Frain signals ‘20-30%’ Binge ad growth as Foxtel eyes programmatic push, hedging on Voz versus own measurement; agencies warn streamers not to get greedy as Netflix mulls own ad stack

Binge has opened its doors to the wider market. Melissa Hey, Craig Cooper, Mark Frain and Jason Tonelli unpack what this means

Foxtel Media CEO Mark Frain is predicting major revenue gains for its ad-funded tier on Binge as it opens up to all advertisers. But buyers say it’s not yet eating linear TV budgets and urged Binge and the other streamers to commit to OzTam’s total TV measurement system and collaborate on frequency capping or risk crimping growth. Frain is hedging his bets. Meanwhile, reports that Netflix could drop Xandr and is building its own ad stack have been met with scepticism given the cost involved. GroupM’s Melissa Hey, Carat’s Craig Cooper and Zenith’s Jason Tonelli weigh in.

What you need to know:

- Foxtel Media's Binge is attracting new advertisers after opening up ad inventory to the wider market this month.

- Mi3 understands that Foxtel Media will switch on biddable programmatic trading of Binge inventory early next year, which will form part of a long-term partnership with adtech firm Magnite. It currently negotiates guaranteed programmatic with agencies and holding groups.

- CEO Mark Frain predicts the streaming platform could attract 20-30 per cent more advertisers or equivalent revenue gains from current spenders. Media buyers are less bullish.

