Brands will spend $70bn to reach gamers this year, ad budgets will double by 2030 - but Australia still undercooked as brand safety, measurement, effectiveness gaps spook marketers

Consumers are spending billions on gaming. Advertisers are now chasing them with budgets set to double by 2030

Gaming is one of the world's largest entertainment industries by revenue, and has already captured almost 3.4 billion consumers worldwide. While most of its money comes from the consumer's own pockets, advertisers appear to be catching on. Budgets to advertise inside gaming environments are forecast to double to almost $140bn by the end of the decade. But in Australia brand safety and suitability appear to be turning advertisers away from a huge audience and dwell times.

What you need to know

- There 3 billion gamers in the world and the sector generates more than a quarter of a trillion dollars across consumer spending and advertising according to research from Newzoo and PwC.

- The outlook for further growth remains solid. Consumer spending will reach $212bn by 2026 and advertising spend is forecast to double between 2022 and 2030.

- But with the immutable law of advertising telling us that money always follows the eyeballs, should it be capturing a bigger share of the pie?

- Locally PwC figures suggest gaming attracted $64m in ad spend in 2021, forecast to rise to $86m by 2025 – which suggests lukewarm advertiser appetite to tap an Australian gaming audience estimated to be circa 12 million people.

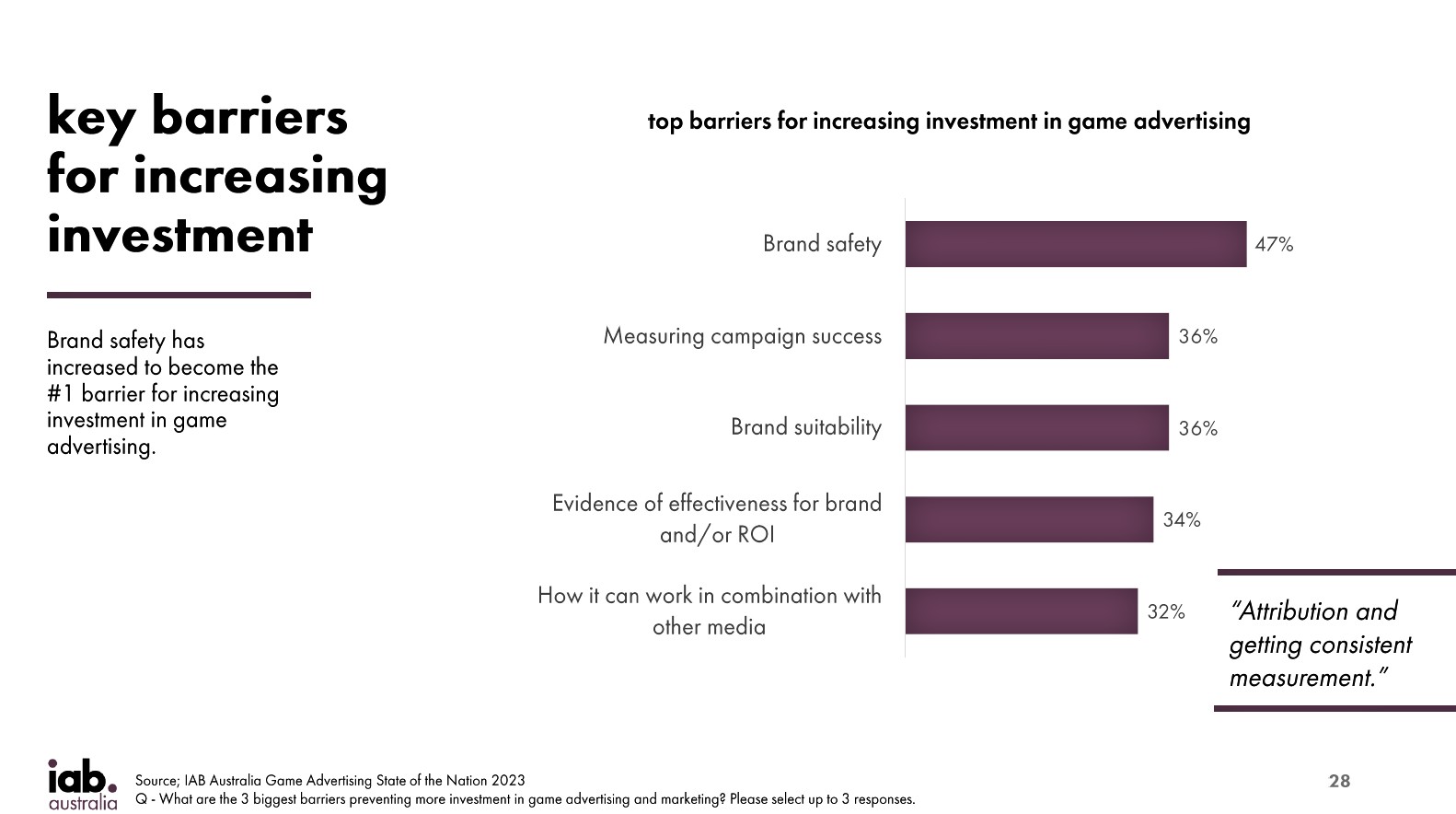

- Brand safety, measurement and evidence of effectiveness are impediments to greater investment per IAB Australia.

- There's also too much focus on buying and not enough on planning says the boss of gaming marketing firm Livewire. The firm is trying to bring more brands and agencies into the channel.

- And while esports is gathering larger and larger audiences for its major online events – especially in APAC – market maturity and scale are holding Australian esports organisations back.

For the last twenty years gaming advertising has seemed on the brink of becoming a more important part of the advertising mix. While there have been pockets of uptake in mobile gaming, major brand integrations and game streaming environments it is still light compared to consumption.

The global games market this year will generate US$187.7bn and grow to $212.4bn by 2026. By year's end there will be 3.38 billion gamers in the world clashing clans, league’ing legends and answering the online call of duty. And while Microsoft, Sony and Nintendo will continue fighting the console wars, most of the action will actually be on mobile.

