When is an audience not an audience? What marketers need to know when allocating video ad dollars

It’s dead simple: the only video platforms that matter to marketers are the ones that carry ads.

The explosion of consumer choices in the video universe may not have changed things as much as you think. From a brands-eye view, the options for effective video advertising are quite simple. Kim Portrate explains.

There’s only one word to describe today’s video universe and that is vast. There’s 10 Play to 9Now, 7plus, Kayo, Foxtel Go, Foxtel Now, Paramount+, Netflix, Stan, Amazon Prime, Binge, iView, Vimeo, YouTube, Tubi, Disney+, Apple TV+, SBS On Demand, Stan Sport and Tik Tok. Australians are utterly spoiled for choice.

But the choice part is a bit misleading because while there’s a sea of choice for viewers, the video advertising options for marketers are much simpler.

When considering video audiences, marketers need only factor in the platforms that allow advertising.

To uncomplicate the complex, there’s audience and then there’s available audience.

Big shiny new audience numbers are enticing, but the truth is not all audiences are actually available.

It’s dead simple: the only video platforms that matter to marketers are the ones that carry ads.

For starters, new data from OzTAM’s national streaming meter shows 15 per cent of audiences are watching Streaming Video on Demand (SVOD) and are therefore not available to advertisers.

New data from OzTAM’s national streaming meter shows 15 per cent of audiences are watching Streaming Video on Demand (SVOD).

