Three horse post-cookie race: LiveRamp, Trade Desk, ID5 scramble for alt ID supremacy as Australia's publishers build walled gardens, fear being gamed again on audience data by agencies, adtech

An Mi3 editorial series brought to you by

Resolution Digital and MiQ

Tech firms are scrambling to create cookie replacements by either using email-based identifiers or by gluing together all the browser and other device identifiers they can muster.

Tech firms are scrambling to create cookie replacements by either using email-based identifiers or by gluing together all the browser and other device identifiers they can muster. The problem is, many of Australia’s big publishers appear reluctant to use them – and fear being gamed again on their audience data by agencies and adtech players per cookies – while audience match rates are low. Right now it's a three horse race. The question for alt-ID providers, advertisers and publishers is whether they can reach the finish line before platforms and regulators raise the red flag.

Mi3 Special Report: Australia Post-Cookies, Post-Privacy

Interviews with 35-plus marketers, publishers and media supply chain. Insights, intelligence, case studies, survival strategies.

What you need to know:

- LiveRamp, The Trade Desk-led UID2.0 and ID5 are attempting to scale their cookie alternatives in Australia, bidding to stop the digital ad industry from losing targeting and retargeting, measurement, personalisation and attribution across the open web.

- But Australia's biggest publishers are concentrating largely on building their own walled gardens. Burnt by the first wave of programmatic, some fear losing audience data to middlemen a second time. Others worry that alt-IDs will not be privacy compliant as Australia's lawmakers overhaul digital rules of engagement.

- Agencies say marketers must now use all the tools at their disposal ahead of cookies being culled, or risk losing sight of what customers are doing, and gaping holes in targeting, measurement and attribution.

- Meanwhile, even Google's FLoC alternative faces major privacy hurdles. If it doesn't fly in Europe, there's every chance it won't get off the ground in Australia.

- This article breaks down the key players locally, publisher and agency approaches and explains the global cookie alternatives being worked ahead of Google's third party cookie cull.

- It's an abridged extract from Mi3's new Special Report: Australia, post-privacy, post-cookies, based on 35 interviews with marketers, publishers, agencies and the media supply chain.

- Download the 67 page report here.

Tech firms are scrambling to create cookie replacements by either using email-based identifiers or by gluing together all the browser and other device identifiers they can muster. The problem is, most of Australia’s biggest publishers appear reluctant to use them.

Publishers that are trialling cookie alternatives are struggling to get broad enough coverage – or match rates – between advertiser audience data and their own signed-in users.

But if ‘alt IDs’ fail to gain traction, how will brands target, retarget measure and attribute across the open web when Google kills cookies in roughly 18 months time?

The growing fear is that Big Tech platforms will take an even bigger share of Australia’s digital ad budgets.

Australia’s major publishers: Who’s doing what

Nine, Seven and 10 ViacomCBS all told Mi3 they are concentrating primarily on building out their own audience IDs. They will effectively become walled gardens.

News Corp appears to be leaning towards ID5 while Guardian Australia appears reluctant to commit to alt IDs, with publishers also wary of losing audience data to adtech middlemen a second time around, as happened in the first wave of programmatic. Yahoo, both adtech provider and publisher, is onboarding just about every alt ID under the sun. But even so, said alt-IDs alone won’t cut it when cookies are culled.

“We need to be clear with people: Having an email based identity solution, whether it’s our Connect ID that we produce from our direct relationship with our logged-in members, or using an industry solution – none of those are scalable enough to cover the majority of the web,” said Yahoo Head of Data, Dan Richardson.

Damien Healy, a former senior exec at Xaxis and global programmatic lead for Denstu Aegis Network and now in Australia as Apac Operations Officer for MiQ, said marketers should forget about trying to replicate cookies and their functionality.

“There will not be a single replacement for cookies. If people are expecting a like-for-like future, they should get over that and move on,” said Healy. “You have to use different kinds of data and different kinds of approaches, and there will be many.”

While that poses brands multiple challenges around targeting and personalisation, measurement “will be impacted very heavily”, said Healy, who predicts a performance marketing shakeout as a result.

“I worked for third party advertising businesses for many years, and all of that measurement was based on cookies. So if you want to look at your conversion rates – who’s hitting your landing page and conversion pages, that will be challenged – and retargeting is going to be impacted quite substantially. So we need to move away from cookie-based measurement.”

