Short market shocks ripple through linear TV; money leaks to BVOD, SVOD, cinema, OOH – but investment chiefs say CMOs ‘committed’ to budgets in flat Aussie ad market

On the money: Guy Burbidge, Claire Butterworth, Brad Palmer, Kristiaan Kroon, Elizabeth Baker, Sam Buchanan

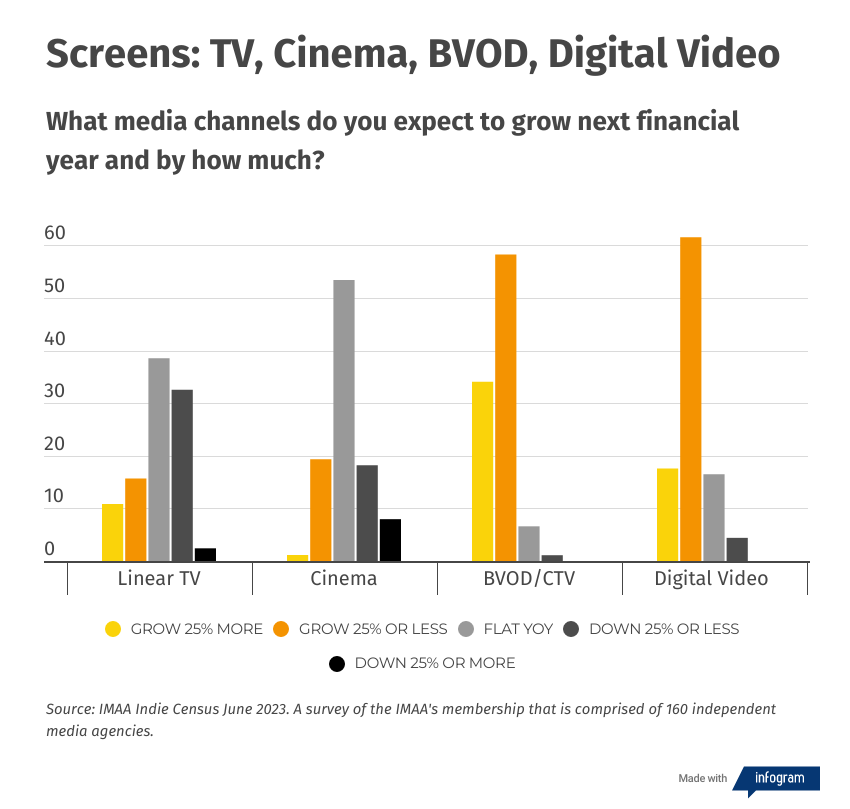

Ad budgets are being moved into the digital arms of analogue media channels in a market that is struggling to match the spending heights of 2022. Linear TV's audience decline will see it worse off by 10 per cent – circa $300m – this year, but that is not a direct hit to TV networks. Their BVODs are capturing a chunk of the leaked revenue, though face competition from SVOD rivals Netflix and Binge, YouTube, cinema and out of home. But is the leakage merited? Concerns have surfaced about the double standards of scrutiny applied to TV and digital rivals. Meanwhile, the media channels able to adapt to a short-term trading conditions have done so – and programmatic OOH is reaping the rewards. New research of 150-plus media agencies, shared exclusively with Mi3, suggests that these trends could continue well into 2024.

What you need to know:

- Predictions of linear TV's $300m decline made at the start of the year by Omnicom's Kristiaan Kroon appear to be on the money.

- The channel is on track to take a 10 per cent revenue hit in 2023 due to declining audiences, a short market, tough trading conditions – and rivals going for all they can eat.

- It's not a $300m hit for network owners: BVODs are cannibalising some of the money, with buyers suggesting it will account for circa $160m of that total. But SVODs, cinema, OOH and digital video are taking a sizeable share.

