Be more like IT: CMOs are smashed with multiple agendas but ‘less mature’ than IT teams to manage; Bega, WW, Victoria Uni, Powershop weigh in on marketer capabilities report

L-R: Report co-author Teresa Sperti, David Llewellyn, Nicole McInnes, Nathan McEwan, Bridie Cowell, Susie Howard and Billy Loizou. (Images digitally altered for effect)

The top strategic priorities for marketers this year are built around driving a growth agenda and getting more juice from their company's data as their organisations continue to digitally transform. But in this year's third annual Digital and Marketing in Focus survey of marketing, CX, ecommerce and digital execs by Arktic Fox, impediments loom large: securing budgets, nailing ROI, getting executive buy-in, building a robust data infrastructure, sourcing the skills and capabilities to implement new systems and even marketers own basic business acumen – including prioritising and making hard choices – are headwinds for their growth focus. IT teams have some answers. Mi3 spoke to CEOs, innovation, customer and marketing execs at Bega, WW (formerly Weight Watchers), Powershop, Victoria University and the Leukaemia Foundation on how they and their teams are tackling the challenges – and in some cases generating impressive results.

What you need to know:

- Driving a growth agenda, getting the first party data ducks lined up, and brand development and brand purpose top the strategic priorities of marketers, with no let up in digital transformation according to this year's Digital and Marketing in Focus study by Arktic Fox.

- Ecommerce, while not an afterthought, remains a secondary consideration in many sectors, especially FMCG.

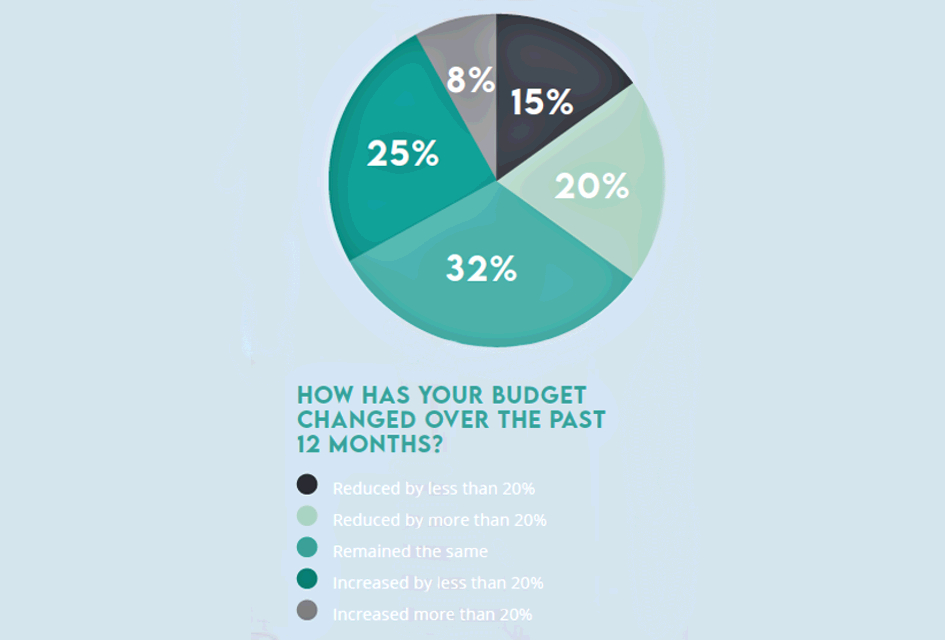

- Belts are tightening, and despite the highest inflation in years, and a still tight labour market, two thirds of marketers expect their budgets will be cut or at best they will hold the line.

- Those budget constraints, as well as a lack of available talent, and deficits in marketers own basic business capabilities such as selling their vision to the c-suite, critical thinking, negotiation and taking the tough decisions around prioritisation are key impediments.

- While recognising the importance of upgrading their teams skills and capabilities, many say dedicated training budgets are far too light: The majority either can't say how much is allocated per person or that amount allocated is less than $500 per head.

- Company leaders aren't helping with almost four in 10 marketers saying they lack leadership support from executive teams that still fall short in digital transformation expertise.

- Building first party data infrastructure is considered essential for success yet almost half of those surveyed struggle to overcome the technical skills gaps, and almost 40 per cent face the same problem across the wider martech skills.

- While there is a strong desire (64 per cent) to better leverage customer data for reporting and personalisation, marketers are just as likely to say they struggle with the problem of disparate data sources (64 per cent). And even a sizeable chunk of those who can access data say they don't really know what to do with it. But at least they are doing better than a third of their peers who don't really know what data assets they have.

