Mi3's top media stories of 2022: The rise of retailer media, the race for attention metrics, BVOD frequency fails, countermeasures, Netflix noise – and who’s got the biggest identity graph

Retailer media made all the running in 2022, at least within Mi3's top 25 media stories of the year. The main TV networks copped flack for BVOD frequency capping fails, and seemingly struggled to agree on their marketplace masterplan. Meanwhile audience IDs became the new arms race, with News and Nine going head-to-head. Here's the big hitters, featuring: News Corp’s Pippa Leary and Suzie Cardwell, Nine’s Michael Stephenson and Liana Dubois, MCN’s Mark Frain, Seven’s Kurt Burnette, TikTok’s Brett Armstrong, Amplified Intelligence’s Prof. Karen Nelson-Field, OMA’s Charles Parry-Okeden, JCDecaux’s Essie Wake, Broadsheet’s Nick Shelton, Omnicom Media Group’s Peter Horgan, Cartology’s Mike Tyquin, Sonder’s Jonathan Hopkins, Uber’s Lucinda Barlow, Dentsu’ Mark Byrne, Hatched’s Jack Byrne and Coles 360’s Paul Brooks and Jess Torre – and more.

25.

The way way we get people in here is through SEO. And it's through a really distinct way of dealing with SEO. There's no pretty pictures, it's hard information – and that is what you do as you are moving high intent audiences through. You're not really looking to be entertained. You are looking for specific information.

News Corp's Pippa Leary: "What you're going to see News doing in the next couple of months...is get really focused on mid-to-lower funnels ."

News Corp has taken a few tips from its consumer wagering business and is galloping into credit cards, home loans and car and personal finance with a consumer product comparison site designed to generate highly qualified customer leads for brands and tap lower funnel, or performance marketing budgets that have driven much of the growth of tech-media platforms. It’s also tapping a more frugal consumer mood – 68 per cent of 2,500 recent News Corp survey respondents say they have already looked to save on bills, utility and fuel costs.

24.

We've got a significant advantage when it comes to a cost per acquisition. So if it gets tough for a while, it's going to be great for Stan versus the rest of the market.

Nine boss Mike Sneesby on inactive Stan customers: "If it gets tough for a while, it's going to be great for Stan versus the rest of the market...Stan has over 7.5 million accounts on the platform with credit cards."

Just when News Corp finally had its nemesis pipped as the media group with the largest database of audience IDs in the country – 16 million – Nine last week doubled down. After bumper FY22 financials, Nine said its group-wide audience database now held 20 million IDs but signalled its early move into “people-based marketing” – those logged in and known – announced two years ago at its upfronts presentation, had seen slow take-up from blue chip advertisers although was set to turn. Nine CEO Mike Sneesby pointed to Stan’s 5m sleeper customers, ready with credit card details, as a competitive edge as households reduce their subscription streaming services in the current economic cycle.

23.

The sector isn’t try to force advertisers to buy programmatically. It is however facilitating the opportunity and giving brands additional strategic capability across the medium. At the moment in Australia, programmatic is less than 5 per cent of [DOOH] spend. If you don’t want to buy it that way, well you have a choice.

Programmatic out of home makes up less than 5 per cent of the Australian digital OOH market, but is tipped as the next major growth area by agencies. Supply side players are making a landgrab for scale and the demand-side platforms globally are moving rapidly to integrate 'pDOOH' into their stacks. But there are concerns that the "tech tax" and opacity that continue to plague broader programmatic may be repeated. Agencies are questioning "50 per cent-plus" price premiums attached for programmatic flexibility, and whether larger advertisers are better off steering clear. More mature markets suggest otherwise.

22.

Facebook/Google customer match, LiveRamp IDs, any cookie-based IDs would be exactly the sort of thing the proposal in the Discussion Paper would be trying to include.

In a change that would have profound implications for the $13 billion digital advertising industry, the Federal Government is looking to define what counts as “personal information” in its overhaul of the nation’s privacy laws. Experts say the proposal in its most recent Discussion Paper, however, would include any digital identifier that is assigned to a specific user – even if the user isn’t explicitly named. That could cover most post-cookie ID initiatives currently being developed and even Facebook and Google’s audience matching platforms. Salinger Privacy's Anna Johnston, Bird & Bird partner Sophie Dawson, ADMA's Sarla Fernando, Luxury Escapes' Willem Paling and Guardian Australia's Dan Stinton weigh in on what brands, agencies and media should know.

21.