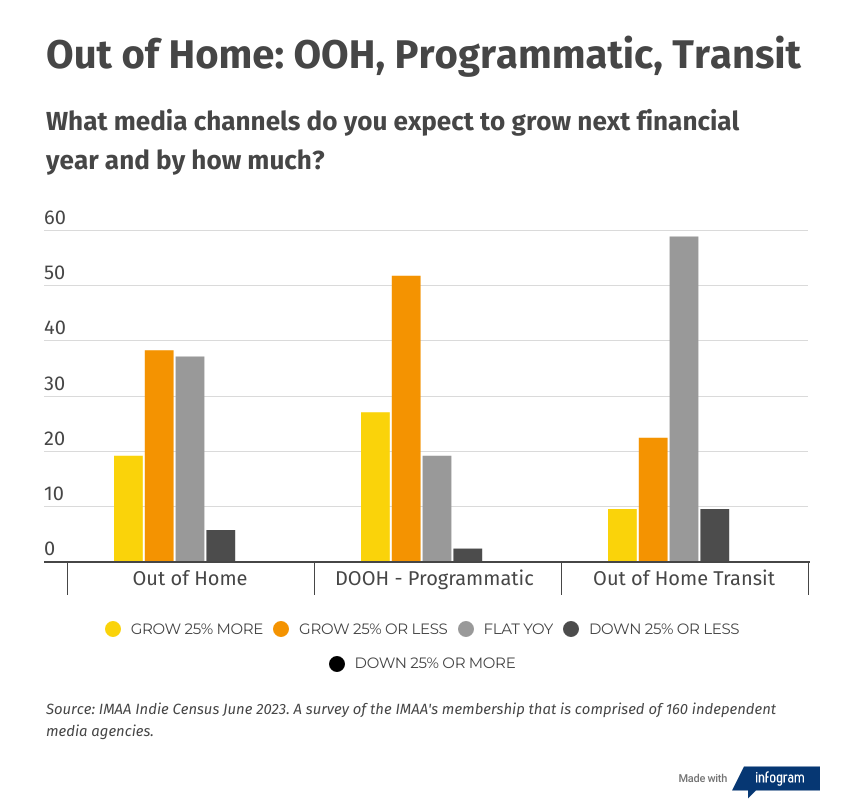

- Pressure on budgets has created a short market, benefitting channels that are flexible and can deliver inventory at short notice – enter programmatic OOH.

- A new study released by the IMAA paints a similar picture for 2024.

- Kristiaan Kroon, GroupM's Claire Butterworth, Zenith's Elizabeth Baker, Val Morgan's Guy Burbidge, JCDecaux's Brad Palmer and the IMMA's Sam Buchanan unpack the state of play, the winners and losers in Australia's media market – and where the money might be headed next.

Last year was the largest ad market we’ve ever seen. So if we can stay close to that, despite the really tough economic conditions, that shows the resilience and commitment of CMOs to their marketing spend

