Amazon Australia cracks $100m in ad sales, $1.3bn from online store, $250m in Amazon Prime subscriptions; Total sales hit $2.6bn but posts loss of $1.5m

Amazon says it is now selling 200 million products on its Australian shopping site.

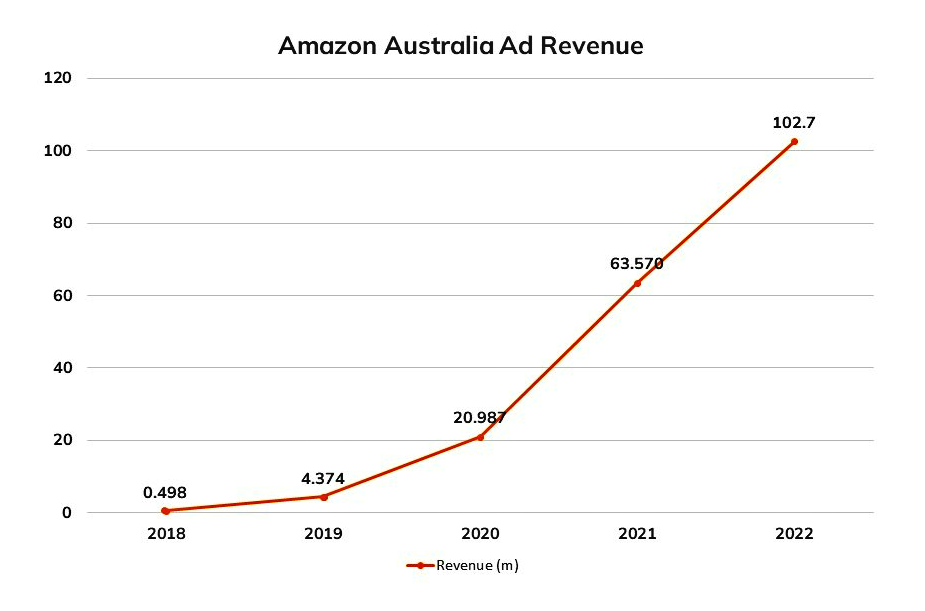

Amazon's Australian ad business cracked $100m last year, up 63 per cent on 2021 as net sales from its online store broke through the billion dollar barrier for the first time, growing 46 per cent for the calendar year to $1.3bn. The online juggernaut says it now has 200 million products listed locally. Amazon Prime's streaming and delivery subscription service delivered $250m in revenues, up 58 per cent on 2021 but it was third-party reseller services - where brands use Amazon's vast distribution and fulfilment infrastructure to sell and deliver products sold online - which was the fastest growing unit. It surged 75 per cent to $316m - a telling signal that the "closed loop" of combining an online shopfront and advertising to promote listed products with outsourced fulfilment and fast delivery is proving an efficient alternative to companies building stand-alone, direct-to-consumer ecom offers.

What you need to know

- Online store cracks 1.3 billion for 2022 calander year; advertising business tops $100m, streaming business up strongly to just shy of a quarter billion, while third party reseller services delivered the strongest growth, up 74 per cent

- Across all lines, Amazon Australia's net sales grew from $1.7bn to 2.6bn, but profits turned red to a 1.5m loss (meaning the accountants hit their KPIs).

- The advertising business is increasingly core to Amazon globally. Without it, it would be losing over $11bn a quarter, per McKinsey.

- While Amazon grew broadly and strongly across all its business lines, the result failed to meet the extraordinary expectations of some in the local advertising sector who expected the company to triple its media business in 2022 to around $180m.

- Amazon's trajectory will have competitors on alert per Foad Fadaghi, Principal Analyst at Telsyte.

- Per Rebecca Tos, Managing Partner Havas Media and Havas Marketx Lead: "There is yield to be extracted for brands in other categories before the platform matures."

Amazon is building serious momentum, both by delivering a great customer promise and experience, and with a growing, loyal, repeat shopper base. Focus on customer lifetime value over return on ad spend or cost per acquisition.

Amazon grew its advertising business in Australia to over $100m during 2022 according to its latest ASIC filing. The ecommerce giant has quietly morphed into an international advertising leviathan in recent years, with its global ad business now generating $37bn annually.

Advertising is increasingly critical to Amazon's performance. McKinsey US-based global lead in “commerce media”, Quentin George, told Mi3 last week Amazon would lose $11.6bn a quarter, without its $37bn advertising business linking ad impressions to a transaction. “And that number is accelerating,” he said. “In the next year or two, when you say Amazon, you have to ask what business are they in? They’re in the advertising business because that’s where the majority of their profits will be derived”.