- Privacy is somebody else's problem. Despite potentially radical changes to the rules over targeting and segmenting consumers, more than three quarters of marketers indicate they are not focussed on improving compliance on data privacy, And similar majorities say they are prioritising the very capabilities that have led to consumer concerns over corporate surveillance.

Most consumers are on digital platforms, so to see it [ecommerce] sitting as low as it did when we know that the traditional path to purchase is so fragmented and not linear, it was really intriguing to me that more businesses aren't thinking about how they need to be purposefully marketing to the modern consumer.

CMOs say they want to drive a growth agenda, but they need to overcome a dizzying array of impediments. That includes everything from falling or at best stable budgets, rising costs, a tight labour market, a paucity of technical and business skills, building a fit for purpose data architecture that's future proofed against looming privacy law changes, educating and convincing reluctant executive leadership teams to stump up more cash, even though marketers themselves acknowledge they struggle to win these arguments.

Two thirds of marketers expect to either see their budgets cut, or at best only hold the line despite the need to either hire and build additional capabilities to drive the company's growth agenda, to continue digitally transforming their business, and build the kinds of data capabilities that will allow them to meet rising customer expectations, while continuing to develop their brands.

These are some of the key insights from a new report released this morning by marketing strategy consultancy Arktic Fox, called Digital and Marketing in Focus, the third annual survey of its kind by the company. Three quarters of the respondents were CMOs or divisional marketing leaders with the balance drawn from CX, Digital, and ecommerce disciplines.

'Rings true'

While many CMOs say they struggle with executive buy-in, by no means are all leaders are ignorant of the challenges facing marketing. Nicole McInnis, managing director of WW (previously Weight Watchers) said the report's headline around growth and resources rang true. As the previous marketing leader at WW, and having held marketing leadership roles in companies such as WooliesX, Pandora and Adshel, she brings a personal insight into the challenges her marketers face.

Asked about the key priorities of the marketing team at Weight Watchers, McInnes said, “It is about using our budget to maximise the share of voice we can get and to then thoroughly and continuously optimise converting that to sales. That is how the BAU engine works. In addition, we have to think of inventive ways to supercharge moments to get unnatural uplift, the type that media can't buy.”

According to McInnes, “That part is where the lateral side is needed using distinctive positioning and initiatives that capture people's imagination. The best outcomes in my experience come from a mix of brilliant data synthesis mixed with sought-out serendipity.”

They have to run concurrently she said. “One is understanding every lever and adjusting them dynamically to maximise results. The other is the answer to the age-old question, ‘How are we going to stand out this year and grab some attention that we wouldn't normally get?’

For Bridie Cowell, innovation director for Bega Cheese, who overseas innovation at the company's dairy and drink business unit, the report's conclusions resonated in three particular areas; on resourcing, data and technology, and on ecommerce cultural resonance.

On resourcing for instance she describes demonstrating the incremental value that online presents to justify additional investment in people, tech and data as an important challenge, along with attracting the right talent and developing the right skillsets. Likewise, she highlights the need determine the most appropriate resourcing model, and choosing between a centralised centre of excellence or embedding capabilities within existing teams.

She favours the latter approach.

"Whilst specialist digital marketing skillsets are needed to drive the insight and understanding across business on how we best serve the omnichannel consumer, in my opinion the responsibility can’t sit solely with a single team or it can create a culture of deferral. Brand marketers need to have a digital lens to their strategic thinking and the whole organisation needs to own ecommerce to drive organisational step change."

On data and technology Cowell flagged the key challenges as the need to identify, raise capital for and then deploy the right martech tools to manage content and enable effective reporting for a business in early stages of digital maturity.

But it was the ecommerce findings, especially the fact that many of her peers in the FMCG world where discounting the importance of ecommerce, that stood out for Cowell. She said it was important for marketers to educate their organisations that online is not just about driving transactions but also brand building. "As an example, think about how many people are shopping on Coles and Woolworths online daily - that’s a huge number of views a brand or product can be getting!"

"Over 60 per cent of consumers are researching online and then converting in store within a few days. So how do you evaluate the ROI for online investment if you're only looking at your online sales, and how do you assess what attribution influence it’s had on the in-store sale? I‘m really curious about this and I think until robust data and reporting is in place the optimal level of digital versus physical store investment will continue to be debated."