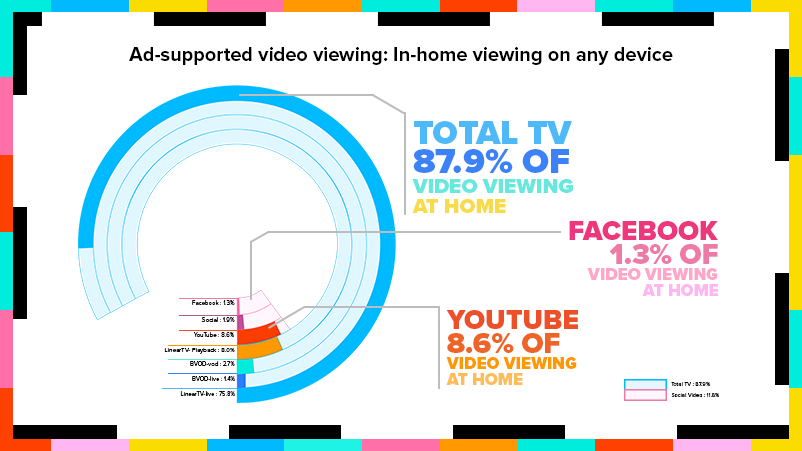

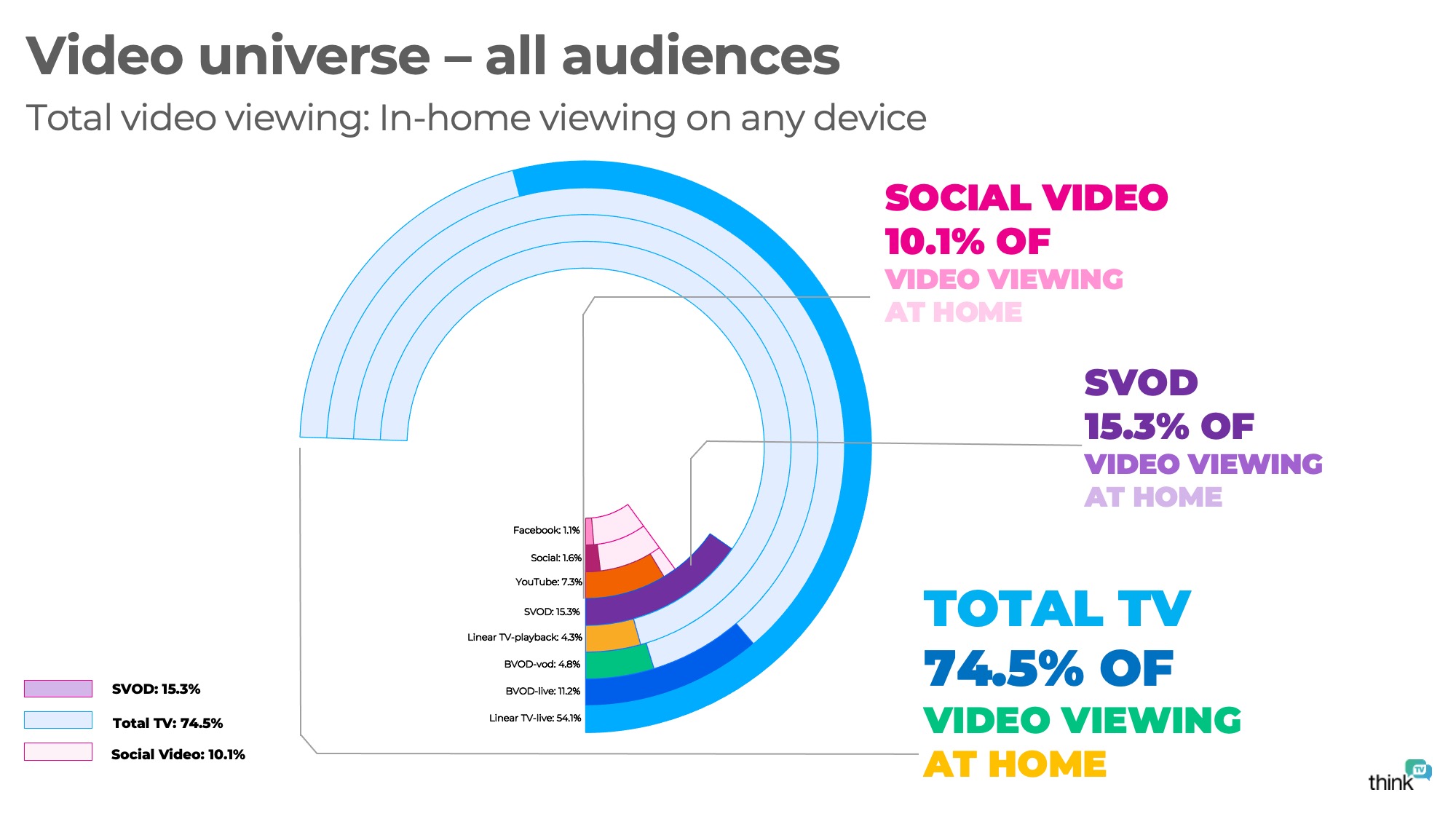

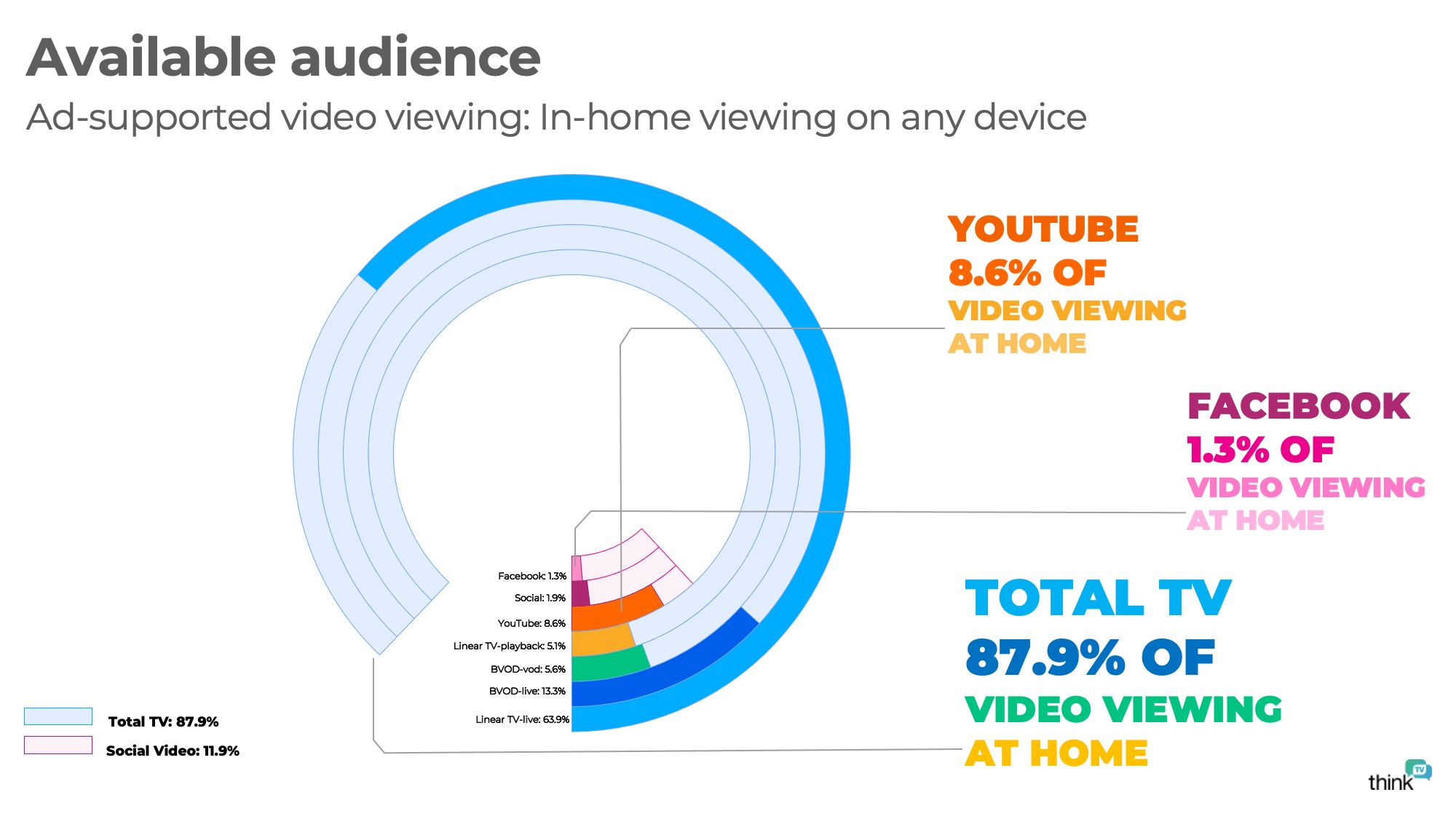

To illustrate this disappearing act, we’ve collected and blended data from OzTAM’s standard TV audience measurement panel and the national streaming meter panel to summarise audiences in the video universe we’re most interested in – the ad-supported one.

A robust representation of the video consumption landscape (bar gaming, porn and other non-broadcast video usage).

The above chart is the result of our media mixology. It shows, for the first time, OzTAM’s best estimate of total in-home video usage on any device.

It is a robust representation of the video consumption landscape (bar gaming, porn and other non-broadcast video usage) so if it’s piqued your interest, do download the latest ThinkTV Fact Pack here for more insights.

What’s plain to see is the audience Total TV commands in the ‘video-verse’: Total TV equates for 74.5 per cent of total video consumption at home and 87.9 per cent when we look at available audience.

Dovetailing with this data is the plethora of insights now available via VOZ which paint a compelling picture about the choices audiences make about when, where and how they consume the video content that matters to advertisers.

The TV in the living room – and 99 per cent of Aussie homes have a high definition one – isn’t the only option for viewing but between linear TV, live-streamed broadcaster content and catch-up via BVOD services, it’s getting a solid workout.

On any given week, more than 1.3 million Australians watch BVOD with women 25 to 54 the biggest BVOD fans. And while viewers are indeed spoiled for choice, plenty continue to choose linear TV with viewers right across the nation watching an average of two hours every day.

So, while the video universe appears complex, when you look at it through an advertising lens, it’s really rather simple.

For advertisers trying to refine a video advertising strategy, there’s a clear way forward.

Disregard video platforms that aren’t supported by advertising. Then look at what’s left and consider the following:

- How large is the audience?

- How quickly can you reach all those people?

- How much of your ad will they see? Will it be a scroll-and-you-miss-it experience that takes up a fraction of the screen or a total view of the content that fills the whole screen?

While the plethora of viewing choices may make your head spin, the choice of where to allocate video advertising spend shouldn’t.