Across the total Australian business. Amazon's net sales grew 50 per cent but none of that extra $874m dropped to the bottom line. Indeed, profitability declined from $2.8m in 2021 to a loss before income tax of $1.5m this year, meaning the company is either poorly managed or has excellent accountants. It's possibly the latter as evidenced by Amazon's extra $2.5m for income tax provisions, despite banking almost $900m in additional sales last year.

But while Australian taxpayers are outplayed by the tech giant - they provide the roads for Amazon's trucks, education for its staff and the broadband infrastructure for its business - Amazon's employees did well. The money the company spent on short-term employee benefits swelled from $163m to $280m. Remuneration for key execs increased from $1.87m in 2021 to $2.68m this year.

According to an Amazon spokesperson: "In the last year alone, we doubled our operational footprint to enable faster delivery and launched free one-day delivery on eligible items for Prime members in the majority of postcodes in Sydney and Melbourne. We’ve also grown the number of products in our store to more than 200 million."

The company also invested heavily in new infrastructure including a robotic fulfillment facility in western Sydney. According to the Amazon, the facility is the largest warehouse ever built in Australia spanning 200,000 square metres across four levels. Covering the land mass of Taronga Zoo, Amazon says it can house up to 20 million of the smaller items sold on Amazon.com.au including jewellery, books, electronics, pantry items and toys. And as any good retailer will tell you, position is everything - the site is within 12 hours drive of more than 80 per cent of the Australian population.

It is the sixth fulfilment centre in Australia for the ecommerce giant, which claims the project will create 1500 jobs in the area. You can find hints of the scale of the investment is reflected in the ASIC report, with the depreciation for property and equipment and lease assets more than doubling from $40m to over $97m, and facilities costs up by about 50 per cent.

Momentum

Research analysts and industry leaders believe brands will increasingly be drawn to Amazon's advertising opportunities.

According to Telsyte Principal analyst Foad Fadaghi, it won't be too long before Amazon is considered an advertising heavyweight in Australia. "Its trajectory will have competitors on alert."

Meanwhile, Rebecca Tos, Managing Partner Havas Media and Havas Marketx Lead, said brands should not overlook an Amazon presence, "Shopper habits are still evolving and adapting both in-store and online post pandemic," she said. "There is sentiment that brands are parking it for later when it’s imperative to assess a strategic fit now for the mid and long term. Retailers think about the next quarter, or half and not next financial year and beyond.

Tos said it was "important to ensure your product can be bought in multiple ways" and matched what was most convenient for target shoppers - "sometimes this is not via your DTC website. There is yield to be extracted for brands in other categories before the platform matures."

"Amazon is building serious momentum, both by delivering a great customer promise and experience, and with a growing, loyal, repeat shopper base. Focus on customer lifetime value over return on ad spend or cost per acquisition. Acquire new customers through easy entry products and cost-effective ad solutions on Amazon and draw them back to your brand to shop direct with seamless customer experience."

Don't diss the OG

Amazon's original business — its online store continues to dominate local ecommerce — and remains an order of magnitude bigger than its advertising business, with 46 percent revenue growth delivering sales of just under $1.3bn.

But it's fastest growing business was 3rd party seller services which encapsulates the programs it runs to help vendors sell their services in its stories, as well as its fulfilment services. This line of business grew 75 per cent to $316m.

Finally, Amazon Prime — the subscription service for digital video and music, generated just shy of a quarter billion dollars, a 58 per cent jump on 2021.

Not everyone is entirely impressed by this latter figure though.

Telsyte's Fadaghi told Mi3, "The latest results show that despite Amazon's underwhelming (by US standards) delivery services in Australia, it still has managed to build gravitas with Prime memberships. Noone should be surprised if Amazon has closed the gap on Netflix in Australia despite Netflix having 2.2 million more users at the end of June 2022."

What have you done for me lately?

While Amazon's advertising results will be viewed enviously by many of its local competitors, they actually came up a long way short of industry predictions from a year ago that the company might triple its ad business down under to $180m in 2022, and that it could grow that to half a billion by the end of this year.

Back in the world of real things, that was never going to happen in a weakening economy and an ecommerce market that went sharply into reverse in the second half of 2022, as evidenced by the results from Woolworths and Coles on the grocery front, and in the results of ecommerce businesses such as Kogan, Adore Beauty, Booktopia and Temple and Webster.