We don’t see any non-attention [within cinema]. That means there is zero waste. So 100 per cent of the time, 100 per cent of people are sitting there watching the ad or they are passively viewing it.

(L-R) NAB's Thomas Dobson, Amplified Intelligence's Karen Nelson-Field, Val Morgan's Guy Burbidge, OMD's Penny Shell, Hatched's Andrew Pascoe.

First Nine claimed massive active attention for BVOD ads playing on mobile devices, 72 per cent for a 30-second commercial, per its Amplified Intelligence’s study. Then came Val Morgan's version from the same outfit – and it suggests cinema blows other channels out of the water for active attention, with no wastage and zero decay across the entire length of an ad. As attention metrics gain momentum globally, Amplified's CEO Karen Nelson-Field warned marketers not to let themselves get gamed by those touting cheap, “dirty” attention CPMs while addressing the naysayers on the march of attention metrics. Locally, the likes of NAB want to bring attention data into econometric modelling; agencies are already using it to re-weight channel spend and show marketers that their share of voice models could be way off.

20.

[TikTok are] launching shopping next year. If you think about how far ahead Meta is on things like that … once all that is launched, they could be unstoppable.

TikTok's Brett Armstrong and PepsiCo's CMO Vandita Pandey.

TikTok in October entered the upfront circuit, rapidly becoming a crowded, nightmare month for razzle-dazzled-out trade hacks. It threw out a few big (and highly questionable) stats around how its users have cut TV and streaming time since it arrived in Australia, while refusing to disclose its local numbers (audience, revenue and staff) but had some ringing endorsements from blue chip brands. The most aggressively expansionist media-social company in market at present – it is said to have an Australian team of circa 300 – also rejected industry conjecture that its huge hiring blitz, where a new employee can double their package overnight, was facing a churn challenge because of aggressive revenue targets. “There’s no issues on churn,” TikTok’s local boss Brett Armstrong told Mi3. “At the moment we’ve got a really stable team and very low attrition.”

19.

I wonder if television networks realise what’s coming.

“Everyone wants in. They are going to be absolutely bombarded. There is going to be so much interest. But not everyone will be able to sustain that given the price,” one agency exec said of Netflix's ad plans.

As the launch of Netflix's ad-tier loomed, media buyers said the platform was likely to book tens of millions of dollars in upfront commitments in Australia, offering big discounts for those committing to spending early. Prices per thousand viewers – known as CPMs – are around $45 to $50 for agencies and $65 to $80 for casual advertising partners. There’s also a pricing push for 30-second ads over 15-second versions, though both will be allowed. Netflix will target the 100 million people globally “stealing” access through shared log-ins to build its advertising audience.

18.

The large publishers secured a significant new revenue stream and they have based investment decisions on that. In three years time they will have to gut their businesses if that is no longer available to them. At that point they may be pushing for designation.

Australian media outlets that have used north of $200m extracted from the platforms via the Federal Government's Media Bargaining Code to increase headcount and fund new products, are facing the prospect of it turning to dust just 18 months after Google and Facebook were forced to pay news publishers for their content, a world first. Facebook has made clear its disdain for the bargaining code, now a template for publishers and regulators internationally, by boycotting formal code review meetings with Federal Treasury and Australian publishers. It is pulling away from news and re-engineering its feed – publishers expect up to 40 per cent declines in Facebook referral traffic as a result. Many now believe it is highly unlikely Facebook will strike any more deals or renew any of those struck two years ago – and that Google is also starting to play hardball for the next round of funding.

17.

Most negotiators will be looking to maintain flexibility with so much movement of audience and performance. There will be less upfront and more scatter.

All Australian line-up: Nine sales chief Michael Stephenson, Nine CEO Mike Sneesby, and the media company’s first CMO, Liana Dubois.

Linear television was almost absent in Nine’s 2023 upfront presentation as it finally shed its historical roots as a TV broadcaster and embraced its future as a unified media company. The old monarch of TV – still Nine's biggest cash cow – was all but usurped publicly by Nine's federation of diverse media assets covering publishing, radio, connected TV and unified users and data. But clouds are looming for Nine and its rivals as media buyers signalled yesterday that economic uncertainty and audience volatility – particularly in linear TV – meant they could withhold the largest pot of advertiser budgets in decades from year-long spending pre-commitments, known as the "float", or the scatter market in US TV parlance. Buyers want to ensure flexibility in following audience changes through 2023 and pressure media companies into better ad rate positions by going short for next year.

16.

