Paramount+ to launch ad-tier in Australia, ‘world first’ shoppable TV; while sharpening attribution and measurement; NCIS Sydney, Gladiators reboot among big content bets

Is Australia ready to for a reboot of 90s show Gladiators? Pic: Paramount

Paramount, the owner of Network 10, is officially joining the AVOD rush with an advertising tier on Paramount+, following Binge and Netflix in trying to take market share and ad dollars away from linear TV, just as Amazon also gears up for ad market entry with Prime. Paramount is also trialling Shoppable TV on Survivor Australia, a “world first” across the Paramount group of companies. Its Upfront also touted attribution and measurement upgrades as well as a more sophisticated dynamic video play that uses data on time, date, location and weather to personalise creative content. Ten’s sales chief Rod Prosser downplayed a “challenging” ratings season by stressing the Paramount-owned Ten Network is focused on a 52-week content calendar, and insisting the parent company cares more about the sum of all parts in its total TV offering. The broadcaster also talked up the success of FAST platform Pluto, which has boosted 10 Play’s viewing figures by 143 per cent in the past two months. On the content front, NCIS Sydney, Top Gear Australia and Gladiators join a stable of familiar reality TV formats and dramas. Conservationist Robbert Irwin – the son of Steve – has replaced Dr Chris Brown as Julia Morris' co-host of I'm a Celebrity... Get Me Out of Here!

What you need to know:

- Paramount+ will launch an advertising tier in Australia in 2024. Later this year it will introduce a Premium Plan charging $13.99 per month.

- Media buyers have long speculated a Paramount+ ad-tier was on the cards. It now leaves Nine's Stan as the major holdout.

- Network 10's ratings lag well behind commercial rivals Seven and Nine, but it is positioning its content as a total TV offering where advertisers can reach eyeballs across linear, BVOD, FAST and, soon, an SVOD ad tier. Paramount's sales chief Rod Prosser says it is focused on a 52-week total TV calendar, rather than ratings season bragging rights. The media company claims it reaches 16.2 million viewers each month.

- Paramount's major Upfront announcements include Shoppable TV, where viewers can shop while they watch programs with the press of a remote control button.

- There are also measurement and attribution tools and more personalised dynamic video ad products.

- Gladiators headlines the new content slate with all of 10's reality TV favourites bulking up its linear and BVOD content calendar. NCIS Sydney is the star turn of new programs slated for Paramount+. Sport continues to be a glaring omission from the line-up, but not for a want of trying.

The introduction of the Premium and ad-supported plans will give us the ability to better serve different consumer segments by providing multiple pricing options while also tapping into tremendous opportunities among our advertising and brand partners.

It was always a question of when not if, but Paramount has finally confirmed it will launch an ad-tier for Paramount+ in Australia next year. The SVOD has offered a cheaper ad-tier in the US for the past couple of years. It means the domestic ad-funded streaming market in 2024 will be crowded with Foxtel’s Kayo, Binge and Netflix already in play and Amazon Prime and Disney+ also planning similar moves.

Pricing and how it will operate remain under wraps, but Paramount will next month roll out a Premium Plan charging $13.99 per month or $124.99 each year to view the platform ad-free, seeding the ground for a cheaper service with ads.

Paramount+ had been widely tipped to run ads following substantial growth in user numbers. Last year, Mi3 reported Paramount+ had an estimated 400,000 subscribers, this year the figure has more than tripled to 1.5 million, according to estimates by tech analysts Telsyte. This places it behind market leader Netflix (6.1 million) Amazon Prime Video (4.5 million), Disney+ (3.1 million) and Stan (2.6 million), but on par with Foxtel’s Binge and Kayo Sports.

“After expanding our footprint to more than 45 markets last year, we are focused on scaling our business and providing customer choice,” Paramount+ EVP and International General Manager Marco Nobili said. “The introduction of the Premium and ad-supported plans will give us the ability to better serve different consumer segments by providing multiple pricing options while also tapping into tremendous opportunities among our advertising and brand partners.”

A full court press

The Paramount+ ad-tier announcement is the icing on the cake of this year’s Paramount Upfronts event and part of the media company’s transition to build inventory and advertising ecosystem across linear and digital channels on Network 10, its BVOD 10 Play, the SVOD Paramount+ and its expanding FAST (free ad-supported TV) streaming service, Pluto.

Mi3 understands Paramount wants to roll out Paramount+ advertising once it has nailed a single trading platform that allows brands and agency partners a single front door to chase eyeballs across the whole Paramount ecosystem.

An ad-tier on Paramount+ will add premium inventory volume, and follows the expansion of Pluto from 15 channels to 51, growing additional viewing minutes and users.