The figures are contained in Newzoo’s Global Games Market Report, regarded as the definitive study for the sector which tracks revenues from consumer spending on games including physical and digital full-game copies, in-game spending, and subscription services like PlayStation Plus and Xbox Game Pass.

It also includes mobile revenues such as paid downloads and in-game spending on all stores, including third-party stores, and from direct downloads.

The market is actually even bigger because missing from the Newzoo number is consumer-to-consumer second-hand trade, (peripheral) hardware, business-to-business services, and the traditionally regulated online gambling and betting industry.

Also crucially – advertising.

While the immutable law of advertising says that money follows eyeballs, advertising and sponsorship support remains undercooked given the audience scale, though not insubstantial.

PwC estimates advertisers spent $70bn advertising to the world’s 3 billion gamers last year, and that that figure will rise to $80bn this year, eventually hitting 137bn by 2030.

By way of contrast Facebook with 2bn daily active users generated $136bn in advertising revenue in 2022.

According to PWC’s most recent global Entertainment and Media Outlook report, published mid-year, “The gaming sector is one of the powerhouses of the global E&M industry. As the ever-expanding sector continues to capture the attention of people in all demographic groups—but especially youth—games are coming into their own as a medium for creativity, consumer spending and advertising.”

The report says, “With confidence in the gaming sector rising, advertising revenue is projected to nearly double between 2022 and 2027 and will reach US$100 billion in 2025.”

PwC's global report didn't break out a number of Australia's gaming ad revenues. The firm's 2021 Media and Entertainment Outlook pegged it at $64m forecasting gaming ad revenues would reach $86m by 2025.

IAB Australia recently held an event in Sydney to explore gaming and advertising, where it launched its Game Advertising State of the Nation Report.

While the IAB didn't attempt to put a number on gaming ad revenues, it did identify media investment barriers – including brand safety, measuring campaign success, brand suitability, evidence of effectiveness and ROI, and a better understand of where it fits into the wider media mix.

20 years of jam tomorrow

According to Gai Le Roy, IAB Australia CEO, “For the last twenty years gaming advertising has seemed on the brink of becoming a more important part of the advertising mix. While there have been pockets of uptake in mobile gaming, major brand integrations and game streaming environments it is still light compared to consumption.”