The next piece [for retailer media] is to work with what we call non-endemic suppliers. They are clients that are not supermarket or BIG W suppliers.

L-R: Cartology boss Mike Tyquin, Woolworths Group CEO Brad Banducci, Shopper Media Group CEO Ed Couche.

Woolworths has firmly dealt itself into the media sector as a powerful new operative and is making a play for non-FMCG and supplier advertising dollars after its Cartology unit in July acquired Shopper Media Group for $150 million – along with its 50 employees and 2,000 digital screens across 400 shopping centres. Woolworths CEO Brad Banducci said the purchase shows how retailer media is “developing rapidly” and is an “important part of the evolution of Woolworths Group”. It's likely a double-edged sword for Seven CEO James Warburton – his investment in Shopper Media in 2019 has paid-off handsomely. But he now has an advertiser client and a new competitor, all in one.

15.

It takes hard work, dedication, and resilience to consistently deliver to your client’s needs at the highest level whilst at the same time navigating our dynamic and complex media landscape. Those of you who have mastered the art are being recognised this evening.

2022 Media i Awards winners: See the full list, including National Sales Team of the Year, here

Nine topped the list as the country’s most recognised company at the annual Media i Awards, which celebrate media sales excellence – as voted by thousands of media agency staff. JCDecaux, oOh! Media and ARN followed. See the winners here.

14.

We've got to develop a different set of skills and capabilities.

Personallised bubbly: Moet & Chandon first to trial News Corp's "shoppable video" unit connecting e-comm platforms within the content to complete transactions

As Google, Woolworths-owned Cartology and Shopify prepare for an advanced grocery e-commerce trial on YouTube, News Corp has cracked a shoppable video advertising and content format which lets users complete a purchase without leaving the content they are in. Uncharacteristically, the media giant will share the new tech with rival publishers and ad agency groups and will also let the shoppable video unit, which plugs into major e-commerce platforms including Shopify, Salesforce and Adobe, trade in programmatic advertising exchanges. Moet & Chandon is an early launch partner and up to 30 advertisers could be trialing the new format by year’s end. News Corp expects the initiative to help drive a 50 per cent increase in affiliate revenues, where it clips the ticket on transactions, each year to 2026. Conversion rates in trials are upwards of 25 per cent.

13.

We expect the retail media explosion to continue. There's a long list of challengers to the top five as they start to get their act together, value what they have and then work out how to leverage it.

Woolworth's-owned Cartology might have made the early running in building its $300m supermarket media unit in a category with commercial potential of $1bn but the broader "owned" media sector - media assets owned by brands including websites, apps, email and stores - is four times bigger than grocery and liquor at $3.9bn, according to a benchmark report from media valuation firm Sonder. "Aggregated’ retail" - think Officeworks, Big W, Myer and JB Hi-Fi - is a bigger prize than supermarkets and Sonder's calculations of owned-media margins in the 80-90 per cent range are turning CEO and CFO heads. That could alter the balance of power between marketing, sales and merchandise, and potentially change the dynamics between paid, owned and earned investment.

12.

I felt as a sort of conspiracy theorist advertiser, ‘oh, my God, Channel Nine is actually throttling this experience to make it so shit so that they're keeping free to air as long as possible. That is what goes through my mind.

“The experience for advertisers is nowhere near the nirvana that was presented earlier," Uber's Lucinda Barlow (L) said. Optus' Nicole Smart (R) said better targeting would put BVOD "back on par" with competitors.

A feisty session at the Future of TV forum in April saw two big brand marketers deliver some frank advice to the major television networks: more money will flow to YouTube if they don't fix the "shit", repetitive ad experience for viewers on their video on-demand platforms. Uber’s APAC marketing boss (and former Google exec) Lucinda Barlow and Optus media ops lead Nicole Smart said poor ad frequency capping, credulous ad effectiveness reporting and expensive independent verification meant they were restraining BVOD budgets or flipping spend to rivals like YouTube.

11.

There will be lots of restrictions on types of advertising. You can imagine what type they look for – they don’t want ‘Down, Down’ and ‘chickens are five dollars’. They want brand ads, storytelling ads.

Ahead of launch last month, Netflix was briefing media buyers on plans for its Australian ad-tier: four minutes of ads per hour, mid rolls on series only, 15 and 30 second pre and post rolls on every other programme, and frequency caps of three ads from any single brand per day to individuals. Despite Netflix having no audience to speak of on its ad tier, buyers say brands are preparing to pile in.

10.

[Amazon] are the fourth largest publisher in Australia based on unique visits, with only Google, Meta and YouTube ahead.

