The ‘anti-consultancy’: OMD CEOs prove naysayers wrong, set new direction with behavioural science, UX, CX first of ten new products in push to break agency mould – say rivals still conflicted on tech

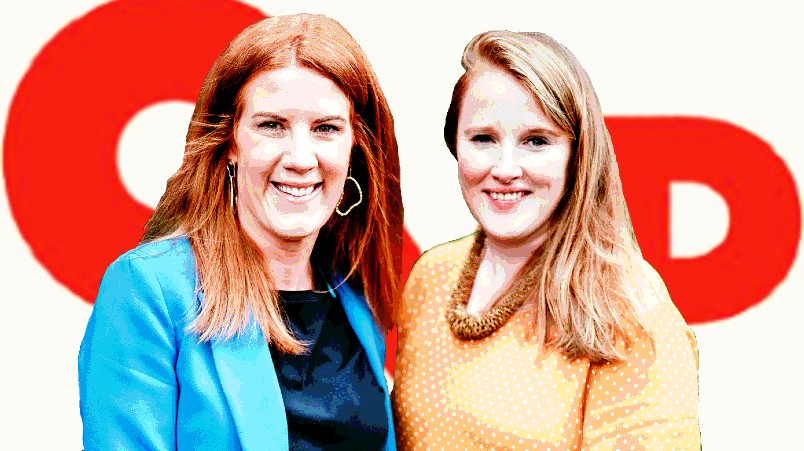

When Aimee Buchanan jumped ship to arch rival GroupM, the knives were out for OMD’s joint CEOs Laura Nice and Sian Whitnall who stepped up to take charge of Australia's biggest media agency network. “The only way is down,” per one nameless exec. One year on, they’ve so far proved the doubters wrong, retaining Coles and landing the consolidated NSW Government account, where a new behavioural science unit helped nudge the business over the line. By 2025, they’re aiming to launch ten similar new products in a push to break the media agency mould, with CX and UX top of the agenda. Unlike some rivals, they’re uninterested in going toe-to-toe with the big consultants eating market share, while suggesting rivals remain conflicted on tech recommendations now driving a big chunk of their cash. They think a very different leadership style to the previous regime is now paying off, and have even accepted the so-called ‘twats’ model – staff mostly in Tuesdays, Wednesdays and Thursdays – is working.

What you need to know:

- A year into the top job, OMD co-CEOs Sian Whitnall and Lauran Nice have so far proven the doubters wrong. Now the duo are plotting major diversification.

- They aim to build circa 10 new products by 2025. At that point, perhaps 40 per cent of business will be outside of the traditional media agency remit.

- Three are already in play, including a behavioural science ‘nudge unit’ that helped land the consolidated NSW government account.

- While some holdcos are countering incursions by big consultancies by emulating them, Whitnall states OMD is the ‘anti-consultancy’ – because it’s there for the duration, not hit and run project delivery.

- Meanwhile, tech agnosticism means that the agency is less conflicted that rivals – “because that is not where we are making our cash”.

- Get the story direct from the bosses via the podcast.

When we got announced, there was the haunting comment of some faceless person in media saying the only way was down. But I guess that's the bit that keeps us up at night.

When Laura Nice and Sian Whitnall were appointed co-CEOs of Australia’s biggest media agency, the knives were out and sharpening stones whirring. “’The only way is down,’ as one faceless person in media put it,” recalls Whitnall. Former boss Aimee Buchanan had jumped ship to GroupM and taken right hand man OMD COO Nathan Young, with her. The talk in some quarters was that a lack of immediate succession planning could come back to bite Group CEO Peter Horgan while others pointedly asked whether two bosses ever really works.

Then came the heavy pitches. A big slice of business, the NSW government was aiming to consolidate with a single holdco. Then Coles came into play. All the while as OMD – and every other agency – grappled with staff disrupted and displaced by Covid and record vacancy rates piling weight onto the collective workload.

A year on, they’ve proved the naysayers wrong, seeing off intense competition for Coles, with some help from Deloitte, and taking the entire NSW government account with a new behavioural science component helping to get the deal over the line. Now the duo are reshaping the agency’s future – and sleeping a bit better at night – while Horgan’s faith appears vindicated.

It’s just a very different time and what is required is a very different [leadership] skillset as well.

Different approach

OMD was powering under Buchanan, though the styles differ. The previous regime was seen as more centralised and hierarchical. Nice and Whitnall appear to be ceding more power to the people. While part of that strategic shift is a function of post-pandemic reality – the duo’s specialisms hint at OMD’s future roadmap.

“I think it’s just a very different time and what is required is a very different skillset as well,” says Whitnall in response to questions around the duo's leadership style and structure versus OMD under Buchanan.

“As to why we were put in these roles, we offered two completely different skillsets that are coming together to set us up for future success and deliver that sustainable growth,” she adds.

“Laura is a black belt in developing client partnerships. My background is product and strategic product overlays. So if we're talking about how do we evolve the entire agency offering, it's the focus of those two skillsets that is going to set us up for success. Which is a very different ask of where we were two, three, four years ago.”

So the management style is markedly different?

