Publicis Groupe's $200m deal for local retailer media platform Citrus triggers tech investors; indie grocer Supabarn backs local Brandcrush to digitise media assets

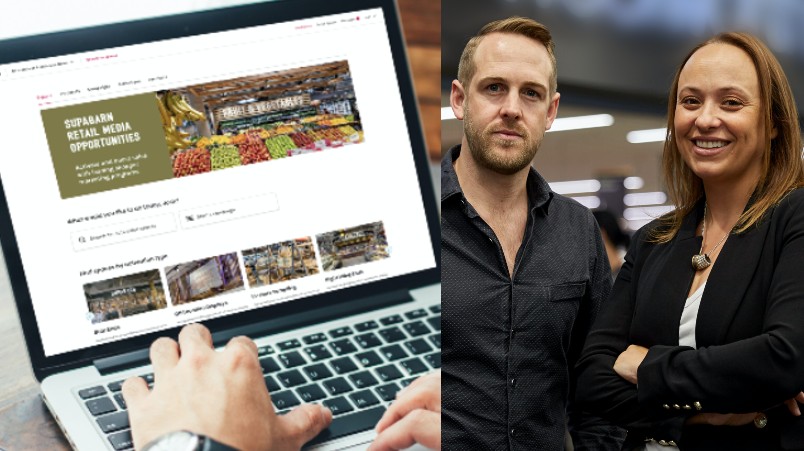

“Every single retailer has taken note and is looking at what's the best way to go to market," Teresa Aprile, co-founder and CEO of Brandcrush, says. She is pictured above (right) with fellow co-founder Matt Hurle.

Indie supermarkets are joining the retailer media market, monetising their in-store and online assets in one spot – Supabarn has just announced it has signed up with Australian platform Brandcrush. A few months after fellow Aussie tech start-up CitrusAd was acquired by Publicis Groupe for more than $200m, there are other tech players in a similar space who are seeing interest from VC or holdco giants.

What you need to know:

- Small independent supermarkets are jumping on the retailer media bandwagon, which is predicted to become a $1bnplus player in Australia by 2025.

- Supabarn has announced it will allow suppliers to buy spots through media tech platform Brandcrush from December 1.

- Brandcrush is an Australian tech company that specialises in nonprogrammatic brand activations, ie not the e-commerce ads ranked and placed by CitrusAd, but rather the in-store physical spots and social promotions.

- Brandcrush cofounder Teresa Aprile says the platform has been approached by potential investors – “strategic partners” – and says the space is heating up.

Independent supermarkets are starting to become mini media networks while venture capitalists, adtech and major holding companies circle retailer media tech platforms.

Family-owned grocery chain Supabarn has signed up with emerging Australian tech platform Brandcrush to sell in-store, online and sponsorship products. From tomorrow (December 1), Supabarn’s suppliers in New South Wales and the ACT will be able to buy spots that previously needed an Excel spreadsheet to manage.

"We know that there is an incredible potential for growth in our retail media assets,” Supabarn Managing Director Theo Koundouris said.

“We had already been doing this to a degree, but without the technology to support it, our growth had been hampered… This will increase media revenue, while also making it easier for suppliers to the see the value of their investment.”

An independent like Supabarn can sell access to wobblers, radio, magazines, social channels, YouTube, display ads, and packages of these.

“Independents are generally on a path of becoming more innovative and more focused on in-store experiences. There are a number of independent retailers around the country that have invested in their stores and are doing great things — it's really positive for the sector," Koundouris said. "Brandcrush is allowing us to monetise our in-store assets that we previously couldn't sell."

Growing market, VCs and HoldCos circling

The growth of retailers as media companies is a market-wide phenomenon, and Mi3 published an in-depth report on the space earlier this year. Cartology, Woolworths’ media unit, is eyeing wider budgets from brands, and other players like Chemists Warehouse have sophisticated media buying and selling divisions.

Because it is such a rapidly a growing space, it has been the subject of much venture capital and adtech interest. CitrusAd, an Australian programmatic retailer ad company, was acquired by Publicis Groupe earlier this year for more than $200m. Criteo, meanwhile, said it sees $900 billion in transactions each year and is open about its focus on retailers and media.

Teresa Aprile, co-founder and CEO of Brandcrush, says her company has a slightly different focus to CitrusAd – but there has been plenty of interest from potential “strategic partners” that have come knocking.

“Our expertise is very complementary to companies like Criteo and CitrusAd,” she said.

“We see the opportunity with our platform that Coles, IGA, really no matter what size, whether they're a major or mid-market, can utilise our platform to be able to instantly unlock that Walmart Connect-like solution within their business.”

She said conversations with other retailers in Australia are “in play”: “Every single retailer has taken note and is looking at what's the best way to go to market.”

Being acquired by one of the major holdcos or other players would be a “great outcome”, but it’s also about finding the right go-to-market partner, Aprile said. “In this space, there’s only so many retailers, so it’s about having the best go-to-market strategy,” she said. “If that means joining forces with someone, then yes, that would be it.”