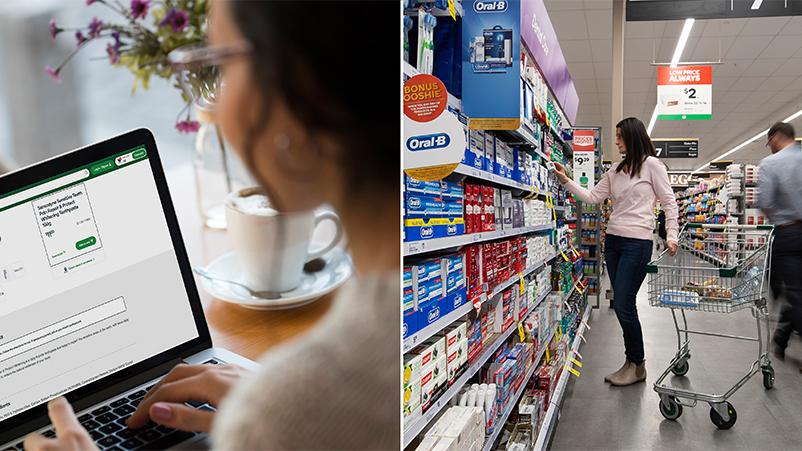

Australia’s grocery buyers have changed how they buy, and they expect brands to find them at every touchpoint: Here’s what every FMCG marketer needs to know.

Research by Cartology and The Lab underlines the lasting impact of the pandemic on shopping habits. FMCG marketers now need to adopt hybrid strategies to attract customers that still shop in-store, but do most of their research, and some of their buying, online. Here’s the post-Covid playbook.

What you need to know

- Three quarters of Australians have changed the way they grocery shop due to Covid – and the change in customer behaviour is here to stay.

- The shift has resulted in a new type of grocery buyer: 30 per cent of Australians are now omnichannel.

- While Woolworths’ Group ecommerce sales soared 53 per cent in the first quarter of F22, 89 per cent of Woolworths sales are still being made in-store1.

- 61 per cent of online shoppers research online and buy in-store within four days2.

- Successful digital FMCG marketing needs to translate the best of in-store to online.

- Here’s how to drive customer-powered growth in the moments that matter most: We have literally written the playbook for you.

Grocery shopping – the one constant in our everyday lives – has taken a rapid turn. Disrupted by the ongoing unknowns of the pandemic, shopper behaviour across the globe has accelerated in leaps and bounds over the past two years. Customers became more accustomed to the online realm of shopping, pivoted their behaviours as they navigated uncertainty and set themselves on a new path – a new omnichannel customer journey that’s here to stay.

As countries across the globe seek to re-establish some form of normal, we’ve seen both sides of the bounce-back with some behaviours remaining, and some returning. In the UK, as restrictions eased, people were happier to head back into stores and consumers made an extra 108,000 shopping trips in August3. Comparatively, there’s a divide between those returning in-store and those who have grown to love the convenience online, really sticking with it and spending more than two thirds of their total grocery bill online.

Locally, we’re seeing a similar trend with Woolworths’ ecommerce sales up by 53 per cent in the first quarter of F22, however 89 per cent of Woolworths sales are still being made in-store1. The result being that 30 per cent of shoppers are now omnichannel, shopping both in-store and online.

This new customer journey that we’re seeing isn’t exclusive to Australia and it is being driven by a new evolution of grocery buyer – the omnichannel shopper. These shoppers are interacting with brands across multiple touchpoints, before they even enter into a store.

How brands stand out and appeal to customers in this new environment is crucial to meeting new and existing customers on their journey.

Shopping habits have changed remarkably quickly – in fact it’s unprecedented – as terms like ‘QR code check-ins’ and ‘social distancing’ emerged over the course of 24 months. There has been a rapid and growing shift to online shopping with initiatives such as ‘Pick Up’, and ‘direct-to-boot’ becoming our ‘new normal’.

Recent research in Cartology’s Customer Playbook in partnership with The Lab suggests that three quarters of Australians have changed the way they grocery shop due to the pandemic and 30 per cent of Australians are now omnichannel.

Those changes to behaviour are not unique to Australia as globally, more than one in three people now prefer to shop online for their groceries4.

Shoppers flock to online in global markets

In the UK, customers have been happier to head in store to make more regular, albeit smaller shops with an extra 108,000 shopping trips recorded in August with the average basket size 10 per cent smaller.3

Online shopping has unearthed a divide in the UK between those who have grown to love the convenience of an online shop choosing to stick with it – spending on average more than two thirds of their total grocery bill online3.