“Well, yeah,” says Whitnall. “But you would want it to be, because we're operating in a very different market in a very different time and with a very different need to deliver for the business.”

Nice backs that view – and says the new set-up is starting to relieve pressure, though there is a way to go yet.

“Our leadership style is about the empowerment of the executive team and we've structured it in a way that mirrors our partnership – in terms of looking at product and looking at clients – so that we can deliver it through the business,” she says.

“So the partnerships continue throughout our structure and what we're seeing is those teams really step up, take accountability and drive the ambition through to our clients’ business and drive the sustainable growth that we keep coming back to.”

Rebuilding people, direction, offices

Bar some Covid cases, almost all of OMDs 677 staff recently hit the Gold Coast to get a glimpse of a future Nice and Whitnall say goes well beyond media (they’re targeting ten new product launches within the next couple of years).

The all-staffer was also to reassure the group’s teams that the future is not endless pitching and all hands on deck retention. “Sustainable growth” is the mantra, “because if you’re trying to win at all costs, then that comes at the cost of your people,” says Whitnall, “and that is not something we are willing to do”.

“Borderless agency” is another maxim, one upside born out of pandemic necessity. The geographical and client lines between Sydney, Melbourne and Brisbane offices “have been massively blurred”, says Nice.

Enforced home-working contributed to that outcome. But like all larger firms, OMD has had to grapple with bringing teams back together physically, without dictating terms and while increasing headcount 12 per cent over the last 12 months. While in the early days of post-pandemic it was seen as more prescriptive than some holdcos in trying to drive staff back into the office, that stance appears to have softened.

“The only mandate that we have is that you are coming together for those ‘meaningful moments’ and making sure that we are building teams that are sustainable – that you're really driving the best of the peers that you're working with,” per Whitnall.

The upshot is that for many, Tuesdays, Wednesdays and Thursdays is now the defacto standard.

We're measuring output, we're not looking at who's sitting at a desk at any given day.

Outcomes not bums

OMD has a shiny new Sydney office in Everleigh. It’s about a quarter full Mondays and Fridays, through 90 per cent upwards Tuesday through Thursday according to Nice. Brisbane is 90 per cent full everyday, she says, “they all love being together”.

“But for Sydney and Melbourne … they're designing the week accordingly and working with the rhythm of what people want … We're measuring output, we're not looking at who's sitting at a desk at any given day,” adds Nice. “But then last week [at Everleigh] we were running out of seats.”

Nice says that set up reflects brands’ own teams.

“Clients are not getting those numbers back in the office … so when we were coming back, we asked the teams individually to work out the right rhythm for them, but also their clients. And that varies, for McDonald’s where all the agencies come together two days a week either at OMD or DDB – they are two quite specific days. For Apple, teams are doing international calls because of the time zone, so they work from home on a certain day because it works best with time shifting,” she says. “It’s not one size fits all."

Plus, she says, having some empty desks is proving useful: “A lot of clients are coming in now and probably spending more time in our offices than they are in their own.”

[Recruitment success] has been the biggest challenge because you're relying on the existing OMDers to train these people up and also keep them – but also manage the gaps that are happening.

Talent wars

OMD churn is “aligned” with the MFA headline rate (last year north of 30 per cent during the pandemic crunch, historically 20-25 per cent) which Nice says is “high for OMD, because we have always been below that benchmark”. They’re working on it – hence the fixation with sustainable growth – while refilling the tanks with circa 70 hires over the last 12 months.

But in the short-term, recruitment success causes its own problems.

“It has been the biggest challenge because you're relying on the existing OMDers to train these people up and also keep them – but also manage the gaps that are happening,” admits Nice. “So that's something that we've been really focusing on”.

The industry-wide talent crunch has forced agencies to broaden their recruitment pool, though poaching remains rife. Whitnall thinks those tactics risk leading agencies down an evolutionary dead end: “If we are only bringing people in with the same media capability … and the same backgrounds, then you're going to get a very one-sided product."

If our job is to help drive performance and business outcomes for our clients, their needs are diversifying. [That necessitates] new capability, new services and we are bringing in new ways of working. Which means the OMD of 2025 will look very different to today.

The future: 'Very different'

The Gold Coast jamboree (at Sea World, “Village Roadshow is a client after all,” per Nice) gave staff a glimpse of the future vision. Nice and Whitnall are not yet ready to go public, but like everything media and marketing post-pandemic, it involves transformation. Whitnall says OMD’s global boss George Manas, who took the top job exactly a year ago, provides a frame of reference.

“He’s got a digital transformation background and a digital transformation agenda,” says Whitnall. How that plays out locally will become apparent. But she insists OMD Australia will “not move away from our bread and butter of media, that is not on the table”.

That said, change is afoot. While it wants to hold the core, the two are making crystal clear that diversification is top priority – and it could be that non-traditional services make up 40 per cent of the business by 2025.

“If our job is to help drive performance and business outcomes for our clients, their needs are diversifying … and the way the services and the skillsets and the way that we navigate a fragmenting consumer, media and communications landscape is changing on the daily”, says Whitnall.