MiQ thinks marketers will need to use all the tools in their arsenal to engage audiences across both the open web and the logged-in web – or walled gardens – that are emerging. Alongside a much higher reliance on modelled data, that also includes alt-IDs.

More money for Facebook and Google?

Philip Pollock, COO at Resolution Digital, thinks both publishers and alt-ID providers will have a hard time taking on Big Tech’s advertising duopoly.

“I think we are moving to a two-year scenario where we are still going to be operating within [Big Tech’s] closed walls, unless the ACCC or some other regulator really pushes to ensure that there is more of a data sharing agreement between the tech providers and publishers. And I just can't see that happening, to be honest.”

While unified identities and other post-cookie alternatives are an attempt to maintain control over user data and user tracking, moves by Apple and regulators towards stricter consent, privacy and opted-in data rules may limit uptake – even if publishers can be convinced to align on cookie alternatives.

“We have [The Trade Desk’s] Unified ID, and speaking from an Australian perspective, it really is completely reliant on the opt in of publishers and consumers. We conceptually understand how it works – but we’re not there in terms of the implementation and how usable it’s going to be,” said Pollock.

Whether via alternative IDs or via publisher’s own ID solutions, hitting the numbers is the crux of the issue, Pollock suggests: “We’ve always seen a challenge with match rates when providing that first party data and getting scale.”

Australia’s alt-ID frontrunners: Can they scale?

In Australia, there are three main runners ahead of the ‘alt-ID’ pack: The Trade Desk-led Unified ID 2.0 (UID2.0); ID5 and LiveRamp’s ATS, with the latter currently leading the charge in terms of penetration.

Unified ID 2.0

Unified ID 2.0, developed primarily by demand-side platform (DSP) The Trade Desk, but intended to be open-source and independent. It is deterministic – meaning it is based on authenticated and accurate information – and built on personally identifiable information (PII). It does, however, have transparency and privacy controls for consumers.

Users log in to a publisher or brand’s website through a single sign-on service, after which their email address or phone number is converted into an unencrypted alphanumeric identifier, known as a UID2. The UID2 is stored by advertisers, data providers and DSPs, while an encrypted version of the UID2, known as a UID2 token, is shared with the real-time ad auction. The UID2 token is different every time, meaning it’s theoretically impossible for someone to build a data profile of a user based on the information contained in a token.

UID2.0 has some big names behind it. Globally, publishers like Buzzfeed, the Los Angeles Times, Rolling Stone and The Washington Post have signed up for UID2 integration. In Australia, Southern Cross Austereo, LiSTNR, Gumtree, and Nova Entertainment are on board. Other major publishers have expressed some hesitation.

“It isn’t the target of Unified ID to be 100 per cent addressable,” said Lachlan McDivitt, The Trade Desk’s Senior Director of Trading. ”That’s not realistic and not really required in order to be successful. We will continue to focus on the areas of the ecosystem that are addressable with Unified ID and use other identifiers where they’re not available… We only need 20 to 30 per cent coverage to be viable… That said, I think we will see far greater adoption than that 20, 30 per cent adoption. How high we get, that remains to be seen.”

LiveRamp’s Authenticated Traffic Solution (ATS)

LiveRamp’s Authenticated Traffic Solution (ATS) is one of the more ubiquitous cookieless identity alternatives in Australia. Seven, 10 ViacomCBS, Gumtree and News Corp Australia are integrating ATS for advertisers, and the company insists the majority of the country’s top 50 publishers are on board.

When Acxiom rebranded as LiveRamp in 2018, after selling Acxiom Marketing Solutions to The Interpublic Group of Companies, it held onto an enormous dataset built up over years.

“LiveRamp owns this database now,” said Travis Clinger, Senior Vice President of Addressability and Ecosystem at LiveRamp. ATS functions as an intermediary between advertising parties. Publishers bring their first party data and match it against LiveRamp’s database – without their data being added to the graph. An advertiser does the same.

“It is a way to enable the publisher and the brand to bring their data together,” added Clinger. “You probably have multiple email addresses, you have a phone number, we’re able to bring that all together to represent one person.”

The advantage of ATS is that it is easy to integrate and can add value immediately. But publishers have privately said match rates – and finding active users – can be a problem. To give an example, if a major publisher brings six million email addresses to LiveRamp, perhaps four million will be matched against their database.

