said.