Old is cool again: Commbank iQ, Woolworths-owned Quantium mine 7 million account customers to uncover 50-plus segment now powering consumer economy, pressured younger set bunkers down, spends less…mostly

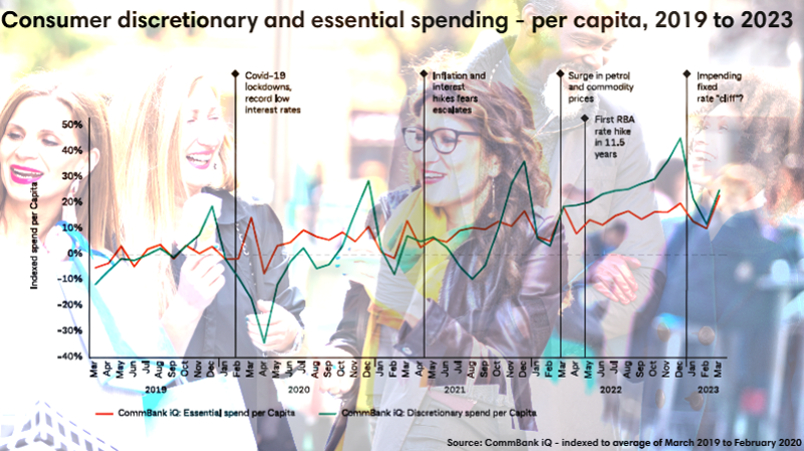

TV networks, with more than a sprinkle of self-interest around their ageing free-to-air TV audiences, have been saying what The Commonwealth Bank and Quantium yesterday proved with millions of bank customer spending records. The free-spending, cashed-up, low-pressured 50-plus set have got all the discretionary spending bucks and they’re throwing them around. The younger set, prized by advertisers, are in retreat. While across the demographic board some of the richest, hippest suburbs are under most pressure. The new quarterly consumer spending series – via the CBA-Quantium joint venture dubbed Commbank iQ – is derived from real spending bank customer data rather than polls and respondent surveys of claimed spending intentions. The AI-crunched data it highlights from 7 million customer accounts has significant implications for marketers.

Younger people are reducing their consumption. Their spending growth is not keeping pace with the erosion of their wallet and so in turn they're reducing their consumption.

Older set romping spend

Commbank and Quantium yesterday launched an all-new consumer spending benchmark series from their Commbank iQ joint venture with a twist – the data is based on real spending records of 7 million Commonwealth Bank customers. Their personal identities are stripped but a full suite of socio-demographic identifiers remain, resulting in the massive AI-enabled data crunching and analytics exercise questioning a few in-vogue business bubbles – like millennials drive the market. They’re certainly not right now. Time for a millennial strategy check.

Fascination with the younger set is nothing new but Commbank iQ – a joint venture between the bank and Quantium, acquired by Woolworths, says twenty and thirty somethings are among the least able to spend in the current economic environment. Feeling most under pressure, they are pulling back – except for a Covid hangover where they join a large chunk of the population in refusing to give-up on travel and experiences as an essential recovery mechanism. They scrimping on essentials to make sure of it. Conversely, those over 50 are romping across the board.

It's all about experience

Hard spending on travel is up 39 per cent for the March quarter, compared to the same period last year. Eating out and food delivery is up 8.5 per cent – and that’s adjusted for a 7 per cent inflation rate. Spending on petrol is down 5 per cent, household goods like furniture declined 11.6 per cent and apparel dropped 4.3 per cent over the same period for Commbank customers.

But the trends remain boldly nuanced. Those under 35 spent 8.4 per cent less on apparel while those over 35 lifted apparel spend 3.1 per cent. It’s the same for retail services like hair and beauty – under 35s decreased their spend 0.6 per cent in the March quarter while their older peers lifted spend 9.7 per cent.

Launching the first in an ongoing quarterly consumer series, the Cost of Living Insights Report yesterday from Commbank iQ paints a very different picture to much economic data and analysis typically produced by a bank. This is a big, real world spending dataset of consumers with oodles of context around who is spending what and how. The new index is based on spend per individual and household versus broader macro economic indicators that ingest immigration numbers, for instance, which can mask what’s happening on the street in like-for-like spending trends.

