‘We’re already seeing brands cut spend 15 per cent, inflation driving whiplash effect; marketing and finance must prepare to accept lower ROI’ – Mutiny CEO

Inflation plus ad spend pullback means the plates are going to start wobbling, and ROI numbers harder to hit, warns Henry Innis (left). Adam Beaupeurt joins him and Matt Farrugia in bid for scale.

Across a billion dollar Australian ad pool, there is evidence of a double-digit pull back in media spend already underway – it's just the lag in traditional indicators, including government data, is yet to show the full effect at play, reckons Mutiny boss Henry Innis. He said rising inflation compounds the market impact and warned that ROI has already become harder to achieve for many. That means marketing and finance teams need a new growth plan and a different set of numbers, especially if they are cutting budgets. Meanwhile, the firm has some global growth plans of its own.

What you need to know:

- Mutiny data shows a double-digit deceleration in ad spend is already underway.

- Combined with “massive inflation”, that creates a “huge whiplash effect,” per CEO Henry Innis.

- ROI numbers will need to be adjusted, he warns.

- Marketers that have the data need to weaponise it, or at least politicise it internally to defend budgets, suggested Innis.

- Meanwhile, the firm has rebranded to Mutinex in bid for global growth.

The market is starting to spend less on advertising. Christmas will help, but we are floating around 10 per cent deceleration. People are starting to decelerate ad spend while Australia is already grappling with massive inflation – and that is a huge whiplash effect.

Jaundiced outlook

Government data is too slow to accurately gauge the economic temperature in Australia as inflation bites and brands have already started pulling back as inflation curbs their ability to grow and crimps ROI, according to Mutiny boss Henry Innis.

Speaking at IAB Australia’s Measure Up conference, he said the firm’s real-time data on marketing spend across a billion dollar pool finds that some Australian brands have already cut marketing expenditure by circa 15 per cent.

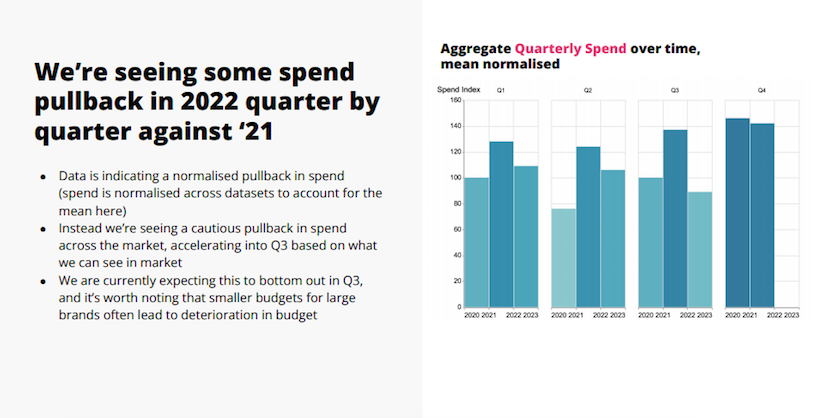

“That is an aggregate market view and different advertisers are pursuing different strategies,” said Innis. “But the market is starting to spend less on advertising and the deceleration is flowing – in Q3 [2022] it’s close to the 10 per cent mark,” he later told Mi3. “Christmas will help. But we are floating around 10 per cent deceleration, people are starting to decelerate ad spend while Australia is already grappling with massive inflation – and that is a huge whiplash effect.”

While he predicted Q3/Q4 will see those impacts “bottom out”, Innis said it could take until Q1 next year when cash rate rises should offset inflation impacts, provided Christmas spending doesn't push inflation higher.

Innis: "This chart shows aggregated quarterly spend, mean normalised. Basically 100 is customers' benchmark normal spend from that period ... and quarter by quarter, we're seeing some very real deceleration."

Data discrepancy

Senior media buyers told Mi3 they have not seen that level of pullback, though many are nervous about the first quarter next year and beyond. Innis insisted the Mutiny data is accurate and based on actual spend and prices paid. The firm claims its platform runs the rule over a billion dollar-plus spend pool in order to determine which investments are working, and which are not. It is now bringing in inputs such as wheat, energy and other commodity prices to get a sharper macroeconomic picture.

“Government data is too slow to keep up, it is not accurately reflecting the rate at which inflation is hitting the economy and that's causing the indicators to lag,” said Innis. “When we were using government data, it just didn't have as strong predictive effect as real world market commodity price indicators.”

At the Measure Up conference, Innis presented data outlining the aggregate picture across the 22 large brands now on its books.

“We're seeing some very real deceleration in terms of how brands are spending and their spend patterns. For some, it's 15 to 20 per cent reduction … We've definitely seen a fairly large pullback in the ad market that we expect to bottom out Q3, Q4,” Innis told delegates.

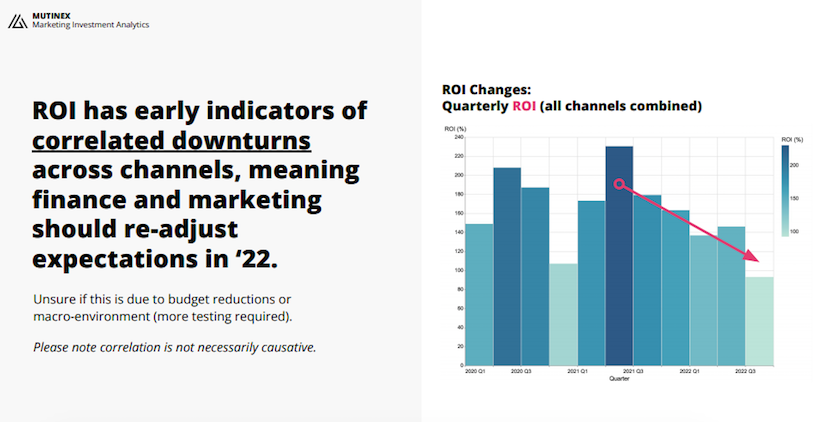

Innis: "With inflation, we're seeing a downward trend. Correlation is not necessarily causative ... We don't know whether or not that ROI is being driven by inflation ... But we think finance and marketing should be reducing their ROI expectations."