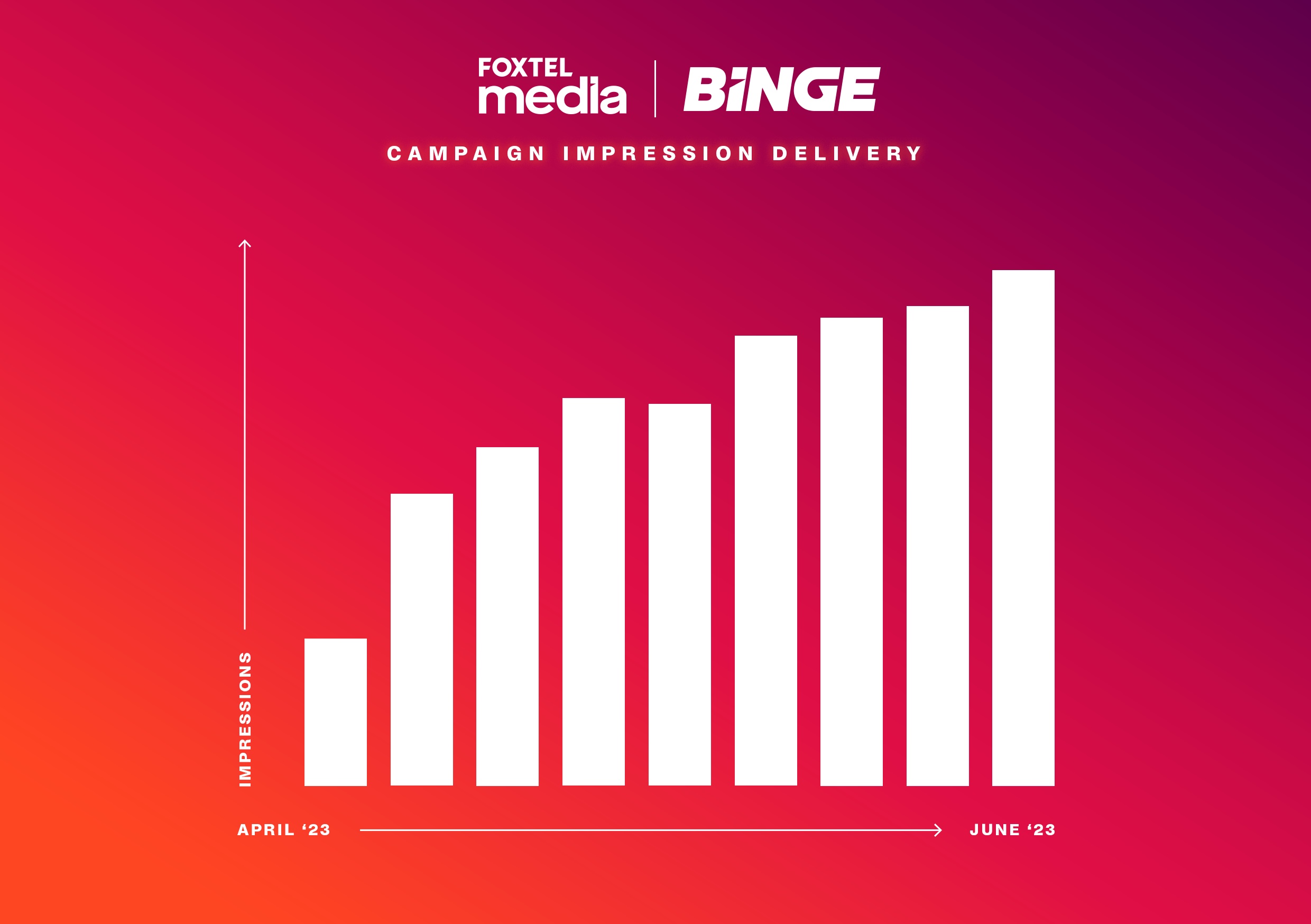

- But buyers agree that Binge's launch has been a strong, with an impressions growth trajectory that has met or exceeded advertiser demand.

- Buyers want Binge to join the Voz measurement system alongside its sister platform, Kayo. Frain said this could happen next financial year.

- Industry measurement debate continues with the prospect of multiple currencies in market. GroupM's Melissa Hey reckons that is already a reality.

- Carat's Craig Cooper and Zenith's Jason Tonelli want AVODs to align measurement, trading and frequency capping standards.

- Buyers say that reports Netflix will evolve its ad offering with better targeting capability make sense and have been signalled to market.

- But reports that Netflix and its sales house Xandr will ultimately part ways when Netflix builds that tech capability – primarily an ad server – have been dismissed by insiders.

- They suggest that while taking sales in-house makes sense – top-level media sales requires ownership of relationships – building out a high quality adtech stack is an expensive undertaking.

- One rival exec also questioned whether Binge's ad tier could maintain its claimed low levels of subscriber churn, suggesting it could hit double digits later in the second half.

The only barrier I see is how Binge, Netflix and other AVODs fit into the industry VOD story and measurement.

Foxtel Media CEO Mark Frain is backing Binge revenues to climb another 20-30 per cent on the back of sustained demand for its streaming ad tier. The firm has now opened up the platform to the broader ad market after launching with an initial 21 commercial partners.

Mi3 understands that Foxtel Media will switch on biddable programmatic trading of Binge inventory early next year, which will form part of a long-term partnership with adtech firm Magnite. It currently negotiates guaranteed programmatic with agencies and holding groups.

Media buyers have hat-tipped Binge’s success, but said it risks "stunted growth" unless it joins stablemate and sports streamer Kayo in the OzTam total TV ratings system. Mi3 has been told that Binge will take that route, though Foxtel Media is understood to be hedging its bets on its own form of currency after longstanding friction between the firm and the official currency provider, owned by Seven, Nine and Ten, with accusations of over and underreporting spilling into the media.

Netflix has been issued with a similar warning to move away from its walled garden approach and embrace independent audience measurement as it has done in the UK with OzTam equivalent BARB.

Netflix to build own ad stack?

Reports from the UK suggest Netflix is planning to overhaul its ad formats and targeting capability, which buyers said have also been signalled locally. A new development from the sidelines of Cannes is that it plans to eventually bring its ad sales function in-house, ending the arrangement its current ad sales partner Xandr. Buyers locally suggested an in-house sales function ultimately makes sense. However, executives close to the streamer suggested reports in the Financial Times that Netflix could completely sever ties with Xandr and build out its own ad server and adtech stack would be surprising, given the agreement between Netflix and the Microsoft-owned firm is understood to be multiyear, and given the expense in building out the component parts.

Locally, the consensus among buyers is that the Netflix advertising launch was undercooked. Media investment chiefs last month told Mi3 that the platform is now heading in the right direction, but still lags Binge by some distance.

Frain bullish

Foxtel Media's Frain and media buyers told Mi3 that demand for Binge remains strong, following a period in which the AVOD “comfortably delivered” on daily and weekly impressions after launching with circa 400,000 subscribers on the ad tier. It achieved that scale by converting a significant base of Binge subscribers automatically – effectively leaving them to choose whether they want to pay more for no ads – versus Netflix’s low-key approach to attract ad-tier subscribers off a clean slate.

Frain said that strategy is paying off. Although Foxtel Media would not reveal impression numbers, the firm shared a chart (below) which suggests sustained impression growth.

“There's been almost a waiting room of clients that want to get on board,” claimed Frain. “We have brands [paying to advertise on Binge] pretty much from every holding group – all the holding groups have seen the quality of the delivery, audience, content and the quality of the Binge subscriber. Brands are desperate to get on board.”

While the firm has claimed no significant churn from its ad-tier subscriber base to date, one rival media owner suggested that may change in the second half.