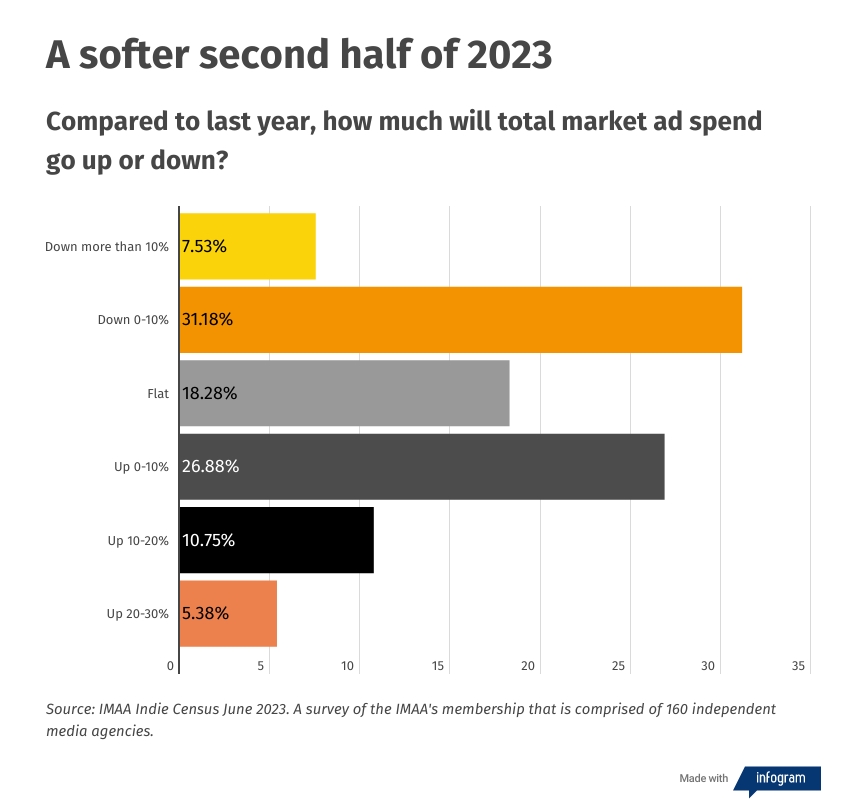

The Australian ad market is on track to deliver flat growth this calendar year despite challenging comparables, i.e. a bumper 2022, plus soaring interest rates and inflation creating sustained pressure.

A short-term market, fragmentation and changes in audience behaviour means marketers are challenging agency partners to shake up channel mix in a bid for growth at best value.

The major winners of these shifts are BVOD, SVOD, audio streaming, podcasting, programmatic out of home, cinema and TikTok, per a new study of the Independent Media Agencies of Australia (IMAA) based on where its 160-plus members are spending their money, and further analysis from senior media buyers.

The largest channel to shed money is linear TV; its ad revenue was down 10.3 per cent in FY23, according to the latest Standard Media Index figures.

More broadly, Omnicom Media Group, GroupM and Zenith forecasts that the Australian ad market would remain flat or marginally down this year appear bang on – not a result to be sniffed at in a tough trading environment, argues OMG Chief Investment Officer Kristiaan Kroon.

“Let’s remember, last year was the largest ad market we’ve ever seen,” he said. “So if we can stay close to that, despite the really tough economic conditions, that shows the resilience and commitment of CMOs to their marketing spend, and the place they have at the table with their CEOs and CFOs to maintain it during unprecedented times."

Kroon said that CMOs are acutely aware of the impact that reducing budgets could have on their businesses when times improve, as some businesses who played the short game found to their detriment during Covid.

“What clients are looking for is the best strategic thinking and trying to avoid being too tactical. They're looking for flexibility and efficiency, but not losing sight of quality and sustained growth,” he said.

Poor visibility

GroupM’s National Head of Investment Claire Butterworth told Mi3 that digital extensions of traditional media will continue to take share.

“If we look at audio, the growth that we are seeing in the market is coming from streaming and podcasting; for out of home, it's coming from programmatic digital out of home; and for screens, it's BVODs and SVODs.”

Butterworth said that client decisions are being shackled by “a lack of visibility” of their budgets, which means investments in media are coming through late, creating a short market headache for some – but also acting as a leveller.

“In years gone by this might have benefitted digital media, but all channels now have the ability and the tech to turn around campaigns quite quickly. The challenge has been more around supply of the available inventory an advertiser would want,” she said.

Butterworth reckons 2024 will be similar to this year before an uptick in consumer confidence fires up the economy and ad market towards 2025.

Mix ‘n’ match

Another issue plaguing marketing teams are budgetary pressures that have led to upper-funnel brand activity being sacrificed “more than it should have” for a focus on lower-funnel performance.

Elizabeth Baker, the Chief Investment Officer of Zenith Australia, observes that for some clients, the pendulum is starting to swing back with a more balanced approach of brand and performance. “We are increasingly being asked to help them find the right balance and narrative for their business,” she said.

“Ideally, the right allocation between brand and performance has an incremental effect. We call it ‘Brand-Fuelled Performance’, where your brand metrics improve simultaneously to your CPA [cost per acquisition] decreasing. We have done this successfully for our clients, such as Cashrewards, who came to us hoping to drive accelerated growth after heavily investing in lower funnel activity only.”