ROI adjuster

The upshot is that marketers might need to convince finance to accept lower ROI for the foreseeable. ROI, said Innis, “is not always the best metric to optimise against anyway”, particularly for scaled brands.

“If I am a very large brand and I want to get a really high ROI number, my best option is to cut my budget to a thousand dollars and spend it all on search – then I would have amazing ROI, but no market share,” said Innis.

With a downward trend in spend and an inflationary environment, while caveating that “correlation is not causation”, Innis said that media budget cuts beyond a certain level will erode return on investment. The firm is now advising clients to maintain spend, but “accept a lower ROI number to maintain marketshare,” said Innis.

“Finance and marketing teams should be reducing their expectations for what is a reasonable ROI going into a recessionary environment … We think that's a better way to operate in the macroeconomic environment at the moment.”

While that’s a hard sell, another variant of many ‘maintain spend in recession to win’ arguments, Innis suggests brands with robust data that underlines marketing’s impact on sales – and that is credible with finance – have a greater chance of success.

“I think that's the really critical thing here. If you have the data, data can be as much political in organisations as it can be useful.”

We talk to VCs and they have been really helpful, but I don’t think we need to raise money. And no [we're not thinking about selling] ... We’re only at 10 per cent of where we want to take this business. There’s a lot of runway.

Global push

Innis and co-founder Matt Farrugia are now bidding to take Mutiny and its War Chest platform, rebranded as Mutinex and GrowthOS, global. There are no plans to sell despite rumours large consultants are sniffing around as MMM M&A heats up. Rival Blackwood Seven was earlier this year acquired by WPP-owned Kantar, with Analytic Partners now part of private equity firm Onex’s US$7.2bn portfolio: “We’re only at 10 per cent of where we want to take this business,” said Innis. “There’s a lot of runway.”

Innis becomes global CEO, and will support the likes of John Sintras in the US while attempting to scale the platform in other markets. Locally he claimed the firm’s top line is “tracking between 20-40 per cent growth quarter by quarter”.

That level of growth – with Intuit, MYOB, Bupa and Mars Australia the latest brands to license the platform – has meant the firm can increase headcount without burning through cash already raised.

Farrugia becomes Chief Operating Officer, while Adam Beaupeurt, who founded data-tech agency BBE and then became MD – Digital at Hero after selling to Ben Lilley’s group in 2020, becomes Chief Commercial Officer. (Beaupeurt has been advising Mutinex in an unpaid capacity for two years.)

Other new hires include Don Li as Senior Data Scientist (ex Rokt), Alex Kosheliev as Senior Customer Data Scientist (ex Data Robot) and Claire Bertolus as Head of Growth Marketing (ex Bupa).

VC veto

Innis said Mutinex plans to double headcount in the next 12-18 months, and ultimately aims to scale to 200 people globally. He stated the firm is unlikely to tap venture capital any time soon, despite product investment. "We talk to VCs and they have been really helpful, but I don’t think we need to raise money."

The next technology push is into “vector search” to power the types of investment recommendation engines "used by the likes of Netflix and Amazon" for content and commerce.

Does that mean it aims to automate media planning?

“No, I don’t think so. What we want to do is help people find the right decision better and surface the right decision, particularly a decision they may not know exists,” said Innis. “You can't replace the human ingenuity agencies bring. But you can bring a decision forward which will help those businesses work more effectively.”

He’s killing it – he’s John Sintras.

Quietly confident

Cracking the US is a rock that has splintered many ships. But Innis is confident, with Beaupeurt coming in to build the processes to enable global scale. “Particularly on sales, commercial and the customer success side of things, looking at automation and making sure processes are really well organised, alleviating some of the pressure on Matt and Henry,” per Beaupeurt, who will predominantly focus commercially on the domestic market, at least in the short term.

Farrugia will be handling operations – and culture.

“Ultimately, this business will be built by having 200 of the best people aligned, solving the biggest and hardest problems in growth. That's how we will create a category defining business,” said Innis. “That requires someone with immense EQ. If you have met Matt, you will know that he has that immensity.”

Mutinex has reasons to be confident of securing US bounty. One is John Sintras, former Starcom chief, who worked state-side as part of Henry Tajer’s IPG talent raid back in 2015.

Another could be Nick Garrett, an early Mutiny investor and now Worldwide Lead, Marketing and Commerce Practice at Deloitte Digital, who will be spending a significant amount of time in the US as part of his new gig.

“[Garrett] has been a phenomenal mentor,” said Innis. “He’s still a pretty large shareholder.”

Sintras has been in New York since early last month tasked both with leveraging existing contacts, and hitting the outreach numbers for a business laser-focused on metrics and targets. How’s he tracking?

“He’s killing it – he’s John Sintras,” said Innis. “I couldn’t be more confident we are going to crack that market with John at the helm.”