Ecommerce immaturity

This study's extension this year into ecommerce, found that despite two years of pandemic fuelled digital transformation, ecommerce is still languishing with almost two thirds of respondents indicating that ecommerce is still not considered integral to the business. (To Cowell's point earlier, only 8 per cent of FMCG brands consider it so.)

As context the study was conducted early in 2023 after a horror H2 for many pureplay ecommerce companies, and at a time of significant ecommerce retreat for multi-channel businesses as shoppers returned to the high street. Australia's grocery giants Woolworths and Coles for instance bother experienced sharp reversals in the online sales, although each is still investing significantly in long term plans, especially around customer fulfillment.

According to Teresa Sperti, founder of Arktic Fox and the report's co- author along with Jo Krause, Manager, Marketing, Digital & eCommerce Six Degrees Executive, "Many brands in Australia still think about ecommerce as a stand-alone channel and the role and influence of ecommerce on other channels is less understood. The persistent belief or idea of a digital consumer and a traditional consumer is outdated, and organisations need to start to mature their thinking around the role of eCommerce as vital to serve the modern consumer.”

In the report she noted that 62 per cent of all CPG purchases are now influenced by digital (according to an Accenture study) and she said this demonstrates the impact that digital and ecommerce has more broadly on business performance and sales outcomes.

Bega's Cowell meanwhile told Mi3 that she was especially surprised to see that only 8 per cent of FMCG businesses viewed ecommerce as a critical channel for engage customers and distributing products.

"I think about our product portfolio today and where the bulk of our online sales sit, they are significantly skewed towards the majors — Coles and Woolworths. So that [8 percent FMCG result] was really surprising to me because marketers these days need to be consumer first. Most consumers are on digital platforms, so to see it sitting as low as it did when we know that the traditional path to purchase is so fragmented and not linear, it was really intriguing to me that more businesses aren't thinking about how they need to be purposefully marketing to the modern consumer."

To be fair, she said, it was also important to recognise a lot of brands where playing catch up.

"Covid kind of forced this acceleration of digital adoption. But consumers are used to that convenience now, so it's not going away. And the dynamic customer today moves between on and offline, freely and frequently - they might be browsing in store, buying in line, and then collecting in store again.

"Retailers have invested significantly in infrastructure in these spaces, so they will continue to fuel that as a growth agenda."

Key priorities

According to Cowell, there is a direct line at Bega Cheese between online channels and three key businesses key priorities; getting the foundational basics right, creating new revenue streams, and more effective omni channel planning.

"Our main focus over the last six months has been just getting our basics right in corporate grocery, which is our bread and butter. And we've been seeing the fruits of that work in terms of market share growth. One of the key things that we've been working on is a more focused online investment strategy so that we can really win that first page, search domination. And that was leveraging an insight that's available to all FMCG players, which Coles actually shared it at their recent supplier update. We know that 64 per cent of the conversion occurs on the top four products on a search page."

Cowell is not talking about Google but rather the Citrus online bidding platform used by Coles and Woolworths.

"It's critical that you're cleaning up search words where they're [delivering] poor yields and you're investing in the high search terms to really help with that visibility. So we've done a lot of work in that space, getting really focused."

Bega Cheese has also been working to improve how its products appear online. "We've updated product imagery copy that reflect high search terms to help with organic search, for example strengthening our product claims around nutritional credentials."

She describes this work as monetising every pixel on the every pixel with a digital shelf.

Bega is also building up a knowledge bank as it relates to trialing, and pack and price promotional activity across the majors grocers. "At the moment we are focused predominantly on Coles and Always website in saying that we will be looking at more broadly how our products are showing up across all of our branded websites as well. That definitely needs some love as well.

And the company is also looking at expanding ecommerce distribution to drive growth off the back of better understanding all of the places our consumers look for their products, along with more effective omni-channel planning. Cowell said this would involve "more sophisticated planning and buying via data rich technology platforms, coupled with new ways of working with our brand and retail media agency partners."

The best outcomes in my experience come from a mix of brilliant data synthesis mixed with sought-out serendipity

Business acumen deficits

The report's findings suggest that marketers are struggling to win the kinds of resource allocations they need from CFOs to meet their priorities, and soft skill gaps identified in the survey offer a clear hint about why. Managing up and across the organisation (48 per cent) critical thinking & problem solving (42 per cent) and influencing and negotiation (40 per cent) are all seen as limiting factors.

