Innovation culture: How Chobani and Treasury Wine Estates mixed wine and yoghurt to drive cross-category growth, faster

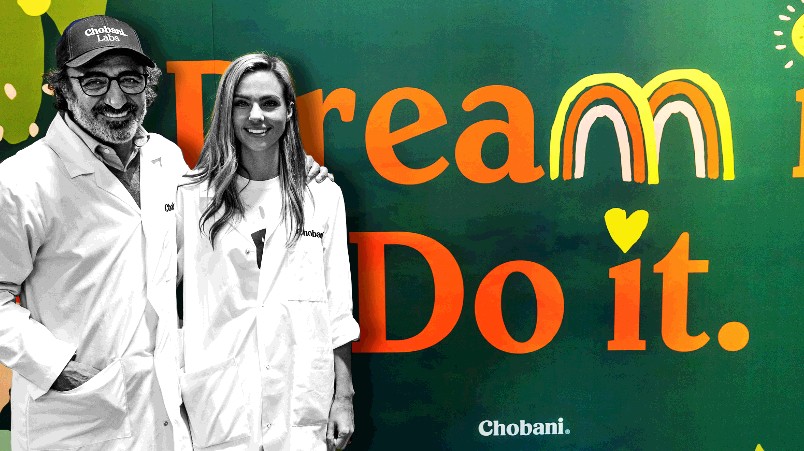

Chobani founder, Hamdi Ulukaya and GM growth, Olivia Dickinson

Chobani entered Australia in 2012 and rapidly amassed 20 per cent market share. An “astonishingly large growth” trajectory, per Roy Morgan analysis. But then growth topped out. So the company restructured, creating a multi-disciplinary growth division spanning ops, engineering, finance, insights, product, project management, marketing and packaging. The upshot is the agility to launch new products three times faster, as little as 20 weeks. Now Growth GM Olivia Dickinson is tapping into other categories, partnering with Treasury Wine Estates on an innovation session that literally ran until everyone was too hungry to keep going. She’s bidding to go beyond “sector silos” and hunting new, equally innovation-hungry brand partners.

What you need to know:

- Established three years ago, Chobani’s growth team, a multi-disciplinary unit including engineers, insights, product and packaging capability, has been innovating innovation itself, boosting agility and drastically reducing time to market, in some cases to just 20 weeks.

- GM of the growth team, Olivia Dickinson, says continuous improvement, a commitment to psychological safety and mantra of staying entrepreneurial despite the company’s rapid maturation are critical to challenging the category and meeting rapidly changing consumer needs.

- A lateral approach to innovation and recognition of the importance of cross-category insight has also seen Chobani seek innovation learnings from the unlikeliest of places: Treasury Wine Estates, one of Australia’s largest wine producers.

- Chobani has also been upping the ante on changing cultural tastes and new occasions for its products and conducted an in-depth usage and attitude study to better identify growth opportunities.

- Dickinson is throwing down the gauntlet for other stalwarts of the food and beverage industry to do the same and challenge themselves to continuous improvement, rather than wait for the category disruptors to emerge.

Comparing innovation in the FMCG space to the evolution of the iPhone isn’t something you hear every day. But for Dickinson, it’s a necessary analogy to explain the gap around how continuous innovation and growth are pursued in the fast-moving consumer goods space.

“From an innovation perspective, new products come in and set the food standard. But what’s completely wrong with this scenario and problematic is manufacturers and food leaders all have a responsibility to challenge not just the categories we’re in, but ourselves,” Dickinson says.

“Take the iPhone: If we could approach the food industry like the evolution of the iPhone, we’d improve entire standards and possibly democratise food innovation for all, while creating much healthier, better options.”

Dickinson singles out products in market 30+ years with barely an ingredient swap as the big example, although she’s equally keen to extend ‘innovation’ through the whole value chain.