If an advertiser brings another four million, maybe two million will be matched to ATS’s data set. Not all of those two million from the advertiser will match the publisher’s four million, and of those that do match, maybe only half will be active on the publisher’s site during the campaign period.

“Scale is a real issue,” one executive from a major publisher noted.

LiveRamp’s Clinger disagreed match rates were low, but noted ATS was never meant to be a holistic replacement for third party cookies.

ID5

The third major identifier being trialled in Australia is ID5, a way of identifying users, effectively, by any means possible. ID5 uses multiple data points to match users: URL, page referrers, user agent, IP addresses, first party cookies and any device IDs. It assigns data points identities, and looks to match the same identities with advertisers as well as publishers.

“I can already hear you say: ‘So you’re basically talking about fingerprinting?!’,” ID5 CEO Mathieu Roche wrote back in February. The poor practices of fingerprinting used in the past, where DSPs and data companies harvested signals to create persistent identifiers that users weren’t aware of, should be consigned to the scrap heap, added Roche.

Instead, “if such a probabilistic method is instead driven by the publishers, it can create a common currency across the Open Web and enable brands to access inventory and audiences at scale. It is an entirely new way to create user identifiers.”

To be legal in some jurisdictions (Europe, for example), the whole process must be based on users’ understanding and approval, Roche says, and requires strict consent management platforms from publishers. News Corp Australia has trialled ID5, and it’s understood some Australian advertisers are also in trials.

Consolidation ahead?

While some think publishers and brands will need to use multiple solutions, Blis’ CTO Aaron McKee thinks only a couple of alt IDs will survive.

“Ultimately, it’s going to be a pretty short period for where there’s a Battle Royale. It’s only really practical that one or two of these will come out and ultimately succeed,” McKee suggests. The alternatives, he believes, don’t necessarily benefit users – possibly the opposite.

“Going from a third-party cookie, which is very easy to reset – every browser can say, ‘clear my history for the past hour’... to saying, ‘now my advertising identifier is my email address, which is durable for an extended period of time’. It seems unimaginable that regulators or consumers think that’s an improvement in privacy.”