Counterintuitive behaviour

At the top line, as CommBank iQ’s Head of Innovation and Analytics, Wade Tubman, pointed out repeatedly during yesterday’s media briefing, there’s a lot of counter-intuitive behaviour happening. Most pressured are those beneath the demographic fault line aged 50 but in aggregate, current spending data shows a large rump are tightening spend on essentials – per the aforementioned declines in household goods, petrol and even insurance, where policy extras are being shaved to ensure they can still travel and get out and about.

Discretionary spending “grew sharply” through 2022 and was up again in the March quarter, at a much slower rate, according to the report, but the topline spending number masks much complexity under the hood.

“The amount Australians are spending on essential items is barely growing in line with inflation,” the report says. “It seems counterintuitive that at a time of increased cost of living pressures, consumers are choosing to boost their discretionary spending.” To do it though, they are pulling all sorts of trade-off and trading down levers.

“If we look at the last twelve months especially, we can see that actual spending adjusted for inflation, which is the number of things that consumers can buy, tails well off compared to the actual dollars they're spending,” Tubman said. “What this is saying is that a lot of the spending growth that we see in our economy in dollar terms is actually more inflationary growth. And that's important when it comes to individuals making choices. They're not necessarily choosing to buy more things, they are spending more money, but they may not have a choice. They've got to buy these goods.”

Commbank iQ monitors spending across 360 different categories which it splits into two core streams – essential and discretionary spending.

Essentials troubled, travel spend booms

“Diving into the categories we can see some quite different behaviours here and we can see that consumers aren't spending the same or changing their spending in all categories the same,” per the report.

Adjusted for inflation, travel and accommodation is the standout, up 39 per cent on the same time last year, which Tubman said was spend made this quarter for travel in the future.

“Of all the categories, this is where we're seeing the highest growth. The others we see are eating out, food delivery and experiences – everything from theatres, shows, concerts, sporting events, going to local fairs, all of that. Australians are prioritising experiences. They're prioritising seeing family interstate or potentially overseas that they've not seen for a couple of years."

But that requires hard choices.

"Because of all the pressures that we've talked about, they're having to be frugal in other categories. So that's why we're seeing this counterintuitive effect of increased discretionary spend at a time when cost of living pressures are high. Consumers are choosing to prioritise experiences because of the pressures they're having to forego with other things.”

In other words, they’re pulling spending levers everywhere. The question is, how long that will last.

“It'll be interesting to see how long that behaviour continues, how long it takes for us to all feel we’ve caught up from Covid,” per Wade.

Commbank mapped its spending trends to geographic regions and again there are surprises – some of the hippest, wealthiest suburbs in Sydney and Melbourne, for instance, are under the most pressure.

The other stark trend is the return of the out-of-fashion older set as consumption powerhouses.

Fault line at 50

There’s a fault line around age 50 in Commbank iQ’s data where those above it are increasing discretionary spend across the board at a fast clip, even after inflation.

“Younger people don't have savings, so basically they have to react faster and cut chunks,” Tubman told Mi3. “Other work that we've done very recently around the particular impacts of inflation and savings leads to a bit of a perfect storm for young people. On average they’re less likely to have those mortgage buffers. We know that from other data, they don't have the savings buffers. We know they are in categories that are higher inflationary categories. And so all of this just goes to make it harder time for young people. And the outcome, which is what we measure, is they're pulling on those spending levers harder than the older people," said Wade.

"Basically what we're saying here is older age groups are spending ahead of inflation, which means that not just that they're spending more dollars, they're buying more stuff across many categories. And conversely, younger people, are reducing their consumption. Their spending growth is not keeping pace with the erosion of their wallet. And so in turn, by definition, they're reducing their consumption.”

Tubman said the upshot is that business generally may have focused too much on the younger set for current and future growth and ignored where the spending power still lies – old money.

New super consumers

Commbank iQ’s 50-plus power spenders aligns with research to be released later this week by Nine at its week-long Big Ideas Store showcase. Nine’s says the rise of a new “super consumer” is linked to the old, not young. And Nine and Seven have been vocal for several years about brands missing a trick by ignoring a less sexy but cashed up older set, who just happen to watch a lot more free-to-air TV than younger demographics.

The 45-64 year-old age band is “spending more in key categories than their younger counterparts when compared to last year,” Nine said in releasing an early snippet to Mi3 yesterday. “An expanded cohort of 45-plus consumers are emerging as the most influential and powerful consumer set in Australia.”