“We know far better what’s good for us today. Suppliers have improved ingredients they work with, and our food should be better than 30 years ago. We see new entrants come in challenging us, but manufacturers have a responsibility to challenge themselves too,” Dickinson says. “It’s the way we look at new health needs but also evolve existing offers to continue to ensure they’re the best they can be.”

We often live in sector silos and we know we shouldn’t. We don’t recognise enough that sectors are blurring, consumers are changing really quickly and if you only look for best practice in your existing category, you find what your competitors are doing. There’s not a lot of fun or creativity in that.

Innovative DNA and mindset

Cross-category comparison is not surprising from Dickinson, who is a firm believer in learning from outside category as well as adopting fresh perspectives to innovation that extend to Chobani’s whole value and supply chain.

Her attitude reflects a mantra set by Chobani founder and CEO, Hamdi Ulukaya: ‘Be as entrepreneurial as the small guys, but as disciplined as the big guys’. Dickinson believes such DNA gives Chobani teams “a collective permission slip” to experiment and try different things, even as the Australian business grows to 260+ employees and over 80 product SKUs.

This belief works in concert with another macro consumer trend and imperative food and beverage producers must tackle: The shift towards different health needs, and changing usage, occasions and attitudes towards their products. It’s these broader forces that led to innovations such as Chobani Fit, pouch yoghurt formats and the No Added Sugar range, for example.

“The way we think about innovation and great ideas is that it’s not just what the product is, but also the perfect timing,” Dickinson says. “The way we map is simple – now, near and next. That’s to ensure innovation is not just right for the consumer right now, but prepares us for future needs states as well.”

Spearheading these product innovations and business evolution has been the growth team, created three years ago and combining specialist expertise from operations to product engineering, food technology, finance, insights, product, new product development, project management, packaging and marketing. In addition, Chobani has established a ‘growth council’ to essentially pitch new ideas to senior leadership.

Dickinson explains growth at Chobani several ways. One pillar is growing top-line, be it through new product opportunities, discovering new markets, such as tapping into New Zealand, or diversifying categories. There’s also profitability improvements plus productivity initiatives that get the business solving tricky business challenges to enable growth.

Having a cross-functional growth team driving this agenda is critical in breaking down organisational silos and bolstering responsiveness to consumers, Dickinson says. This was critical when bringing the Chobani No Sugar Added range to market.

“When we went to the growth council and said this is what we’re going to do and here are the timings, it was 20 weeks out from when we needed to launch,” Dickinson recalls. “If that had sat in a traditional marketing department and you tried to get the business behind it, it’d be a challenge. Having all these relationships in our team, where the ops engineer is talking to production and food technologists are talking to the commercial team, has given us an agility that’s enabled us to get something to market in 20 weeks. It would normally have taken three times longer to do that.”

Business performance and impact aside, another meaningful measure of success for Dickinson is psychological safety – something Chobani actively measures through engagement scoring.

“What I refer to when I say that is the shared held believe everyone can voice and put forward ideas plus share feedback and do it without judgment, or consequence of making mistakes,” she says. “Establishing an organisational culture like that is what generates that creativity and innovation.”

Finding growth fodder in wine

Building innovation from within isn’t the only way Dickinson is pursuing fresh thinking. She’s bringing that out-of-category lens to bear here too.

Dickinson paired up with former Treasury Wine Estates global innovation leader, Pete Randeira, on an innovation session that saw respective teams come together to discuss innovation models, consumer insights, distinct market category experiences, and approaches that could be useful for the other to consider. The pair were connected through strategy leader at mutual agency partner, VML (formerly Wunderman Thompson), Jill Manester.

“We often live in sector silos and we know we shouldn’t”, comments Dickinson. “We don’t recognise enough that sectors are blurring, consumers are changing really quickly and if you only look for best practice in your existing category, you find what your competitors are doing. There’s not a lot of fun or creativity in that.”