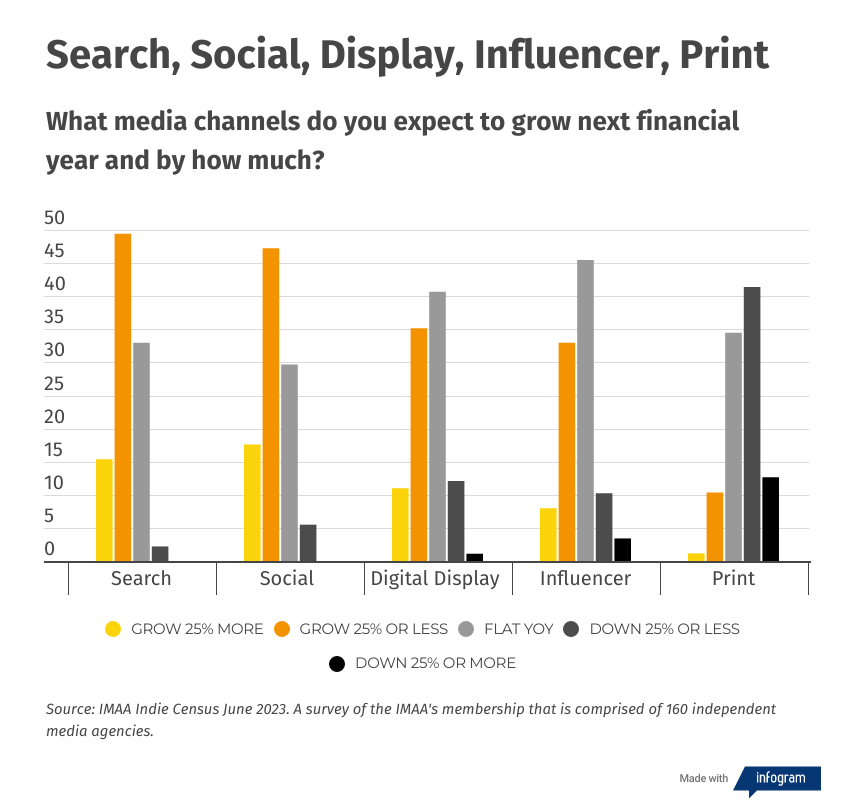

IMAA members expect digital growth to remain solid, particularly in search and social media (see chart below). TikTok has been the star platform among its competitive set, in spite of the regulatory and privacy headwinds that are swirling around the Chinese-owned app.

Baker predicts digital ad revenue will growth by 4 per cent this year, hampered by lower than anticipated growth in the first half of 2023. The digital channels that are expected to outperform include retail media, connected TV and programmatic.

Globally, the demand for social media advertising appears in decent shape. In its latest quarterly figures, Meta reported Q2 ad revenue was up 12 per cent to $31.5bn, Google’s YouTube grew 4 per cent to $7.7bn and search was up 5 per cent to $42.6bn.

There is a huge swing and appetite towards buying semi traditional media through digital pipes. That means there are a whole bunch of media owners who now have clients they’ve never met before.

The IMAA’s census also asked agencies what was the most important attribute in selecting an advertising, with ‘ability to reach people at the right’ coming out on top. This was followed by ‘influential talent’, ‘a medium people enjoy consuming’, ‘content that triggers an emotional response’ and ‘talent who are inspirational’.

Location-based targeting was seen as ‘extremely/very’ important by almost 70 per cent of agencies, with a similar proportion allocating up to 15 per cent of client budgets to test and learn strategies.

Using attention-based data for media planning and buying decisions was ‘most likely’ to be used this year by 56 per cent of agencies, and a media owner’s sustainability credentials would influence buying decisions of 55 per cent of respondents.

IMAA CEO Sam Buchanan said the findings identified two trends: that digital agencies are increasingly encroaching traditional media agency turf, and: “There is a huge swing and appetite towards buying semi traditional media through digital pipes. That means there are a whole bunch of media owners who now have clients they’ve never met before. That trend towards buying through digital pipes will only continue to accelerate.”

In February, Kroon predicted linear TV would leak $300m in revenue – about 10 per cent of its overall pie – due to huge drops in TV audiences in 2022 (circa 20 per cent).

