Kantar: TV and OOH combo drives best awareness bang for buck, Youtube scores poorly

ThinkTV's Kim Portrate (left) and Kantar's Sharon Hilton: "Incredibly robust data" for marketers making channel choices as headwinds bite.

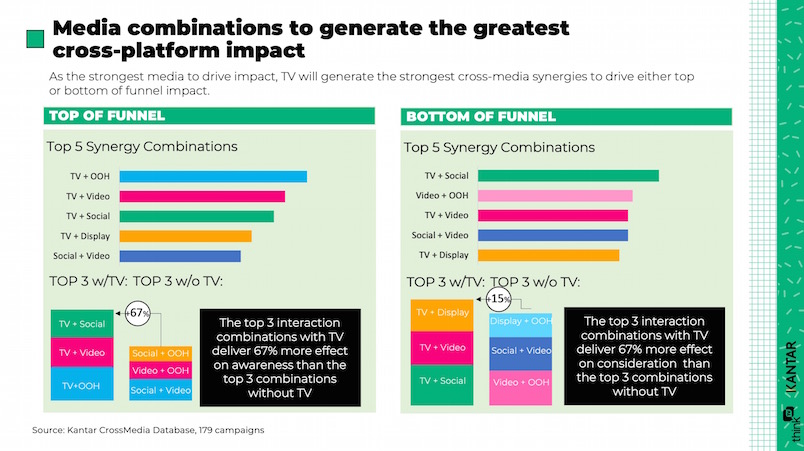

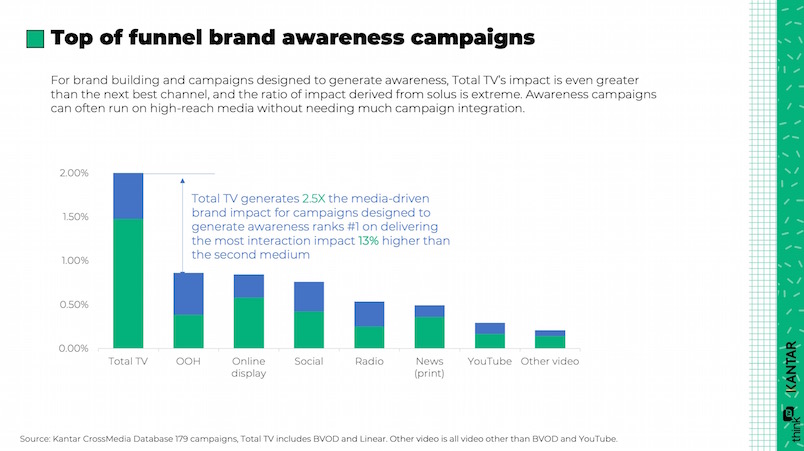

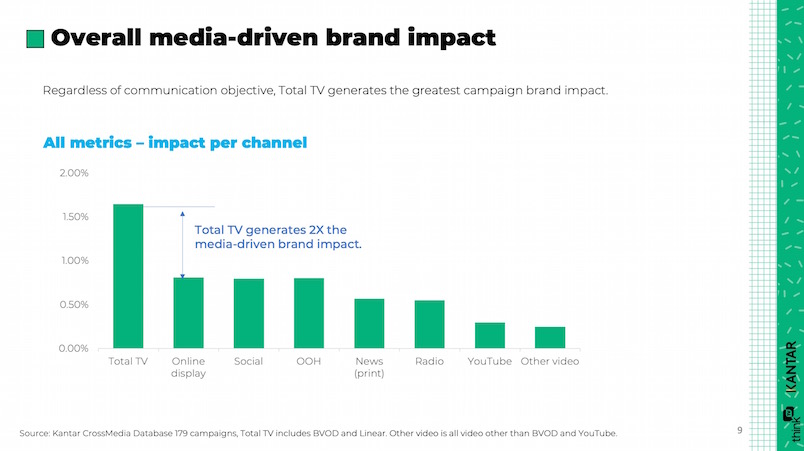

Combining television and outdoor advertising delivers the biggest brand awareness buck, although it's linear TV that does most of the heavy lifting, according to a study by Kantar. Outdoor delivers lower standalone awareness, and is also more reliant on other media to deliver its full potential, per the research. Youtube, meanwhile, did surprisingly poorly in the study. Some may question the credibility of the research, commissioned by ThinkTV, but Kantar stands by its data and independence.