Fast forward to late 2023 and an in-person morning innovation session featuring Dickinson’s entire growth department, along with several representatives from the TWE team, ran for over five hours and only stopped because everyone was too hungry to continue.

“We know consumer beliefs are changing so quickly, and we recognised Treasury was an organisation that acknowledged that. They anticipate needs and understand the need to evolve with that consumer landscape. We were both able to share what we’re seeing in a way that was safe, and be open in a really collaborative way,” Dickinson says.

Guardrails and establishing trust

Having first found a mutually trusted advisor in Manester, the next step was several conversations between Dickinson and Randeria to flesh out what the session could look like. The pair found they’d both undertaken extensive usage and attitude (U&A) studies aimed at better understanding a market and identifying growth opportunities.

For Chobani, this study involved consumers maintaining detailed diaries to understand what people consume and functional and emotional motivations guiding their choices at that time. Information was clustered together to create what Chobani calls ‘demand zones’ for growth that inform its innovation pipeline.

“Our ambition is to be in as many occasions as possible. So, as we look at innovation, we’re looking for gaps and therefore commissioned some research trying to understand occasion in more detail and how yogurt as a category and our brands are delivering to that. Where are the focus areas as well as future opportunities for modern food,” Dickinson explains.

“We really approach innovation based on what the project or scope is. We take a design thinking approach and look at qualitative and quantitative research. We have some tech-enabled platforms that support us in the back end to help that. But there’s also a component of gathering all the cultural trends, talking to consumers, and we’ve even started doing co-design sessions, screening creative-based initiatives and co-designing in workshops with them.”

This is also where Chobani’s cross-functional growth team hits its stride. “We go through an iterative process, where we might concept test these ideas; we have the product techs making it, but within the the same team we have finance costing all out, engineers saying how we might make them, and we go through the process until we have solid concepts at the end,” Dickinson says.

It became apparent several things Chobani was trying to optimise and find improvements on were the same business conversations TWE was having.

“That was reassuring for teams in thinking through how they’d done it. The other thing, which was more confirming, was we look at food from a food and beverage totality category point of view,” Dickinson says. “Seeing some of the trends they were anticipating around how consumers are drinking less alcohol, how that’s changing other social contexts and what that means for wider food and beverage was really interesting.”

Health and wellness, or lifestyle concerns, remain a powerful influence on shopper behaviour and basket spend and also proved rich fodder for the session with Treasury. Declining alcohol consumption and the rise of new sociability trends have arisen as a result. Another social-led trend is TikTok influencing the way we eat, as well as making food preparation approachable and accessible. Market research from Verve Market Research Agency shows several food and drink cultural shifts are playing out on the social media platform, such as ‘the gram’, or fly-on-the-wall style content that takes viewers through the whole process of shopping, cooking and eating. One in 10 UK consumers surveyed by HelloFresh were also found to get recipe and meal ideas from TikTok. Today, 8.5 million Australians are using TikTok.

“This could be the antidote for a country with declining rates of cooking,” Dickinson comments. “For brands, it’s not just learning from these platforms but also understand what it means for your brands as ingredients. Natural yoghurt has seen significant growth in the way people cook and are introducing it into meals. What that means for informing an innovation agenda is critical.

“You can only connect the dots on the dots you collect. It’s so important we’re close to consumers, close to category, but then go wide with understanding all these other relevant cultural trends and what’s happening so we can anticipate the next need.”

A further line of discussion between Chobani and TWE was product development, as well as how both approach activations and engage with consumers.

“It was interesting to us given our limited batches, where we generally focus on the food. We have done purpose-driven activations, where we have used our billboards to help promote that. But certainly talking about brand activations was interesting,” Dickinson says.

The whole experience has left Dickinson with a desire to do more sessions in 2024, working with other partners on how innovation materialises and how the brand engages and thinks differently.

“This year, I want to set these up to be more structured, rather than ad hoc, and learn from other industries. As an FMCG, there is so much we have to learn,” she adds.