Six months later it appears Omnicom’s investment chief’s predictions are coming to pass if the latest SMI figures are an indicator.

“That isn’t necessarily a bad outcome for TV networks because a lot of that money will flow into BVOD, which continues to show strong growth,” Kroon said. “SVOD will become part of the proposition; Netflix has gained momentum in the last couple of months and Binge has done very well at scale.”

Zenith's Elizabeth Baker cited changing viewer behaviours, a “weaker than anticipated Australian Open” and economic uncertainty as reasons why linear TV budgets have been cut. She also believes the linear TV is on track for double-digit declines this year.

Some digital players especially, such as YouTube, have done a great job in defining best practice planning principles that cleverly secure separate budgets for various funnel tactics – including awareness and consideration – often on activity running concurrently. This has also eaten into TV ad spend, which has mostly been viewed/planned as driving the upper funnel.

YouTube’s easy pass?

A hurdle TV networks must overcome is that linear TV budgets face greater scrutiny than other channels, especially pure-play digital rivals headquartered in California.

“The scrutiny of linear TV remains at levels that existed when it captured significantly more share of total ad spend. We do not see the same level of careful examination of other channels. This includes the level being planned into them, not just the delivery,” Baker said. “We also see procurement-led pricing exercises even on smaller linear TV volumes that are incredibly granular, and CPM-focused."

She continued: “Some digital players especially, such as YouTube, have done a great job in defining best practice planning principles that cleverly secure separate budgets for various funnel tactics – including awareness and consideration – often on activity running concurrently. This has also eaten into TV ad spend, which has mostly been viewed/planned as driving the upper funnel.”

She believes that TV also gets pigeon-holed purely as an awareness channel, when it can be effective at driving results further down the funnel, like some of its digital rivals.

Not helping TV’s cause, Baked added, are archaic media metrics and definitions, such as prime time (audiences delivered between 6pm and 10.30pm), which has not changed in 20 years and no longer reflects how many people consume TV. A good illustration of this was when a record-breaking 384,000 viewers tuned into Seven’s BVOD 7plus to watch the Matildas defeat Denmark in the Women’s World Cup.

“Linear TV activity is being supplemented with a network of digital video sources to deliver incremental reach. Broadcasters recognised this years ago, and continue to invest in their BVOD, FAST and digital news assets to meet the market. Our forecast has BVOD sitting at +36 per cent for the year,” Baker said.

Per ThinkTV figures, BVOD clocked revenues of $448m in calendar 2022. If Baker's forecast is right, that suggests 2023 revenue growth of $161m for BVOD – just over half of the $300m forecast to leak from linear TV.

We’re picking up more short-term money than we’ve ever done ... but it's worth pointing out that it's not just not just linear TV [budgets that cinema is taking], people are looking at social media and all forms of AV to see if they have got the channel mix right.

The bigger short

Cinema is another channel that has shown impressive growth, with ad spend up 27.5 per cent in FY23. Like outdoor, it has rapidly recovered since Covid forced a total shutdown.

Val Morgan Managing Director Guy Burbidge told Mi3 that although it hasn’t quite recovered to pre-Covid ad revenue levels, money is surging back due to a slate of recent blockbusters – Top Gun, Avatar 2, Spider Man, Barbie and Oppenheimer. Trading conditions are also giving cinema a shot in the arm.

“Clients are looking for those cultural moments beyond sports and live television and they want to know their audiences are being delivered consistently,” he said. “It isn't just a reach game anymore, it’s turning into more of a quality game.

“We’re also picking up more short-term money than we’ve ever done. The spend profile is changing, but it's worth pointing out that it's not just not just linear TV [that we are picking up spend from] people are looking at social media and all forms of AV to see if they have got the channel mix right.”

OOH: programmatic primer

Out of home is powering with ad spend up 23.9 per cent per SMI figures. The IMAA census suggests that growth trend is likely to continue well into 2024 (see chart above).

Although parts of the sector have benefitted from “a couple of one offs”, including City of Sydney’s new network of QMS digital street furniture that opened up late last year, the real growth story is in programmatic digital OOH.