According to the report's author, Arktic Fox's Sperti, "Teams and leaders seem to be focussed on key initiatives that will drive growth – for example transformation, customer centricity, brand development, driving innovation and developing new revenue streams but skills and capabilities will hold teams back."

She called out, in particular, the difficulty many marketers face measuring return in investment and outcomes. "Nearly 1 in 3 are experiencing challenges with it but nearly 8 and 10 are trying to drive growth. How can you drive growth if you struggle to measure it?"

The ongoing gaps in commercial acumen have been consistent over the three years of the report, she said and this year it was the third biggest skill gap in 2023 study (34 per cent).

"If we lack commercial acumen we are less likely to understand the key drivers of business performance, be able to interpret financial statements and understand how best to drive growth in a way that delivers value for the organisation. We are also less able to engage with stakeholders to sell in key initiatives linked to business performance."

Making choices

The inability to make hard decisions over prioritisation is a case in point. Disciplines like IT has long settled on formal and robust methodologies for prioritising what gets done but Sperti said this is a capability often lacking in marketing.

"It's nowhere near as mature (as IT)," she said, "And what I often see in organisations is marketers are like 'we're drowning, we're drowning we're drowning', but they're not creating enough visibility of the pipeline, and just how much is coming at them. The reality is if the business can't see it, they will fill the void, rather than realising that, 'hey, we've got a real problem here.' "

"It ties back to performance, measurement, reporting, demonstrating value, all of those topics. Because if we can't measure effectively and we don't know what's delivering return and outcome, how can we make strategic choices about where to invest and where not? And this is in an environment where we've already seen in the report that 35 per cent of people have stated that their budget has been cut in the last twelve months."

"That prioritisation piece is going to become even more vital and important because it doesn't matter how convincing you are in asking for more resources, it's going to be harder to secure more resources in this environment," she said.

According to Sperti, marketers are too often too willing just to keep adding to programs, rather than making tough choices about where their efforts are generating the best returns, then wielding the knife.

It's an issue that Nathan McEwan, chief customer officer at Powershop has had to address at the sustainable energy retailer. For McEwan, who's remit covers sales, marketing, customer service and digital product, business capabilities such as prioritisation marry up to core marketing objectives such as growth.

"We are absolutely anchored in growth mindset. So being a challenger brand, we are challenged by growing consistently, which is good, but also maintaining commercial sustainability. For us there's that equal challenge. Where we are at the moment and how we go about making decisions is making sure that we focus on delivering on both of those points at the same time.

"We absolutely do not value customer growth at all costs more. Our longer term ambitions, which are [about] growing at significant scale now, have made us sit back and reset what's the capabilities we're going to require over the next couple of years."

That has led to a change in how the business allocates investments and time. "It's about what the organisation needs to look like in three years in order to unlock that exponential growth component. The linear conversation around growing 5 per cent every year, we actually do that really well. And so what we've done in that space is really optimised, automated and simplified that part so we can actually remove all the costs from stuff that doesn't really add significant value. We can still deliver the linear growth, that annual growth number, but redeploy 30 per cent of our time, effort and resources into building the organization, whether it's platforms, strategic audiences, products or system capabilities that start to unlock that exponential 10, 15, 20 per cent that growth in year one, year two, year three."

But that also means being willing to delay or jettison some projects, rather than simply adding constantly to the mix. That in turn meant building a more formal process of prioritisation, something the company has implemented over the last six months.

"The challenge that we had to overcome was that every idea or activity was a good one, and so it was about genuinely routing how do we prioritise rather than filtering"

"We have a monthly Governance Forum (made up of most of the executive leadership team) and the tools and the frameworks get applied before the concept gets brought to the Governance Forum. Then the Governance Forum reviews it, thinks about it, prioritises it, challenges it respectfully, and then those things are also reviewed on a quarterly basis around 'where are you at with the implementation based on the investment allocated and also what business benefits as per your business case, have been realised?' "

McEwan gave the example of how this commitment to prioritisation enhanced its approach to its digital sales channel, through resource reallocation.

What we actually did was reorganize investment and people from other parts of the marketing team to invest in building market leading digital capability in that channel. And as we start to release components of that program work, what we're starting to see is the digital channel now is our absolute lead channel for acquisition.

"The digital sales channel had been working very well and had been demonstrating some good growth in the last year. Twelve months ago we sat back and said, what do we want this channel to be? What do we need it to be? Not what is it today?"