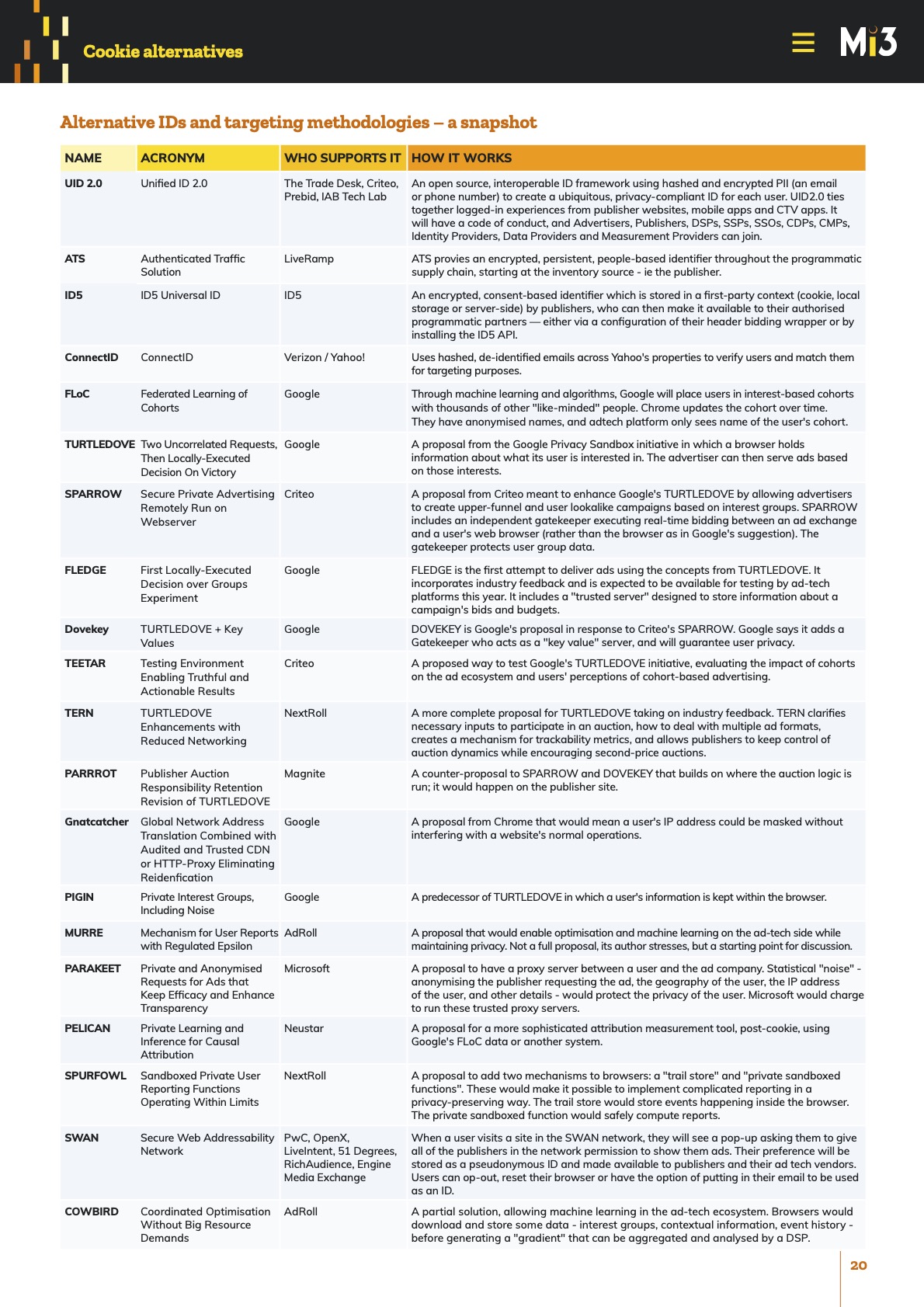

Ready for take off or on the nose? Cookie alternatives

Globally, the list of proposals for cookie alternatives reads like a grotesque aviary.

There’s Google’s FLoC, Google’s TURTLEDOVE, Google-led FLEDGE, Google’s Dovekey, Google’s Gnatcatcher, and Google’s PIGIN; there’s Criteo’s SPARROW and Criteo’s TEETAR; NextRoll’s TERN and NextRoll’s SPURFOWL; Magnite’s PARRROT, AdRoll’s MURRE, AdRoll’s COWBIRD, Microsoft’s PARAKEET, Neustar’s PELICAN, and SWAN.

While the nerds are having fun flipping the bird, there are serious questions over the medium and long-term viability of many cookie alternatives.

“FLoC (Google’s Federated Learning of Cohorts) is widely regarded as a non-starter in Europe as – amongst other things – it wasn’t really asking for user permission before placing people into cohorts, so there is a big question around GDPR compliance that the Chrome team continues to dodge,” European data regulation and publishing consultant, and Australian expat Phil Eligio said.

Likewise, Apple’s iOS14.5 and iOS15 changes have profoundly impacted the viability of email and personally identifiable information or PII-based identifiers.

“Other forms of tracking are also covered by the terms of Apple’s User Privacy & Data Use policy – including name, email address, phone number and other customer identifiers,” said Joey Nguyen, co-founder of martech advisory, Venntifact. While he added that Apple has not yet moved to fully enforce those terms, the direction of travel is clear – and where Apple goes, Google usually eventually follows.

See below for a snapshot of key cookie alternatives being developed globally.

To find out where marketers, publishers and the media supply chain think Australia will end up, post-cookies, post privacy – and what they are doing about it – download the full 67 page report here.

Mi3 Special Report: Australia Post-Cookies, Post-Privacy

- How brands including ANZ, CommBank, Adore Beauty, Little Birdie, Menulog and Westpac are racing for new privacy-compliant ways to market to customers as platform and regulatory changes bite.

- Report covers all of Australia‘s major publishers, their strategies.

- All major alternative IDs covered.

- Plus marketing consultancies, tech provider and agency insights.

- Independent Mi3 report, based on 35-plus interviews, supported by MiQ and Resolution Digital.

How brands including CommBank, Adore Beauty, Little Birdie, Menulog and more are racing for new privacy-compliant ways to market to customers as platform and regulatory changes bite.

Get ahead of the curve. DOWNLOAD THE REPORT HERE DOWNLOAD your 67-page report here.