In September, Paramount pushed all 51 Pluto FAST channels onto 10 Play, growing the BVOD's average daily viewing by 143 per cent in its first two months. In the past year, 10 Play has grown viewership by 23 per cent.

“In the first month of Pluto on 10 Play, we added an additional 43 million minutes, had 129,000 new monthly active users and, importantly, 76 per cent of our audience was in the 18-54 demographic for those channels,” Paramount Australia SVP, Content and Programming Daniel Monaghan told Mi3.

“We've had some really good learnings and have got a lot of Paramount-owned channels on there now. We've seen the performance of those, particularly in-house brands, really pop such as Judge Judy and Nick Jr.”

Chief Sales Officer Rod Prosser told Mi3 Paramount was growing incremental revenue from Pluto and that it has also become an important test and learn platform.

“Viewer engagement and curated channels are very much wanted and needed by our audience. What it's enabled us to do is have greater scale when we're out talking to the market,” he said.

Paramount's Shoppable TV will allow viewers to buy products from Australian Survivor using their remote control Pic: Paramount

Shoppable TV

Arguably Paramount’s most intriguing announcement is the trial of new shoppable TV next year. Paramount has partnered with KERV to trial the innovation first in Australia and on 10 Play before rolling it out wider across Paramount globally. Using their remote control, viewers of Australian Survivor will be able to pause the show and explore Survivor merchandise available in the Paramount Shop. A shoppable screen will expand once a product is selected providing detailed information and a QR code directing viewers to ‘Shop Now’ via their mobile phone or tablet to complete the transaction.

Prosser described Shoppable TV as “one of our most exciting product evolutions in years”.

“Our ambition is that the trial drives high interest, and it will most likely be sold at a premium,” he said. “We will start directing viewers to our own Paramount store and once this proof of concept is validated, we will roll it out globally. We can then talk to a broader range of brands and direct them to their own ecommerce sites as well.”

This dynamic video Connected TV offering that allows us to compete with some of our digital competitors, delivering highly relevant, targeted segments.

Personalised video creative

Paramount Australia is extending its partnership with Innovid by offering personalisation and relevancy for its BrandBOOST ad products.

Last year it launched a BrandBOOST suite of new ad formats for CTV: a branded frame around TVCs; a split screen impact card message; and an animated pop up overlay.

The Dynamic Video suite will now use data triggers such as time of day, day of week, weather and location to automatically generate personalised creative to viewers.

Paramount commissioned brand lift studies to test out the impact of dynamic video campaigns in Masterchef. These showed an average uplift of 22 per cent in ad recall and increased brand awareness by 14 per cent. Consideration grew on average 23.6 per cent with some brands witnessing up to 39 per cent uplift and purchase intent was also positively impacted with an average uplift of 8 per cent, with some product categories seeing growth of up to 50 per cent.

In the first year of BrandBOOST, Network Ten ran over 100 campaigns and Prosser said that Paramount is able to validate the ROI.

“This is a dynamic video Connected TV offering that allows us to compete with some of our digital competitors, delivering highly relevant, targeted segments,” he said.