Amazon's advertising business has continued its exponential growth.

Amazon grew its Australian advertising business 3x in 2021 – and agency ecomm execs think the juggernaut is starting to roll. They predict it will triple again in 2022, putting it on track to take $180 million in ad dollars by year's end. Amazon is already the biggest 'publisher' behind Google, Meta and YouTube, and its mountain of first party data makes it largely immune to privacy and mobile app tracking changes. But where is the money coming from? The answers may be surprising.

9.

Agencies must also play their role in terms of [the frequency management] they do through their own trading desks.

Frank exchanges and broader supply chain conversations required: Nine's Michael Stephenson, Uber's Lucinda Barlow, Seven's Kurt Burnette, Foxtel Media's Mark Frain.

Complaints of terrible BVOD user experience from Uber’s top regional marketer struck a chord and threaten to hobble TV's great white hope. TV execs and advertisers weigh in on frequency capping fails but some suggest Australia's big video publishers have a fundamental decision to make: short term ad dollars or viewer experience. Networks reject accusations they are putting commercial interest over UX and point to programmatic supply chain apathy, increasingly complex technical challenges and a supply-demand imbalance. But ultimately the experience buck stops with them.

8.

That scale of 16 million email addresses matched to our IDs is the real differentiator. Nine has got 14m, Seven has considerably less than that. Even Google and Facebook only claim around that 17,18, 19 million mark. So we reckon this is going to give us an extremely competitive position.

News Corp has broken cover on its plan to reclaim ground ceded to big tech – and rivals Nine and Seven – in the race for first party data at scale. Touting 16 million IDs and audience-advertiser match rates broadly double what it suggests competitors are delivering, execs Pippa Leary and Suzie Cardwell say the new customer data platform, or CDP, is one of the largest in Australia and its audience data – from across brands including Foxtel, REA, Binge and Kayo – provide visibility that had been sorely lacking. Now the firm will harness that firepower to underpin a video commerce play being backed to drive material revenue growth.

News Corp's data duo Suzie Cardwell (L) and Pippa Leary: “Nine has got 14m, Seven has considerably less than that. Even Google and Facebook only claim around that 17,18, 19 million mark. This is going to give us an extremely competitive position."

7.

If you are buying dirt cheap reach on platforms with little to no effective attention, you are likely wasting your money or that of your clients.

“There's also some nuances and some variances that for me as a sort of media math junkie are actually manna from heaven," Hatched's Andrew Pascoe says.

Attention metrics gained major traction in 2021 and 2022 – and Nine threw its hat in the ring, announcing a deal with Prof. Karen Nelson-Field's Amplified Intelligence at its 2021 upfront. Six months later, the publisher became the first major Australian media group to share the results of its resulting attention study, which threw up some interesting findings across BVOD on mobile, BVOD on CTV, and Linear TV. Kudos to Nine for looking beyond reach, but what happens next is the key question.

6.

In a year of unpredictable economic turmoil, marketing budget resets are inevitable as costs of online and TV advertising go up. However, impression costs of classic Out-of-Home remain comparatively low. It simply makes good economic sense to balance marketing spend and deploy Out-of-Home for its effectiveness, unique scale and dollar-for-dollar efficiencies.

Out-of-Home is primed for growth, and there are many reasons why advertisers should take note.

I’m calling it: 2023 is the year of Out-of-Home

Harvard Business Review research flags a big swing back to traditional advertising, even from online pure-players, says JCDecaux CMO Essie Wake. With TV audiences ageing and in decline, while brands drown in digital clutter paying higher prices for declining performance, she thinks Out-of-Home will be the main beneficiary. Published mid-November, this one stormed into the top 10 media stories of the year.

5.