In China, proximity of stores and convenience channels remain a favourite choice for many since the outbreak of Covid 19, but online channels have grown in favour5. Ordering online and having groceries delivered at home or in the office has remained. Sales through online to offline channels have continued to grow and, in the first half of this year, nearly 50 per cent of Chinese urban families have purchased FMCGs products through online to offline platforms5.

More broadly, 90 per cent of marketers surveyed by Kantar expect these changes to persist post the pandemic4. That’s a sentiment I believe to be true and we’re seeing this trend locally.

Change is here to stay

These global trends, many of which are mirrored in Australia, show that while we will always shop for groceries, the shopper journey has transformed and omnichannel is at the height of that change.

As customers demand more from brands than ever before, it’s inherent that understanding customer behaviour is the key to unlocking customer-powered growth. This new omnichannel customer journey is circuitous and complex, but has also resulted in expanded marketing and engagement opportunities for brands.

This was a real driving force for us at Cartology in understanding the evolving customer journey and the role that omnichannel plays in reaching today's customers.

Research unearths the new, more complex shopper journey

Customers are no longer faced with a binary choice of an online or in-store journey. They’re shopping when they want, how they want, based on their needs and mindset. It really is up to marketers to show up on this new omnichannel journey.

61 per cent of online shoppers research online and buy in-store within four days2.

Ecommerce sales at Woolworths are significantly greater than a year ago and this increased digital literacy has advanced customer expectations of brands. Customers crave convenience and are looking to be able to transact across multiple categories and retailers at once.

With all eyes on the customer, we’re seeing a real critical opportunity for FMCG brands to engage and inspire shoppers as 38 per cent of shoppers actively want to hear from brands and like to discover new products. With customers on the hunt for brand and product information, there’s a place in the cart for those in the FMCG space that reach their right customer at the right point of their journey.

We’ve also seen three key missions punctuate the way that customers carry out their grocery shops.

Through this, the in-store experience remains key with 89 per cent of Woolworths sales still being made in-store1. Shopping behaviours are still extremely habitual, with 74 per cent saying in-store is still their preferred way to shop.

This means that in-store provides the lens through which customers interact with FMCG brands online and therefore, successful digital marketing needs to translate the best of in-store to online.

There is also an emerging cohort of customers who are equally comfortable online and in-store, with 30 per cent of people shopping both online and offline at least monthly. With the growth of the omnichannel customer cohort has come enhanced discovery, confidence and enjoyment amongst shoppers. Compared to those that shop online or in-store only, omnichannel shoppers like to discover new products when they shop (78 per cent), they love to do grocery shopping (61 per cent) and are very confident grocery shopping online (81 per cent).

It’s no longer online or in-store – it’s omni-everything.

Consumer mindset and channel strategy key for FMCG marketers

Our customer playbook research has unearthed valuable strategies for brands to navigate this omnichannel shopper journey. Successful omnichannel marketing needs to tailor the shopping experience to customer’s mindsets, which changes when online or in-store.

Awareness, consideration and purchase still punctuate the journey, however there is more overlap than ever before. Customers continuously fluctuate between awareness and consideration and they are exposed to more messages across multiple touchpoints - all of which contribute to a well-stocked mental pantry which can be activated at the point of purchase. Customers need to be guided through the purchase journey and brands are now expected to show up on the digital journey, to be accessible and available in multiple ways.

For marketers it means adapting channel strategies to keep pace with customer attention and mindset, as they increasingly adopt a hybrid online/offline shopping model.

Understanding the evolving customer journey is crucial to connecting brands to the right customer at the right moment, but the shopper journey is complex and increasingly linked to their mindset. While some may enjoy the in-store experience and the theatre and connection it brings, others look for convenience and inspiration online. Increasingly, some like both.

If you’d like to hear more on omnichannel customer behaviour, we have the playbook for you.

Cartology works with brands to provide customers with discovery and inspiration and sits at the intersection of on-line and digital. Our new playbook is designed to ensure customer’s changing needs remain front and centre with marketers.

Article sourced by: Cartology Customer Playbook study, September 2021, nationally representative sample of 18-75 year old Australian main/joint grocery buyers, n=1000

Reference of Australians from the Cartology Customer Playbook study refers to Australian main/joint grocery buyers

- Woolworths Group F22 Q1 sales announcement, 27 October 2021. Available at https://www.woolworthsgroup.com.au/content/Document/ ASX%20announcements/2021/Woolworths%20Group%20F22%20 Q1%20Sales%20Announcement.pdf

- WooliesX, ROBIS, October 2021

- Kantar UK grocery shoppers explore newfound freedoms

- Kantar As people change, is technology the key to fast human insights at scale?

- Kantar FMCG in China recovers well during the first half of 2021