Higher rollers

Frain, however, predicts Binge will grow ad revenues significantly – circa 20-30 per cent – either by growing its advertiser base by that kind of quantum, or extracting more revenue from current advertisers based on the volume of impressions it is now able to deliver.

He said that some launch partner advertisers have already committed to larger deals and expect others to follow suit.

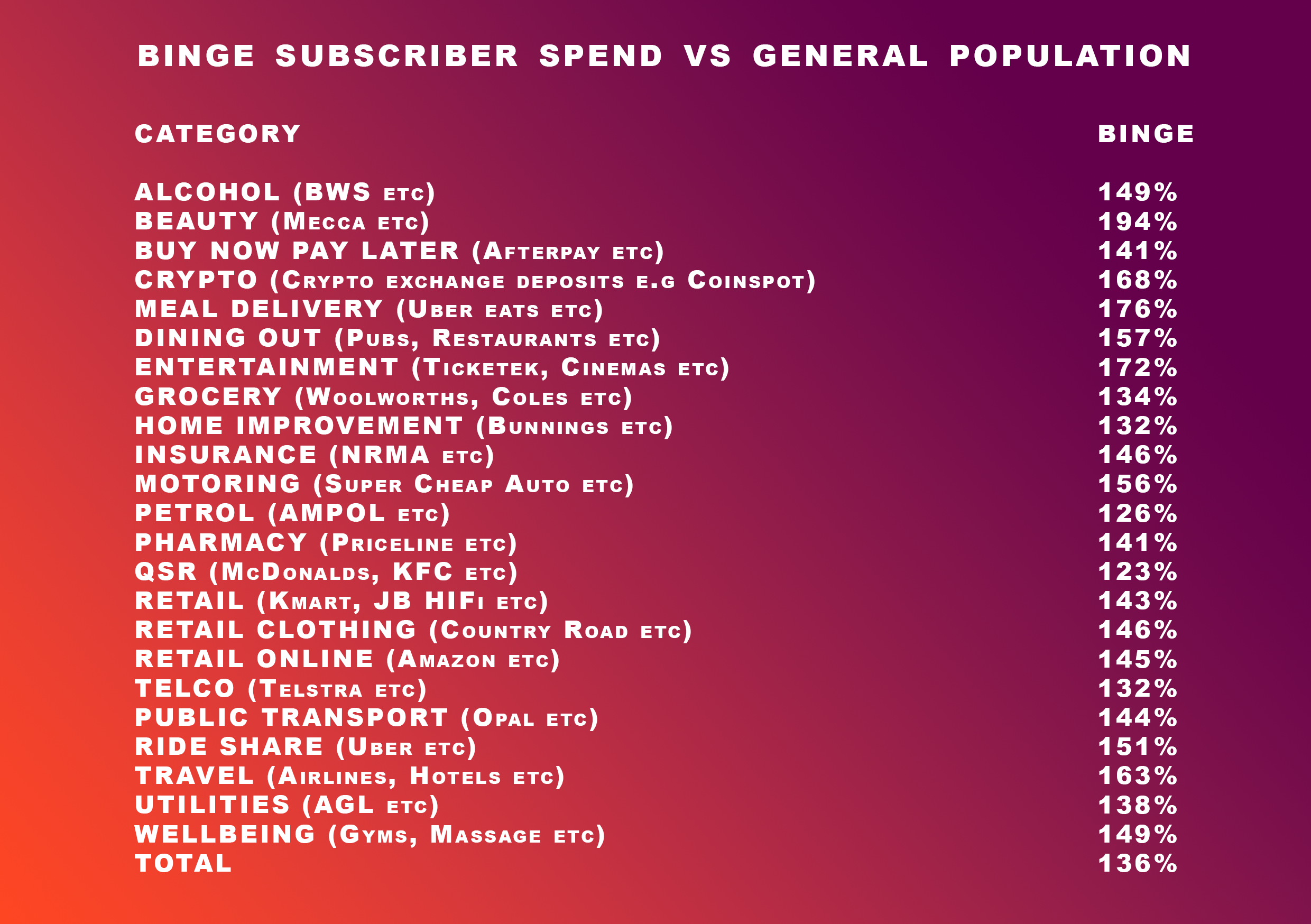

He claimed that demand is being fuelled by data that suggests a typical Bing subscriber aged 18 to 64 spends more money across categories than the average Australian, per a study it the firm commissioned from consumer research outfit Fonto.

It found Binge subscribers spent 36 per cent more, including larger lifts in beauty (a 94 per cent higher spend), meal delivery (76 per cent), entertainment (72 per cent) and travel (63 per cent). Per the table below, they also spend half as much again as the general population on booze.

Buyers: Don't get greedy

Foxtel Media’s confidence in Binge growth is shared by media buyers – but with some important caveats.