Le Roy told Mi3: “The emergence of platforms to make selling and buying gaming inventory easier and provide more confidence around any placement issues for a wider range of marketers is a smart move for the sector, as the investment increases presumably there will be more demand in the omni-channel platforms as well.”

Indy Khabra, CEO of gametech business Livewire, and a 15 year veteran of the programmatic advertising sector says the growth in interest in gaming advertising echoes some earlier transitions in the digital ad market.

“I've seen I've seen the change from traditional media to digital, with linear going to BVOD and now CTV, and the same thing with radio going to digital audio. One of the things that I always saw in that evolution was that it started with planning. Whereas, I think a lot of the current conversation is sitting with buying, and that’s an interesting conversation that we need to look at."

He claimed gaming is winning attention economy. “The numbers are very clear, I think it's 81 minutes for females and 97 minutes for males [spent gaming by gamers per day]. The dwell times are considerable, considering how much spare time people have, that they’re using that time to play games on a daily basis. One of the focus areas for gaming market as a platform is the need to think about going upstream into the planning phase. The strategy guys love gaming, because it provides the creative whitespace and the blue sky opportunities for ideating these incredible award winning campaigns," said Khabra.

"And then you have on the other spectrum where you've got the buying, the in-game media and advertising, and it quite quickly becomes a conversation around ad formats and activation.”

Esports: Scale challenge

Brand safety is also a particular consideration one of the more performative niches of the gaming sector – esports which will likely attract about $2bn globally in sponsorship and advertising support by the middle of the decade. It also starting to build the kinds of mass audiences online that pique the interest of consumer advertisers. The most watched live esports event ever was the Free Fire World Series in Singapore in 2021 which garnered 5.4 million viewers during the tournament (and critically, millions more on YouTube in the years since.) The 2022 League of Legends World Championship Likewise clocked in at over 5 million viewers during the event and again, millions more afterward.

But by the time that scales down to a market the size of Australia, the pickings for straight advertising and sponsorship dollars are thin. That’s why esports organisations like 95X are chasing adjacent opportunities.

Co-founder Miles Toolin was brought into the group a year ago to help develop a sustainable business model. “For us that’s content creation, and esports is then tacked onto the back of that. It’s content for large brands including the personal brands of the content creators, and then we operate as an agency to bring them brand deals and logos.”

It’s essentially an influencer play, and Toolin cites Lenovo, AOC, and Aftershock as brands they have worked with, as well as Focus and Savvy Beverage.

When it comes to attracting more sponsorship dollars into Australian esports, Toolin cites the immaturity of the market and says that it's an education process. “And it’s also eyes on screens. But it’s also not backed with the infrastructure from the major game titles if we are talking about esports specifically. I think content creators have got a great platform in Twitch or YouTube and things like that.

“But outside of that, esports just doesn't have the platform required yet. And I think it essentially just comes down to ROI. Advertisers look at Asia, where they get 100,000 people viewing a match on a Friday night, but in Australia, we get 2,000,” he said.

Mobile will remain gaming’s most significant segment by consumer spending by far, accounting for just under half of the entire global market.

User pays and plays

For now consumers seem perfectly happy putting their hands into their own pockets to fund their Clash of Clans, Call of Duty, and Genshin addictions.

But games publishers are also facing challenges that will be familiar to to average digital marketer. According to the Newzoo report, “Mobile publishers are currently facing privacy-related monetisation and user-acquisition challenges due to policies from Apple and Google. Mobile developers and marketers have been forced to course-correct their strategies and experiment with new ones, stopping the segment’s trend of immense growth in its tracks.”

Despite this, the outlook for revenue growth is solid – especially in emerging markets— off the back of “continued strong performance of mobile’s biggest legacy hits.”

Per Newzoo: “Mobile will remain gaming’s most significant segment by consumer spending by far, accounting for just under half of the entire global market.”

Among the other key findings of the research, mobile games player numbers are predicted to grow by +7.3 per cent globally to 1.47 billion in 2023 and to reach 1.66 billion players by the end of 2026.

The authors also note that “Console will be 2023’s biggest revenue growth vehicle, thanks to its +7.4 per cent year-on-year growth. To put this in context, the console segment underperformed in 2022 due to several development and release delays.”