As a result, the business recalibrated how much time and effort it put into it. "What we actually did was reorganise investment and people from other parts of the marketing team to invest in building market leading digital capability in that channel. And as we start to release components of that program work, what we're starting to see is the digital channel now is our absolute lead channel for acquisition. So it's now our absolute lead channel for acquiring new customers."

The end result has been a 17 per cent improvement in acquisition and performance efficiency, which translates to almost a million dollar improvement for the business, he said.

Digital Transformation

Despite almost two decades of digital transformation, and a very rapid digital acceleration during the pandemic for many organisations, the failure of leadership teams (and boards) to equip themselves with the necessary digital literacy to drive growth remains a key inhibitor.

According to the report digital transformation remains a top five priority ,"For leaders operating within organisations with a turnover in excess of $100m, the importance of digital transformation and customer-centricity is heightened, with 55 per cent stating digital transformation it is one of their top priorities for the year ahead and 47 per cent stating customer centricity is one of their top priorities."

Success however relies upon overcoming the key challenges surfaced across all aspects of the report, but the top three in particular are;

- A lack of knowledge and support at the executive leadership table

- Teams that lack the capability and skills to drive the change and implement the strategy

- And securing investment to support the transformation

Leukemia Foundation GM marketing and brand Susie Howard has at least cleared the first set of hurdles, securing funding and board sign off for a three year digital transformation that is organisation wide but has marketing at its heart.

Like many not-for-profits Leukemia Foundation took a fundraising hit during Covid. "Because we hadn't digitalised or gone through a transformation prior to COVID, we are probably a step behind in our process. But it absolutely crystallised the need to expedite this."

Howard told Mi3 Australia, "We have recently embarked on digital transformation as part of a three year plan. It's taken us six to nine months to explore, review, and build out a strategy which was built from within the business. And from there, we have redesigned a structure to align with the objectives of the strategy."

She described the project as enterprise-wide but said "What it's doing is allowing us to operationalise digital products that we have, or are about to launch to market."

Reflecting a common theme across the study, the organisation's data play is central to its transformation. "We have recently restructured our Digital Data Insights team and are focusing on the integration of the digital and salesforce data, which is our major CRM platform. [We're]making sure that we are improving our ability to tag and connect and bring that information to a central customer view so that we can absolutely target our marketing strategies."

The skills and capability gap is as much a concern for NFPs as for any business or institution, but unlike other organisations it doesn't have the option of throwing money at the skills gap. Instead has to take a smarter approach and the first step was getting past the familiar management mindset that digital transformation means less staff.

"What happens is you lose headcount in other parts of the business. Digital you invest in, and digital means more people, " said Howard.

"Yes, we have smaller budgets. Yes, the investment needs to be staggered because you're working in an environment where fundraising will ebb and flow throughout different periods of the year. But the important part is where do you invest first? And that's about looking at what's in your tech stack, what's your data strategy, what's your marketing strategy, and how do you start to work out where's the priorities now?"

She said, "For nus, our priorities are around bringing our data lake together and prioritising marketing automation. So we have seamless experiences across all of our stakeholder groups. That's where we're starting. It's a three year strategy, and we just have to phase it. That's the only way that we can digest the cost of digital transformation."

What does success look like?

Arktic Fox's Sperti identified... what she regards as the common characteristics of organisation that have tamed the digital transformation dragon. These include;

- A citizen level of digital literacy across the leadership team – leadership teams understand the shift in consumer behaviour, the impact on their business and the importance of digital to compete in the digital age

- Strong alignment around a common vision and an interconnected strategy with key strategic choices made

- A real commitment to stay the course – an understanding that to change this is a multi-year endeavour – not a short term strategy

- Willingness to embrace being uncomfortable and knowing that you don’t have all of the answers. That also requires a keen willingness to learn and keep an open mind

- And you need to commit from an investment perspective – and those investment levels need to demonstrate a commitment beyond just an appetite to transform.

Many companies have a long way to go, it seems.

Sperti said that when they delved into the most difficult aspects of digital transformation, it became clear that knowledge and capability present some of the biggest challenges. The lack of knowledge at the executive leadership table topped the list of digital transformation difficulties marketing and digital leaders face, she said.

That is borne out in the report. "Whilst 39 per cent of all respondents cited executive leadership knowledge and support as a challenge they are finding difficult to navigate, this rose to 45 per cent of leaders operating in organisations larger than $100m. This should serve as a wake up call for executive leaders across the country. Digital transformation requires investment, focus and alignment at an executive level and the need for organisations to play the long game, all of which do not happen if executive leaders lack knowledge and understanding of what it takes to digitally transform."