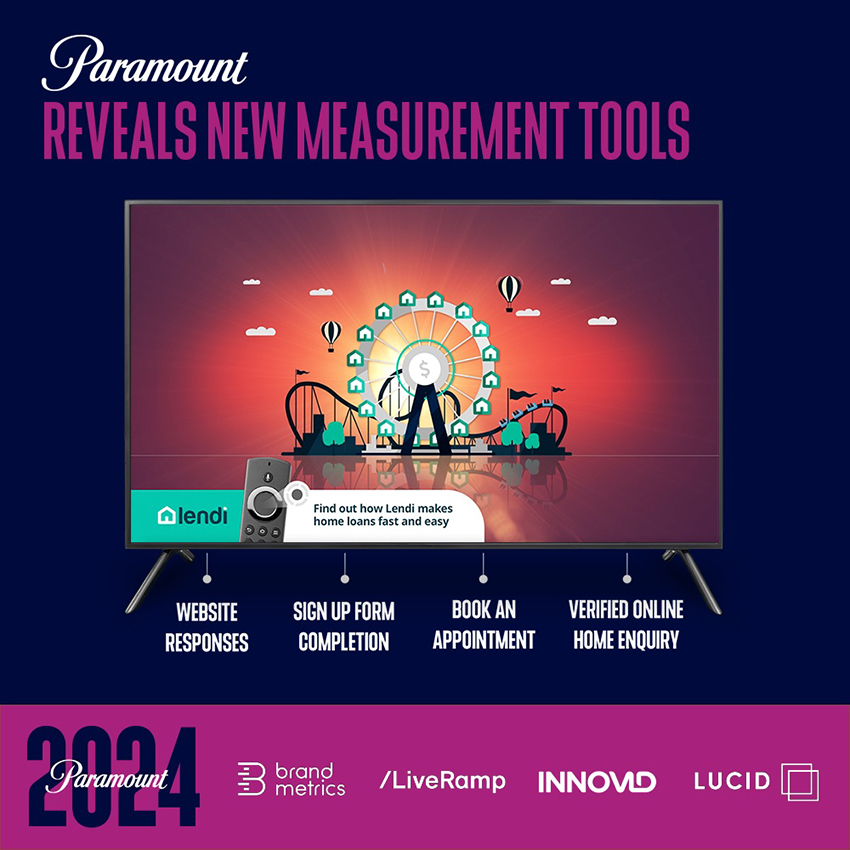

Paramount is adding four new measurement and attribution tools Pic: Paramount

Measurement, attribution

Paramount is attempting to solve another part of the validation puzzle via four new measurement and attribution tools:

-

A Digital Brand Impact Study that gives advertisers a “consumer pulse check”, testing digital campaign activity against brand KPIs.

-

Paramount Interactive Attribution, in partnership with Innovid, identifies the impact of CTV interactive advertising either as a standalone tactic or integrated within a broadcast video on demand (BVOD) campaign.

-

Paramount Brand Lift Study, in partnership with Lucid, is a responsive traditional brand lift study that tracks digital campaigns on 10 Play across all devices and creative executions.

-

Paramount Data Collaboration, in partnership with LiveRamp, which allows advertisers to plug in first party data and understand the role of Paramount campaign and sponsorship attribution plays within their broader media mix.

Per Prosser: “We’re closing the loop for marketers by providing more meaningful metrics that demonstrate the role and power of CTV advertising within their marketing mix and empowering them to respond to trends and insights to achieve business outcomes.”

Top Gear Australia has driven to Paramount after stop and start stints at SBS and Nine. Pic: Paramount

Gladiators, ready

New shows in in Paramount's line-up that catch the eye include a reboot of Gladiators, NCIS Sydney (the first non-US version of the franchise), Top Gear Australia, Deal or No Deal (to be hosted by a returning Grant Denyer), Graham Norton's Wheel of Fortune (filmed in the UK but with an expat Aussie audience) and a new season of Hunted Australia, a reality format in which desperate fugitives attempt to vanish before being hunted. Other shows to catch the eye include Aussie Shore on MTV, and the dramas Fake, Paperdolls and a second season of The Last King of the Cross on Paramount+

Ten prides itself on sticky reality TV formats, and will continue with hits including Australian Survivor: Titans vs Rebels, I’m a Celebrity... Get Me Out of Here and The Amazing Race. MasterChef also returns with a mostly new line-up of judges as Michelin Star award-winning chef Jean-Christophe Novelli, food critic and journalist Sofia Levin, and former MasterChef runner-up Poh Ling Yeow join Andy Allen. Melissa Leong leaves MasterChef to front an off-shoot, Dessert Masters, with pastry chef Amaury Guichon.

Other programs that should pull in the numbers include The Bachelors Australia, Shark Tank Australia and The Masked Singer Australia.

A notable gap in Paramount's content calendar is sport; both Prosser and Monaghan acknowledged this. It's not for a want of trying, per the duo, but sports rights have to be commercially viable.

Ten has the rights to A League, Socceroos and Matildas games, NBL, Melbourne Cup and the Australian Formula One. It previously bid for the AFL sports rights, but could not outmuscle long-term broadcast partner Seven. Can Aussie hopefuls taking on Gladiators help fill the sporting void?

Channel 10 is launching the year with some of its stronger properties: Gladiator, followed by Australian Survivor: Titans vs Rebels, and I’m a Celebrity... Get Me Out of Here.

A song and dance spectacular starring Robert Irwin and Julia Morris stole the show at Paramount's Upfront. Pic: Paramount

‘Not just about ratings’

Paramount will hope the combination of tried and tested hits with a sprinkling of new formats can help it revive lacklustre ratings.

So far in this year’s ratings season, Network 10 has captured about 21 per cent of audience share between Australia’s three commercial TV networks, well behind Seven and Nine who both claim they are in the 35-40 per cent share range.

When asked about Ten’s ratings performance, Prosser doubled-down on how he views audiences and success, arguing the ratings season is a relic of the past.

“For us, the 52 week is important, because the reality is people don't stop consuming TV when it gets to December and advertisers don't stop advertising. [The ratings season] really is a legacy thing and seems a little bit tired and old. When I talk to clients about it they don’t really care so I’m not sure how long it will last and how important it is anyway,” he said.

“Our job now is to find the connectivity between platforms that we can take to market and advertisers can advertise effectively across all those platforms. So if you just want to have a look at one of our platforms, such as linear, and not all of the others that contribute to total TV, you're not really seeing the whole picture.”