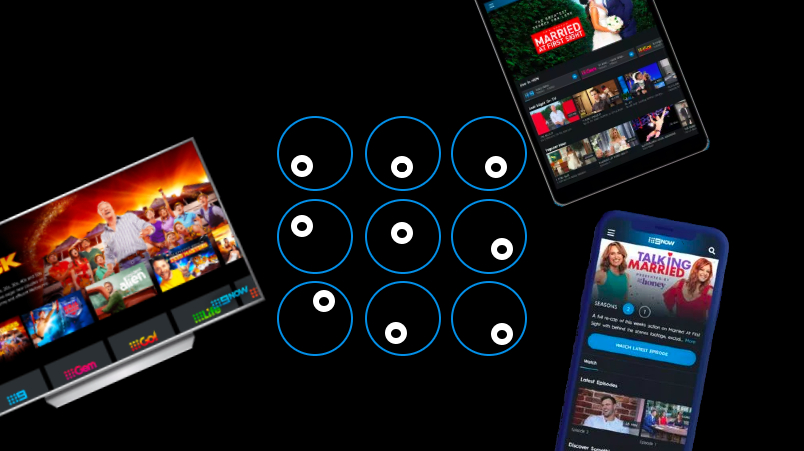

The networks collaborating to gain more control and visibility over their largest growing assets strategically makes sense – eventually BVOD and linear TV revenues will flip. They are collectively trying to build a more transparent, premium video ecosystem and something like this has to happen.

"If you want a frequency-capped buy across the major publishers… using a common ID… this is how you will have to do it."

Covert ops: TV networks plot BVOD walled garden powered by OzTam IDs to counter YouTube’s might

News that Seven, Nine and Ten were (and apparently still are, despite reservations from Paramount lawyers) attempting to build a combined 'BVOD Marketplace' that uses OzTam IDs to enable targeting and capped frequency across networks in a bid to counter YouTube's might got some traction at the start of the year. Burned by announcing grand initiatives and then taking years to deliver, the networks didn't want to go on record. They aimed to be in market by June '22 – but now there are question marks, as ever, about whether they can get it together.

4.

There’s no more effective outcome than targeting someone you know is an intended purchaser of a product ... CEOs are licking their lips.

(L-R): Endeavour Group's Lachlan Brahe, and Zitcha's founders Jack Byrne, co-founder of Melbourne indie Hatched, and Troy Townsend, co-founder of The Pistol.

Retailer media will likely blow $1bn by 2025 forecasts out of the water. New players are entering the market behind Woolworths and Coles, which make up the lion’s share. Endeavour Group earlier this named Lachlan Brahe as its new retail media division chief, while Hatched co-founder Jack Byrne and former CEO of The Pistol Troy Townsend launched Zitcha, a platform to capitalise on the growth of the sector. They claim retailers are just the beginning – soon everyone with first party data will monetise audiences and compete for ad dollars. Which sounds pretty dystopian, but stranger things have happened.

3.

The advertising press story is effectively 'We're the champion identity-farming uber-trackers, just like Google and Meta'… The privacy policies give consumers the 'nothing to see here' version of data practices. It's a pretty stunning contrast.

Dr Katharine Kemp presented her paper, How to Track Consumers Who Don’t Want to be Tracked, at the ACCC’s National Consumer Congress earlier this year.

Prominent UNSW Law & Justice faculty academic, Dr Katharine Kemp, published a paper in August recommending News Corp, Nine and Seven be scrutinised under Australian Consumer Law for their use of terms like “anonymous” and “de-identified” when talking about consumer data. The publishers, which reject Dr Kemp’s findings, claim to distinguish millions of Australians for advertising purposes using vast troves of behavioural data. Kemp is still on the case – and has more papers to come.

2.

When you look at the past ten or 15 years in terms of where growth has come from, this is the next one ... But [Coles'] inspiration is probably drawn more closely from what the likes of Walmart and Tesco are doing overseas with regards to what the model looks like here in Australia [than lifting a local rival's playbook].

Ronson and Brooks: Bidding to carve out a bigger slice of what Brooks thinks will be a $1bn-plus market within three years (though Ronson has subsequently left the retailer).

2022 was the year the broader market sat up and took note of retailer media - including Coles. After letting rival Woolworths take a massive headstart, it decided to enter the fray, hiring former Nine, Carat and MediaCom exec Paul Brooks to steer the trolley – and stop Woolies' supermarket sweep in its tracks. Brooks reckons there are better models to emulate, and said he's lifting UK-US templates rather than creating a local me-too.

1.

Second mover advantage means we can learn from some of the mistakes made overseas and locally … [Plus] we have actually got people that have moved from and understand the Cartology business into Coles 360.

Billion dollar question: Can second mover advantage and avoiding the mistakes made by others create a retailer media world-beater? Jess Torre and Paul Brooks reckon it's all to play for.

Coles is playing catch-up on the billion dollar retailer media market but officially set out its stall in October, bidding to catch rival Woolworths and its Cartology unit. Coles 360 boss Paul Brooks reckons second mover advantage, “humility” said by some to be lacking to date, and a non-aggression pact between Coles business units, merchandise and suppliers will fast track its ambitions to be a global leader. Next year will likely give an indication as to whether he's on the money.