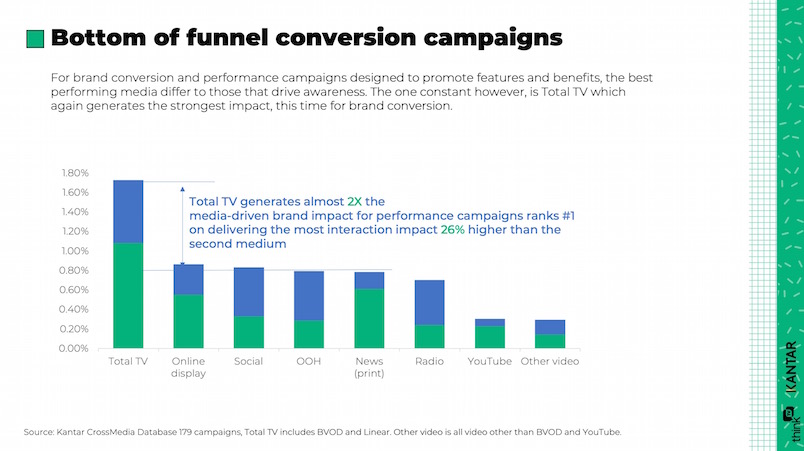

Combining TV and out-of-home delivers best bang for buck in terms of driving brand awareness, per a study by Kantar, with TV and social media the strongest combination for driving conversion followed by out-of-home and video. As a standalone channel, Youtube came out poorly across both awareness and conversion.

The research was commissioned by the major TV networks via ThinkTV. That will likely raise questions over the credibility of the findings, especially from other media channels, digital buyers and not least Youtube. But Kantar, owned by Bain and WPP, backs its data and independence.

The study was based on “an incredibly robust data set,” some 179 Australian campaigns using Kantar’s cross-media methodology, factoring in 180,000 consumer survey responses across brands of all sizes, with an average campaign spend of $5.3m per Kantar Director, Media & Digital, Sharon Hilton.

The TV effect primarily comes from linear, said Hilton, though BVOD was part of the equation. While TV and OOH delivered the strongest brand awareness combination, according to the study, the sample data suggests OOH delivers lower standalone awareness. It was also more reliant on other media to deliver “its full potential”, according to Hilton. “73 per cent of the impact for TV on awareness is what TV could do on its own, versus 45 per cent for out-of-home,” she added.

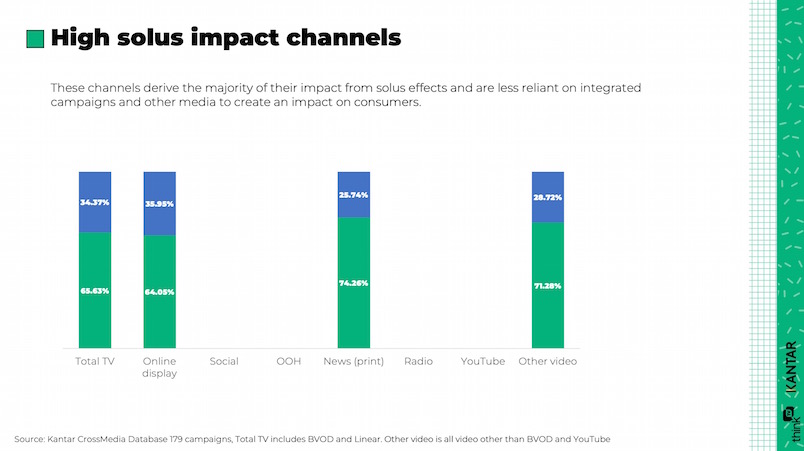

The research firm calls standalone capacity to drive results ‘solus effects’, versus ‘interaction effects’, i.e. channels that are more reliant on other media. Digital display and print also had strong ‘solus’ or standalone capability, alongside ‘other video’, defined as video excluding Youtube. “So they're not as reliant on those campaign integrations and other media channels to see their full effect,” said Hilton.

Was Hilton surprised at Youtube’s poor showing in the research, given it is estimated to take somewhere near $2bn in ad dollars locally? “From a magnitude point of view, it is featuring at the end of the list. I wouldn't say that it's not a viable channel, though,” she said. “It still has a role to play in the overall media mix. From a video point of view, it does perform cost efficiently.”

CEO Kim Portrate said ThinkTV commissioned the research late last year to “democratise data” as marketers face increasing pressure from finance departments seeking short-term savings in the face of rate rises.

She said the body had not been able to find similar research globally (an independent study in the same ballpark from the Narsee Monjee Institute of Management Studies in Mumbai, compares TV to Youtube, reaching broadly the same conclusions, but is narrower in scope). Kantar's Hilton said the firm has conducted similar work in other regions, but has previously grouped BVOD and CTV with online video, whereas the ThinkTV study groups them with TV.

“We know that in challenging times people are asked to constrain budgets. But they are never asked to constrain sales outcomes. We understand you're going to have to be more efficient without reducing effectiveness. Here is a way for you to look at the way you're buying media, particularly if you're considering substitution or if you're considering reductions,” said Portrate. “Just be careful where you take that money from. The data shows it is not about removing a channel and assuming the rest will do the job.”

Economic headwinds coincide with increased talk in market that brands can be built in digital channels alone.

“That’s fantastic,” said Portrate. “My question is always, where is the evidence? Produce some data that makes that statement truthful.”

Clarification: An earlier version of this story described Kantar as "WPP-owned" WPP owns 40 per cent of Kantar. Bain Capital owns 60 per cent.