That necessitates “new capability … new services and we are bringing in new ways of working. Which means that it will all ladder up to the OMD of 2025 looking very different to the one today.”

Ten new services incoming

Transformation work is already underway.

“This year alone we’ve added three new capabilities to the business, behaviour change and behavioural science is one of them. We've also got a lot of focus on UX and CX and customer journeys. But then there's also things like data as a service that we're offering, so that's the starting point. But can I tell you what those service offerings in the future? No, because we're not there yet," says Whitnall. [But] the needs of today are going to look very different from tomorrow – and I think the proof is in the pudding.”

She points to NSW Government by way of example, where OMD lifted the template for the behavioural science unit built for the UK government (David Cameron’s famed ‘Nudge Unit’), which ultimately helped to land the consolidated account. Which likely means the citizens of NSW can look out for subtle mental shoves from Perrottet and co as the powers that be bid to change collective behaviours.

By 2025, the Nice and Whitnall aim to develop circa ten new services, many leaning on data and tech, where all holding groups now claim a capability lead. But Whitnall reckons OMD stands apart, because it doesn’t have a technology dog in the fight for margin growth.

“Aside from transparency, I think the biggest differentiator is that we don’t own technology, so we can come with a really agnostic viewpoint. We can use whatever you want in whatever format; whether you own it or borrow it doesn’t matter to us, because that is not where we are making our cash.”

A consultancy model by nature, consults. It gives you a perspective and then steps away or delivers a project. We are the anti-consultancy model when it comes to data and tech ... we are having an agnostic conversation, because there is no skin in the game for us.

‘Anti-consultancy’, non-conflicted

While some holdcos have reacted to consultants cutting their lunch by trying to become more like them, OMD takes a different view.

“This isn't a consultancy model. So many brands work with consultancies for data and technology services, but we are the anti-consultancy model when it comes to data and tech,” says Whitnall.

“A consultancy model by nature, consults. It gives you a perspective and then steps away or delivers a project. We're not there for the short-term, we're there for the long-term. We're there to not only drive the initial outcome … but to make sure that the whole of the communications funnel is being leveraged – and that is a main differentiator,” she adds.

"We are having an agnostic conversation that is always omnichannel and it’s always coming from a place with utmost integrity – because there’s no further skin in the game for us.”

Predicting your McDonald's order

Nice says McDonald’s is a prime example of that long-burn, anti consultancy approach, nodding to Mi3’s recent podcast with CMO Chris Brown. "We’ve been working with Macca’s for a long time, but over the last three years [a big part] has been how we’ve been using our capability with Annalect, which is the data, tech and analytics part of our business. And they are not a bolt-on, they are the absolute opposite,” says Nice.

“They are the engine that is powering the capability through the McDonald's business and it brings Sian's point to life – it is such an integrated, core part of what we do.”

Nice points to McDonald’s Monopoly MFA Award for best use of analytics and data as evidence that the campaign “is a piece of work that keeps on giving, because we are constantly evolving it”.

“It gets submitted every year because we're constantly learning from the data. We're then taking those insights and it's then fuelling our planning as well, so it's having a halo impact. We've got two million active customers every month, so we can understand their buying habits and then we can predict what we think they're going to buy, what their behaviours are,” says Nice.

“That becomes a really tangible output. It becomes something that you can put a commercial figure on and you can keep growing and expanding and learning.”

Outlook: navigating chaos

Much of the market is nervous about next year. Some analysis suggests brands are already pulling back, though that is not borne out by SMI figures. Whitnall says OMD is “not forecasting any big swings” in terms of overall investment, but suggests CX will become a major focus for many.

“I think what is keeping most marketers up at night is the level of competition each of their businesses will be facing into. If you think about the economic uncertainty … they are fighting harder to retain their own customers but also to steal share from other businesses. Then it becomes about doubling down on customer experience … which then sees an increase in interest in personalisation and the relevant investment there.”

The media aspect is navigating fragmentation that continues at pace, with Netflix now taking ad dollars and the “commercialisation of multiple SVOD services” such as Binge and Disney+ coming thick and fast.

“That's a lot to navigate because you will see more fragmentation of investment at a time when consumers and brands are wanting to do more consistency and experience. Those two things are complete polar opposites. And our job is how do you weather that storm and how do you kind of mitigate the chaos?”

I reckon 60 per cent [of OMD business by 2025] will be in the traditional space and then we’d be looking at 40 per cent outside of that.

Where OMD ends up: 60:40 media?

Amid fragmentation and transformation, where does Australia’s biggest media agency end up in terms of traditional planning and buying versus diversified services? Nice and Whitnall have a similar but different view on what 2025 looks like.

“I reckon 60 per cent will be in the traditional space and then we’d be looking at 40 per cent outside of that,” per Nice.

“My perspective is you will probably find it’s still 70-80 per cent traditional media – if you’re looking at dollars from media investment,” says Whitnall. “But what we are doing to that investment will fundamentally change … By that I’m talking about the different thinking and different supporting services we are ultimately delivering to change the outcomes we are driving within that investment. So, we’ve got different perspectives, but the outcome is the same: We know that we need to evolve.”