In Australia, only around 4 per cent of digital out of home revenue (68.1 percent of OOH market) is traded programmatically. In more mature markets across Europe and the US, it varies from 10-20 per cent, and can be as high as 30 per cent for some media owners.

For JCDecaux, programmatic makes up about 8 per cent of its digital ad revenue and is on the march, said National Programmatic Director Brad Palmer, who this week launched the Programmatic Digital Out of Home Awards to showcase what good campaigns look like.

“We have seen growth north of 50 per cent for programmatic,” he said. “There is more widespread agency adoption and the DSPs are getting better. Another reason is that it’s a short-term market and out of home digital inventory is in high demand. Sometimes the only way for clients to get campaigns away is to run it programmatically, due to the fact that we've got dedicated supply there for clients to tap into.”

Palmer predicts that in five year’s time 30 per cent of JCDecaux’s digital inventory will be traded programmatically.

Audio: Sound investments

Metropolitan commercial radio stations reported advertising revenue of $686m in the past financial year, which was on par with FY22 results. The revenue booked through agencies, per SMI figures, dropped 4.4 per cent.

At the time the results were released, CRA CEO Ford Ennals said radio had a year of two halves, a strong start followed by a much softer six months in 2023.

“Growth in broadcast revenue ended flat with the previous year, but we are continuing to see very strong growth in digital audio advertising, which is not yet included in these figures,” Ennals said.

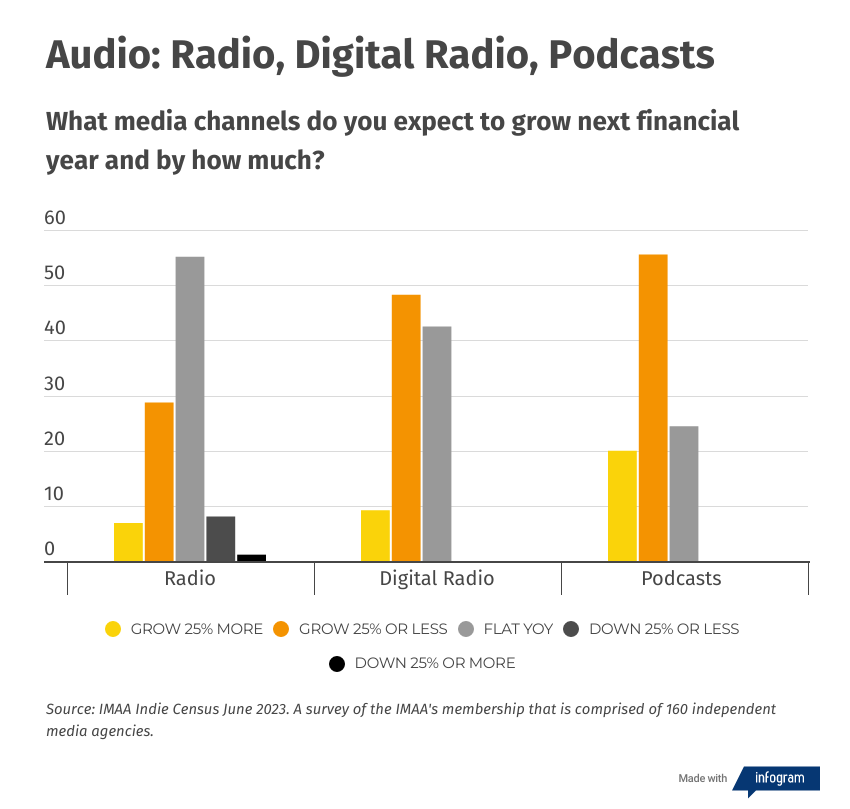

Where there is growth is in digital audio advertising. SMI figures noted an 8.5 per cent increase, and media agencies responding to the IMAA census expect this trend to continue.

One area on the rise is podcasts; 43 per cent of Australians are now monthly listeners, which is one of the highest penetration levels in the world, per an Infinite Dial report. Weekly podcast listener numbers rose seven points to 33 per cent in the past year. Nearly one in three Australians stream radio weekly, the CRA said.