Carat Australia chief investment officer Craig Cooper said the streaming market is entering a “perfect storm” in which macroeconomic conditions are driving household belt tightening, making cheaper ad-funded models an attractive entertainment proposition when compared with a more expensive Foxtel Media subscription.

“This means they could grow impressions and would be able to sell more inventory to advertisers,” Cooper said. “I wouldn’t agree with 20-30 per cent [growth] but there is definitely growth there.

“The only barrier I see is how Binge, Netflix and other AVODs fit into the industry is measurement. They're sitting a bit separately from BVOD players like Seven, Nine, Ten, Foxtel and SBS. What the industry wants is one holistic measurement system that captures everything – and that's not currently available through Voz.”

GroupM’s chief investment officer Melissa Hey said Binge's transition from a direct sale to programmatic guaranteed has made trading easier and more automated. That allows smaller-spending advertisers to test and learn on Binge as they can buy inventory over weekly periods. Previously launch partners had to commit to a three-month block.

However, she urged both Binge and Netflix to continue keeping a tight rein on frequency capping and ad loads, and not “going after the investment of advertisers”.

'Not yet eating TV's lunch'

Zenith Australia CEO Jason Tonelli described Binge’s ad-tier launch and advertiser appetite for the platform as “very strong”. He said the platform has so far struck the right balance between delivering ad impression volume and user experience.

“There are definitely advertisers that want to trial it. I’d say the demand is as much advertiser-led as it is agencies showing them new ways to find consumers,” per Tonelli. “Right now [Binge] is typically getting budgets that are more allocated to innovation testing, but that will evolve and it will probably sit somewhere between BVOD expenditure and subscription TV."

But he said Binge is not yet cutting linear TV's lunch. "It's more budgets being attributed with the audience reach that [Binge] is delivering at the moment.”

Tonelli backed Craig Cooper's call for unified measurement as well as Melissa Hey's warnings on ad loads and frequency capping.

While Binge has managed both of those aspects to date, Tonelli said advertisers are still working in silos when it coms to the latter.

“[Foxtel Media] don't control the consumer and what happens when viewers flick channels to Netflix. We want a healthy ecosystem where Netflix and Binge and Kayo and Disney-plus all thrive. I’ve told Frain that you've going to open your inventory up so we can help our clients manage their frequency across all the platforms, the entire ecosystem, not just his.”

I think often the industry gets kind of caught up with the notion of currency versus measurement, and they are two very different things.

Currency fragmentation?

Frain said that Foxtel Media would lean into the “preferred currency for the industry” – in Australia’s case Voz – but this would not deter it from exploring alternative measurement systems that offer “richer, deeper insights” and are more aligned with streaming tech and viewer behaviour. In the US AVOD sector, he said, there are multiple measurement currencies in use and it is likely Australia could follow a similar path.

Others, such as Nine sales chief Michael Stephenson, have warned that fragmentation of currencies would create "total chaos" for advertisers.

But Frain suggested measurement and currency are separate issues.

“I think often the industry gets kind of caught up with the notion of currency versus measurement, and they are two very different things. Therefore, depth of measurement [we can provide advertisers] can be a very different avenue than being part of an overall currency,” Frain said. “We will still support industry initiatives, but as we've said before, the strategic mandate that we're driving through Foxtel Media is more aggressive than others in the streaming space.”

It may be six months to a year before Binge considers joining Voz, but media chiefs admit it won’t be as straightforward to convince global platforms like Netflix, Disney-plus and Amazon Prime Video to follow suit, even though Netflix signed up with Barb last year following market pressure. Youtube has indicated it is highly unlikely to join the Oztam-owned currency citing privacy concerns. However, both Binge and Netflix now allow third-party tracking and verification, which GroupM’s Hey welcomes.

She believes the Australian market is already fragmented in terms of measurement and there are new measurement providers like Samba, Adgile and Beatgrid, the latter being used by Google, that help reconcile different currencies to a single, holistic view after the fact.

“I think it's more important in understanding what the business needs are for clients and delivering outcomes based on what their KPIs are for a campaign,” she said. "In the planning process, you may be using the likes of Binge differently to how you're using broadcast TV, versus YouTube, and you could also be buying different audiences across all of them.”

Carat’s Cooper believes the strength of brands like Netflix and Disney may provide them with confidence they can operate as “outliers” of the Voz regime and still attract substantial advertiser dollars, but warned that streamers remaining outside the currency “may stunt their growth and revenue”.

He added: “The role of Netflix doesn't change, it's more to do with the ease of transaction. When you're buying across VOD, to have one platform that you can't buy alongside the others is problematic.”